Welcome to the CoinStack Newsletter. This was sent yesterday as a PDF and Google Doc. We finally got it working via email. This week’s issue explains the emerging world of NFTs and their use cases in digital art, collectibles, music, sports, virtual worlds, games, real estate, and book publishing. I also share how to invest in buying your very first NFT.

Returns of My Top 5 Picks

The NFT Issue

Yep, Beeple sold an NFT this week for $69.3 million via a Christie’s Auction. It was a compilation image of his first 5000 digital art pieces, created one per day since 2007. Here it is.

The buyer is known only as Metakovan, a Y-Combinator alum and “DeFi OG” as he puts it. Metakovan is the founder of Singapore-based NFT & social impact crypto investment fund Metapurse. He paid using Ethereum for a total of 42,329 ETH.

While I think the $69M record in fiat terms will be broken in the next couple years, we may never again see an art purchase for 42,000+ ETH, considering just how much that Ether is likely going to be worth over the next 5-10 years (10x-30x of what it is worth now in terms of fiat) as EIP-1559 and ETH 2.0 rolls out.

And in what would have normally been the largest NFT purchase in a “regular week” this rare alien cryptopunk also sold for $7.56M (4200 ETH). Yep, that’s one computer generated image with the ultra rare beanie and pipe, for 4200 ETH.

What Could Possibly Explain All This?

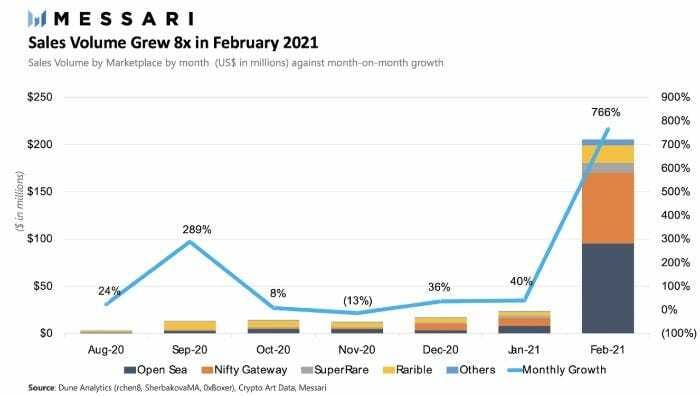

NFT Platforms did over $200 million in sales in February 2021 alone. March will beat that record.

OpenSea alone did over $100M in sales so far in 2021.

What could explain all this?

Well, here’s why NFTs are awesome and simply a better way for creators and artists to bring their creations to market:

97.5% Of the Sale Goes Immediately to Creators - On OpenSea, 97.5% of the first sale goes directly to the creator (instead of <50% in traditional art world). The top two NFT platforms by sales volume (OpenSea and NiftyGateway) take 2.5% and 2.4% fees for their services of hosting the NFT.

Artists Get Sale Royalties In Perpetuity - This is big… Creators can set a custom % for royalties for every subsequent resale. A common figure used is 5-10%. This means that artists will literally be getting Ethereum automatically deposited into their Metamask wallets for all secondary sales of their artworks, indefinitely. And it doesn’t take a month for a royalty check to arrive. It comes in minutes, right into your digital wallet.

Old Art World: I sell a painting for $10k and I get about $4k after gallery fees and shipping costs. I get 0% on future re-sales.

NFT Art World: I sell a painting for $10k and I get $9,750 immediately a few seconds later. I get 5-10% on all future re-sales autodeposited to my wallet. I may earn $20k+ for that one painting sale over time, all profit. Even better, I get paid in Ethereum, which is highly likely to appreciate significantly in value the next decade, allowing artists to invest in other up-and-coming artists and in their family’s financial prosperity.

Creator Verifiability - NFTs prove that the artist actually created the artwork through a verifiable and immutable record on the blockchain.

NFT Platforms like Rarible, OpenSea, MakersPlace, SuperRare, NiftyGateway, and Foundation verify each artist to ensure they are the actual creator.

While anyone can create an account, until you demonstrate that you are the actual artist (through your website, Instagram, Twitter, videos of you working on your art pieces, etc.) you won’t get verified or show up in search results and it will be hard to make your first sale.

Immutable Trading History - NFTs show the trading history of every token back to when it was created, allowing collectors to have transparent and accurate information about market value over time. Imagine being able to instantly see the price that a famous Picasso art piece traded at since it’s first sale. For the artists of the future, you’ll be able to see an immutable record of the price history since inception.

Put all these factors together and you have well-known creators including Gary Vaynerchuk, Mark Cuban, Lindsay Lohan, and 3BLAU all getting into the NFT space in Q1 2021.

The New Renaissance of the 2020s

Back in 2016, the most expensive art purchase ever was Saudi Crown Prince Mohammed Bin Salman’s purchase of Renaissance inventor and artist Leonardo’s DaVinci’s “Salvator Mundi” for $450 million. That record has yet to be beaten by art on the blockchain — but someday it likely will be.

Just like the Medici’s funded the Italian Renaissance of the 16th century, the MetaVerses and Justin Sun’s of the world are funding the Global Art Renaissance of the 2020s by investing in NFTs.

I wonder, how long before the land of Ethereum becomes the Digital Florence?

Well it’s happening now. And because of the Internet all creators globally can have equal market access — whether you are in New York or Nairobi.

And instead of the Uffizi Gallery in Florence it’s the SuperRare Gallery on Decentraland that matters most.

Yes, the 2020s are becoming a decade of massive creativity. Unlike past cultural revolutions that centered in one place, this cultural revolution is happening globally in cyberspace, powered by a globally-neutral decentralized currency called Ethereum.

As you can see from the chart below, almost all top NFT projects are built on top of Ethereum.

Digital Art Galleries

The “thing to do" the last year on COVID-Saturday nights for Cypherpunks (and Gen-Z teens) has been to meet up in Decentraland. It’s like Second Life, but for the decentralized crypto world.

I discovered this week that you can teleport to various art galleries within Decentraland (try the SuperRare Gallery) and see really cool NFT art.

Yes, you can buy your NFT art and then display it online in your virtual gallery.

Yep that’s right -- digital art in a digital gallery inside a digital world. Welcome to 2021.

The cryptocurrency that powers this digital world (MANA) is up 189% in the last 30 days. Again, welcome to 2021.

I am very excited for the next Burning Man so we can all experience great art IRL again :).

Music On the Blockchain

Not to be outdone, the music world also had a great week on the blockchain.

3LAU, a techno artist, sold NFTs representing the 11 songs on his new album to a total of 33 bidders for a total of $11.7 million. The top ranked bidder paid $3.6 million for all 11 songs plus:

The right to collaborate with 3LAU on a future song

A Vinyl record of the songs

Access to unreleased music

Many more musicians are now coming onto the blockchain with Audius. 1991 brought us New Kids on the Block. 2021 is bringing us New Kids on the Blockchain.

The Major NFT Use Cases

Non-Fungible tokens are useful for more than just art and music.

I think the biggest use cases for NFTs this decade will be…

Sports collectibles

Digital art

Music

Gaming

Virtual world building

Podcasts

Communities (own this community token to get these special benefits)

Digital Book publishing

Fractional Real estate represented as an NFT for clear deeds and titles

Anything where royalties need to get back to original creator

Many opportunities still are available for those who want to build businesses to use NFTs for fractional real estate ownership or digital publishing.

The Top 10 NFT Platforms

Here are the top ten NFT platforms by estimated sales volume.

But… How Do I Invest In NFTs?

There are at least three major ways to invest in the NFT boom.

Invest in the NFT Platform Tokens

Invest in the Established NFT Collectibles

Invest in the Up & Coming NFT Artists (The Next Beeples & CryptoPunks)

With up-and-coming NFT artists, you can buy an art piece for as low as 0.1 ETH to 0.2 ETH (about $200 to $400) and get in the collector game while it’s still early instead of paying $180k for a Beeple. Give it a try and see what happens…

Exactly How to Buy Your First NFT…

See if you can buy your very first NFT this week! Here’s how…

Get yourself a Metamask wallet (the way you log in to most NFT platforms)

Get some Ethereum in your Metamask wallet (you can transfer it in from Coinbase, Binance, etc.)

Buy your first NFT with your Ethereum (click either Make Offer or Buy Now)

Build your collection. Buy what you love. You can re-list what you buy for auction, sale, or just hold onto it for a while.

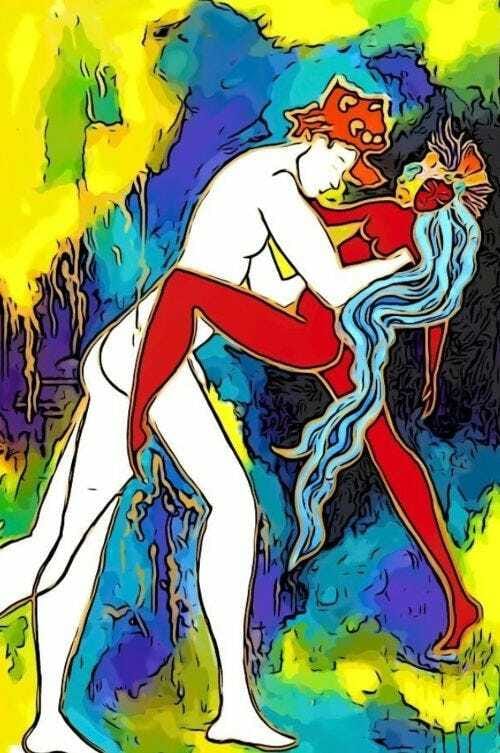

Personally, I like supporting rising female NFT artists like Bubbl, Diana Coatu and those from Women of Crypto Art.

As an example, the below NFT artwork “The Gods of Tantra” byBubbl sold this week for 0.5 ETH (about $900) to the NFT Collector DANNY. Her works range from 0.1 ETH to 1.11 ETH currently, while Beeple’s cheapest works now start at 93 ETH.

How to Spot Up & Coming NFT Winners

When considering an NFT artist to invest in and collect, look for NFT artists who are:

Consistent - Publish every day or at least every few days

Persistent - Have 50+ NFT pieces and are active on social media

Talented - Create art that is different that everything else out there

There are generally two-type of NFT artworks: Computer-generated and human-generated.

While computer-generated art like the CryptoPunks have taken an initial lead, I think ultimately human-generated art from prolific artists who publish new art daily (like Bubbl and Beeple) will do the best. You can see the NFT artist rankings by sales volume here.

NFTs are here to stay. They are going to be the major way that art and music gets distributed this decade.

When you’re collecting NFTs, know that there is no guarantee these works will appreciate in price. So collect works you are okay holding in your wallet for a while. However if you can spot a prolific and good artist early and accumulate his or her works before they gain fame and more general awareness, you can do well.

Some early Beeple NFTs sold for $1 and are now trading at $150k. Many early buyers of Beeple artworks have made over 10,000%... now’s the time to find the next Beeple and invest in their NFT artworks.

To learn more, I recommend this brief overview of the NFT space by Messari. I also recommend reading this article, “NFTs: Explain it Like I am 5” to get a good understanding.

CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

My Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

70% of Portfolio

Bitcoin (BTC) 20% of portfolio

Ethereum (ETH) 20% of portfolio

Nexo (NEXO) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Kusama (KSM) 10% of portfolio

30% of Portfolio - About 2% Each

Cardano (ADA)

Cosmos (ATOM)

Polygon (MATIC)

Voyager (VGX)

Uniswap (UNI)

PancakeSwap (CAKE)

Polystarter (POLS)

Chainlink (LINK)

Binance (BNB)

Ocean Protocol (OCEAN)

Ontology (ONT)

PolkaCover (CVR)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

The People I’m Following Closely on Twitter

Start Here If You’re Getting Started With Crypto

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The CoinStack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis.

Comments and thoughts welcome:

Telegram channel at t.me/thecoinstack

NFT Telegram channel at t.me/nftstack

Substack at CoinStack.substack.com

Please share with your friends and colleagues.