Social Links: Twitter | Telegram | Newsletter

Price performance of the major L1 tokens since we began writing Coinstack in January 2021

Coinstack Partners helps crypto/web3 companies raise equity and token funding from crypto venture capital firms for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss hiring us to make introductions to our network of crypto VC firms, please review our deck and schedule a free consultation.

Become a Coinstack Sponsor

To reach our weekly audience of 100,000 crypto insiders with 40%+ weekly open rates, view our sponsor deck and schedule a call. We are looking for a Headline Sponsor for Q3 and Q4 2023.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Bittrex Files for Bankruptcy Protection Less Than a Month After SEC Charges- Bittrex Inc. filed for Chapter 11 bankruptcy protection in Delaware on Monday, less than a month after the Securities and Exchange Commissions charged it with running an unregistered exchange.

⚖️ Sam Bankman-Fried Moves to Dismiss Most Criminal Charges Against Him - FTX founder Sam Bankman-Fried filed pretrial motions to dismiss a majority of the charges he faces late Monday. We shall see if any of these motions are granted.

⚖️ New York Could Force Crypto Firms To Refund Fraud Victims With New Legislation- State of New York Attorney General Letitia James escalated her office's crackdown on the crypto industry on Friday with proposed legislation that would force companies to refund customers who are victims of fraud.

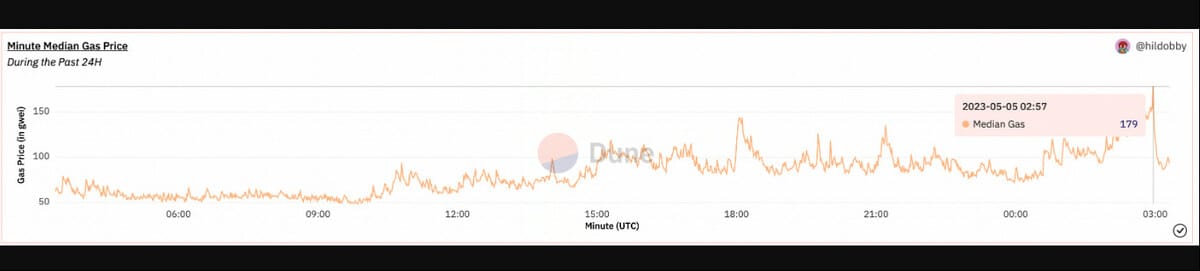

🚀 Ethereum Gas Fee Surges to 12-Month High as PEPE Frenzy Grips Market- Ethereum is becoming costlier to use as the latest meme coin mania has investors spending millions in gas fees for a frog-themed token called pepecoin (PEPE).

😮 SEC Removes Proposed Definition of ‘Digital Assets’ From Its Final Hedge Fund Rules- The U.S. Securities and Exchange Commission (SEC) has deleted its once-proposed definition of "digital assets" from its final hedge fund reporting rules.

💬 Tweet of the Week

Source: @brian_armstrong

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Year-to-date, Arbitrum’s daily transactions have averaged around 660K+, more than twice that of Optimism.

Source: @MessariCrypto

2. ETH Mean Fee Paid (7d MA) just reached a 11-month high of 0.010 ETH. Previous 11-month high of 0.009 ETH was observed on 06 May 2023.

Source: @glassnodealerts

3. Over the last week of April, nearly every day saw Ordinal Inscription counts eclipse previous all-time high daily inscription counts.

Source: @MessariCrypto

4. Dramatic increase in crypto investing in Europe. Dramatic decrease in crypto investing in the USA.

Source: @nlw

5. Bitcoin transaction fees are now higher than they were at the peak of the 2021 bull market.

Source: @WClementeIII

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Introduction

Meme coins originated with the advent of Dogecoin (DOGE) in late 2013 and reached peak interest during the 2021 bull market. During 2021, DOGE gained mainstream popularity and grew from a $700 million market cap on January 1st to a $88 billion market cap in early May. Following Dogecoin’s run, Shiba Inu (SHIB) achieved a $42 billion market cap in late October after beginning the year under $1 million market cap. These dog-themed assets offer no intrinsic value, but their linkage to viral internet memes has driven their popularity amongst both crypto-native users and retail audiences.

Now, PEPE is the latest memecoin to capture the market’s attention. The coin’s popularity originates from the Pepe the Frog character created by Matt Furie in his 2005 cartoon, “Boys Club”. After the original Pepe drawing and subsequent variants achieved virality throughout the 2010s on internet platforms such as 4chan and Tumblr, Pepe was adopted within crypto communities and quickly became a part of crypto culture lore.

The PEPE token was launched just over three weeks ago on April 14th with a capped supply of 420.69 trillion tokens. 93.1% of this was sent to a Uniswap liquidity pool while 6.9% was held in a multi-sig wallet for future centralized exchange listings. The anonymous team behind PEPE leveraged Pepe the Frog’s existing popularity on Twitter and created a coordinated meme campaign to catalyze early adoption. To say this strategy worked would be an understatement.

PEPE’s Growth by the Numbers

PEPE’s meteoric rise is unlike anything we’ve witnessed in crypto history. Its first two days were relatively quiet, but by the third day, its daily holders were increasing by the thousands. It only took PEPE 22 days to surpass 100,000 holders on-chain.

This is even more impressive when compared to the historical growth of other fast-growing Ethereum-based tokens. When SHIB entered its period of hyperbolic growth in 2021, it still took 90 days for the token to reach 100,000 holders. Viral assets from 2020’s DeFi Summer, such as YFI and YAM, never even reached the 100,000 holder milestone. As a proxy for more organic growth rather than speculative demand, Dai provides a benchmark of 225 days to reach the 100,000 holder mark.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.