Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week we feature a deep dive into the new Peer Metaverse Coin (PMC), the native token for a web3 social network and L1 blockchain.

In This Week’s Issue:

This Week in Crypto

📝 Peer Metaverse Coin (PMC) Deep Dive - The Native Token for a Web3 Social Network by Ryan Allis & Mike Gavela

📺 Upcoming Webinar - Understanding Web3 Social Networks and the Metaverse - Tuesday 12pm PT / 3pm ET

🗞️ Top Weekly Crypto News - 3AC Bankruptcy, Voyager Bankruptcy & Stock Delisting, FTX Option to Acquire BlockFi, Vauld Exploring Sale to Nexo

💵 Weekly Fundraises - H2O Water ($150M), Kaiko ($53M), BKN301 (~$15M)

📊 Key Stats - ENS, Binance, Bitcoin Under 200DMA

🧵 Article of The Week - Number Three by Arthur Hayes (on the resilience of DeFi over CeFi)

📝 Report Highlights - Messari: The Solana Mobile Stack

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

📈 Top 10 Tokens of the Week - UST, UNFI, YFII

Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a Web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

Peer Metaverse Coin (PMC) Deep Dive

By Mike Gavela & Ryan Allis, Publishers of Coinstack

Peer is a Web3 social network and blockchain-based metaverse ecosystem. As we wrote an earlier deep dive article about, Peer’s debut application this Fall will be a Web3 social network that will allow users to read, write, and own their social content and friend graph and be incentivized through tokenization.

After three years of development, Peer launched their own L1 blockchain in March ‘22 and will soon launch their own wallet. This technology will power their first dapp—the Peer Web3 social network.

Peer is now aiming to be the big winner bringing to market the Web3 version of Facebook, a huge opportunity.

While others have tried including BitClout/Deso, Steem, and Lens, none have yet cracked the nut on having a beautiful user experience, fast load times, and a token incentive system that drives loyalty with a viral loop.

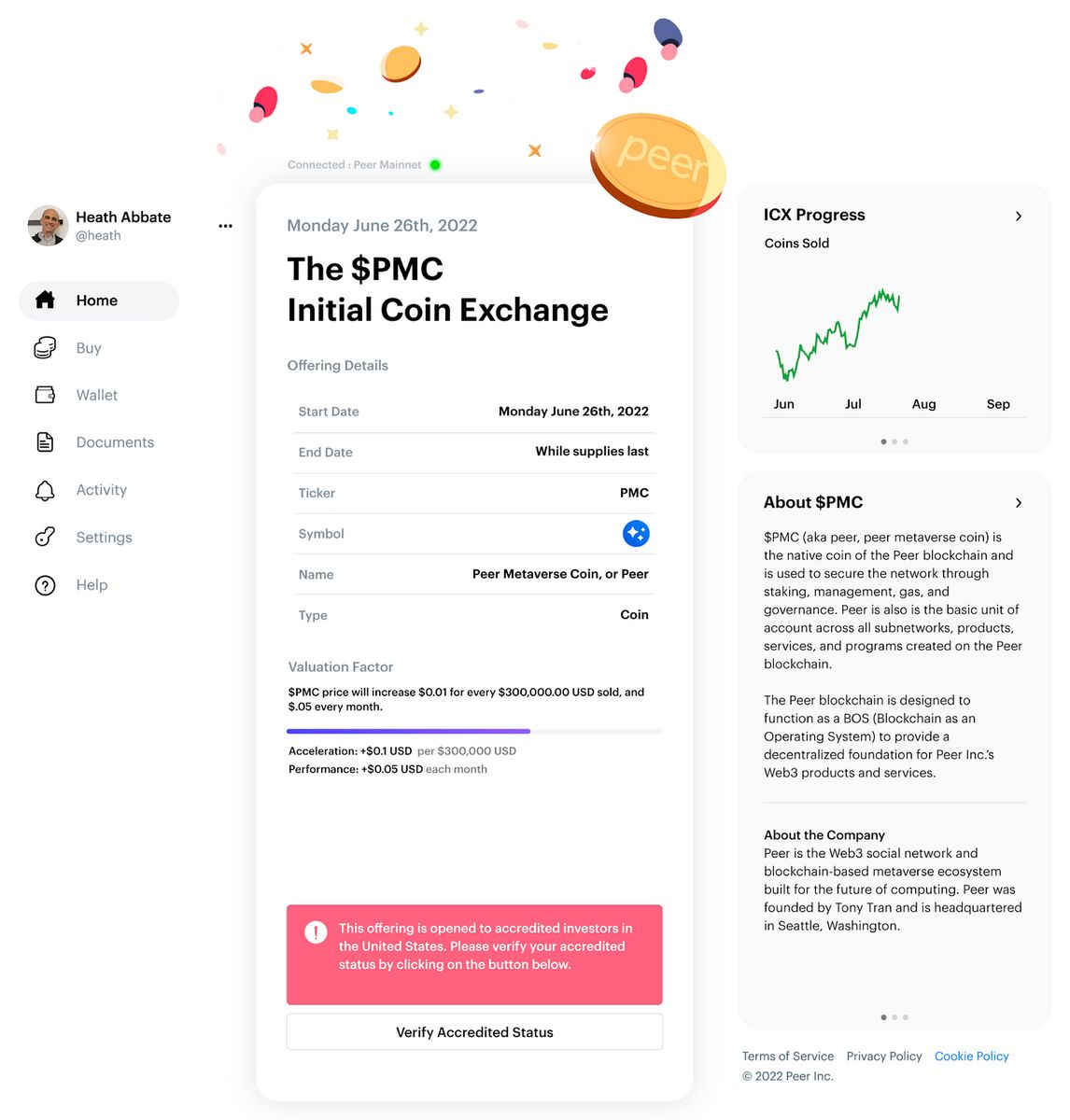

Peer’s native cryptocurrency is the Peer Metaverse Coin (PMC), which launched last week. This article is a deep dive into their coin. We interviewed the Peer management team for this article.

While a “token” operates on someone else's blockchain (think UNI on Ethereum), a coin is native to its own blockchain (think ETH on Ethereum). The Peer Metaverse Coin is the native coin used for all transactions and rewards on the Peer blockchain, thus it is a “coin.”

As of Monday, June 27, accredited investors in the U.S. and all non-U.S. persons outside the U.S. can sign up to exchange crypto or USD for PMC from Peer’s ICX Launchpad.

PMC will be used for app transactions within Peer’s own blockchain, access to features and products, staking to secure the network, and voting on governance proposals.

We’ll be doing a webinar with the Peer team next Tuesday July 12 at 12pm PT for those interested in learning more about web3 social networks.

A Blockchain-Based Social Network

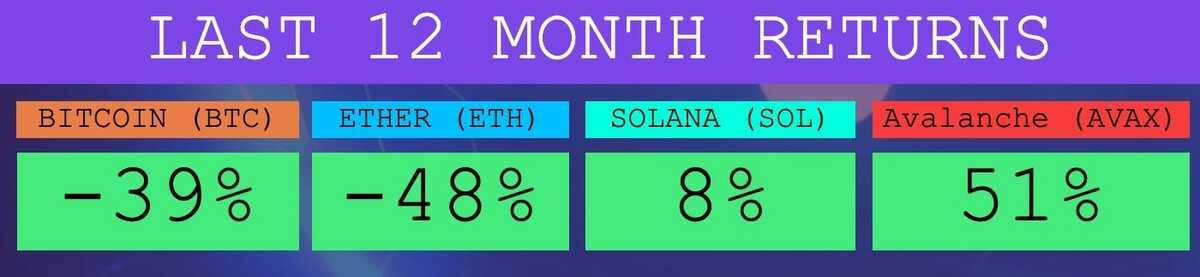

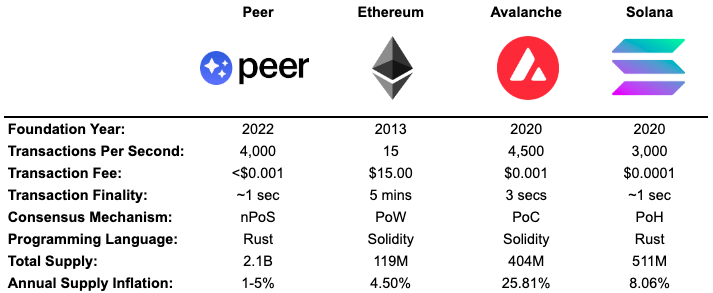

Peer has designed their blockchain with the consumer experience in mind with throughput speeds that rival Avalanche and Solana to power their own Web3 social network and future metaverse applications.

Unlike Facebook, which sells user data to advertisers, Peer will provide PMC coins to its content creators and users to incentivize great content and user loyalty. If they succeed, Peer may become one of the leaders in the multi-billion dollar race to win in the web3 creator economy. You can see a preview of their social network below.

Users on Peer will be able to create and share content beyond just feed posts. Peer’s social network application will be leveraging aspects native to blockchain such as immutability, scarcity, and tangibility to enable the creation of new types of media.

An example of this would be if a band unveiled a new song in Chicago and turned it into an NFT, they can make it so only people physically in Chicago can listen to the song NFT. That NFT can then be used as a ticket to a secret show for only their die-hard fans. Peer coins this the “ambient web”, where our digital and physical realities meet.

To learn more about Peer and their PMC Initial Coin Exchange you can visit the Peer site, join next week’s web3 social networks webinar, or continue to read more below. You can also follow Peer on Twitter at @peerpmc.

PMC Coin Launch Details

Peer is now selling its native coin PMC (Peer Metaverse Coin) during their ICX (Initial Coin Exchange) exclusively to accredited investors via a U.S. offering under Rule 506(c) of Regulation D under the U.S. Securities Act of 1933, and to non-U.S. persons in an offshore offering under Regulation S under the Act. The initial supply for PMC will be fixed at 2,100,000,000 (2.1B) with the goal to sell roughly 10% or 250M coins over the next few months.

Interestingly, Peer is conducting the Reg D and Reg S offerings of PMC pursuant to exemptions from registration under the Act available for digital assets classified as securities under the Act, often referred to as security tokens.

Before purchasing PMC, Visitors to Peer’s website must establish that they are either (1) accredited investors or (2) non-U.S. persons accessing the site from outside the U.S.

Accredited U.S. investors and non-U.S. persons visiting the site from outside the U.S. can view Peer's offering materials here.

The ICX launchpad is a dapp built on the Peer blockchain. Peer plans to open the ICX Platform to all projects looking to raise capital following the ICX standard for later-stage projects.

PMC Pricing Model

The price for the PMC coin will begin at $1 and then goes up $0.05 every month and $0.01 more after every $300k worth of PMC is sold. The reason for this is to mirror the way a firm would raise capital from a VC, with each round going up over time as progress is being made with products, usage, and revenue. The PMC pricing policy affects only sales by Peer. Peer does not intend to establish a repurchase program and the value of PMC in the marketplace (if any) may differ significantly from the purchase price from Peer.

PMC coins purchased from Peer will be “restricted securities” that must generally be held for a minimum of 1 year after purchase pursuant to regulations under the Act. Peer plans to launch a DEX platform after the first year to create their own secondary market for the coin, but cannot assure that a resale market will develop or that PMC will have significant value or liquidity. Availability of future resales may depend on Peer either (1) establishing that PMC has value primarily based on the market value of its utility in commerce and not as an investment contract, or (2) listing PMC on one or more trading forums in compliance with treatment as a security in the U.S.

If you are qualified to purchase PMC and wish to learn more about Peer and their offering, you may visit their site using the link here.

This discussion of PMC and Peer Inc is for general information only and not to induce a sale of PMC or an offer to purchase PMC. It does not include important information that must be read by potential purchasers. We encourage interested readers to read their PPM.

Through the ICX process, Peer hopes to create a framework that automates and decentralizes the method for projects to arrive at a proper fundamental and traction-based valuation and to help qualify and quantify a project's worth without a needed intermediary.

PMC Tokenomics

PMC is the native currency for the Peer blockchain and will be used to pay for features across all the Web3 platforms Peer will be building on top of the blockchain. Meaning, that all transaction fees will be paid using the PMC token. Moreover, Peer’s planned hardware roadmap will also require PMC. The ecosystem is bi-lateral by design which means developers can request PMC from users, but users can also require PMC from developers, such as developers that need to use their data.

Some products will require more PMC than others but overall Peer anticipates having low sub-cent transaction fees like that of Solana. Peer’s expected their issuance rate for new circulating PMC will grow by 1-5% per annum.

Peer expects their initial coin supply distribution to be as follows, with 40% available for public and private sale.

The company also plans to launch Peer USD ($USP), their stablecoin later this year. Users will be able to mint USP based on total dollars sold during the ICX for the initial backing. It will maintain peg via a burn/mint algorithmic stabilizer and double-backed by both cash from flow and the Peer Inc. cash treasury from earnings.

Peer’s Entrance Into The Ambient Web & Augmented Reality via Hardware

The ambient web is defined as an augmented reality where our newsfeeds and video calls go beyond the screen on your phone/laptop and digitally interact with the world around it. Similar to Pokemon Go or Microsoft Hololens but on the blockchain.

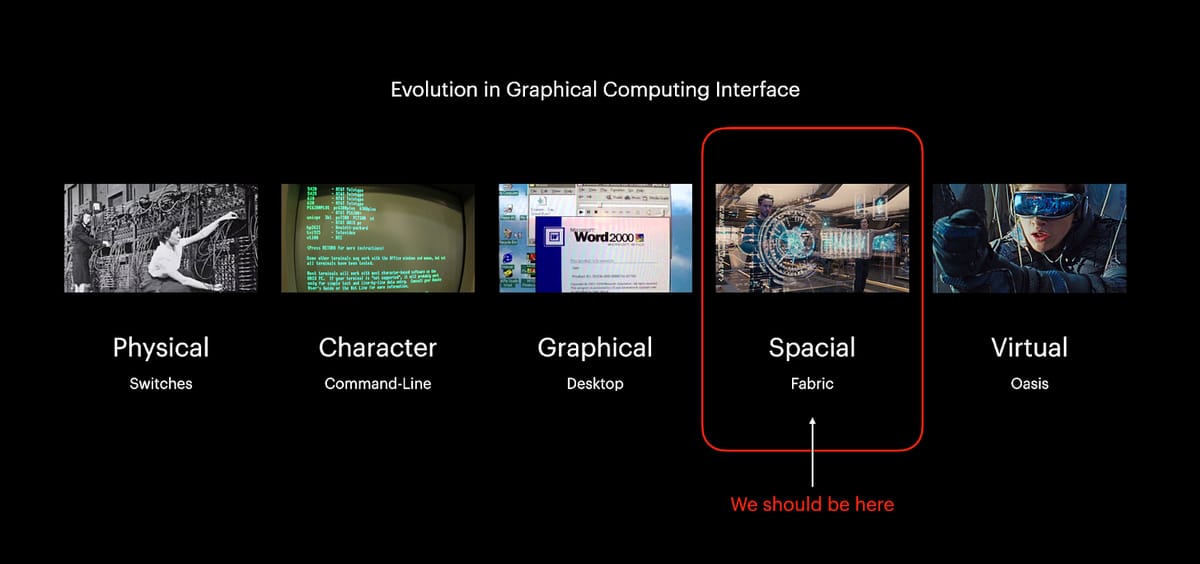

Peer is building a new architecture for an entirely new generation of computing systems. To kick start its plans, Peer will build a foundational GUI layer in their Web3 Social Network that brings both developers and users into a decentralized environment. This environment will provide Publisher, Browser, and Viewer for Web3 content. This visual layer is like the Desktop GUI, which provides an environment in which developers can serve users, and users can create media that uses blockchain properties.

Once enough Web3 data is created, Peer will turn this environment into the GUI for an operating system for users to experience Web3 in better ways to interact with spatial/ambient computing using AR glasses similar to Microsoft Hololens, which is primarily for commercial applications, or Apple’s upcoming AR offering, rumored to be launching in 2023.

Peer’s leadership team features Chief Design Officer Kyle Hay, who previously worked at San Francisco-based Leap Motion for 4.5 years as Industrial Designer and Creator Director. Kyle and his team are now working on designing the hardware devices for the future of web3 at Peer.

Web3/Crypto/Blockchain is as foundational as the shift from mainframes to PCS, then PCs to web, then web to mobile. Web3 is about layering trust on top of an untrusted environment of the web.

“The first era of the modern internet (roughly 1990-2005) was about open protocols that were decentralized and community-governed. Most of the value accrued to the edges of the network: users and builders. The second era of the internet (roughly 2005-2020) favored siloed, centralized services. Most of the value accrued to a handful of large tech companies. We are now beginning the third era of the internet — what many call web3 — which combines the decentralized, community-governed ethos of the first era with the advanced, modern functionality of the second era. This will unlock a new wave of creativity and entrepreneurship.”

Peer’s vision of Web3 will connect digital data to physical real world information. This digital to physical connection plus the trustless nature of crypto will create brand new experiences and economic models, driving hardware devices of the future.

While Meta’s Oculus is working on cornering the consumer VR market, no one has yet cornered the AR market, which Peer plans to play within.

Peer - The Blockchain for the Metaverse & Ambient Web

Unlike other L1s who are optimizing their development for transaction speeds, dApp development, or quite frankly VC liquidity, Peer aims to spearhead a next-generation technology landscape with an end-to-end technology ecosystem, a Web3 operating system for the ambient web.

Peer aims to bring blockchain to the masses by first developing easy-to-use decentralized applications with beautiful UX/UI then expanding into hardware products that will interact with the metaverse in VR/AR experiences. Peer’s L1 blockchain is built with a novel take on Nominated Proof of Stake (nPoS) that allows the chain to adapt and scale transaction speeds and security to accommodate consumer and developer needs.

Peer has been developing their blockchain for the last three years. Peer set out to design a hybrid model that will allow decentralization for their blockchain consensus but all high-level design and development decisions will be made by the company. In developing their hybrid model, 2 years of research and development were spent attempting to build a blockchain that suits their needs. Ultimately, they were able to develop a chain based on Nominated Proof of Stake (nPOS) and launch their mainnet back in March.

The Peer blockchain is built alongside a bundle of side-chains connected by bridges that are then stored to a master chain record (MCR) that forms the reference backbone of all activities. Peer is focused on higher throughput capabilities. They see 3 different ways to scale the blockchain’s Transactions Per Second (TPS) as demand increases: adding side-chains, increasing transactions per block, or cutting block time. By being able to scale their TPS using any of those factors, Peer has the ability to scale its chain to be in lockstep with the consumer experience and developer needs.

Peer is devoted to the consumer experience above all else which is why they felt the need to develop their own L1. Peer’s Tony Tran comments on the development of his chain compared to the other chains on the market.

“Far too many projects are designed with a ceiling in mind, but that’s not consumer-focused. That’s because they are focused on selling coins and hyping the tech with a number—which is where the ICO screwed up. If blockchain is indeed the future, we need to design for flexibility and extensibility because if tech progresses in the way we’re envisioning, we’ll need hundreds of millions of transactions per second. Speed will take care of itself over time. There’s no rush, just yet.

We needed to develop an L1 from the ground up so that it serves users. In most cases, we see blockchains being developed to serve blockchain miners or validators—which makes a project a self-referential blockchain business. It’s untenable and unsustainable, and we’ve seen this play out in the recent downdraft. What Peer wants to do is develop a vast Web3 ecosystem of products and services, which includes both software and hardware.

We are obsessed with the customer experience in blockchain. If we build on another L1, we’d have tokens and tokens can only provide utility within a single app’s walled gardens whereas coins are platform agnostic. Also, our project ethos, vision, and roadmap is completely different from all other L1’s intended path. We wanted to have precise control of its growth as well as insulate it from broader market volatility at our formative stage.”

Peer’s Programming Language: Rust

The Peer team decided to not use Solidity as its programming language and instead opted into using Rust. Peer’s development team is focused on throughput and time to finality, which parallels what Rust is famed for: Simplicity, Concurrency, & Time to Finality. This is why Anatoly Yakovenko from Solana also chose Rust as Solana’s programming language.

Rust has high performance while ensuring memory safety and also supporting concurrent programming. Rust is a coding language that is backward compatible and many argue is future-proof given its popularity in current development teams. Although the chain is not natively compatible with other EVM chains such as Ethereum and Avalanche, Peer is open to the idea of developing cross-blockchain tech if the need arises (similar to Neon on Solana).

Peer’s Consensus Model

The Peer blockchain is reinforced with the Nominated Proof-of-Stake (nPoS) mechanism, an extension of the Proof of Stake (PoS) consensus mechanism. In nPoS the nominators back validators with their stake as a sign of confidence in the validator's good behavior. The Peer blockchain is one of the PoS-based projects that grant equal influence and authority to all the chosen validators who will contribute to the consensus protocol. To reflect this value, it is expected nominators will take care of their preferences and still disperse their stake as evenly as feasible among the chosen validators.

The objective of nPoS is to ensure decentralization and fair representation through proportional justified representation as well as robust security via maximum support. Due to proportional justified representation, slots are assigned to validators proportional to their nominations. Hence, the more nominations are present means the higher the number of coins available for backing a validator and the higher the likelihood of the validator to be elected into the active set. At the end of each era, validators are elected (one era = one hour). So, the set of validators changes with each era.

Peer’s Staking & Rewards Model

Peer will require validators to stake at a minimum of 1000 PMC to start. Currently, rewards are set to 200 PMC tokens per Era and the rewards rate is set to 10%The reward payments to stakers are processed as soon as an era (1 Era = 1 Hour) ends. The era's total reward is calculated by dividing the total token supply by the total number of tokens staked by nominators during an era. The main purpose of rewards is to encourage people to stake at a certain rate. All the active validators in a set earn the same amount of rewards. The validator's commission fee is subtracted from these earned rewards. The remaining prizes are allocated proportionally to the stakes of the nominators.

The reward and slashing module, at the heart of the staking system, aims to promote ideal activities while penalizing any misconduct or absence during the era.

Once misconduct is identified, slashing can occur at any time. A value is subtracted from the validator’s balance and the balance of all the nominators who voted for the particular penalized entity. Deductions are carried out from the stash account of the slashed entity.

Peer’s Governance Model

In the Peer blockchain, three bodies take care of on-chain governance. These include the public referenda chamber, the council, and the technical committee.

If a token holder in the system provides a bond, then they can propose and vote on public referendums. Every time a proposal is put forward, community members can second it and put tokens equivalent to the initial bond. At the time of the launch period, the proposal with the highest number of seconded votes is transferred to a public referendum table for voting. This is the stage where voters can choose to lock their tokens for a longer period. Whenever someone seconds a proposal, it simply means that they agree with it and are ready to back it with an amount equal to the deposit initially locked. Just like what happens with the initial proposer’s bond, the bonded tokens can only be released once the proposal is tabled or voted upon. When someone seconds a proposal, it automatically moves it up the rank of proposals. The most popular seconded proposal in value (not the number of supporters) is eventually brought to a referendum during the launch period.

When the launch period ends, the most voted seconded proposal then moves on to the referendum. It is in this period that someone can cast a vote for or against the proposal. Users also get the flexibility to lock their tokens for a longer period to have a strong vote. Once tokens are locked users won’t be able to transfer them but can use them for further voting. From a technical point of view, locks are stacked in layers on top of each other. This means that an 8-week lock doesn’t become a 15-week lock if you vote after 7 days. Instead, an additional 8-week lock is placed on a vote placed after a week.

Users have a choice to delegate their vote to other accounts they trust. Upon delegation, the account is awarded an additional voting power to the tokens. Here, the conviction for delegation works the same way it does for regular voting. The only difference is, that tokens may be locked longer as the locking resets in an event of undelegation.

Comparing Peer (PMC) & Ethereum (ETH)

Ethereum is the original smart contract platform. The Ethereum Foundation and its development of the Ethereum blockchain catalyzed the smart contract revolution. Today we have thousands of apps on the Ethereum chain that are all trustless and fully decentralized.

Ethereum was first proposed in late 2013 and then brought to life in 2014 by Vitalik Buterin who at the time was the co-founder of Bitcoin Magazine. The Ethereum platform has thousands of independent computers running it meaning it is fully decentralized. Once a program is deployed onto the Ethereum network these computers, also known as nodes, will make sure it executes as written.

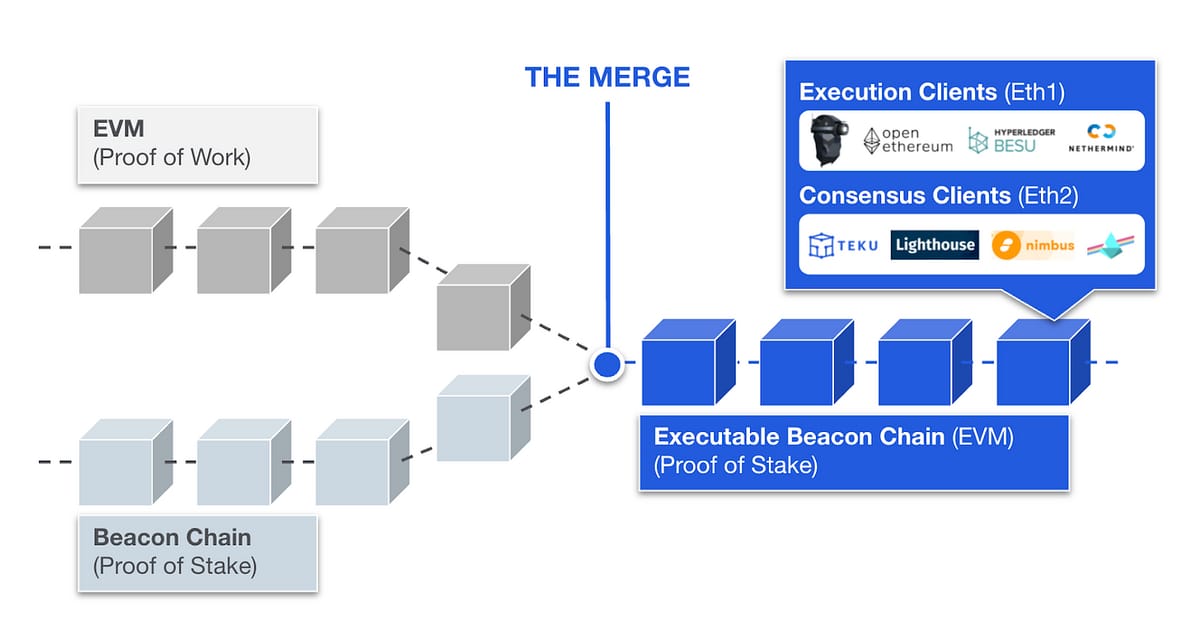

Ethereum currently uses the same consensus model as Bitcoin called Proof of Work. In a Proof of Work consensus model, there are miners who validate transactions by solving complex mathematical equations. The downside to this consensus model is that it is heavily reliant on electricity being that you would need high-end graphics cards in order to process the transactions. This is one of the many reasons why ETH will be moving to Proof of Stake in September 2022.

Known as, “The Merge”. Ethereum’s blockchain will become more scalable, secure and eco friendly. This will be accomplished by moving from a Proof of Work consensus model to a Proof of Stake consensus model. In Proof of Stake anyone can validate a transaction so long as they either run a validator or stake to a validator using a service such as Lido or Rocket Pool. In regards to scalability, Ethereum can only handle around 15 transactions a second whenever the network is very busy. Ethereum 2.0 should have mechanisms in place that allow it to perform up to 100,000 transactions a second and maybe even more.

Ethereum 2.0 will also be much more resistant to 51% attacks due to how it works. In other words, it will be much more difficult to attack the network or to do something malicious to it. Lastly, by moving to a Proof of Stake consensus model Ethereum’s global energy use will be reduced down a staggering 99.95%. Knowing the high energy costs required to run the chain, Peer elected to go with a Proof of Stake consensus model and save on the relative energy consumption per transaction.

Although Ethereum is currently the king when it comes to smart contract platforms, the blockchain still has its flaws which is why there is always a new class of, “ETH Killers” coming to market every year. At the moment, Ethereum uses the Solidity programming language which is an object-oriented programming language built specifically for developing smart contracts.

Peer Offers Faster TPS Than Ethereum and Allows Devs to Use Rust

One of Ethereum’s biggest criticisms for developer adoption is that Solidity is a new programming language that is only used for smart contracts unlike Solana or Peer which use Rust. Rust is most commonly used in enterprise development settings giving a larger array of developers the opportunity to immediately jump into Web3 development vs going through the learning curve on Solidity.

When comparing the Ethereum (ETH) token to Peer’s (PMC) token, one will immediately notice a difference in transaction speeds when interacting with dapps. Peer’s initial TPS will mirror that of Solana’s giving sub-second time to finality. Rather than waiting 30 minutes to an hour constantly refreshing Etherscan to see if a transaction actually went through, users can visually see their confirmation right in front of their eyes in less than a second - all of this with transaction fees less than a penny vs paying sometimes $60 for a Uniswap exchange from ETH to USDC.

Comparing Peer (PMC) & Avalanche (AVAX)

Avalanche is an open-source platform for launching decentralized applications and enterprise blockchain deployments. Avalanche's founder, Emin Gün Sirer, developed the protocol while a professor at Cornell University. Sirer and his research group developed alternative blockchain technology for the financial sector shortly after publishing his paper, "Majority is not Enough, Bitcoin Mining is Vulnerable," in 2013.

The fundamentals for Avalanche's consensus mechanism came from a white paper called "Snowflake to Avalanche: A Novel Metastable Consensus Protocol Family for Cryptocurrencies" developed by a pseudonymous group named Team Rocket in May 2018. The paper proposed the Snow family of consensus protocols and proved that it could work. It combines the best of both Classical and Nakamoto consensus. While the Snow consensus protocols are permissionless, there is no mining or high energy expenditure with its consensus systems.

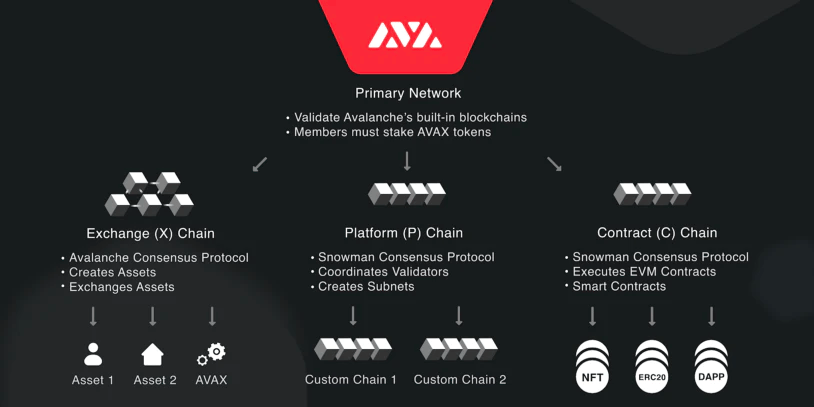

One of the technical breakthroughs Avalanche has made was the development of their Primary Network, which validates Avalanche’s three built-in blockchains.

Exchange Chain: X-Chain - The X-Chain is a decentralized platform enabling the creation of new assets, the exchange of assets, and transfers between subnets, as well as being an instance of the Avalanche Virtual Machine (AVM).

Platform Chain: P-Chain - The P-Chain is the metadata blockchain on Avalanche and coordinates validators, keeps track of active subnets, and enables the creation of new subnets.

Contracts Chain: C-Chain - The Avalanche Contract Chain (or C-Chain) implements Ethereum Virtual Machine (EVM) that allows developers to port over Ethereum applications seamlessly, such as the critical tooling that has fuelled DeFi’s growth to date, for example, MetaMask and Web3.js.

Similar to Ethereum, AVAX has its host of problems despite being the top alternative L1 EVM chain. At the moment it costs 2,000 AVAX tokens to become a validator in the chain which at the time of writing is equivalent to ~$33k. With Peer the cost to set up a validator is currently set to 1000 PMC tokens. During Peer’s ICX, accredited investors in the U.S. and non-U.S. persons located outside the USA will have the ability to purchase the token at $1 making the initial cost to set up a validator $1k vs $33k. Avalanche uses 3 separate chains to process transactions which is fine for die-hard crypto fans but the reality is the average consumer is not going to remember the difference between X, P, or C chain when all they want to do is flip a jpeg, play a game, log into a social app, or get a loan.

Comparing Peer (PMC) & Solana (SOL)

Solana was built by the software company Solana Labs. Solana’s founder, Anatoly Yakovenko, describes Solana as an operating system because that was the kind of engineer he was bred to be during his career at Qualcomm. He initially built Solana and designed it with his team of fellow Qualcomm engineers. They thought an essential use case was financial information. It needs to be readily available, cheap to modify, and as low latency as possible or as coined, “The Blockchain at NASDAQ speed.” From the beginning, Anatoly’s vision was to develop a platform for developers with virtually unlimited potential, so speed, scalability, and low fees became the main focus when designing the Solana protocol.

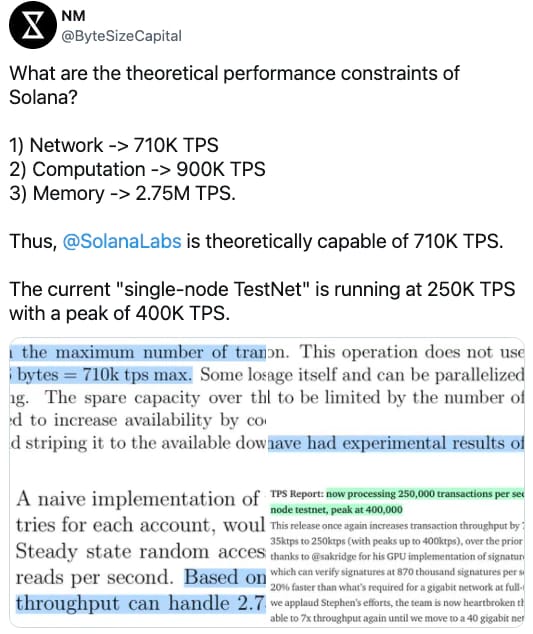

Solana is currently the fastest running L1 blockchain on the market and this is due to its Proof of History consensus mechanism which timestamps transactions. Proof of History uses a recursive, verifiable delay function to hash incoming events and transactions. Every event has a unique hash and counts along with this data structure as a function of real time. This information tells users what event had to come before another, like a cryptographic timestamp giving a verifiable order of events as a function of time. Each node gets a cryptographic clock that helps the network agree on the time and order of events without having to wait to hear from other nodes.

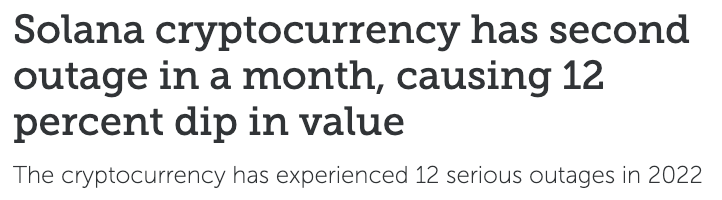

Solana’s mainnet went live in March 2020 and its blockchain is still technically in beta which is evident by the number of outages the chain has experienced in the past year. The duration of the shortest disruption was 75 minutes while the longest shutdown spanned 18 hours and 12 minutes according to Solana's own uptime audit. It's not entirely clear when Solana’s blockchain will transition to its alpha stage.

Unfortunately, Solana Labs has not offered an official developer roadmap for its full launch but it is currently rumored to be by the end of 2022. The Solana blockchain is currently secured by around 1800 validators but it's important to note that transactions on Solana are processed by smaller groups of up to 150 validators called Solana clusters. Solana uses its own virtual machine and is coded using Rust as its programming language meaning it is not EVM compatible like Avalanche’s C-chain.

Peer and Solana share a lot of similarities. They both have the highest TPS when compared to other EVM chains. They both use a single wallet that does not need to be constantly changed to a different network. They are both written in Rust and have mass developer adoption capabilities being that it is a language that most developers already use. The difference between the two L1 chains is their consensus models and the sustainability to handle periods of high traffic.

The latest Solana outage, which shut down the network for four hours and 10 minutes, is the result of a lack of new blocks being produced - key to keeping the Solana blockchain operational. Unlike Solana Labs (the development company maintaining the Solana chain), Peer will be creating software applications for the Peer blockchain as well as maintaining the chain. Peer aims to learn from its predecessors and rather than launching a beta project. Peer took the last three years to work on its underlying architecture to handle the transaction load from its users.

The Peer Vision - Metaverse Rising

For more on the Peer vision to build the Web3 social network and blockchain for the metaverse, watch this 3 minute video from their founder, Tony Tran, called Metaverse Rising.

Here’s an excerpt from

“Everything in blockchain revolves around trading, from tokens to NFTs. But in order to bring blockchain to the masses, we have to do what the desktop experience did for the command line user interface—we need to hide the complexities of the blockchain and expose possibilities so that normal people can use it.

Steve Jobs often said humans build tools that amplify our inherent abilities. He believed a computer amplifies the mind by making it faster and more efficient. It dawned on me that if we can just figure out what blockchain amplifies, we will know how to approach the user experience.

Rather than bringing the physical world into cyberspace, we’re beginning to map cyberspace directly on the physical world,” Tran said. “It’s not immersion, where you stand still, strap your head to a device, and drag your avatar across virtual space—but presence, where the web can inhabit the space where you are. That’s the metaverse.” - Tony Tran, CEO of Peer

While this vision is huge and a lot of execution will be needed, if they can execute well on even half of it there will be a lot of opportunity for Peer.

Peer’s First Dapp - The Web3 Social Network

As we shared above, Peer is building the Web3 Social Network where users own their data - a decentralized version of Facebook and Twitter that will bring the metaverse to life.

The Peer team envisions the metaverse as an interactive world not constrained by desktop or mobile screens. Instead, the metaverse will marry our day-to-day lives with blockchain technology.

Here’s a great excerpt from the February 2022 Venture Beat article, “Web3 holds the promise of decentralization” that describes what is possible for users within a web3 social network:

The platforms that we use generate billions of dollars, but the users never receive anything for their loyalty. Web3 changes this drastically by rewarding users for their participation.

Currently, there are several blockchain-powered Web3 platforms, including web browsers, video-sharing platforms, blogging platforms, and social networking, where both creators and consumers are entitled to rewards. Powered by their native tokens, these platforms bring a symbiotic model to the internet where everyone benefits instead of taking a zero-sum approach where one party must win, so the other can lose.

To achieve this, Web3 social networks offer built-in payment layers, reducing unwanted middlemen and unnecessary costs. They are also fully interoperable, granting users the flexibility to easily buy, sell, and trade native assets across different platforms. For example, content creators can monetize their content using NFTs and sell it across marketplaces. They can also set up custom subscription models and add-on features for their communities using the underlying platform’s native token to unlock income generation avenues.

At the same time, Web3 platforms also enable content creators to tap into the growing metaverse by allowing them to implement a diverse range of play-to-earn, learn-to-earn, and other similar incentivized programs for their communities. By participating in these activities, community members can earn platform-native tokens, which they can use to purchase more features within the platform, reward creators, or exchange them for other tokens.

In the context of social networks, a native token can also offer holders the right to decide the future of the network. Unlike Web2, where users have little to no say regarding the platform’s development, Web3 distributes this responsibility to stakeholders.

Token holders can vote on proposals that work best for their communities and shape the platform’s future with their hands. These proposals may cover a wide array of topics, including adding new features to the platform, deciding on future upgrades, making changes in existing teams focused on development and marketing, and much more.

As founder Tony Tran has written about, we will be moving from the traditional “social media” to “blockchain media” allowing new forms of content that is immutable, scarce, and tied to specific places and time.

“Blockchain media is the ability to create digital content imbued with blockchain properties. NFT for example, is a digital content that uses Scarcity. Tokens is a digital item that uses Immutability and Scarcity. Posting an image to a specific time and place, and pinning it there forever on a blockchain will use scarcity and immutability. No one can move it and there's only one of it.” - Tony Tran, CEO of Peer, Inc.

Other Dapps Launching on the Peer Blockchain

Post-launch there will be three other DeFi Dapps launching on the Peer Network.

Nooncake - A decentralized media transfer protocol that’ll be used to create a video-based town square of Web3.

Telesto - A project that aims to create micro-cryptocurrency with quantitative algorithmic dampeners to hedge against market volatility.

Puffin - A template system for creating and uploading time-space assets into the Peer ambient web fabric.

Post-launch of the social networking app users will be able to enter Peer’s dApp ecosystem through the application. Peer will be creating a Peer Developer Program to provide a framework through which developers can create dApps on the network (similar to Apple Developer Program). Lastly, Peer aims to incentivize creators as well as host hackathons to foster development on the platform.

To Learn More about Peer and PMC

This article is a deep dive review of the coin by Coinstack and is not an offer to sell PMC.

Peer asked us to share that the offering of PMC will be made exclusively through a private placement memorandum (PPM) directly by Peer, Inc to qualified investors. The Peer PPM contains important information for potential purchasers, including the risk of loss of investment.

To learn more about Peer and their Initial Coin Exchange you can visit their site. Accredited U.S. investors, and non-U.S. persons visiting the site from outside the U.S., can view offering materials here starting June 27. You can also follow Peer on Twitter at @peerpmc.

If you’re interested in learning more about Peer and the race to win the web3 social network market, on Tuesday we will be hosting a webinar on web3 social networks along with a live interview with Peer’s CEO Tony Tran. You can learn more below.

📺 Upcoming Webinar on Understanding Web3 Social Networks

Coinstack founder Ryan Allis is hosting an webinar next Tuesday on Web3 Social Networks and the Metaverse. He will be interviewing Peer CEO Tony Tran and COO Heath Abbate live as well as sharing a primer on the fast growing web3 social network ecosystem. We encourage anyone interested in the space or investing in the space to attend. Learn more and register for free below.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week… It’s another one of those holy crap weeks in crypto as the pieces are picked up from the ashes of contagion from the Luna, 3AC, and Celsius mess…

⚖️ Three Arrows Capital Files for Chapter 15 Bankruptcy - Crypto hedge fund Three Arrows Capital (3AC) filed for Chapter 15 bankruptcy in a federal bankruptcy court in the Southern District of New York on Friday in hopes to shield its U.S. assets after a court in the British Virgin Islands ordered the firm into liquidation last week. Chapter 15 is specifically designed for protecting domestically-held assets of foreign firms.

🚫 Voyager Files for Bankruptcy – Crypto broker Voyager Digital Ltd. filed for Chapter 11 bankruptcy protection just weeks after getting a lifeline $250M line of credit from Alameda Research, citing market volatility and the collapse of 3AC. Shares in Voyager plunged 42% on Monday, reducing its market value to $51 million. The company was valued at over $2.1 billion at the start of 2022. The Toronto Stock Exchange is now considering delisting the Voyager stock.

🤑 BlockFi CEO Says FTX Has an ‘Option To Acquire’ Crypto Lender at a Price of Up to $240M - According to BlockFi’s co-founder Zac Prince, the company has signed definitive agreements with the crypto firm FTX, and the deal is up for shareholder approval. The deal represents a total value of $680 million, but Prince noted that $240 million of that total could be used to acquire Blockfi.

🧊 Crypto lender Nexo offers to buy embattled rival Vauld as the market consolidates - Nexo has signed a term sheet with embattled Singapore-based crypto lender Vauld and is exploring an all-equity acquisition. It now has a 60-day window of exclusivity to explore Vauld's books and complete due diligence. Nexo plans to restructure Vauld and pursue an expansion in Southeast Asia and India.

💰 Grayscale Investments Sues the SEC - Grayscale Investments announced that its Senior Legal Strategist filed a petition for review with the United States Court of Appeals on behalf of Grayscale — challenging the decision by the SEC to deny conversion to a spot Bitcoin ETF. It’s Don Verrilli vs. Gary Gensler in this next edition of UFC.

💸 MakerDAO Members Vote on $100M DAI Vault for Bank - The MakerDAO community is voting on whether to provide a DAI vault to Huntingdon Valley Bank, a 151-year-old lender in Pennsylvania with $500M in assets. This would be a major step for the industry. DAI and Maker (and the rest of the DeFi lenders like Compound and Aave have held up incredibly well during this recent CeFi contagion).

📱 HTC Launches Metaverse Phone With Ethereum, Polygon Support - HTC launched metaverse phone “Desire 22 Pro” on Tuesday, which comes with a digital assets wallet and virtual reality (VR) headset pairing feature, as part of the Taiwanese firm’s Web3 expansion. HTC has beaten Solana to market with the first web3 phone.

🔪 Crypto Lender Celsius Cuts 150 Jobs Amid Restructuring - Celsius laid off some 150 employees as it battles a financial crisis that saw it halt customer withdrawals last month. The firm had about 650 staff members listed on LinkedIn, including executives, so roughly 23% of the company was affected.

💎 Ethereum Difficulty Bomb Delayed to Mid-September - Ethereum developers have delayed the network’s so-called “difficulty bomb” by about 100 days, placing a rough estimate in September for its long-awaited transition to proof-of-stake. This move was expected and gives greater clarity on the timeline for moving to PoS.

☀️ Solana DeFi Protocol Crema Loses $8.8M in Exploit - Solana-based liquidity protocol Crema Finance had more than $8.78 million worth of cryptocurrencies stolen from its platform in an attack over the weekend.Share Coinstack

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

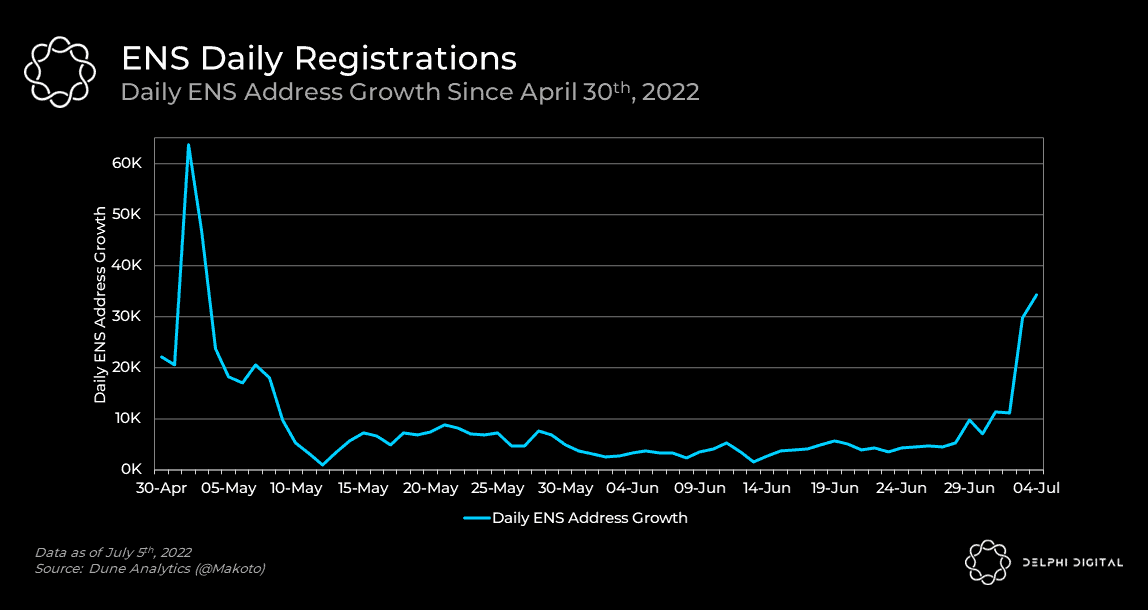

1. Daily ENS Registrations Spiked Reaching Over 30k New Addresses on July 4th Due to the ENS Address 000.eth Being Bought for a Record-Breaking 300 ETH on OpenSea, Setting Off a 3-Digit Mania As Traders Try To Capitalize on the Hype.

2. Binance.us Processes a Record Number of Trades After the Fee Cut

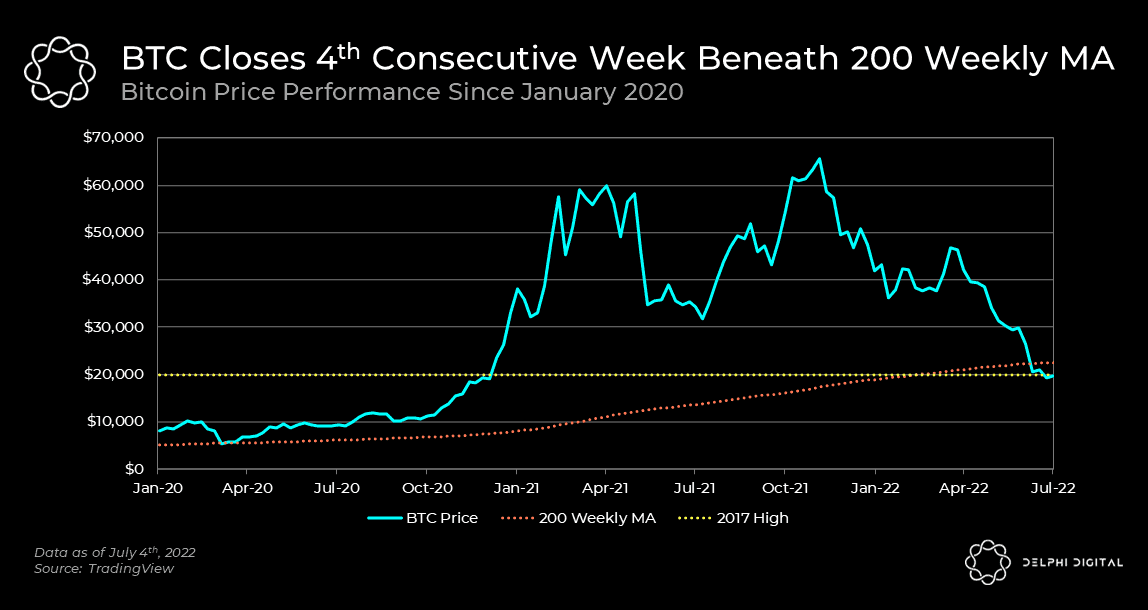

3. Bitcoin Maintains 20k Price Level But Dips Below Its 200 Weekly MA, Signaling a Accumulation Opportunity

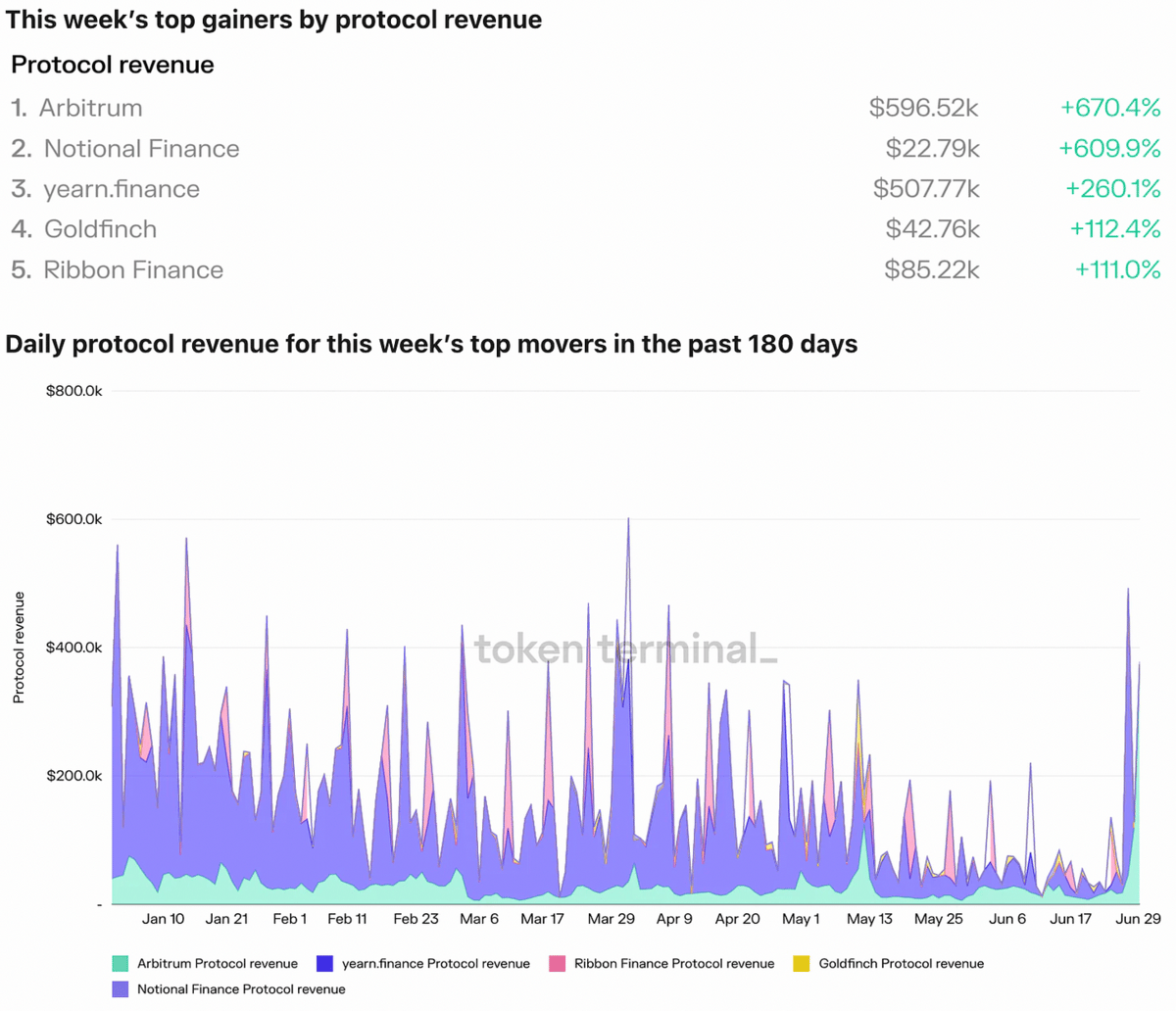

5. This Week’s Top Gainer by Protocol Revenue Was Arbitrum With a 670% Gain

5. Compound Governance Surpasses 100 Proposals While Cumulative Individual Addresses Have Grown 59% From ~11k to ~17.5k, Continuing Trends Since July 2021.

🧵 Article of the Week - Number Three - How Well DeFi Lending Protocols Have Performed During this Crisis While CeFi Has Suffered

By: Arthur Hayes

Below is an excerpt from a wonderful tour de force Medium article by Arthur Hayes on how well DeFi has performed with it transparent on-chain lending while CeFi has been killed due to its hidden lending agreements and the lessons from the third crypto bear market he’s lived through. You can read the full article here.

DeFi Lending Protocols

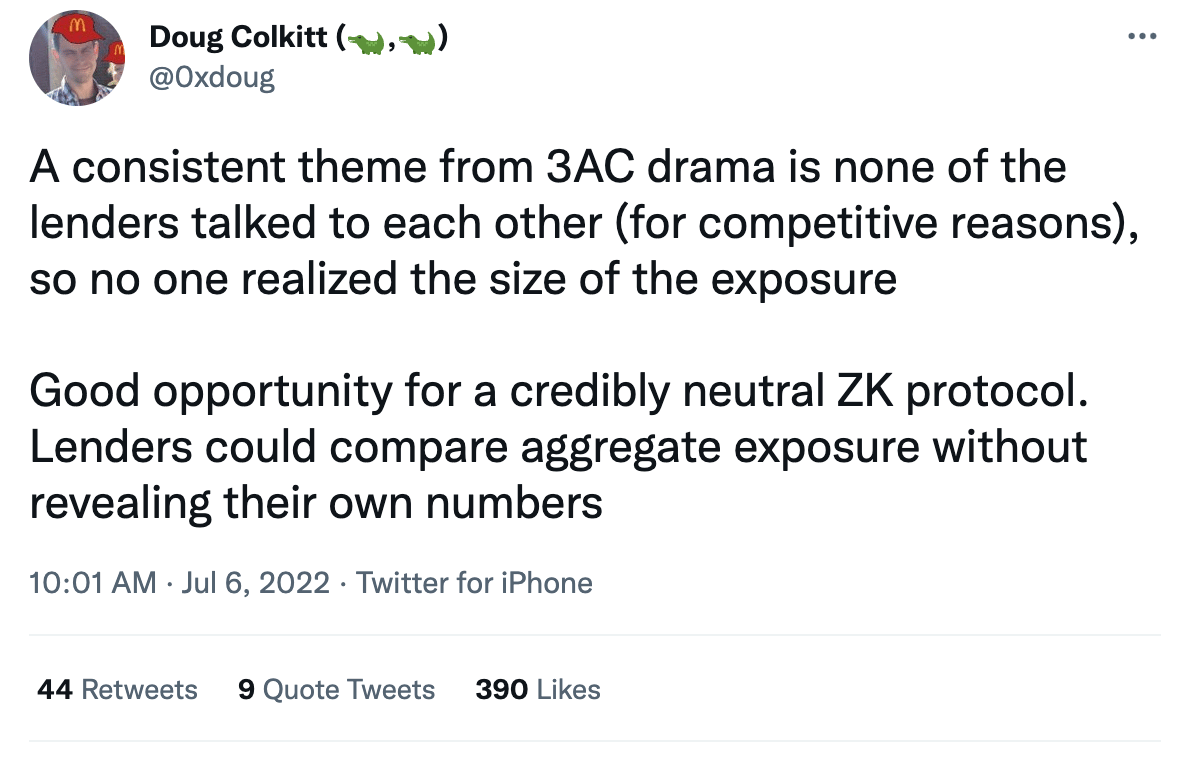

The other entities that lent money to 3AC and various other addresses in the crypto ecosystem were DeFi lending protocols. The major ones that played a part in this melodrama were Compound (COMP), Aave (AAVE), and MakerDAO (MKR).

When you lend in a decentralized fashion, there are no arbitrary decisions made by individual humans. That means the protocol cannot factor any trust-related data points into its decision on whether to loan funds and how to secure them. The protocols, which are governed by the community, have sets of rules which clearly state the type of collateral required and its amount.

If I want to borrow USDC with Bitcoin collateral, the protocols will require the borrower to over-collateralize with Bitcoin. This is because Bitcoin is the more volatile asset vs. a fiat stablecoin, such as USDC. Usually, the initial margin is 150% of the value of the USDC borrowed. If Bitcoin is $100, and I want to borrow 100 USDC, then I must post 1.5 BTC as collateral against a loan of 100 USDC.

If the price of Bitcoin declines, usually to a set level of 120% of the value of the USDC loan, the protocol will immediately and programmatically liquidate the Bitcoin so that, in most cases, the 100 USDC is returned to the lender. These levels are established at the protocol level and can only be changed if enough governance token holders agree to loosen or tighten lending standards.

In fact, during this current crisis, some lending protocols have changed their policies. These changes had to go through a series of community-driven governance votes to be implemented. Wah, isn’t it amazing when decision-making can be done quickly, efficiently, digitally, and in a programmatic fashion by self-interested parties? Just to give you an example, here is a recent proposal for adjusting Compound. Finance’s collateral factors were approved by the DAO governing the protocol.

The only information these protocols have about a lender and borrower is their Ethereum wallet address. To them, 3AC is just an address with a balance, and it is not a collection of humans with a certain pedigree that indicates they can and should be trusted to pay back what is owed even when no collateral is required upfront. I will repeat: these lending protocols are designed with the explicit goal of removing the need for trust from the lending equation.

These protocols control loan books in the billions of dollars. Their lending standards, borrowers/lenders’ addresses, and liquidation levels are completely transparent as they are all published publicly on the blockchain. We can evaluate the health of their loan books in real-time. Depositors in these protocols can process all the relevant information about the health of these protocols before they deposit their funds. Contrast that with the opaque nature of centralized lenders, where the depositors only have slick marketing campaigns to consider.

3AC and the cabal of centralised lending company bag holders all participated heavily on these DeFi lending protocols. We know this because using blockchain analytics tools, market participants were able to ascertain where certain companies would get liquidated on the large loans they had outstanding on these protocols. The market is cruel, and it systematically hunted for levels that would force the protocols to sell indiscriminately in order to make its lenders whole. And thankfully, due to the community stipulating conservative margin requirements, all of these major DeFi lending protocols survived.

The protocols did not have to halt any withdrawals.

The protocols continued to issue loans.

The protocols did not suffer any downtime.

Rekt’um Damn Near Killed ‘Em

When you remove trust from the equation and rely purely on transparent lending standards executed by impartial computer code, you get a better outcome. This is the lesson to be learned.

Above was an excerpt from a wonderful tour de force Medium article by Arthur Hayes on how well DeFi has performed with it transparent on-chain lending while CeFi has been killed due to its hidden lending agreements. You can read the full article here.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Messari: Analyst Note: The Solana Mobile Stack

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and is building data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here

Key Insights:

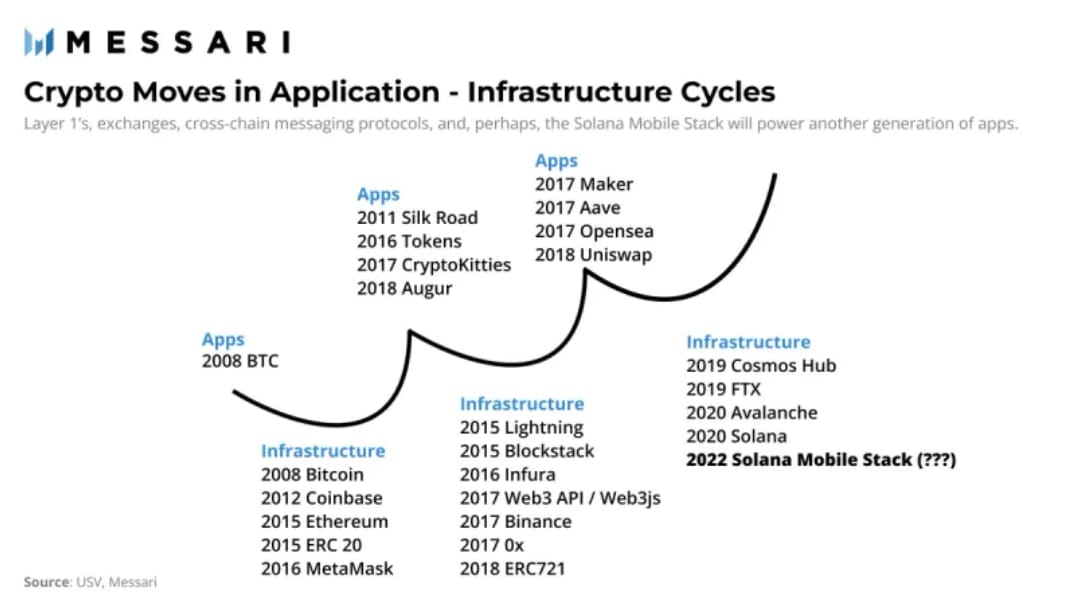

Infrastructure and applications are built in cycles. The Solana Mobile Stack (SMS) represents a big bet on mobile infrastructure being the next significant development to power a generation of unicorn crypto applications.

The SMS may attract developers by reducing the app store “take rate” from Apple and Google’s 15–30% to 0%, saving mobile developers hundreds of millions in value.

Mobile devices facilitate 68% of global web traffic. Tailoring existing crypto apps with product-market fit and novel applications to mobile users will likely expand Solana’s total user set.

Adoption of the SMS may cause downstream adoption of Web3 data services, including Arweave for storage, Helium for 5G connectivity, and others.

Solana Labs recently unveiled the “Solana Mobile Stack” (SMS). It's a combination of a Web3-native Software Development Kit (SDK) built on top of Google’s Android OS and a new smartphone dubbed the “Solana Saga” to match it. We analyzed the potential implications of the SMS on:

Adoption of Solana by developers

Adoption of Solana by users

Adoption of other decentralized networks

Let’s dive in.

Developer Adoption

Today, 68% of global web traffic flows through mobile devices — a number likely to increase due to generational preferences for mobile devices. Despite this, most crypto applications to date have been optimized for desktops. These desktop apps have proven some early forms of product-market fit within crypto, but the mobile market is the larger reward for developers to capture.

USV outlined an application-infrastructure cycle describing their view on the harmony between app and infra development in modern technology stacks. If the SMS becomes the default mobile infrastructure for Web3, the first generation of unicorn-level, mobile-first on-chain apps will likely be built on Solana, and increased development would likely follow.

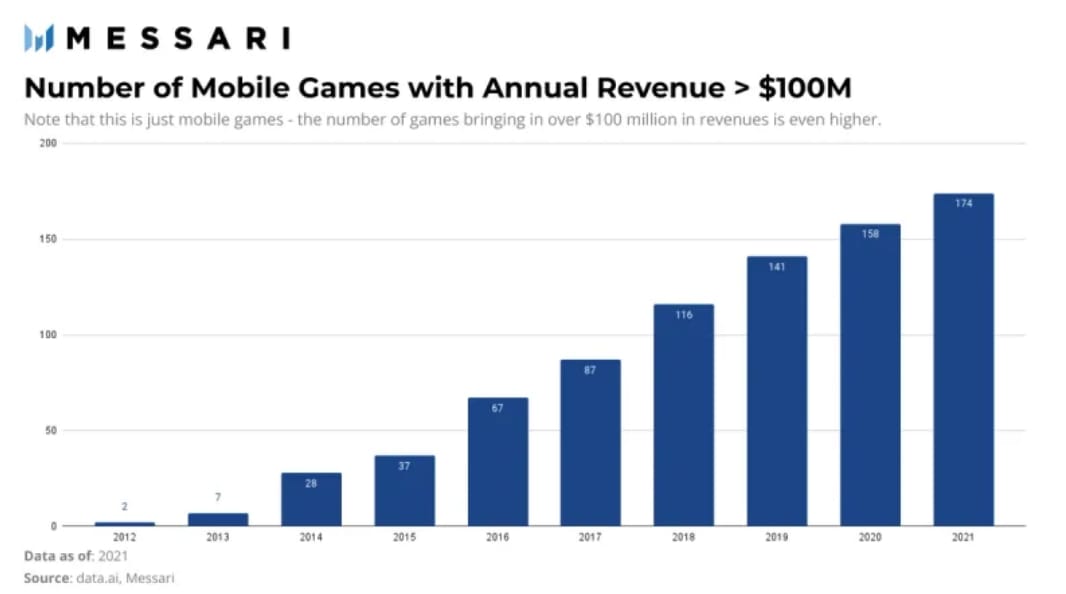

While winning Web3 mobile business models may be unclear today, the market size is not. There were over 170 traditional mobile games with $100 million in annual revenue in 2021 — that’s just one of several potential mobile market verticals.

Why would developers switch from traditional Web2 applications to Web3 ones? Chris Dixon answered this best — Web2’s take rate is Web3’s opportunity. Marketplace fees on Web2 app stores range from 10–30%. Considering these app stores are economies worth hundreds of billions of dollars, that’s billions in value siphoned away from devs and into Apple's or Google’s pockets. Solana potentially offering a 0% take rate decentralized app store is a considerable business advantage that should incentivize the best developers to, at the very least, give the SMS a try.

Read the full Pro Research report from Kel Eleje: Analyst Note: The Solana Mobile Stack

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: TerraUSD is a depegged and deprecated Stablecoin that has recovered some value in the last 30 days, Unifi is an L1, DFI.Money is a Farming Aggregator, and Ceek VR are L1s.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 26,661 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.