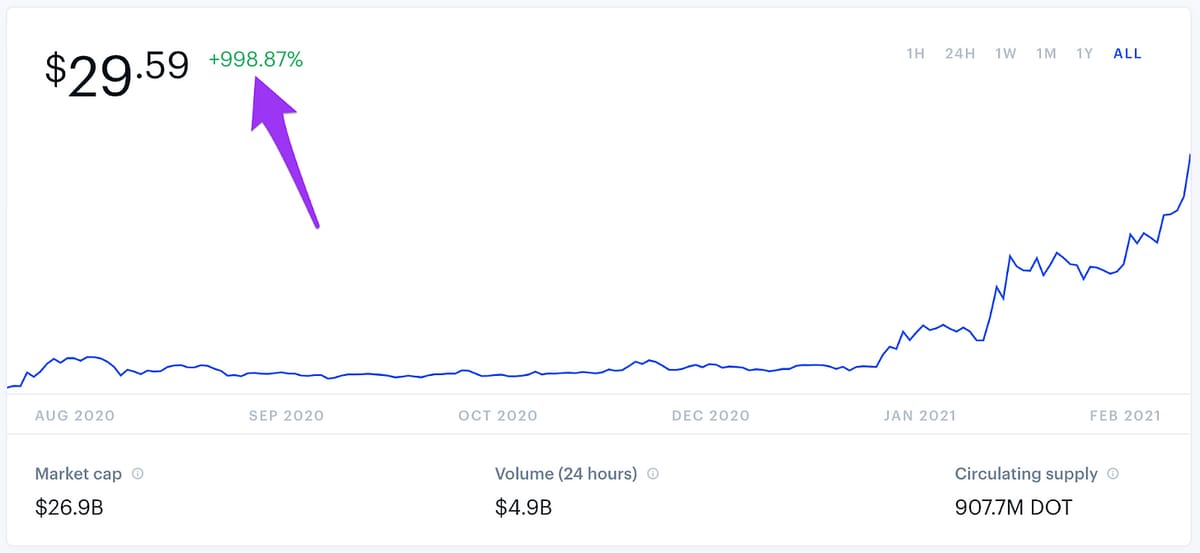

Polkadot Up 998% Since Its August 2020 Launch

How I First Heard About Polkadot

Since late 2019, I’ve been living in Bali with my wife Morgan and new puppy Gracie. There is a very large blockchain ecosystem here in Bali, and I’ve been learning a lot from the leaders in it.

Bali is the home to founders of MetaMask, PlasmaPay, SatoshiPay, Seeds, Qiwi, HVN, and Unit, among many other great projects. It is from the developer community here that I’m often getting my best insights into what is coming in the blockchain world.

Between Singapore and Bali, there is a very strong network of Blockchain developers who are building Dapps at the leading edge of DeFi, payments, and blockchain scalability and interoperability.

Within these circles, what developers are talking about most is by far: Ethereum and Polkadot.

It is from this community of developers-in-the-know that I first heard about Polkadot in December 2020 from my friends Faiz Nazarali founder of HVN and Michael Healy, founder of Unit.

By now you’re probably very familiar with and an owner of Ethereum (ETH), the 2nd largest cryptocurrency by market cap and the first to introduce smart contracts in 2015. If you’re not yet invested into Ethereum, you should be. Go on Coinbase or Binance and buy some ETH and hold for 10-15 years, and in a decade you’ll be very glad you did!

But what in the world is Polkadot???

What is Polkadot and How Do I Invest In It?

However, some of our readers may not yet have heard yet of Polkadot, which launched last May. Polkadot is a new open-source interoperable blockchain technology that addresses speed and scaling.

Polkadot achieves this by using parachains, essentially a different chain for every application -- so heavy usage in one app doesn’t slow down usage in another app -- sort of like having different AWS servers for every big application.

Polkadot’s creation is being led by Gavin Wood, one of the main co-founders of Ethereum. Gavin left the Ethereum team in 2016 to begin working on Polkadot after having a slightly different vision from Ethereum’s main leader, Vitalik Buterin.

Polkadot’s technology is being designed to be interoperable to Ethereum. Polkadot launched its first genesis block in May 26, 2020 and is fully live. It uses a combination of parachains, relay chains, and bridges to enable interoperability and scalability — based on a belief in a multichain future.

Polkadot’s first applications will be launching its parachains over the next 3-6 months, first on Rococo and Kusama, its lower cost test networks, and then on Polkadot itself. Once that happens, I anticipate the token price will increase substantially. Polkadot uses the substrate language, which is apparently easier to code in than Ethereum’s solidity. Polkadot facilitates an internet where independent blockchains can exchange information and transactions in a trustless way.

You can learn more about Polkadot at https://polkadot.network/.

The Polkadot Token (DOT)

Polkadot’s token DOT began trading on August 21, 2020 at $2.69. It is up 998% since launch, and now trades at $29.59 per DOT token. As of today, Polkadot (DOT) has a market cap of $27B compared to Ethereum’s market cap of $212B. It’s still very cheap compared to where it is going in a couple years. Most people haven’t heard of it yet, but in 2-3 years, they’ll know all about it.

You can get the Polkadot token on Binance, Huobi, Kraken, KuCoin, Uphold, Voyager, OKEx, Changelly, or Crypto.com. It’s not yet listed on Coinbase, but it will likely be listed there later this year. Don’t wait until it’s listed on Coinbase as it is likely to be worth a lot more in six months than now. I recommend you get some now.

I encourage everyone to hold around 10% of their total crypto portfolio in Polkadot. See my specific guidelines below in Crypto Portfolio Recommendations.

The Kusama Token (KSM)

You can also invest in the Kusama token (KSM), which is the Polkadot network many developers are choosing to launch on as it will cost a lot less to launch an application on Kusama than Polkadot. You can learn about Kusama at https://kusama.network/.

Polkadot’s parachains (blockchain slots) are being reserved for enterprise applications and well-funded projects and are difficult to acquire, while Kusama’s are much easier to acquire. The Kusama token started trading at $1.78 back in December 2019 and is now trading at $164 (up 92x in 14 months!). Kusama’s market cap is still low at $1.3B, compared to Polkadot at $27 billion.

You can get the Kusama token on Binance, Huobi, Kraken, KuCoin, Okex, Changelly, or Crypto.com.

I would encourage our readers to look into investing in both Kusama and Polkadot and plan on holding for 10-15 years for maximum long term appreciation.

Polkadot is Beating Cardano in Developer Activity

Currently Cardano is valued slightly higher in market cap that Polkadot. Cardano is at $29B versus $26B for Polkadot.

I’m a big fan of Polkadot over Cardano for one simple reason: there’s a lot more developers building on Polkadot. There are 359 projects building on Polkadot so far, 18 of which are dApps. In our research, we could find just one dApp building on Cardano at the moment.

As of October 29, 2020 there were over 384 developers worldwide building Polkadot with just 151 building on Cardano. Other than Ethereum, Polkadot is the project with the most active developers AND the most growth in developers from 2019-2020.

And this figure doesn’t even include all the developers building dApps on Polkadot (just those working on the protocol itself). Long story short: Polkadot > Cardano.

Active Protocol Developers as of October 2020:

Ethereum: 2296

Bitcoin: 401

Polkadot: 384

Cosmos: 230

Cardano: 150

Polkadot Projects With Live Tokens

If you believe in Polkadot, then it’s good to invest in the initial dApps being built on Polkadot. Our favorites so far are:

Polkastarter is the place to raise capital for any blockchain-based project. You can invest in projects before they begin trading on exchanges. Token: POLS

Real-time prediction and betting markets. They are offering their tokens for sale for the first time on February 24 via an IDO on Polkastarter. Register early to get them. Token: POLK

A DeFi protocol, originally built on Ethereum and now being rebuilt on top of Polkadot. Token: AKRO

Reef is a cross-chain DeFi tool that makes it easy to get a return on your crypto holdings. Build on Polkadot. Token: REEF

Ocean makes it easy for data to be exchanged among blockchain based applications (including AI, future social networks, IoT apps, autonomous vehicles, NewFi banks, and wallets). It is built on top of Polkadot. TOKEN: OCEAN

OriginTrail is a leader in using the blockchain for Enterprise supply chains, a huge industry. They originally built on Ethereum and are now building on Polkadot. Plus, they have an epic name that rekindles childhood memories of playing Oregon Trail in the ‘90s. Token: TRAC

They are working on building a decentralized central bank for the world that provides capital to promising Polkadot projects. Token: XOR

A decentralized identity framework and data exchange, built on top of Polkadot. Token: ONT

Dock is a protocol for verifying the legitimacy of certificates, licenses, and degrees -- built on top of Polkadot. Token: DOCK

Offshift is a DeFi protocol built on Ethereum and Polkadot and the first dual-sided public/private protocol to be built entirely on a public blockchain. TOKEN: XFT.

Celer Network is a layer-2 scaling platform designed to build fast, easy-to-use, low-cost and secure blockchain applications. It is building with Polkadot. Token: CELR

RioDeFi is bringing DeFi to Polkadot and bringing the power of decentralized finance to the masses by bridging the worlds of traditional finance and digital assets. It isn’t yet live, but I see big things coming. Token: Coming in 2021

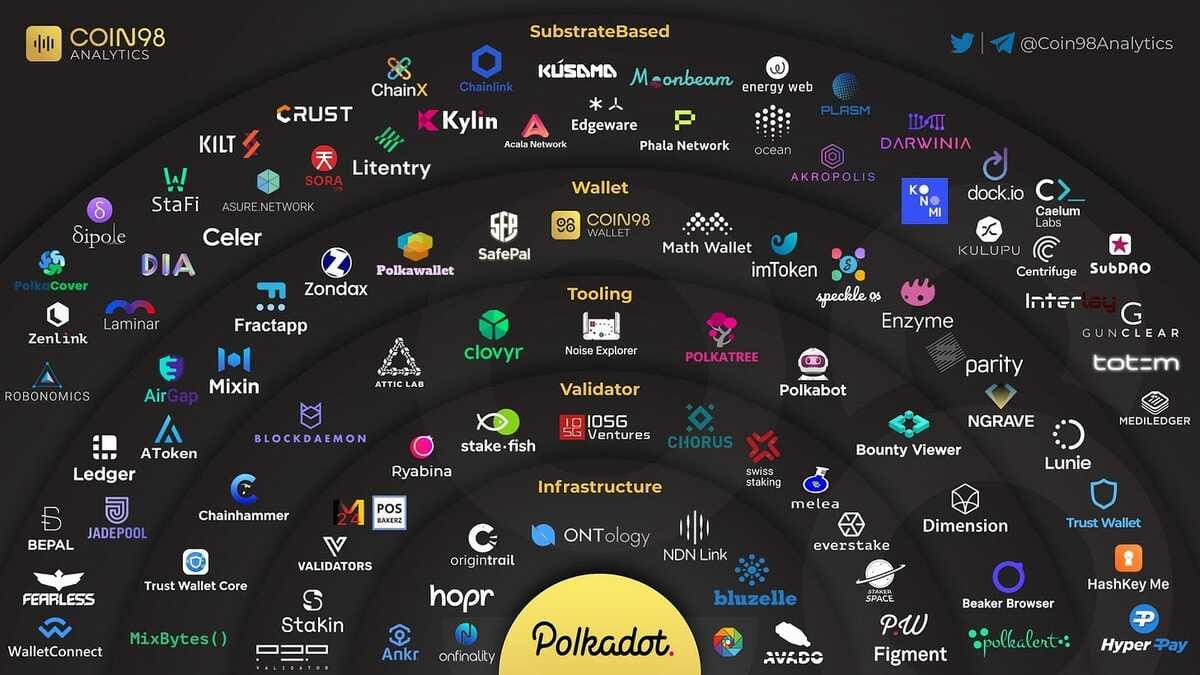

Polkadot Ecosystem Map

And here’s a map of the very active Polkadot Ecosystem from Coin98...

Finally, below is a graphic from Coin98 showing some other not yet launched projects on Polkadot, including the very strong forthcoming projectsAcala Network (Cross-Chain DeFi), Moonbeam (Smart Contracts on Polkadot), and Plasm (dApp building on Polkadot). Sign up for their Telegram groups and email lists to learn about when their tokens will launch.

It’s clear the future is multichain. If you haven’t already invested in DOT, you should probably stop reading this :)

My Crypto Portfolio Recommendations (Updated)

Here are my big picture recommendations for anyone getting started in crypto investing with a balanced mix of potential return and asset preservation. I adjust these each week or so based on what I learn and any changes in the marketplace.

Never invest an amount you can’t afford to lose. Crypto is volatile and downswings of 80%+ happen. Don’t invest more than 50% of your total net worth in crypto.

Be careful investing on borrowed money (margin). We don’t recommend it until you’re a professional.

Unless you’re an experienced and professional trader with many years of training, your best bet is to buy and hold for the long term (10-15 years) and not attempt to time the market. If you are going to attempt to time the market, be very familiar with the Stock to Flow model and the timing of BTC halvings and be very familiar with the research backing up the blue chips like BTC, ETH, DOT, etc.

We recommend Coinbase for those investing small amounts (<$10K) and Binance (use a VPN if needed), Coinbase Pro, Huobi, Kucoin, Gemini, or Kraken for those investing larger amounts ($10k+). You can also use the no-fee Voyager or Nexo which give you no-commission trades and 6-8% annual interest in exchange for holding your cryptodeposits.

Many tokens don’t yet trade on Coinbase. Binance has most of them. Huobi, Kucoin, and Uniswap have anything Binance doesn’t have.

For a mix of long-term capital preservation and growth, we recommend keeping 33% of your holding in BTC, 33% in ETH (“The Blue Chips”), 10% in Polkadot (“The New Ethereum”), 10% in NEXO (the best NeoBank), and around 13% in up-and-coming projects. Here’s what we like the most right now based on months of research (the 20 we like the most are bolded):

We like these blockchain techs: ETH, DOT, KSM, ATOM,ADA, SOL, HBAR

We like these NewFi Banks: NEXO,VGX, CAS

We like these Exchanges: BNB, HT, UNI, SUSHI,1INCH, BURGER

We like these DeFi protocols: PPAY, AAVE,COMP, SNX, CRV, BAL, REN, CAKE

We like these Oracles: LINK, BAND

We like these Web 3.0 Tools: BTT, THETA, GRT, FIL, MATIC

We like these Insurance Tools: WNXM, ARMOR

We like these Polkadot Apps: POLS, REEF, TRAC,OCEAN, ONT, XFT, AKRO

We like these Data Platforms: DATA

We like these Payment Platforms: EGLD, CELO, XLM

We like this Security Token Platform: POLY

See the research at Simetri, Messari, Trade the Chain, and Flipside Crypto for even more due diligence.

The People We’re Following Closely on Twitter

If You’re Just Getting Started With Crypto, Start Here

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coin Times: Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published 2x per week. Published and written by Ryan Allis.

Comments and thoughts welcome:

Telegram channel at t.me/thecointimes

Substack at TheCoinTimes.com

Please share with your friends and colleagues.