Raising Crypto Venture Capital in Today’s Market

By Ryan Allis, CEO of Coinstack Partners & Publisher of Coinstack

About this article: In this article we explain how Coinstack Partners helps crypto and web3 firms raise venture capital for Series A/B/C rounds of $1M to $100M. We’ve built relationships with 300+ crypto VCs and 500+ Fintech/SaaS VCs. To discuss venture capital fundraising services for your company, please review our web site and deck and then schedule a free consultation here.

Times Have Changed in Crypto VC

A year ago in Q4 ‘21, raising venture capital for web3 and crypto companies was often as easy as doing a couple Zoom calls and then asking for a term sheet.

Projects had their choice of capital providers. Anonymous teams with a six page semi-plagiarized whitepapers and an unincorporated DAO were getting backed.

Pre-launch crypto projects with no revenues could launch a $20M equity or token sale in a few weeks -- often at a 9 figure valuation of $100M or more. And firms with literally no product could issue a token, list it on Binance and Uniswap, pay off market makers, and then sell newly issued tokens at discounts to VC firms with minimal lockups -- shamelessly using retail buyers buying into the hype cycle for exit liquidity once lockups expired.

Few questions about “how will this project actually make money” were ever asked.

Crypto VCs were popping up with new funds left and right and were allocating capital to as many projects as they could -- hoping that a diverse allocation across the industry would generate enough 50x winners to pay for all the losers.

Back in the crypto bubble of 2021, winging it was possible. A CEO could handle fundraising in 4-6 weeks by going to a couple crypto conferences, asking a couple advisors for intros, doing a couple zooms, and then asking for the money.

In this new environment, a proper fundraising process is very helpful to a round getting done. That’s what we do at Coinstack Partners — we help crypto/web3 firms raise equity and token capital from venture investors by taking them through a defined and structured fundraising process.

The Top Crypto VCs

Back in 2021, top firms like A16Z, Pantera, Multicoin, Paradigm, Galaxy Interactive, and Polychain were all working on deploying multibillion dollar crypto-only funds.

Even traditionally conservative pension funds and large sovereign wealth funds were jumping into new crypto funds with huge allocations on minimal diligence.

Today, after a couple big failures (notably FTX Ventures), we’re tracking 25 global crypto VCs with $1B+ funds and 308 unique crypto venture capital firms with a minimum of $10M in fund size.

The top 25 crypto VCs by fund size. Our full crypto VC reachout list is 308 firms.

How The Crypto VC Industry Changed in 2022

So much has changed in 2022 from the free-flowing bubble times of ‘21.

This year Terra, 3AC, Celsius, Voyager, FTX, and BlockFi have all collapsed in a massive unwinding for the industry.

Few would have believed a year ago that:

Do Kwon (Terra) would be hiding from Interpol warrant

Kyle Davies (Three Arrows Capital) would be hunkered down in Bali awaiting liquidation proceedings

Alex Mashinsky (Celsius) would have resigned with a multi-billion hole in his balance sheet from risky bets using customer deposits

SBF (FTX) would have been kicked out as CEO and now be preparing for Congressional Testimony to explain how in the world he didn’t know that billions of dollars of customer deposits were given to a risky hedge fund he founded and controlled in exchange for self-minted collateral.

It’s been that kind of year. The firms that have survived 2022 and can raise in 2023 will be the ones who thrive in 2025 and beyond.

Lessons The Industry Learned This Year

It was a year that brought a lot of lessons for the industry.

While the long-term technological hype behind web3 is real (smart contracts, distributed ledgers, tokenized financial assets, stablecoins, and 24/7 markets running on blockchains, are in my view the foundational new rails of global finance), some important lessons had to be learned first in 2022 to reset the market for long-term industry health…

Don’t mess with customer deposits (should have been obvious, but this is what took down FTX and Celsius)

Don’t use your own native token to back your own algorithmic stablecoin (what took down Terra/Luna/UST and 3AC)

Don’t lend money to highly speculative hedge funds in order to get promised yield (what took out Voyager)

Don’t give out uncollateralized loans

Don’t give out collateralized loans when the collateral is a highly volatile token

After a year of unwinding and learning very costly lessons – the value of the crypto market cap is now $840 billion down from $3 trillion a year ago.

Now, out of necessity it’s back to the fundamentals -- for both the VC funds who are raising from their LPs -- and for the companies that are raising from the funds.

Now, if you want to raise lots of venture capital you actually need to be building something that solves a real need that customers will pay for, have actual paying customers, and have product-market fit.

And it can be helpful to have an investment bank working with you to run a thorough process for you. That’s why we’re here.

Our web site: www.coinstackpartners.com

How To Run a Crypto VC Fundraising Process

We founded Coinstack Partners as a boutique investment bank that helps web2 and web3 firms raise venture capital. Our speciality is helping SaaS and crypto firms raise between $1M and $100M in Series A/B/C rounds. We’ll sometimes do a seed round — but only if the product is already launched and has either paying customers or lots of active users.

We don’t do pre-seed rounds as we specialize on working with companies that already have a launched product, ideally with customers and revenues and are ready to scale up. We focus on raising growth capital for engines that are already at least mostly built.

For each of our clients, we spend a few weeks helping them prepare their fundraising materials if needed, and then we will through a rigorous and defined process reach out to an average of 300 firms for each client. We customize the reach out list for each client based on stage, amount, and industry.

For our recent clients, we’ve been averaging about 100 different firms requesting the pitch deck and around 10 introductions to capital providers for pitch meetings.

The basic steps we go through are:

Prepare the materials (deck + historical financials + financial forecast)

Prepare the reach out list (customized by stage, amount, and industry niche)

Send a teaser paragraph to around 300-500 total crypto/fintech/SaaS VCs

Send the deck via DocSend for the firms who request it

Make an introduction between the investor and the firm CEO as requested

Guide the firm in identifying the lead investor

Help the firm fill in the round with follow-up investor once the lead and terms have been set

Here’s what a typical three month crypto VC fundraising process looks like when working with us:

We break down this 3 month fundraising process into a week by week rigorous reachout and follow-up process.

A standard 13 week fundraising process

Building The VC Reachout List

In fundraising, the magic is in the list, the relationships, the materials, and the follow-ups. We spent many months building our reachout lists -- and then updating them with each firm’s preference for niche, stage, and round size.

So far, we have built relationships with partners at:

308 Crypto/Web3 VCs

223 Fintech VCs

352 Web2/SaaS VCs

At each of these firms we will usually have between 2-5 contacts we’ve established over the last year. Our total manually researched and up-to-date reachout list includes over 2000+ venture investors and 1,200 family offices.

With each client, we have them go through the list and mark any firms that they’ve either already contacted or that they don’t want us to reach out to.

Working with us, you are not only getting your deck out to many dozens of interested investors — but you’re getting our advisory help throughout the fundraising process and access to the relationships we’ve built.

So, instead of spending hundreds of hours doing it yourself -- we do the reachouts and the investor meeting set up for you so you can focus on growing your business and then nailing the pitch meetings.

What makes us unique is that when we reach out – we get responses. We often will see 70%+ open rates on our reachouts -- as the firms we are reaching out to know the Coinstack name.

We’re fortunate to have a “who’s who” of crypto reading Coinstack

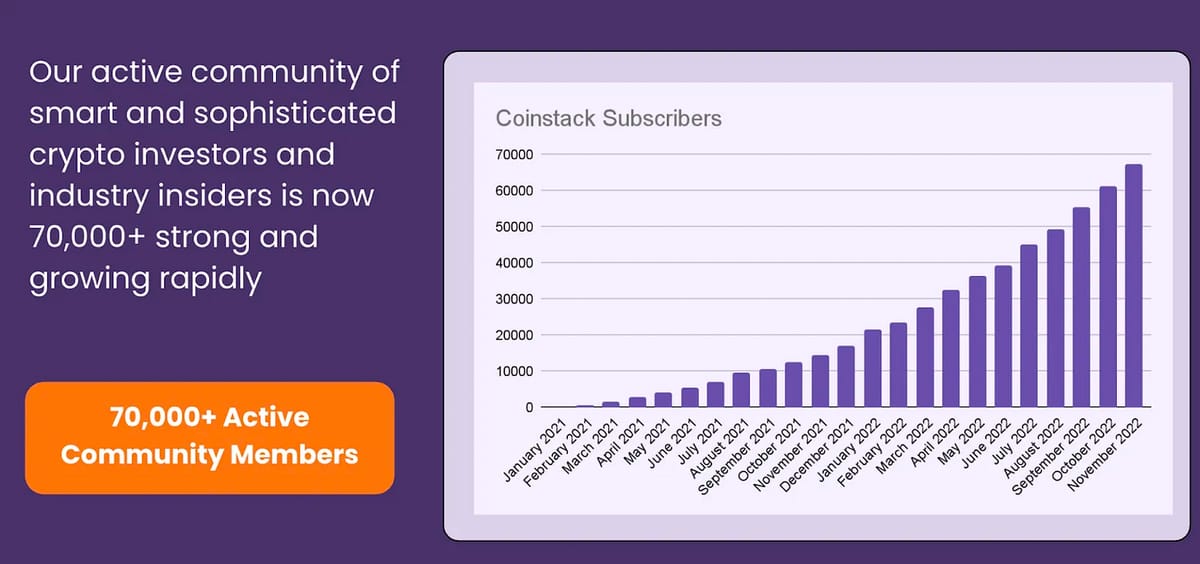

We also include our clients as sponsors in our weekly crypto newsletter Coinstack which now has 70,000 subscribers, giving your firm added exposure. The newsletter has been rapidly growing since we started it two years ago.

Our newsletter has grown from 12,000 to 70,000 subscribers in 2022

If You’d Like to Work Together On Your Raise

If you are a post-revenue, post-launch crypto, web3, fintech, or SaaS firm that would like discuss us to run your upcoming VC process for you, please:

Review our deck (past results and cost is in the deck)

Schedule a free consultation here (if you fit the post-revenue, post-launch requirements)

We will review your current deck, ask you a few questions to get to know your business, and give you our honest assessment as to whether we think we could raise capital for your firm and at what valuations.

It’s a good idea to get in touch with us ideally about a month before you want to kick off your process.

If you’d like to raise venture capital during Q1 2023 please schedule a free consultation with us before the Holidays.

Current Market Valuations by Stage

Seed rounds for pre-revenue crypto/web3 firms are still getting done but valuations have come down by about 50-60% since the beginning of the year.

Most seed deals we’re seeing are now getting done at around a $15M to $20M valuation (down about 50% since Q4 2021)

Most Series A deals are getting done at around a $25M to $75M valuation (also down about 50% from 2021). Factors like team experience and the rate of revenue growth matter a lot here. You might see one Series A get done at $20M and another at $120M, depending on revenue growth rate and team experience.

As a founder, you don’t really want to raise money at too high of a valuation anyway, as that can lead to very painful down rounds that dilute employee equity and a lot of pressure to quickly ramp up monetization and sales before the product is truly ready.

The over-exuberance of 2021 where the business model was an afterthought has given way to a grounded focus on the fundamentals that come from traditional fintech and SaaS business analysis.

Key Questions That Are Being Asked by VCs

Questions like these are now being asked by appropriately skeptical investment committees:

Has this company demonstrated it has a product that customers are willing to pay for?

How many paying customers does this company have?

How much monthly revenue does this company have?

Is that revenue growing or shrinking quarter over quarter?

What value is the product providing in the market?

How big is this market really?

What moat has the company built that will protect it from competition?

What is the actual economic value of the firm’s token, if any?

Has anyone on the leadership team actually built a successful company before?

Does this firm have a Chief Financial Officer and a Chief Compliance Officer?

My sense is that VC partnerships putting a bit of a skeptical eye on their investments is healthy. It’s simply no longer enough as a crypto venture capital firm to simply put a little bit of money into every deal that your partners send your way. Now, deep analysis, rigor, and some common business analytical sense is required to identify the most likely winners — and the spray and pray strategy doesn’t work quite as well any longer.

My Background

Prior to building Coinstack I spent 10 years building then selling iContact, a marketing automation SaaS company, for $169 million and then got an MBA at Harvard Business School. In my career I’ve raised $66 million in venture capital personally as Founder/CEO. The last few years I’ve been advising the CEOs of and helping grow the SaaS companies Tatango, Pipeline Deals, Seamless.ai, and Green Packet.

The last two years, I’ve also been building Coinstack into one of the larger weekly institutional-focused crypto newsletters with over 70,000 subscribers. I’m now excited to build Coinstack Partners as we help connect quality SaaS and crypto companies with capital. I now consult with both Web2/SaaS CEOs and Web3/Crypto CEOs in growth and fundraising. Reach out if I can be of support.

We Remain Bullish on The Industry

We believe that the future rails of global finance are being built right now on top of distributed ledgers, smart contracts (often written in Solidity and Rust), stablecoins, tokenized financial assets (we believe all assets will eventually be tokenized) which are traded on 24/7 always-on markets.

We wouldn’t still be here if we weren’t still super bullish about these technologies being the foundational underpinning of the new rails of finance.

And for the web3/crypto companies raising — while it may now require a defined process, help from a firm like us, and reaching out to a few more firms than before to raise a successful round — those who can thrive in the climate of 2023 will be the firms that are strong in 2025 and beyond as the market comes back bigger than ever.

We’re here to help if desired. Just take a look at our deck and then reach out for a free consultation here. We hope to speak with you soon.

About this article: Coinstack Partners helps web3 and crypto companies raise funding from venture capital firms for Series A/B/C rounds of $1M to $100M. We’ve built relationships with 300+ crypto VCs and 500+ Fintech/SaaS VCs. To discuss venture capital fundraising services for your company, please review our web site, deck and then schedule a free consultation.