Social Links: Twitter | Telegram | Newsletter

Learn More at www.wiselending.com and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 150k weekly subscribers. This week we cover the big SBF trial in NYC, Su Zhu’s arrest in Singapore, Do Kwon’s blocked extradition to the US, and big new venture rounds for Supra ($24M) and IYK ($16.8M). We’re now less than 200 days away from the next Bitcoin halving, which historically has been the catalyst to the start of the next bull market. It’s time to build!

Price performance since we began writing Coinstack in January 2021

Published By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Become a Coinstack Sponsor

To reach our weekly audience of 150,000 crypto insiders and daily audience of 50,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Thanks to Our 2023 Coinstack Sponsors…

Wise Lending is a fully decentralized liquidity market that allows users to supply crypto assets and start earning a variable APY from borrowers. Wise Lending has merged lending platform technology with yield aggregator technology to create higher APY opportunities for borrowers, which ultimately raises the interest paid to lenders across the platform.

Amphibian Capital is a market/delta neutral fund for the world’s leading crypto funds. They returned approximately 5.35% net in Q1 ‘23, 186.33% net (pro-forma) since '19* and aim to deeply mitigate downside. They have USD and ETH share classes, soon BTC. Deck here: www.amphibiancapital.com.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ SBF’s Trial Begins Tuesday in Manhattan - Judge Lewis Kaplan on Wednesday announced a 12-person jury that will determine the former FTX CEO’s fate in a criminal case in the U.S. District Court for the Southern District of New York. A physician’s assistant, a librarian, a nurse and nine others will decide if Sam Bankman-Fried committed fraud. Here’s an overview of the the trial and case.

⚖️ Su Zhu arrested in Singapore; Kyle Davies wanted by authorities- Zhu Su, co-founder of the now-bankrupt Three Arrows Capital (3AC), has been apprehended in Singapore, according to a tweet by online news aggregator db, known as @tier10k on X, and later confirmed by Three Arrows’ liquidator, Teneo.

⚖️Terraform Labs’ defense team says extraditing Do Kwon to the U.S. for SEC testimony is ‘impossible’- The legal defense for Terraform Labs submitted a court filing that aims to show that its former CEO, Do Kwon, cannot be extradited to the United States. In a Sept. 27 filing, the defense’s legal team noted that the U.S. Securities and Exchange Commission (SEC) intends to depose Kwon to the U.S. prior to Oct. 13. If the SEC were successful, Kwon would provide testimony in the securities case.

⚖️ Sam Bankman-Fried not allowed to blame FTX counsel in opening statement, judge rules - FTX founder Sam Bankman-Fried, whose trial began on Tuesday, is not allowed to pin the blame for his alleged wrongdoings on FTX’s lawyers in his opening statement, a federal judge ruled on Sunday.

⚖️ SEC Moves to Delay Spot bitcoin ETFs from BlackRock, Valkyrie and Bitwise - The Securities and Exchange Commission on Thursday said it is instituting additional proceedings to determine whether proposed spot bitcoin ETFs from BlackRock, Invesco, Valkyrie and Bitwise should be approved or disapproved, in apparent additional delays to the ongoing review processes underway.

✅ Coinbase granted full license in Singapore- Coinbase, the crypto exchange operator, was granted a key regulatory license in Singapore. The Monetary Authority of Singapore handed the company a Major Payment Institution license, after granting in-principal approval late last year, according to an announcement today.

💬 Tweet of the Week

Source: @EricBalchunas

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

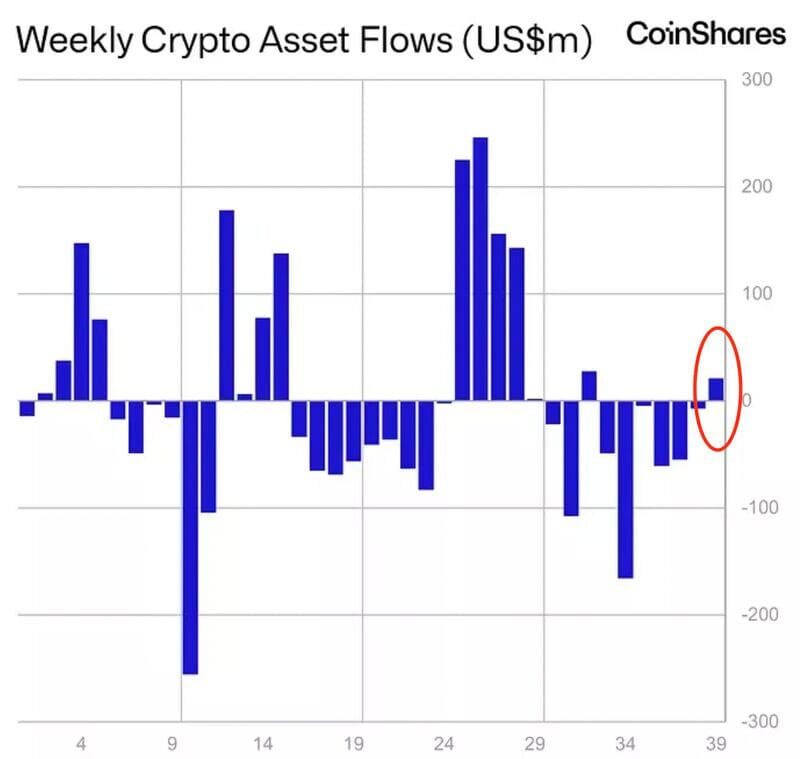

1. Institutional investments in digital assets finally turn positive after 6 consecutive weeks of net outflows. We've now seen inflows totaling $21M this past week.

Source: @DavidShuttleworth

2. Launch day for futures-based ETH ETF. First-day trading volume: $1.96m.

Source: @VetleLunde

3. friendtech has reached $50M TVL

Source: @tomwanhh

4. Ethereum blockspace profitability has fallen to -$2.5m per day

Source: @JasonYanowitz

5. Solana futures open interest is now $350M, the highest it has been since mid-August.

Source: @DavidShuttleworth

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

As rightly pointed out in this article from Coindesk “Every CEX needs a DEX”, CEXs (‘Centralised Exchanges’) and DEXs (‘Decentralised Exchanges’) are often seen as competitors, but in reality they can be complementary with a CEX running a decentralised backend to guarantee security, transparency and permissionless transactions. Infact some of the largest exchanges in the world are already working with Brine.fi just for this one use case.

Brine.fi is a robust platform powered by Starkware, audited by PeckShield that allows CEXs, institutions, hedge-funds, high frequency trading firms and even retail users to trade crypto assets with millisecond latency while maintaining full custody of their assets. What truly sets Brine apart is its pioneering role as among the first decentralised exchange to grant institutions the freedom to execute orders exclusively with KYC-verified and known counterparties, establishing a new standard for security and compliance in the DeFi landscape for institutions.

What makes Brine special?

Innovation is an undeniably crucial constituent of decentralisation - we see new ventures within the DeFi space every day and these are as vital to DeFi as DeFi is to finance. Among the multitude of projects emerging, Brine stands out with its implementation of user-centric protocols and a strong push towards a more inclusive financial future.

The Brine Fi team includes former execs from CoinBase, PayPal, Venmo, Flipkart, Harvard, and MIT and are on a mission to deliver the best DEX experience possible to traders and institutions alike. Brine Fi was founded by university friends Bhavesh Praveen, Ritumbhara Bhatnagar and Shaaran Lakshminarayanan.

Shaaran Lakshminarayanan, co-founder and CEO at Brine Fi on a recent article by Forbes commented: “Having built one of the largest crypto exchange in India, we have had to diversify users assets constantly in multiple exchanges and venues to reduce asset loss risk due to troubled exchanges/parties, with Brine Fi we make it easy for institutions, centralised exchanges, HFT traders and retail users to reduce their counterparty risk and at the same time get the best price for their orders in the industry”.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.wiselending.com and www.amphibiancapital.com