Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.wemetalabs.com and www.investdefy.com

Issue Summary: Welcome back to Coinstack, the weekly letter for institutional crypto investors and industry insiders, where we summarize the top news, stats, and reports in the digital asset ecosystem. Below we cover SBF’s arrest, his rather shocking Congressional testimony notes that he had planned to give, and the top funding rounds and stats of the week. This week for some reason feels like a cycle bottom. It’s time to build.

Thanks to Our Coinstack Sponsors…

Coinstack Partners advises crypto and web3 companies on raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

WeMeta is the Bloomberg for web3 and the metaverse, combining on-chain data, social data, and news data from many sources into a single dashboard and API source designed for web3 investors, app builders, and brands. Learn more at www.wemetalabs.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) ⚖️ FTX Founder Sam Bankman-Fried Arrested Monday in the Bahamas - The Royal Bahamas Police Force arrested FTX founder Sam Bankman-Fried on Monday. The arrest came after the U.S. filed criminal charges against Bankman-Fried. The U.S. has requested to extradite Bankman-Fried for trial in the USA. The earliest the trial could begin is late-2023/early 2024.

2) 🚩 SEC Charges Sam Bankman-Fried for Defrauding FTX Investors - The U.S. Securities and Exchange Commission (SEC) has charged Sam Bankman-Fried, the former CEO of defunct crypto exchange FTX, for defrauding investors of his platform.

3) ⚖️ Full Testimony Bankman-Fried Planned to Give to Congress - Sam Bankman-Fried, was scheduled to testify Tuesday before the U.S. House of Representatives Committee on Financial Services. You can see full planned testimony here.

4) 👁️ SBF Written Testimony Reveals Bankruptcy Second Thoughts - In his prepared remarks for Congressional Testimony that were never delivered due to being attested, SBF claims he received an offer for billions in funding to make customers whole just 10 minutes after he signed the Chapter 11 DocuSign and that he told the FTX law firm to not send in the filing, but they did anyway. The plot thickens…

5) 🔗 Tron’s Justin Sun ‘Deploying More Capital’ to Stop Stablecoin USDD’s Slide - Normally pegged to the price of the greenback, the stablecoin has traded below $1 since the end of October. The token did, however, drop to its lowest point ever of $0.97.

6) 🟩 U.S. Justice Dept Is Split Over Charging Binance As Crypto World Falters - Splits between U.S. Department of Justice prosecutors are delaying the conclusion of a long-running criminal investigation into the world's largest cryptocurrency exchange Binance.

💬 Tweet of the Week

Source: @AutismCapital

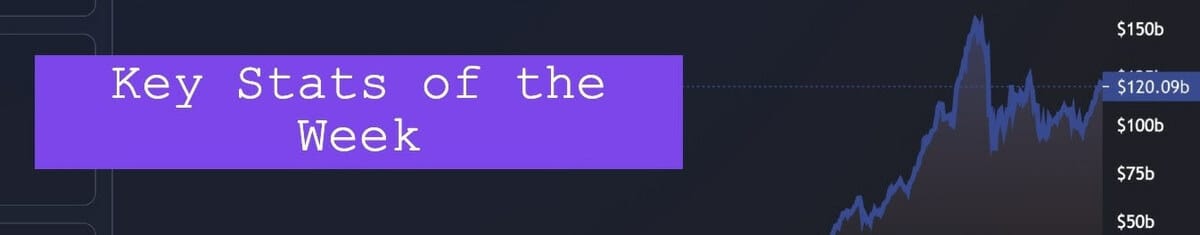

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Ethereum Number of Addresses Holding 32+ ETH Just Hit ATHs

Source: @CryptoGucci

2. New Users on DEXes Have Shot Up Over the Past Month

Source: @DuneDigest

3. Sudoswap LP Fees Reach $2.1M

Source: @OurNetwork

4. Flow Blockchain Reaches 25% of NFT Transactions vs ETH & SOL

Source: @OurNetwork

5. Since October, the Supply of stETH in Bridges to the Two Rollup Chains Has Increased by About 24,500 ETH

Source: @TheBlockRes

🧵 Thread of the Week - SBF Indictment

By: @GRDecter

1/ Sam is facing 8 charges, which can be broken into 4 areas:

Wire fraud, securities fraud, money laundering, and campaign finance violations

2/ The first charge is conspiracy to commit wire fraud on customers.

The indictment says that SBF and others took in FTX deposits knowing that they'd use them to pay Alameda expenses and debts

3/ Charge 2 is related to the above: Wire fraud on customers

The indictment says that SBF "misappropriated customer deposits"

4/ Charge 3 is conspiracy to commit to wire fraud on lenders

SBF allegedly obtained financing on false pretenses by providing false and misleading information

5/ Count 4 is wire fraud on lenders, similar to #3.

SBF and other FTX execs allegedly lied about the FTX's performance, holdings and reserves to obtain loans

6/ Count 5 is conspiracy to commit commodities fraud. It says that SBF committed commodities fraud by taking in customer funds for commodities and using that money for other trades and business expenses.

7/ Basically, FTX sold commodities and derivatives, but quickly diverted the incoming funds for other uses, including other trades.

It was a house of cards.

8/ Count 6 is conspiracy to commit securities fraud.

The indictment says that SBF violated securities laws by sending an email to an investor in New York with materially false information about the business.

9/ Count 7 is conspiracy to commit money laundering.

This one says that FTX helped to carry out financial transactions even when SBF knew the purpose of the transaction was to evade money laundering laws

10/ Count 8 is violation of campaign finance laws. The indictment says that SBF made contributions in other people's names in order to hide his own involvement in the donations.

11/ The last part of the indictment has to do with forfeiture. SBF must forfeit all assets in the United States that were made from or involved in the crimes outlined in the indictment

12/ I'll be on the lookout for more information as it's made available.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

When any industry adopts a new technological paradigm, the initial business models closely resemble the models of old. The Internet, inheriting from preceding print publications, initially monetized via static ads before giving way to dynamic auctions and direct subscriptions.

DeFi has loosely followed in the footsteps of its traditional finance predecessors by monetizing via transaction-based fees. For example, DEXs charge a swap fee for liquidity providers (LPs) and can take a cut while money markets take a portion of accrued interest.

Adopting business models from the preceding paradigm has historically been naive and unsuccessful, as it fails to account for the shifting competitive environment imposed by the new technology. Open-source software, shared settlement, and standardized integration (tokens) all dramatically erode the regulatory and switching-cost moats enjoyed by traditional finance and change the foundational competitive landscape for DeFi in the process.

Therefore, to understand where DeFi business models are going, one must firmly grasp the competitive nature of DeFi and crypto more broadly.

Competitive Dimensions of DeFi

Every industry can be boiled down to a few key variables that companies fine tune, usually at the expense of another variable, to compete with other companies. For traditional financial services, regulatory positioning, switching costs, and technological scale are some of the key dimensions that define the competitive landscape.

However, crypto’s open and shared settlement properties negate a few key traditional competitive dimensions and subsequently accentuate other competitive dimensions in their place. As a result, DeFi largely competes on 10 dimensions:

Liquidity: Deep liquidity enables protocols to attract larger users and more volume.

Trust: In the form of a reputable team, brand, and audits assure users of safety.

Returns: High returns can attract capital and users when coupled with trust and liquidity.

Fees: Typically, lower fees attract more users and volumes.

Availability: Customers need to be able to use products downstream. For example, a stablecoin needs to be widely available in other markets to be competitive.

User Experience: Simple or comprehensive user experiences can attract different types of users.

Composability: Protocols designed to be composable have more potential customers.

Capital Efficiency: How efficiently a deposit is utilized and thus earning revenue in a protocol drives users via higher returns.

Scalability: Ability to safely handle larger amounts of capital in the protocol.

Specialization: Specifically engineering a protocol for a specific use case like concentrated liquidity can attract dedicated users at the expense of limiting the market size.

Of these 10 dimensions, liquidity is presently the most important variable. It is the definitive constraint for product performance and user growth within the wealthiest user segments. Therefore, business models that impede liquidity growth (such as those that take transaction fees from LPs) are under-optimized on the most critical competitive dimension. The inability to competitively sustain transaction fees is further exacerbated by open-source code, which can easily be copied with discretionarily set fees.

The battle for liquidity among protocols is best seen in the steady decline of DeFi fees as a percentage of volume.

DeFi Fee Decline

The defining competitive feature of DEXs is liquidity as vast liquidity means lower slippage and thus the ability to support larger trades. With Sushi’s fork of Uniswap, the competitive landscape shifted, as having near identical protocols accentuated the fee consciousness of users. Uniswap later responded by releasing its V3, which included lower fee tiers and granular capital efficiency for LPs.

Thus began the gradual decline of DEX total fees as a percentage of trade volumes.

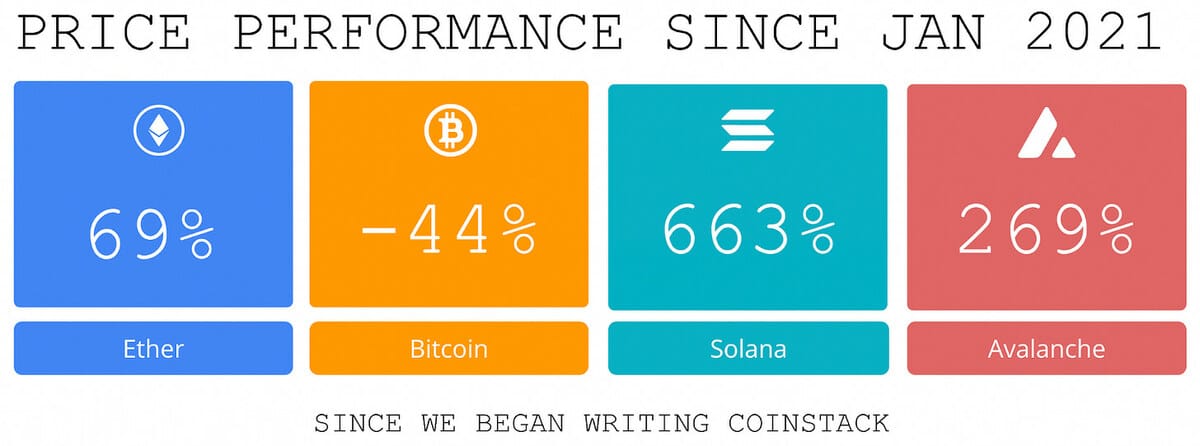

Uniswap V3 initially introduced 5 bps and 100 bps fee tiers in addition to the existing 30 bps pools. Lower swap fees led to Uniswap increasing its trade volume market share from under 50% in January 2021 to nearly 70% by August. However, this came at the added cost of reducing the fee efficiency of the protocol by nearly a third.

By Q4 2021, both the increased competition for liquidity from Curve’s popular veTokenomics and increasingly popular alternative chains necessitated the introduction of a 1 bps fee tier, further driving down the overall fee efficiency.

Effectively, open-source code, competitive protocol designs, and the ease of moving LP capital forced swap fees lower – resulting in a nearly 50% decline in fee efficiency since the start of 2021. Money markets faced a similar fate as incentives dropped and competition for liquidity became increasingly fee driven.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 33,717 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.wemeta.world, www.amphibiancapital.com, and www.investdefy.com