Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 150k weekly subscribers. This week we cover the motion to unseal key documents in the Binance lawsuit, a Celsius exec pleading guilty, 3AC’s nine year ban from the Singapore Monetary Authority, and a big new venture round for Bastion ($25M).

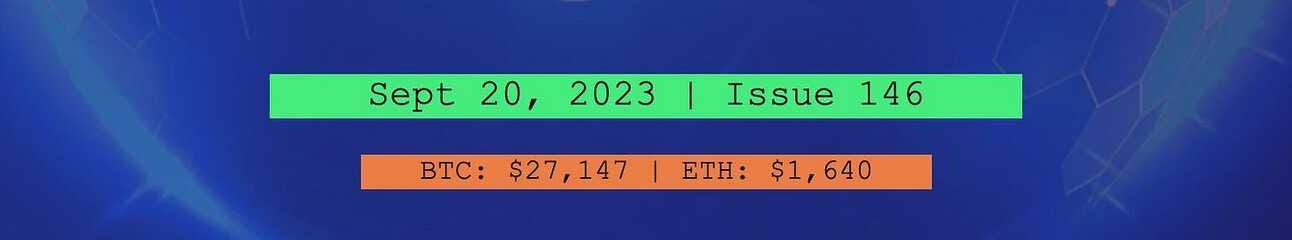

Price performance since we began writing Coinstack in January 2021

Published By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Become a Coinstack Sponsor

To reach our weekly audience of 150,000 crypto insiders and daily audience of 50,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund for the world’s leading crypto funds, they returned approximately 5.35% net in Q1 ‘23, 186.33% net (pro-forma) since '19* and aim to deeply mitigate downside. They have USD and ETH share classes, soon BTC. Deck here: www.amphibiancapital.com.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

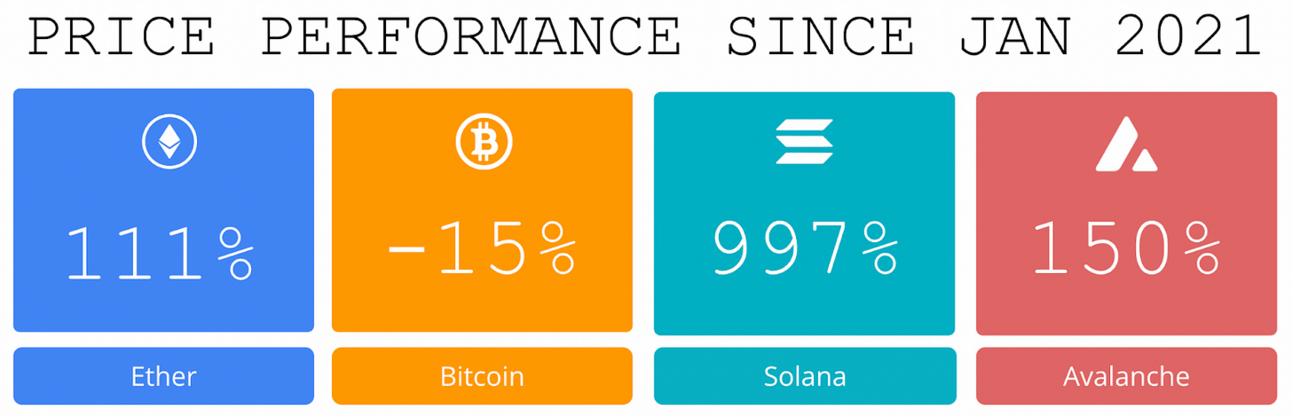

👨⚖️ Judge Grants SEC’s Motion to Unseal Key Documents in Binance Lawsuit- The Securities and Exchange Commission’s (SEC) motion to unseal documents in its lawsuit against Binance US was approved on Friday by a district judge, according to a court filing.

⚖️ Celsius Exec Pleads Guilty, Agrees to Cooperate in Case Against CEO- Roni Cohen-Pavon, 36, a former executive at Alex Mashinsky’s bankrupt crypto lending platform Celsius Network, has pleaded guilty to four criminal charges, per court documents shared by Inner City Press.

🚫 3AC’s Su Zhu, Kyle Davies Slapped With 9-Year Finance Ban by Singapore Monetary Authority - The two founders of former Singapore-based cryptocurrency hedge fund Three Arrows Capital (3AC) have been barred from financial activity in the island city state for nine years, according to a press release by the Monetary Authority of Singapore (MAS).

🎭 Mark Cuban loses $860,000 of crypto to phishing attack- One of Mark Cuban’s crypto wallets was drained of over $860,000 in tokens and NFTs following a phishing attack late last night, according to blockchain data.

📜 Gemini lawyers accuse DCG of gaslighting in latest recovery plan- Crypto exchange Gemini is accusing Genesis parent company Digital Currency Group of "gaslighting" with a proposed new deal for creditors. That agreement, released on Wednesday as part of Genesis’ bankruptcy proceedings, would provide a framework for creditors that would offer "all unsecured creditors a 70-90% recovery with a meaningful portion of the recovery in digital currencies," according to DCG.

💬 Tweet of the Week

Source: @WatcherGuru

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Farcaster_xyz has seen all time high usage over the past few weeks and is gearing up for a public release in the near future

Source: @0xallyzach

2. 13% of FriendTech’s TVL is driven by self-buys (up from 8.4% a week ago) 📈

Source: @0xSector

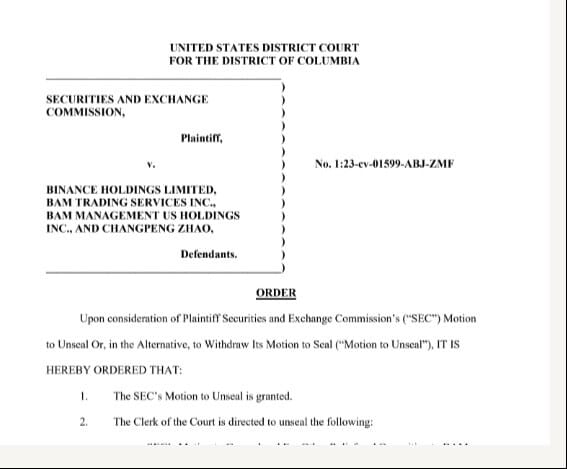

3. Ethereum NFT trading volumes hit new lows.

Source: @MessariCrypto

4. Amidst waning interest in PFP trading, floor prices for most collections have decreased at least 30%

Source: @MessariCrypto

5. A successful web2 start up takes upwards of 3 yrs to reach 10M+ cumulative revenue milestone with a significant employee base. FriendTech has just breached 11 mm USD in protocol fees within 39 days, with 3 employees.

Source: @0xjaypeg

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

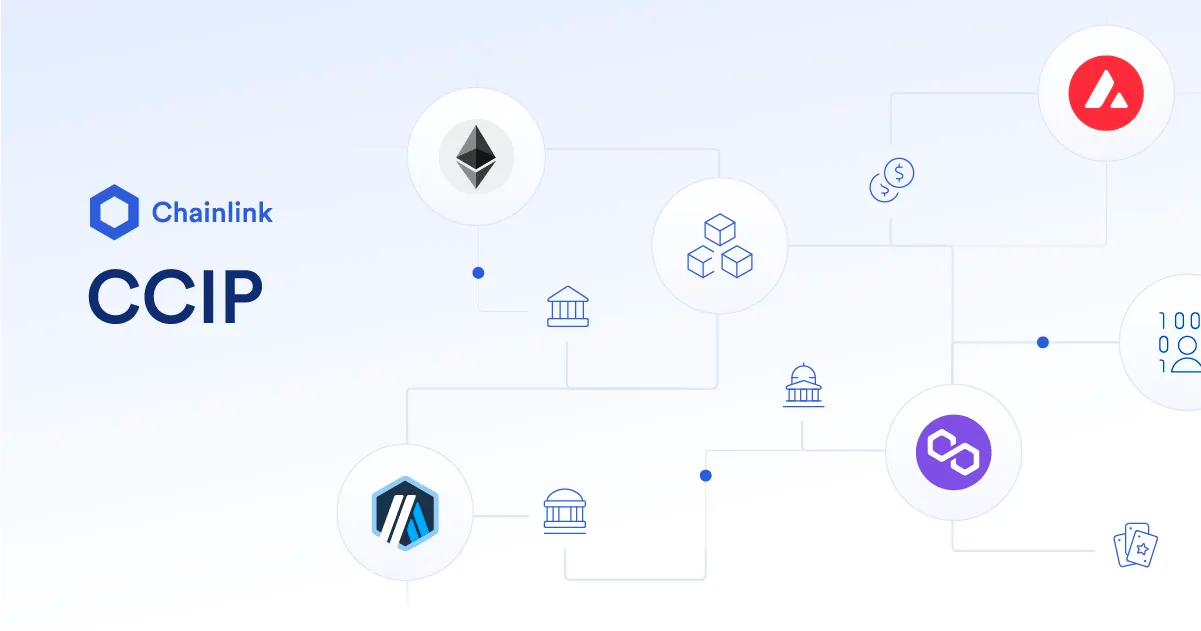

We live in a multichain world; from L2s to appchains to non-EVM ecosystems, it is clear that there does not exist a one-size-fits-all public blockchain for all use cases. Yet, interoperability has been a notoriously difficult problem to solve, due to the great diversity of codebases, frameworks, and design choices that various ecosystems have made. Without a unified interoperability protocol, many blockchains and applications need to build in-house implementations of cross-chain interactions that are expensive, error-prone, and highly unscalable [1].

Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which launched on mainnet at EthCC in July 2023, is one of the boldest attempts at solving this problem of interoperability. Through leveraging its unique position in the blockchain ecosystem as the market-leading Web3 services platform, Chainlink seeks to build the “industry standard” protocol for interoperability between a diverse set of ecosystems. Within this article, we will explore the conceptual design of CCIP, its architecture including the novel Risk Management Network, and the use cases unlocked by this groundbreaking new idea.

Conceptual Design

Historically, most cross-chain interactions have been moderated through blockchain bridges, which have traditionally been centralized and unscalable, introducing counterparty risk that has led to some of the largest cryptocurrency hacks by volume [2]. On a high level, CCIP seeks to solve this “centralized bridge problem” by leveraging Chainlink’s decentralized oracle networks (DONs), which have already gained industry recognition and adoption for Price Feeds and other off-chain data.

CCIP primarily supports three main capabilities [2]:

Arbitrary Messaging between smart contracts on different blockchains – eg. A “buy NFT” function on Polygon triggers the minting of the NFT on the Ethereum mainnet.

Token Transfers, such as transferring an ERC-20 token from a smart contract on Avalanche to a user’s wallet on Arbitrum.

Programmable Token Transfers, which are a mixture of both of the above – you’re sending both byte data parameters (eg. transaction price) and a token cross-chain.

Through this cross-chain transfer of tokens and arbitrary byte data, one of the main problems that CCIP seeks to solve is the fragmentation of liquidity across different chains and ecosystems. This is especially an important issue for DApps such as Uniswap, which is deployed on 10+ chains [3]. Currently, even if all the chains are EVM-compatible, and the same smart contract can be deployed on multiple chains with minimal changes, the inefficiency of a cross-chain framework creates “liquidity islands” on each of the different chains. Rarer token pairs on Uniswap, for example, may only have sufficient liquidity on Ethereum mainnet, and if someone is trying to trade these pairs on Arbitrum Uniswap where there is little to no liquidity, they would be forced to migrate to Ethereum mainnet and pay for higher transaction fees.

Thus, CCIP may potentially usher in a new generation of cross-chain DApps that can leverage both the liquidity advantages of certain networks (such as Ethereum mainnet) and the throughput advantages of scaling solutions such as Arbitrum. This not only leads to greater capital efficiency of these DeFi platforms, but more importantly, a much cheaper, easier, and smoother experience for both developers and users, allowing them to abstract away the complexities of cross-chain interactions.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com