Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week we cover the SEC probe of Coinbase, CFTC’s stunning press release criticizing the SEC, Voyager’s rebuff of the FTX bailout, Aptos’ big $150M raise, the raid on a Terra co-founder’s house, and the top 25 crypto VCs by investment volume. Here we go…

In This Week’s Issue:

This Week in Crypto…

🗞️ Top Weekly Crypto News - Coinbase Faces SEC probe, CFTC & SEC Spar Publicly, Voyager Rebuffs SBF’s Bid, U.S. Stablecoin Bill Delayed, Terra Co-Founder Gets Raided

💵 Weekly Fundraises - Aptos ($150M), Hashflow ($25M), Optic ($11M)

📺 Institutional Webinar - Investing in Crypto Quant Fund of Funds

📊 Key Stats - The Top 25 Crypto VCs

🧵 Thread of The Week - SBF Breaks Down Voyager Bankruptcy

💊 Vitamin3 of the Week: The Definition of Virtual Real Estate

📝 Report Highlights - Messari: Revisiting Art Blocks

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

📈 Top 10 Tokens of the Week - BOND, RAMP, AKT

Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a Web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto hedge funds. They have researched 150+ crypto funds and built a diversified portfolio of the best performing fifteen, making it easier to access the top crypto funds. Their portfolio of funds is up so far in 2022, being designed for all market environments. Learn more at www.amphibiancapital.com.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

🚫 Crypto Exchange Coinbase Faces SEC Probe Over Securities – Bloomberg News - The U.S. Securities and Exchange Commission (SEC) is investigating whether Coinbase Global Inc improperly let Americans trade digital assets that “should have been registered as securities.” You can read Coinbase’s fiery response here, which accuses the SEC of regulation through improper “one-off enforcement actions.”

🤠 CFTC Issues Statement Condemning SEC For Overreach - In the absence of clarity from Congress as to which agency should regulate digital assets and whether they are securities or commodities, the CFTC went on the offensive this week in a public turf war with the SEC, condemning the SEC for regulation through litigation instead of regulation through legislation. This is a striking example of why Congress needs to pass the Loomis-Gillibrand bill, and soon.

⚖️ CFTC Launches Office of Technology Innovation to Expand Crypto Regulatory Efforts. The CFTC is creating the new Office of Technology Innovation to expand crypto regulatory work. CFTC Chief Rosten Benning said at a Brookings Institution event on Monday, “We have moved past the stage of digital assets as a research project. In the absence of new legislative authority, we at the CFTC continue to look at how we can work to protect markets and investors within the bounds of our existing authority.” The new OTI director will be Jorge Herrada, who previously worked on the Federal Reserve’s CBDC project and has substantial experience with digital assets.

😢 Bankrupt Voyager Rebuffs Sam Bankman-Fried’s “Low-Ball Bid” - Bankrupt crypto lender Voyager Digital said a recent joint proposal from FTX and Alameda Ventures was a "low-ball bid dressed up as a white knight rescue" and alleged the plan would disrupt its bankruptcy process.

⚖️ Bipartisan Bill To Regulate Stablecoin Is Delayed for at Least Several Weeks - U.S. House lawmakers are delaying consideration of a bipartisan bill to curb potential risks posed by so-called stablecoins, pushing back a vote on the measure until September. This bill should help decide in the U.S. whether non-bank firms will be able to issue stablecoins, what reserve requirements will be, and whether segregation of company funds from depositor funds should be required.

🔥 South Korean Authorities Widen Terra Probe As Co-Founder Daniel Shin’s Home Raided - A probe into possible illegal activity behind the algorithmic stablecoin TerraUSD (UST) and the affiliated LUNA token has deepened with a raid on the Seoul home of the firm’s co-founder Daniel Shin.

✨ Moonbeam Now Lets You Swap Tokens Between Polkadot and Cosmos - Moonbeam, a smart contract parachain on Polkadot, has partnered with Cosmos-based decentralized exchange Osmosis to enable cross-chain token swaps between the Polkadot and Cosmos ecosystems.

💸 Smart Contract Audits Not Bulletproof: Audius Was Hacked for $6M - Decentralized streaming music service Audius was hacked for more than $6 million worth of AUDIO tokens over the weekend, which the attacker stole from its governance smart contract

🗞️ California Overturns Ban on Political Crypto Donations - California’s political campaign financing watchdog approved measures Thursday allowing state and local offices the right to raise funds using crypto once more.

💎 Three Arrows Founders Break Silence Over Collapse of Crypto Hedge Fund - After five weeks in hiding, the founders of Three Arrows Capital, Su Zhu and Kyle Davies, spoke extensively about the spectacular implosion of their once high-flying hedge fund, saying their bungled crypto speculation unleashed cascading margin calls on loans that should never have been made.Share Coinstack

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Webinar: Investing in Crypto Quant Funds

We will be hosting a free webinar next Thursday on investing in crypto quant funds where will be giving an overview of the space and talking about Amphibian Capital’s crypto quant fund of funds model. You can learn more and register here.

This webinar is tailored to high net worth individuals, portfolio managers, institutions, family offices, and RIAs who would like to learn more about vetting, selecting, and investing in crypto quant funds.Thursday, August 4, 202212pm PT / 3pm ET / 7pm GMT55 minutes on Zoom / register herePresented by Ryan Allis, Publisher of CoinstackIn Partnership with Amphibian Capital

What You Will Learn

The four types of crypto quant funds

The primary trading strategies of crypto quant funds including market marking, liquidity provision, OTC trading, arbitrage, systematic machine learning, and algorithmic trading

How Amphibian researched 150+ crypto quant funds, selecting the 15 best for its fund of funds

How the portfolio of selected funds performed in 2019-2022

How Amphibian achieved +92% in '21 and +12% YTD in '22 even in a bear market

How accredited investors and institutional investors can invest in their crypto quant fund of funds

How the fund of funds model mitigates risk

Requirements

For institutional investors and accredited investors

For portfolio managers inside hedge funds, private equity firms, or family offices

For financial advisors advising HNWIs

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

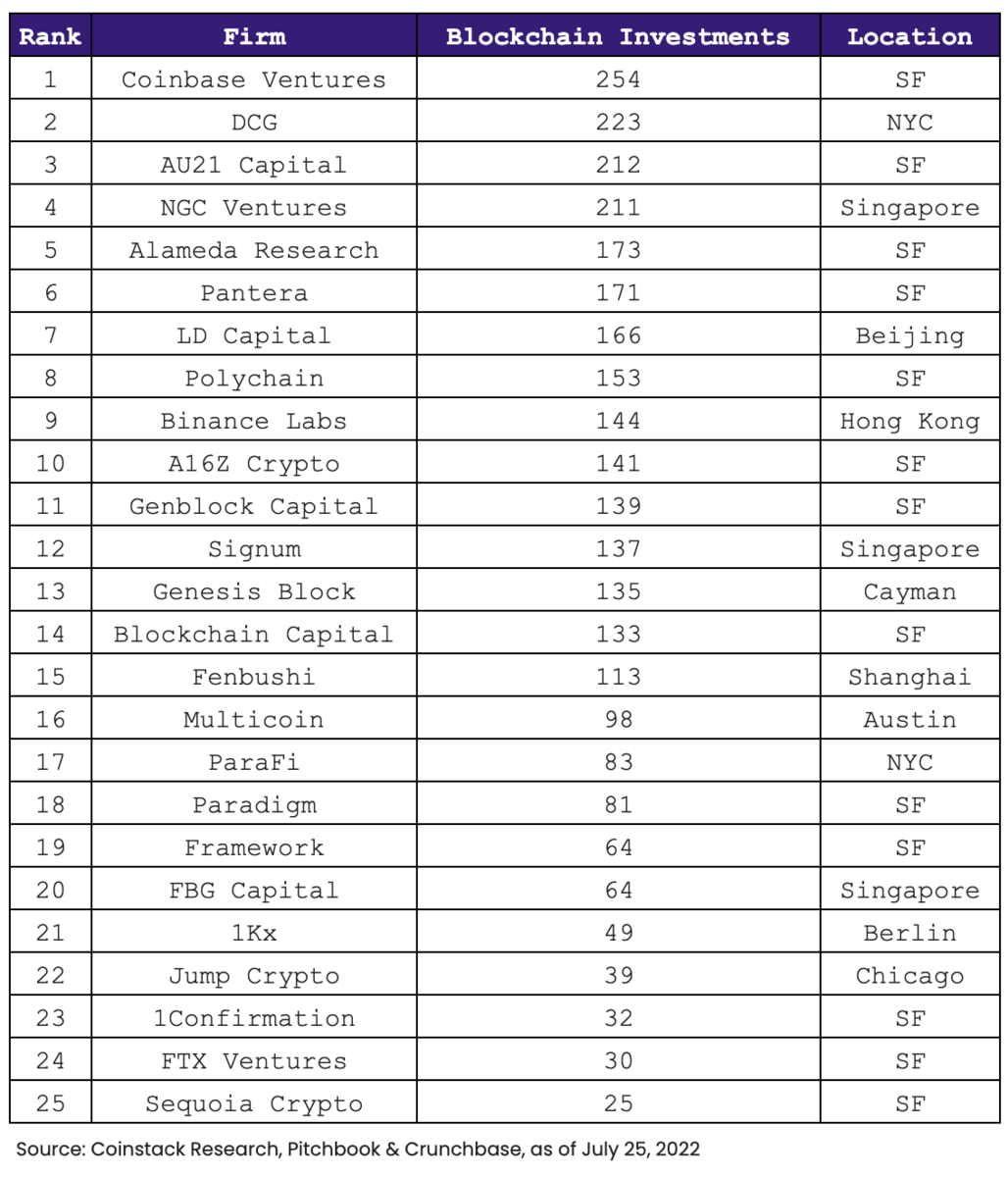

1. The Top 25 Crypto VCs in the World, Listed by Number of Blockchain Investments Made Since Inception

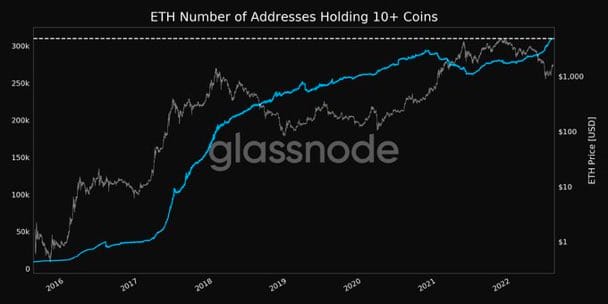

2. Ethereum Number of Addresses Holding 10+ ETH Just Hit an ATH of 309,787

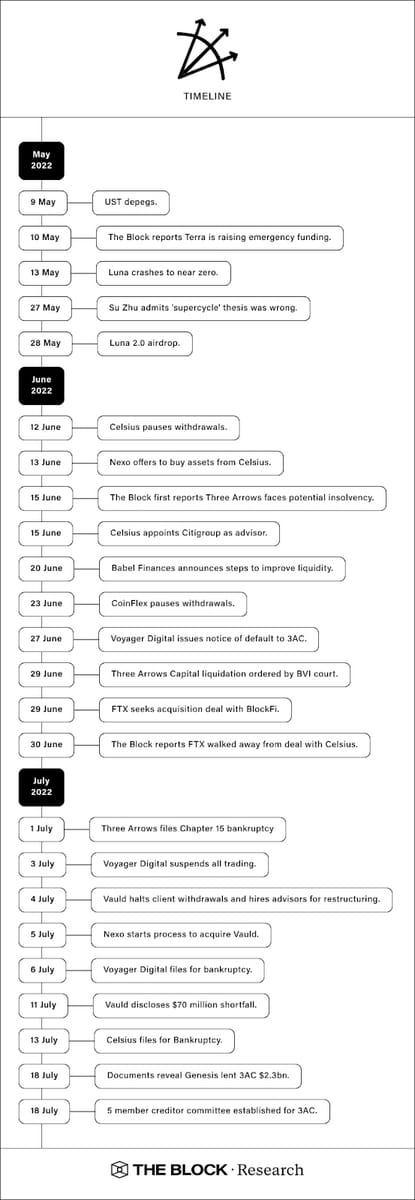

3. The Block Outlines the Terra Luna Collapse Timeline

4. Celsius Chapter 11 Filling Lists All of Their Creditors

5. The Rate of Change for M2 (Monetary Supply) Is Highly Correlated to the Performance of Crypto Market Cap

6. Yuga Labs’ Otherside Leads With the Most Land Sales in the Metaverse Thus Far

7. Uniswap Continues To Dominate the DEX Market Leading With 65% Volume Share

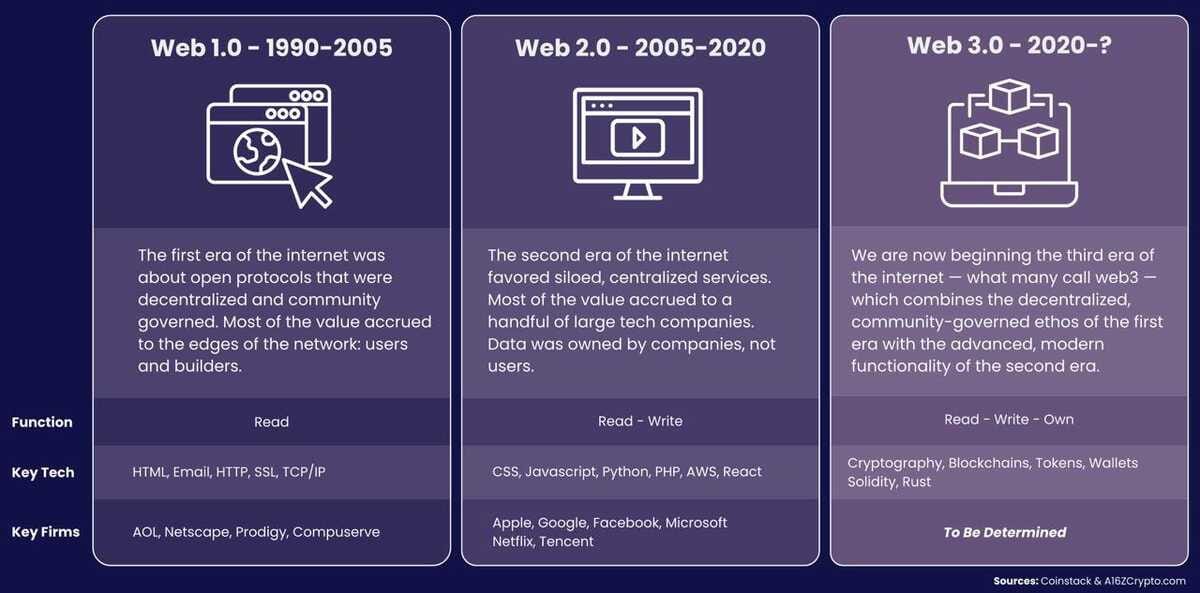

8. The Web Has Gone Through an Evolution Over the Past 3 Years, With This Round Being Led by Blockchain Technology

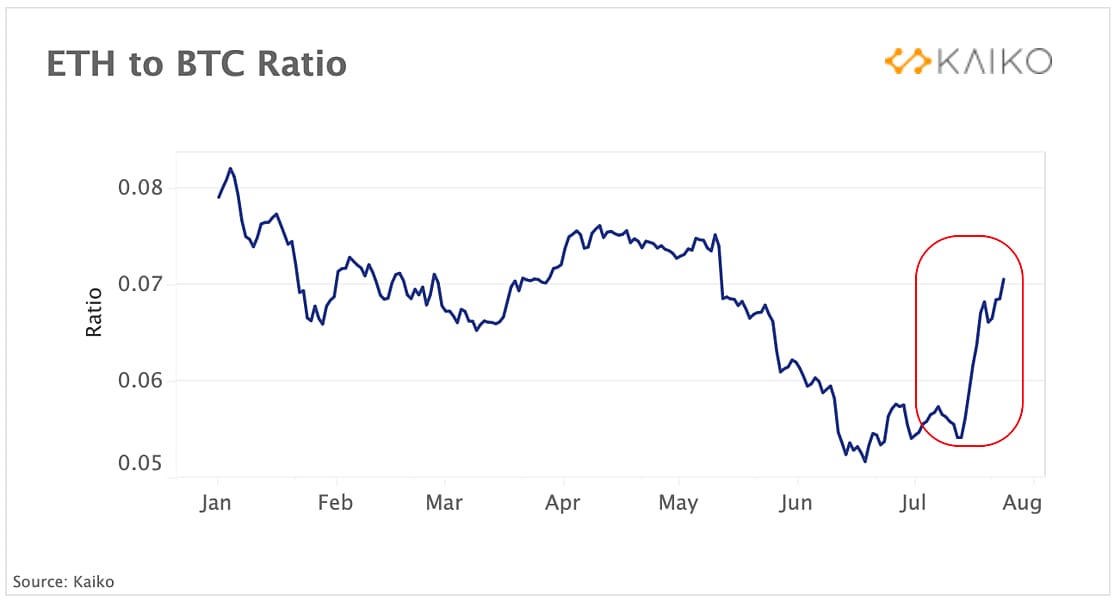

9. ETH Outperformed Bitcoin This Week After a Date for the Merge Was Announced

🧵 Thread of the Week - SBF Breaks Down Bankruptcy

By: @SBF_FTX

1) Voyager lost customer assets, but it still has the majority left. Why haven't those been returned to customers yet? Sad facts from a bankruptcy process.

2) Let's say that Voyager has, remaining, 75% of assets (I don't know the exact number).

It seems like the first thing that should happen is that customers get back the 75%, and then later get back the rest if anything is recovered from 3AC.

But that hasn't happened yet. Why?

3) Well, the *traditional* process is that before customers get their assets back, they get fucked.

First, there's a long, drawn out process, during which funds are frozen. It can take years.

Remember Mt. Gox? That process is *still going on*.

4) Meanwhile, that entire time, various bankruptcy agents are slowly bleeding the customer's frozen assets dry with consulting fees.

This can cost customers hundreds of millions of dollars by the time all is said and done.

And, finally, there's an imbedded option.

5) See, if a customers had 1 BTC on the platform, and BTC was worth $30k...

and then it takes years to go through bankruptcy...

what do they get back? 1 BTC, or $30k?

Probably, whichever is worth less.

So the longer the process drags out, the more optionality customers lose.

6) So, what's going on with Voyager?

Well, lots of parties were trying to bid $0.10 on the dollar for the assets.

If a customer had $100 on the platform, a third party would pay $10 for it, get whatever funds remained (maybe $75), and then the customer... gets back $10.

7) And meanwhile, Voyager's consultants would be slowly draining the remaining funds by charging fees every month the bankruptcy process dragged on.

This didn't seem right to us. Customers already lost assets; we didn't want them to lose more.

8) So we submitted an offer:

If accepted, any customer who wanted could come and get back their share of everything that remained, as soon as possible.

So the customer above would get back $75 immediately, *and* retain their claim in case more was recovered from 3AC.

9) It would let customers--if they chose--get the remaining assets back right away, with no fees or additional haircut.

10) So, who's against our offer?

Well, it was voluntary--customers wouldn't have to use it!

But there are parties that *would* lose from it: third parties who want to take some of the customer assets as fees.

11) The consultants, for instance, likely want the bankruptcy process to drag out as long as possible maximizing their fees. Our offer would let people claim assets quickly.

Or people who wanted to submit a lower bid--taking a large share of customer assets in the middle.

12) As a disclaimer, I also have a stake in this process, but I'm pretty sure our offer hurts the stake; there's a chance equity in Voyager would be worth more (at the cost of customers) if the process drags out.

But equity holders aren't who matter right now; customers are.

13) Anyway: in the end, we think Voyager's customers should have the right to quickly claim their remaining assets if they want, without rent seeking in the middle.

They've been through enough already.

14 p.s. to clarify: our offer would give Voyager customers back 100% of the remaining assets that Voyager has, including claims on anything recovered in the future.15) ...and the "please give us some excuse to charge more fees on the estate" parade begins:

Anyway we've made our offer, hopefully customers are allowed to choose it if they want. If not guess it's up to the consultants to ensure prompt liquidity...

Vitamin of the Week: The Definition of the Virtual Real Estate

About this Section: Our friends at Vitamin3 have launched a free daily SMS covering web3 topics. You can subscribe free by sending HELLO to 305-614-9440. Here’s an excerpt from their SMS earlier this week on the Metaverse.

(1/4) Virtual land is a key part of decentralized virtual worlds like Sandbox, where users are active owners & creators of the ecosystems.

It's easier to understand the appeal when you think of real estate not as a plot of land or building, but as a container of social & economic interactions. In the physical world, those interactions naturally occur in physical spaces. But in the digital realm?

(2/4) A website is a basic unit of digital real estate - it's where information is presented, value is exchanged, and interactions are executed. If a 3D metaverse is the next phase of the Internet, land will play the same role as a host of social & economic experiences - in that way, buying a piece of virtual land is similar to buying an attractive website domain, which can be built out or resold.

(3/4) Virtual plots are NFTs, which makes it easy to trade them. Given the early days of the metaverse, and lack of clarity around which virtual worlds will become most popular, many people are buying land NFTs for option value (or short term speculation) - if one platform starts gaining traction, its land will increase in value; others simply enjoy being early builders of metaverse experiences.

(4/4) No one really knows how to value virtual land today, as methodologies borrowed from traditional real estate (location!) don't make sense with frictionless movement (although land next to plots owned by cool projects or celebrities does sell at a premium!). Virtual land is also artificially supply-restricted - there's a limited number of plots due to platform choice, not physical constraints.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and is building data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here

Key Insights

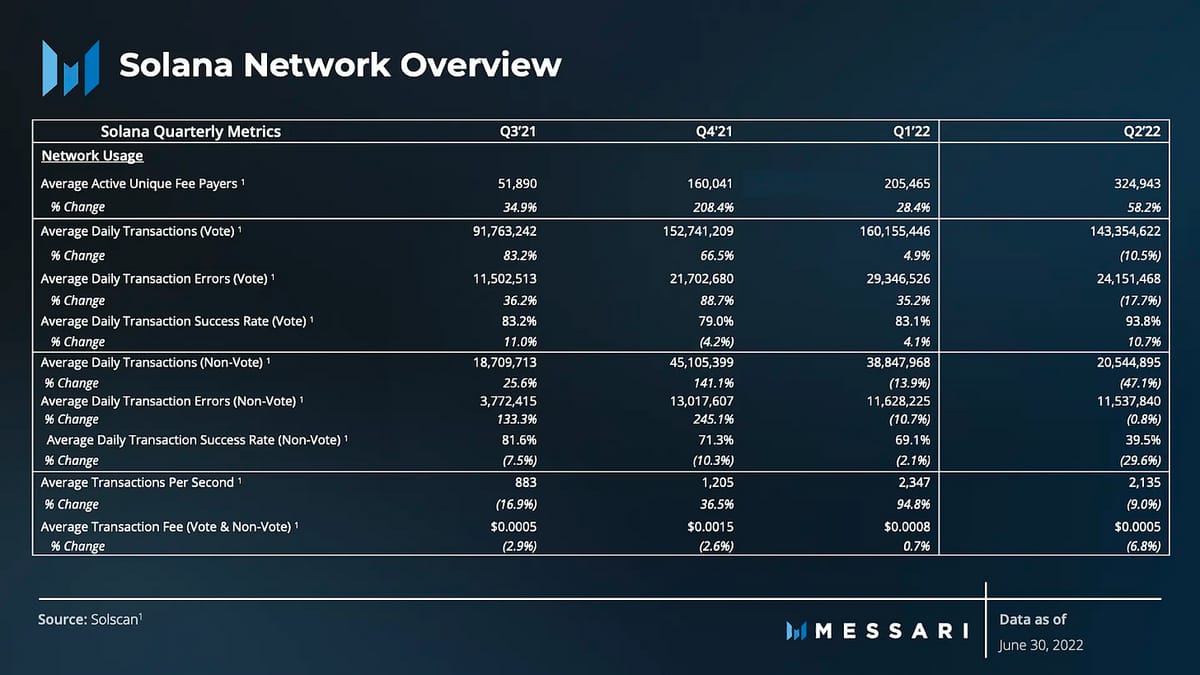

While ecosystem growth strategies continued to catalyze Solana network adoption, challenges regarding network reliability persisted during Q2.

Core developers focused on network updates and building out QUIC and a novel fee prioritization mechanism to improve the network's reliability.

The network updates mitigated the issues that persisted during the quarter as degraded performance stopped in early June.

Solana's Neon Ethereum Virtual Machine (EVM) is expected to launch on mainnet over the near term.

The open sourcing of the Solana Mobile Stack (SMS) for Android and Solana Mobile's Android phone, Saga, will be significant developments over the months ahead.

A Primer on Solana

Solana is a public, open-source blockchain that aims to deliver scalability and support smart contracts without sacrificing decentralization and security. It accomplishes this through a novel timestamp mechanism called Proof-of-History (PoH). Using PoH, the network can order and batch transactions before they’re processed through a separate Proof-of-Stake (PoS) consensus. Additional design goals include sub-second settlement times, low transaction costs, and support for all LLVM-compatible smart contract languages, including Rust, C, and C++.

As a follow-up to the State of Solana Q1 2022 report, this report will revisit developments and events from the prior quarter, analyze the network's most recent quarterly performance, and give insight into the coming months. A complete appendix of data tables is available at the end of the report.

The Second Quarter Narrative

Following unprecedented growth in 2021, the Solana network experienced continued growth in some areas but challenges in others during Q1 2022. Volatility was prevalent across metrics, but stabilization of network usage, financial performance, and network infrastructure occurred by the end of the first quarter. A growing NFT marketplace reached billion-dollar sales volumes, TVL diversified across an increasing number of DeFi applications, and strategies to launch applications across several new sectors were underway as the quarter came to a close. At the same time, growing pains persisted with periods of unstable network conditions, and as a result, the outlook for Q2 2022 was unclear.

Ultimately, chaos arrived at the onset of Q2 as Layer-1 network activity declined dramatically across the space. Macro forces such as hawkish monetary policy and the $60 billion collapse of terraUSD (UST) and LUNA set the market into a tailspin. Solana, like most networks, felt the macroeconomic environment as we saw declines in financial and network usage metrics.

However, the bear market has not stopped Solana from implementing solutions to improve network stability and expand its ecosystem. In Q2, core developers focused on building out QUIC and a novel fee prioritization mechanism to improve the network's reliability and reduce downtime during periods of congestion. Further, strategies to expand ecosystem adoption became more evident with the continued expansion of NFT marketplaces, progress towards EVM compatibility, advancement of Solana Pay, and the roll-out of Solana Mobile.

Performance Analysis

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

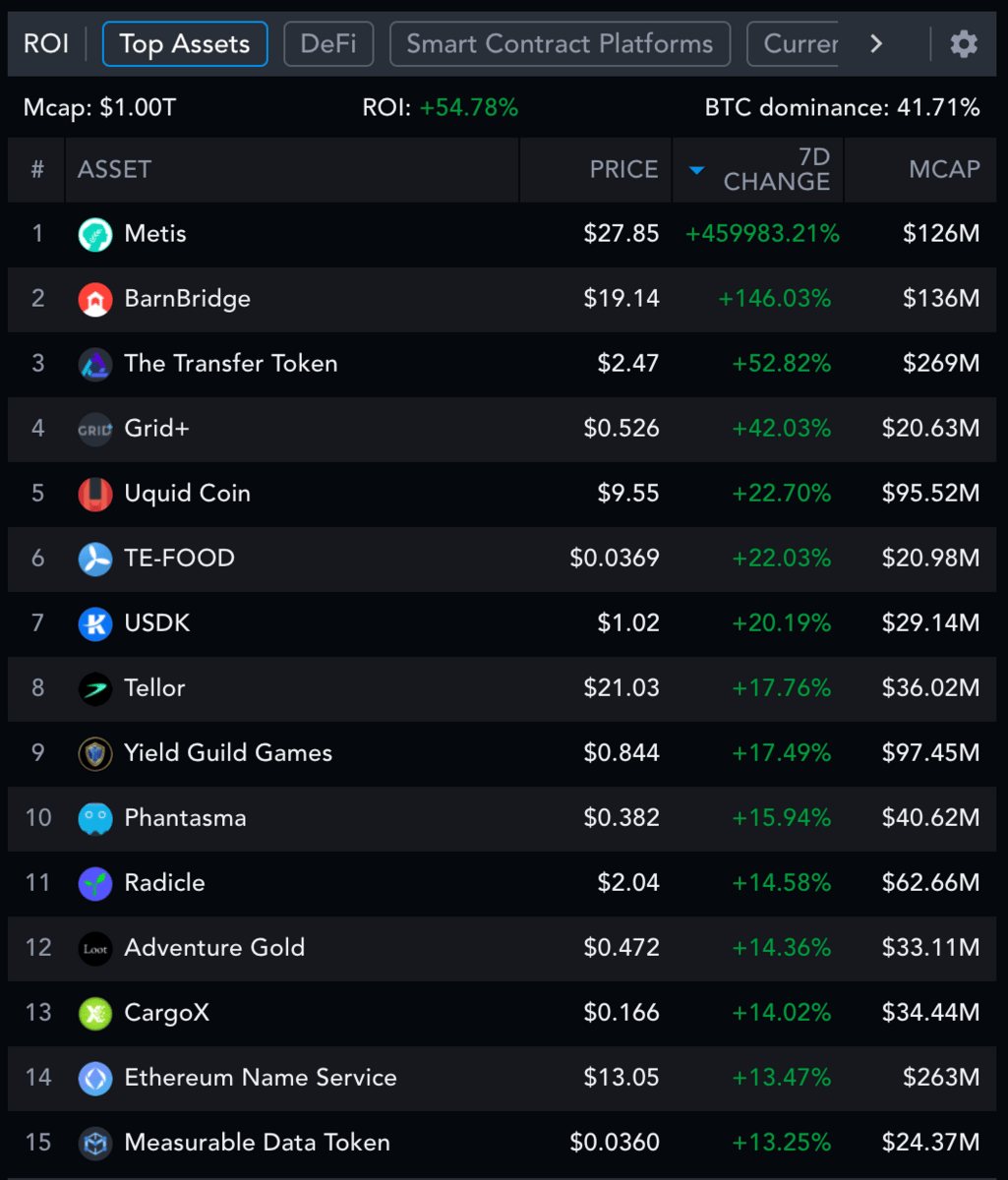

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: BarnBridge is a Derivatives Protocol, Ramp is a Cross-chain Liquidity Protocol, Akash Network is a Cloud Marketplace, Burger Swap is a DEX

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 27,751 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The Coinstack Newsletter" to "We are a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues