Learn More at and www.decard.io

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 140k weekly subscribers. This week we cover the Sei’s Mainnet Launch, SBF’s bail being revoked, DCG sought to dismiss a fraud lawsuit, and big new venture rounds for Helio ($10M) and Anoma Foundation ($8.2M).

Price performance since we began writing Coinstack in January 2021

Published By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Become a Coinstack Sponsor

To reach our weekly audience of 140,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Thanks to Our 2023 Coinstack Sponsors…

Unveiling the next big leap in decentralized technology with Tagion. Dive into the first-ever permissionless and decentralized hashgraph. Revel in limitless transactions per second, ultra-low fees, and swift finality. With all data histories securely anchored on-chain with unbeatable Byzantine-proof ensures unparalleled data integrity. A technology leap unlike any other. Step into tomorrow's protocol, today.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Sei Mainnet is Live After Testnet Sees More Than 7.5M Wallets Created- Sei Labs, the company behind layer 1 blockchain Sei, has announced that its mainnet is now live after a successful testnet phase. The blockchain's native token SEI also went live today on exchanges such as Binance, Kraken and Huobi, among others

⚖️ Bankman-Fried placed in custody of US Marshal after judge revokes bail- Former FTX CEO Sam Bankman-Fried is headed to jail, after a federal judge decided during a hearing on Friday in the U.S. District Court for the Southern District of New York to revoke his bail.

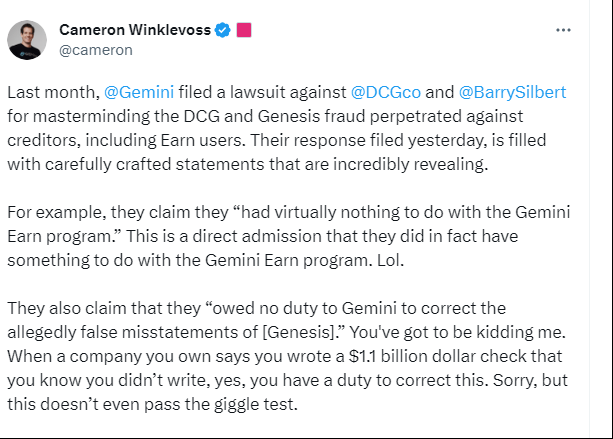

⚖️ Cameron Winklevoss to DCG Amid Their Crypto Lending Fight: 'Good Luck' Convincing a Jury- The verbal battle between the Winklevoss twins’ Gemini crypto exchange and Digital Currency Group, the crypto conglomerate that had helped power a now-frozen Gemini lending service, continued Friday, a day after DCG sought to dismiss a fraud lawsuit.

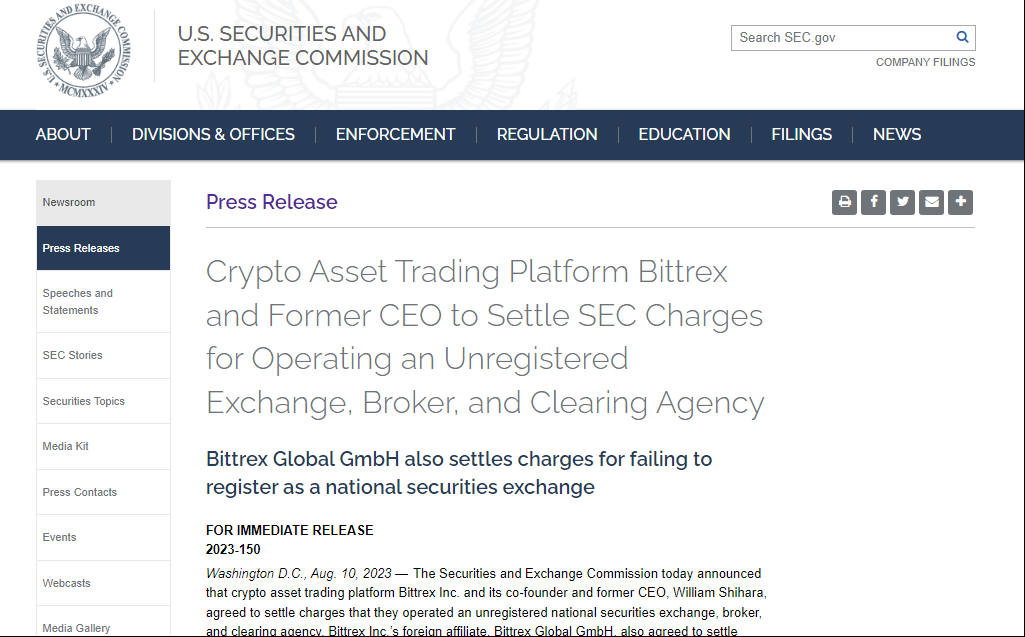

⚖️ Bittrex settles with the SEC for $24 million- Bankrupt crypto exchange Bittrex and its CEO settled with the Securities and Exchange Commission for $24 million, after the agency charged it in April for operating as an unregistered exchange.

🚀 Coinbase's Base mainnet officially opens to the general public- Coinbase's Base mainnet has officially opened to the general public, featuring over 100 dapps and service providers as part of the Base ecosystem.

💬 Tweet of the Week

Source: @_ThePinkyToe

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Dai volume hit its highest since the Sillicon Valley Bank collapse earlier this year. The option to earn yield on top one of the bluechip stablecoin is one of the main drivers of this increase.

Source: @intotheblock

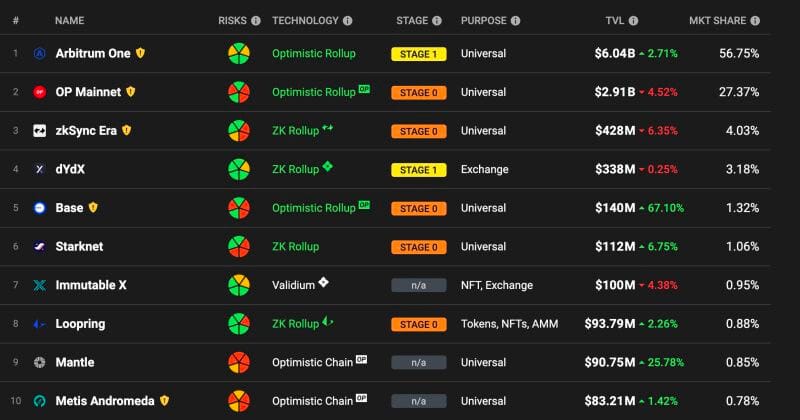

2. Despite being closed for just developers throughout July and into early August, over $87M was bridged to Base leading up to the public mainnet. There is now over $140M total value locked (TVL) on the network.

Source: @Kaiko Research

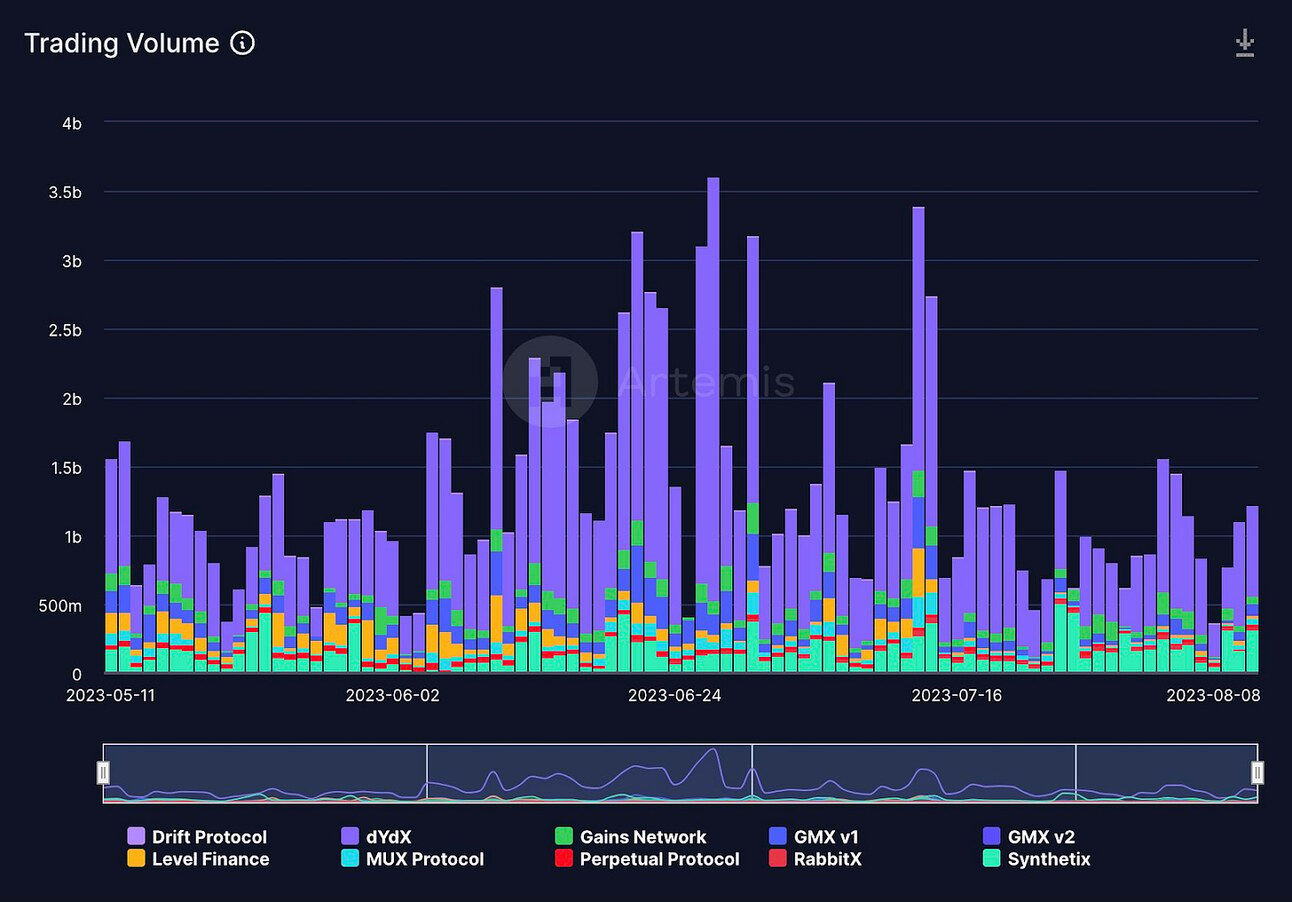

3. After just one week, GMX v2 has achieved $20mm daily volume

Source: @cosmo_jiang

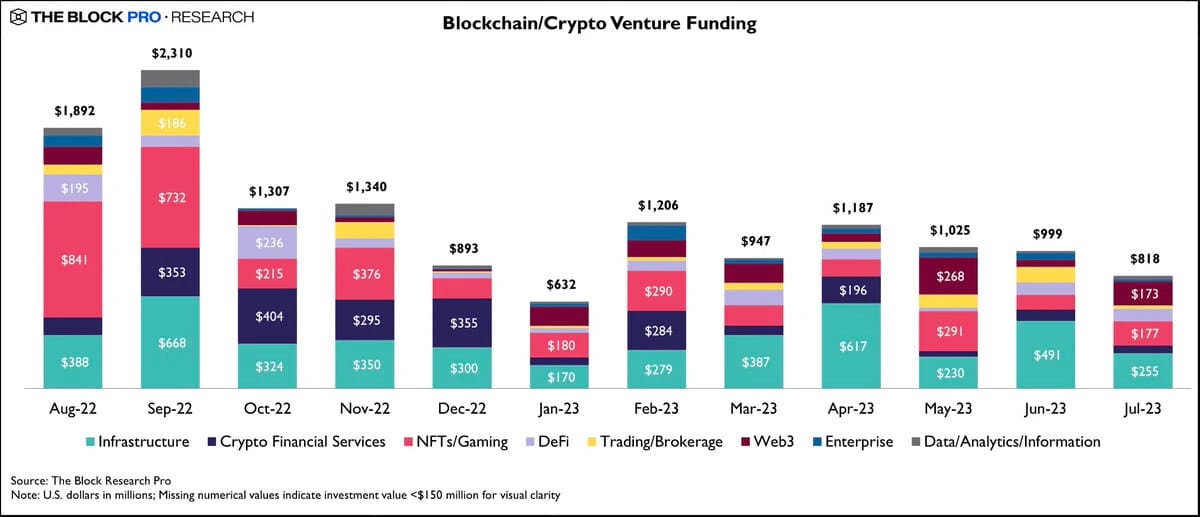

4. It’s been a challenging climate for Crypto VC. July had the fewest VC deals YTD. July funding had ~18% decrease in dollar terms from June. July was the 4th consecutive month in this downtrend

Source: @mallikakolar

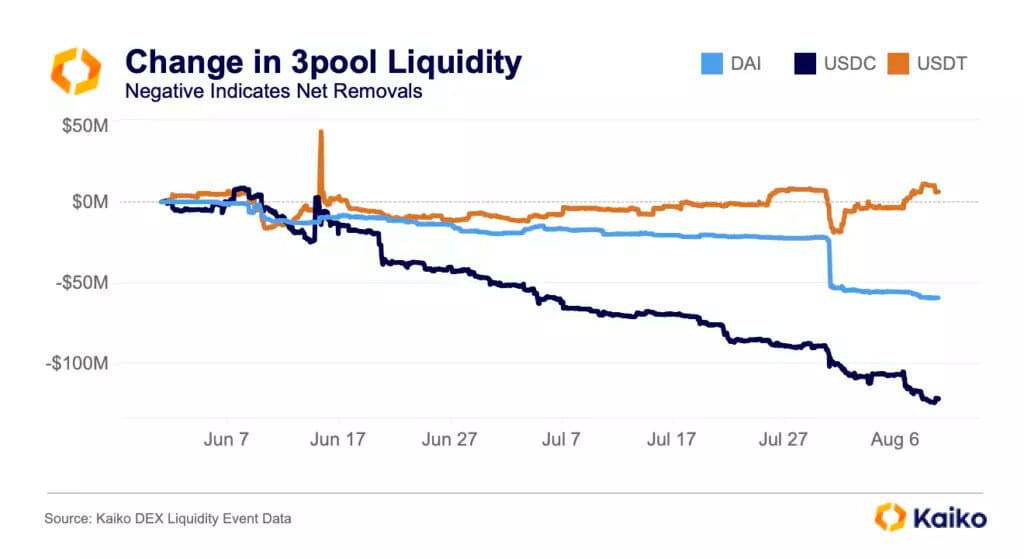

5. Since the start of June over $175mn has left the Curve 3pool, led by USDC despite Maker DAO increasing the Enhanced DAI Savings Rate.

Source: @KaikoData

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

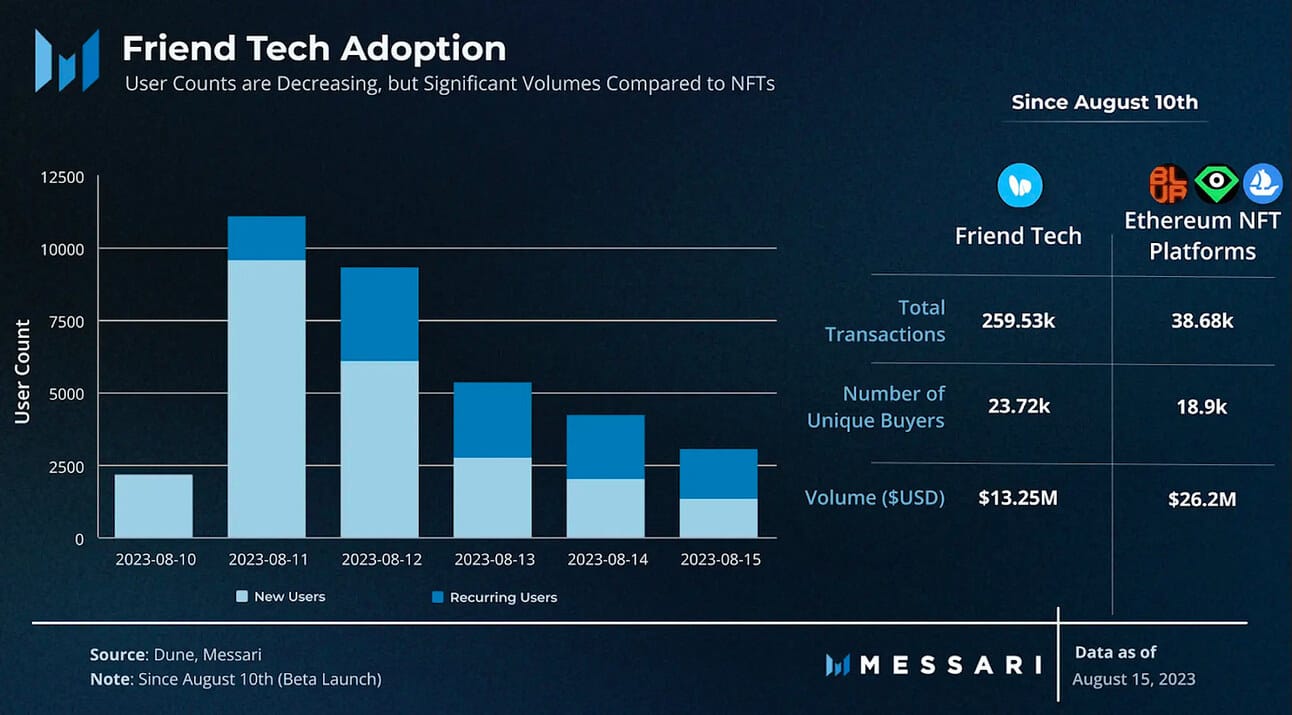

Launched August 10, friend.tech has quickly become the most popular application on Base with over 7,000 ETH of volume in its first week. friend.tech allows users to buy and sell tokenized shares of crypto personalities. Prices are largely derived from popularity, both on Twitter and on the platform (Cobie is the most expensive at 1.22 ETH). Owning shares gives users direct access to interact with the individual via a private chat within the app. As of August 16, friend.tech has processed over 300,000 transactions from 23,000 unique users. There is limited documentation and no visible roadmap, but the platform shared that it will begin airdropping rewards points to beta app testers every Friday for six months, starting this Friday. The app’s full release date appears to be several months away.

friend.tech isn't exactly an original idea. BitClout (launched March 2021 and now rebranded into DeSo) integrated the same playbook of trading creator tokens. BitClout took a slightly different approach by preloading users onto the platform without their permission, landing them in legal scrutiny. Dissidents also criticized the morality of “human-stock markets”, and the ability to bet on the rise or fall of individuals. Regardless, the product received significant attraction from both institutions and retail, receiving over $100 million investment from top VCs such as a16z, Pantera, and Coinbase, and totaling over 300,000 user accounts. While BitClout’s token price and traction have largely fizzled out, the central idea is still intriguing.

Users on friend.tech receive 5% of their share’s volume which is a much greater percentage than other Web3 consumer applications (Lens/NFTs), let alone traditional channels (Twitter/Instagram). This has translated to $650,000 in user revenue on $13.25 million in volume in only one week. Additionally, friend.tech’s total transactions and user counts are higher than Ethereum’s largest NFT platforms since its launch. While these aren’t 1:1 comparisons, it highlights the potential growth for both creators and speculators alike.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.decard.io