All Things Bitcoin, Ethereum, DeFi, Blockchain, Web 3.0, and the future of money

Published weekdays on Substack and TelegramJanuary 22, 2021 | Issue 3 | 317 SubscribersPublisher: Ryan Allis

In Today’s Issue:

Smart Money is Buying the Dip

U.S. Treasury Secretary Janet Yellen Thankfully “Amends” Her Remarks

More Cryptocurrency Experts On Path Toward Key Nominations Within the Biden Administration

Don’t Fear Tether

Celo is Readying a Euro-Stablecoin

Why The World’s Largest Asset Manager is Getting Into Bitcoin

Graph: 45k Net New Bitcoin Holders In Last 24 Hours

Digital Event - Bitcoin For the Balance Sheet

Our End of Decade Price Prediction FWIW

The Allocation Formula We Recommend to Friends

Table of the Day - Smart Money Is Buying the Dip

Daily News Summary

U.S. Treasury Secretary Janet Yellen Thankfully “Amends” Her Remarks

Now this is big. Janet Yellow, in her written remarks coming after her live testimony, has written much more positive words about cryptocurrencies and digital assets:

Here’s what Yellen said live on Tuesday during her live Senate hearing:

“Cryptocurrencies are a particular concern. I think many are used - at least in a transaction sense - mainly for illicit financing.”

What Yellen wrote 48 hours later in her properly considered written testimony that was reviewed with her staff and formally sent to Congress:

“I think it important we consider the benefits of cryptocurrencies and other digital assets, and the potential they have to improve the efficiency of the financial system. At the same time, we know they can be used to finance terrorism, facilitate money laundering, and support malign activities that threaten U.S. national security interests and the integrity of the U.S. and international financial systems. I think we need to look closely at how to encourage their use for legitimate activities while curtailing their use for malign and illegal activities. If confirmed, I intend to work closely with the Federal Reserve Board and the other federal banking and securities regulators on how to implement an effective regulatory framework for these and other fintech innovations.”

More Cryptocurrency Experts On Path Toward Key Nominations Within the Biden Administration (This is Good)

In 2009 President Barack Obama created the very first U.S. CTO position within the Office of Science and Technology Policy, setting the stage for technological innovation to be at the forefront of the Obama Administration. Democrats tend to be closely aligned with Tech.

Now that President Biden is in office, he is nominating leaders of key agencies who are similarly forward-thinking on technology and who are highly knowledgeable and favorable about the potential of Bitcoin and blockchain-based technologies. Here are some of his leading candidates for key roles per news reports.

Office of the Comptroller of the Currency (OCC) - Michael Barr (Former Ripple advisor)

Commodities Futures Trading Commission (CFTC) - Chris Brummer (A Georgetown Law Professor and he literally wrote the 2019 textbook "Cryptoassets: Legal, Regulatory, and Monetary Perspectives")

Securities and Exchange Commission (SEC) - Professor Gary Gensler (Taught the MIT Sloan Business School Class, “Blockchain & Money” in 2018)

The writing is on the wall here… The Biden Administration is going to put smart regulations in place (KYC) that allow the blockchain ecosystem to thrive over the next four years, while the SEC is going to make it much clearer about what is a security, and what isn’t through the Ripple case. The “Final Boss” of the government is actually pro-blockchain. Mario and Bowser are working together to create a better monetary system. Pretty cool. Follow these two guidelines, and you’re likely ‘Good as Golden’ as an American saving and using cryptocurrency.

1. Pay your taxes on your gains when you sell

2. Don’t use crypto to buy illegal goods

Key Fact: Today there is only 1 Millennial in the U.S. Senate (Jon Ossof, D - Georgia). The other 99 are Gen X and Boomers. If the US government is this open now to blockchain digital assets imagine where we will be in 25 years when we have "digital native Millennials and “Blockchain native” Gen Z leading Washington D.C. and Beijing. A better and more fair global monetary system that works for everyone is coming, my friends. Yes, it’s time to build.

Don’t Fear Tether - As we shared yesterday, the community consensus is that the Tether stablecoin is not worth being concerned about. If anything, the misunderstanding about it, is keeping the price of Bitcoin temporarily low and institutions that know what they are doing are buying up retail sellers who get concerned about short-term fluctuations. Here’s another definitive Tether FUD explanation by Dan Held.

“The author of the original Tether short article didn’t know the difference between spot and derivative exchange volume. They used coinlib, which conflates derivative volume with spot inflows. Tether represents a much smaller portion of spot exchange volume.”

“It’s funny that folks worry about Tether being fractional reserve without first being introspective with their existing banking infrastructure. All of traditional fiat is fractional reserve.”

“If Tether was found to be worthless tomorrow, guess what would immediately happen to the price of Bitcoin? It would skyrocket as Tether holders convert $24B of Tether into Bitcoin.”

“Tether’s market cap is $24B and Bitcoin is $641B at the time of this post. That is only 4% of Bitcoin’s market cap. What happened to Bitcoin when XRP, Bitconnect, EOS, ETH, and dozens of other cryptocurrencies rose and fell? Bitcoin was fine.”

Celo is Readying a Euro-Stablecoin - Open platform for digital payments, Celo, is readying a Euro-pegged Stablecoin that is kept stable through a peg to a basket of cryptoassets including Celo, Bitcoin, and Ethereum.

Ryan Weeks at TheBlockCrypto reports that “a number of big names in the wider crypto industry - including Anchorage, Ramp, Coinbase Ventures, Ledger, and Blockchain.com -- are committed to building on the Celo protocol.”

Daily Podcast Summary

As BlackRock gets ready to make its first foray into bitcoin, innovation-focused ARK ETF flows surpass that of BlackRock.

A new SPAC exchange-traded fund with bitcoin-experienced leadership

First look at Brian Brooks’ possible replacement at OCC

What to expect from institutional bitcoin price targets in the coming weeks

BlackRock filings with the SEC suggest two funds might buy bitcoin futures.

Why BlackRock’s CIO thinks bitcoin will out-compete gold for millennial investors

How ARK ETFs are seeing startling fund flows, causing larger market FOMO around innovation

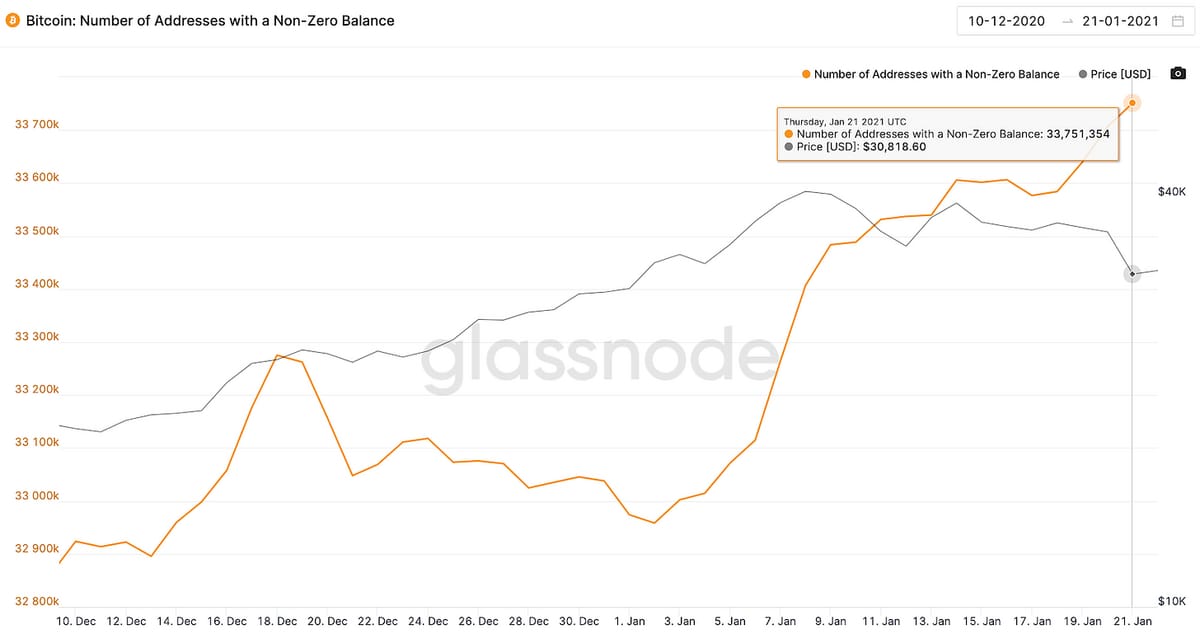

Graph of the Day - 45k Net New Bitcoin Holders In Last 24 Hours

Digital Event - Bitcoin For the Balance Sheet

Bitcoin for the Balance Sheet - Microstrategy CEO Michael Saylor is hosting a February 3 online event for CEOs and CFOs interested in holding bitcoin on their Corporate Balance Sheet.

“Last year, we became the first publicly traded company to adopt bitcoin as a primary treasury reserve asset. Forward-thinking organizations have taken note and reactions have been overwhelmingly positive. We are now taking the opportunity to share our learnings and methodologies, as well as bring together bitcoin luminaries and corporate strategists to discuss how others can benefit from this trend. Join our Bitcoin for Corporations landmark event to understand the array of considerations of this new strategy.” - Michael Saylor

Our End of Decade Price Prediction FWIW

While there are many risks along the way that we foresee (regulation, hacking, quantum computing, etc.) and many we may not foresee (black swans) and there will be LOTS of volatility along the way, here’s our rough prediction for ten years from now. Mark Dec 31, 2030 on your calendars and let’s see what actually happens. Buy us a Kombucha if we’re directionally right!

Our Current December 31, 2030 Prediction -

BTC - $593k per Bitcoin (~$11.8T Market Cap)

Summary Reasoning: At least the equivalent market cap to that of gold ($11.8 Trillion) as BTC is at least 10x better than Gold at the five properties of money (divisibility, durability, portability, recognizability, and scarcity). With the Lightning Network allowing very quick transaction speed, Bitcoin finally has the chance in the next few years to be used as both a store of value and a medium-of-exchange for the regular person.

Read this Skybridge deck and this Messari report if you want to understand why BTC is likely to beat gold in market cap within this decade.

ETH - $93k per Ether (~$11.8T Market Cap)

Summary Reasoning: Ethereum is already beating Bitcoin in daily transaction volume and developer community size. Assuming EIP-1559 is pushed to production that starts burning transaction fees, we’re on track for a store of value with a monetary policy even less inflationary than Bitcoin.

By the time ETH 2.0 comes out around December 2022, Ethereum will be seen as stable and ready for institutional support. Much of the Web 3.0 infrastructure (decentralized web) and the new decentralized banking system will be built on top of Ethereum along with interoperable blockchain technologies like Polkadot and Cardano.

See TxStreet.com for a powerful real-time visualization of just how much ETH is already beating BTC, even while ETH is still rapidly under development.

The institutions will be 24 months behind on Ethereum vs. Bitcoin. But they are coming as the Grayscale ETH Fund is already showing.

We see Ethereum in ten years being equal in size to Bitcoin in market capitalization. It’s not an either/or. It’s a both/and. Read this report from Messari if you want to understand ETH 2.0.

We will update this 12/31/2030 prediction from time-to-time as we learn more, but keep the archives for posterity.

The Allocation Formula We Recommend to Friends

For now, we encourage considering a 50/50 holding between BTC and ETH to keep things simple.

If you want added exposure, consider exploring some minimal exposure (~10% of crypto portfolio) to interoperable blockchain tech like Polkadot and Cardano, global payment tools like Celo, decentralized exchanges Uniswap and SushiSwap, DeFi leaders like Yearn, Compound, Maker, Ren, and Aave, and Layer 2 ERC-20 decentralized technologies like Chainlink, Basic Attention Token, The Graph.

Most of these are available on Coinbase, Binance, and Kraken.

FWIW, I’m long all these things. I don’t short. Generally speaking, I buy and hold.

As long as you have a 10 year time horizon or longer, 50/40/10 is what I’d tell my best friend (50% BTC, 40% ETH, and 10% Alts).

Leave some comments if there are others you’d like us to look into. If we can understand it, we will report on it.

The People We’re Following Closely

If You’re Just Getting Started With Crypto, Start Here

Michael Saylor - Bitcoin is Hope (Podcast)

About The Coin Times: Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new global monetary system that works for everyone. As always, published for informational purposes only. Not intended as financial advice. Please do your own research.

Please Comment:Comments and thoughts welcomed on our Telegram channel at t.me/thecointimes and Substack at cointimes.substack.com. Let us know what you’d like us to write about in the comments. We hope this issue is helpful to you and your family as together we chronicle the path to a new system.

Please share with your friends and colleagues and help spread the word.