Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors. This week we look at how crypto yield funds are providing an alternative to corporate bonds and muni bonds for large institutional investors on the global hunt for meaningful yield rates above inflation. We also review the top news, stats, and reports of the week.

In This Week’s Issue:

A Solution for Yield Investors: Crypto Yield from DeFi

This Week in Crypto

🗞️ Top Weekly Crypto News - Federal Reserve, El Salvador, Bitcoin ETF

💵 Weekly Fundraises - Amber Group, Circle, Helium

📊 Key Stats - Uniswap, Luna, Maple Finance

📝 Report Highlights - Stratmont Brothers: Casper & DeFi Kingdom

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

📈 Top 10 Tokens of the Week - ANC, LEO, GALA

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Headline Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto yield fund that invests in DeFi, margin lending, DEX liquidity, and algorithmic trading to generate monthly yield for institutional allocators in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

📈 A Solution for Yield Investors: Crypto Yield

By Ryan Allis

About the Author: Ryan is the founder and publisher of Coinstack & Managing Partner of HeartRithm, a market-neutral crypto fund for large capital allocators.

The Downside of QE

After fourteen years of Quantitative Easing (QE) policies from central banks in response first to the 2008 financial crisis which expanded during COVID, institutional investors today face a huge challenge in the global search for yield.

Let’s look at what current annual yields are to see what we are dealing with:

Bank savings accounts are paying out 0.5% (at best)

U.S. treasuries are paying out 0.9%

Municipal bonds are paying out 1.6%

Corporate bonds are paying out 3.3%

High yield debt, which has the highest risk of default, is paying out 5.6%

Now Let’s Factor in High Inflation

Inflation is now 7.5% annually in the United States as of the January 2022 Consumer Price Index report.

It’s the highest it’s been since 1982.

So let’s adjust our yields above to share the real rates of return after subtracting the current level of annual inflation.

Bank savings accounts are paying out -7%

U.S. treasuries are paying a -6.4% real rate of return

Municipal bonds are paying out -5.9% real rate of return

Corporate bonds are paying out -4.2% real rate of return

High yield debt is paying out -1.9% real rate of return

Yes, we live in an upside down world where every day people are seeing their savings inflated away and even large institutional investors are losing money to take risk on high-yield debt.

This is what happens when governments print money nearly endlessly, thinking they are trying to help.

There is now $21.7 trillion of U.S. dollars in existence compared to $15.4 trillion in January 2020. This means that the supply of dollars has increased by 40.9% in the last two years alone. These are the official U.S. government statistics from the St. Louis Federal Reserve.

Potential Volatility in Equities

So if we can’t invest in fixed income without generating a negative real return, rational investors have to look at other asset classes like stocks and real estate.

The problem with investing in stocks right now is that they are still rather overpriced by historical measures.

The average PE10 ratio for companies in the S&P 500 over the last 140 years has been 16.92. This means it takes 16.92 years of earnings payouts (based on average ten year earnings) to achieve the full market capitalization of the firm.

Right now the average S&P 500 stock is trading at a Price to Earnings ratio of 35.59 (based on their average ten year earnings).

This is the highest stocks have ever traded at in 140 years of history, with only one exception, the massive dot com bubble of 1999.

Yes, it’s pretty obvious we’re in an equities bubble as well that may pop soon as well. We’ve already seen some major volatility in 2022 and I wouldn’t be surprised to see more the next 36 months.

GMO, a very respected institutional equities analyst recently published that based on how overvalued prices are today, they expect U.S. equities to average a negative 6.8% return for 2022-2008.

This is a big deal -- respected firms like GMO are predicting negative real returns for bonds and equities the next 7 years.

Real estate isn’t looking any better, with prices for residential real estate at all time highs, having now far exceeded their 2008 bubble prices.

So if fixed income returns are negative, and equities/real estate are overpriced, what are larger institutional investors supposed to invest in?

So What Are Yield Investors To Do?

There is a potential solution here. It’s a little out of the box.

It’s a new space called crypto yield.

After a few years of development, this space of crypto yield has matured and is ready for hundreds of billions of dollars of institutional capital inflow.

There is now over $190 billion of total value locked in Decentralized Finance (DeFi) applications already -- so larger institutions have already moved in.

And there are now crypto yield funds (like the one I’m a Managing Partner at, HeartRithm), which are investing in market-neutral yield producing strategies in DeFi.

You can think of this as “DeFi as a Service" or DaaS, where a fund will select a diversified and well-managed selection of pools and vetted protocols for yield generation.

You could do this yourself in CeFi apps by putting money in crypto banks like Nexo, BlockFi, or Celsius — or by jumping into the world of decentralized finance with protocols like Compound, Aave, Curve, Yearn, or others. But be warned, doing this professionally at scale requires technical sophistication to know how to do it safely.

The space is quickly growing. There’s now over $198 billion in Total Value Locked (TVL) in DeFi, showing that institutional capital in the hundreds of billions has already started pouring to the space — with some crypto funds specializing in market-neutral yield crypto yield strategies.

HeartRithm: A Market-Neutral Crypto Yield Fund for Institutional Investors

HeartRithm, the firm I work with, is a good example of a market-neutral crypto yield fund using DeFi to generate historically higher returns than traditional fixed income -- while maintaining low volatility.

The firm achieved a +15.94% net return to investors for its market-neutral strategies in 2021 -- and hasn’t had a single down month since fund inception, generating a very healthy Sharpe ratio.

HeartRithm has produced consistent yields substantially above alternative options like corporate bonds (3.3%) and crypto banks (6-9% on USDC).

HeartRithm also offers monthly liquidity to fund investors -- with the ability to allocate new capital (or make a withdrawal) on the 1st day of each month.

Crypto Yield for Larger Institutional Allocators

While digital assets can be very volatile, the firm is generating returns by providing stablecoin liquidity to a diversified basket of DeFi protocols and exchanges, and also through other strategies like over-collateralized digital asset margin lending.

HeartRithm’s returns have historically been positive, even in months when the crypto assets have gone down. It’s like investing in the “picks and shovels” that support crypto -- generating yield through usage and trading -- rather than being exposed to volatility of the digital assets themselves.

While future returns are never guaranteed and past performance is no guarantee of the future, when you look at HeartRithm’s 15.94% 2021 net return to investors and low volatility, it presents a compelling option that all yield investors should consider as an alternative in the marketplace — and part of their tool belt with overall portfolio construction.

It historically has been better than putting money in BlockFi at 8% on USDC or corporate bonds at ~3.5%.

It’s nice to have an asset class to consider that is performing higher than bonds, with very low volatility, and low correlation to equities or real estate, with monthly liquidity.

Doing It Yourself vs. Hiring Professional Managers

You can either manage your own DeFi yield investing internally or hire a professionally managed DeFi-as-a-Service (DaaS) fund.

There is a lot of complexity to doing it yourself including smart contract auditing, pool diversification, custody, and tracking stablecoin and token developments.

You’d have to become very adept at managing pools and yields across top DeFi platforms.

In the end hiring a DeFi-as-a-Service (DaaS) provider that can manage and grow your capital for you often reduces the need to build an in-house dedicated team.

HeartRithm, for example, keeps capital diversified across many protocols and pools, optimizes yields weekly, monitors risk factors, and reduces the costs of transaction gas fees by aggregating capital.

For any institution that is managing significant amounts of capital and is searching for yield, consider allocating capital to professionally managed crypto yield funds like HeartRithm.

If you are interested in exploring an allocation and would like to learn more, you can get in touch with us here. We’d be happy to share our fact sheet and make a presentation to qualified institutional investors and family offices.

If you’d like to learn more on this topic, I will be hosting a webinar this Thursday called Crypto Investing for Portfolio Managers that you can join for interested portfolio managers, RIAs, family offices, sovereign wealth funds, and institutional allocators learn more.

About HeartRithm: HeartRithm is a crypto yield fund that invests in DeFi, margin lending, DEX liquidity, and algorithmic trading to generate monthly yield for institutional allocators in a market-neutral manner, without a single down month since fund inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting an upcoming 55-minute webinar on crypto investing for portfolio managers covering our thoughts on crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing, and mapping out the crypto hedge fund ecosystem. Register for free below.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚡ Federal Reserve Officials Banned From Owning Cryptocurrencies, Stocks After Public Outcry - The move, which follows controversy over personal trades from members, is said by the Fed to guard against “even the appearance of any conflict of interest”. (Source)

😮 Pro-Bitcoin President of El Salvador To Offer Citizenship for Foreign Investors - The 52 proposed legal reforms call for less bureaucracy, less red tape and creating tax incentives to make El Salvador one of the most freedom-centric countries. (Source)

🏧 With US Bitcoin ETF in Limbo, Crypto Exchange-Traded Products All the Rage in Europe - With the prospects of a physical bitcoin ETF at a standstill in the US, an already-crowded market for cryptocurrency exchange-traded products (ETPs) in Europe is heating up with a series of new listings. (Source)

💰 Japan’s Largest Bank MUFG Provides Blockchain Utility Token Issuance Platform - The MUFG Trust’s blockchain platform Progmat would support security tokens and stablecoins issued by multiple firms. However, it will also be a platform for ‘utility tokens’. (Source)

🤑 Crypto Exchange Huobi Plans Return to U.S. Market As Asset Manager - Huobi co-founder Du Jun doesn't think that a crypto exchange is a 'necessary element' in its prospective return to the U.S. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Uniswap Captures ~45% of DEX Market Share on Polygon

2. In 2021 Alone, LUNA Experienced a +14,000% Change in Market Capitalization, and UST’s Supply Surpassed $10B

3. Maple Finance Now Sees $600M in Total-Value Liquidity Provided to Maple’s Credit Pools

4. Since December, Total Value Locked (TVL) on Cronos Has Grown From $1B to Near $2.5B Today, a Whopping 2.5x

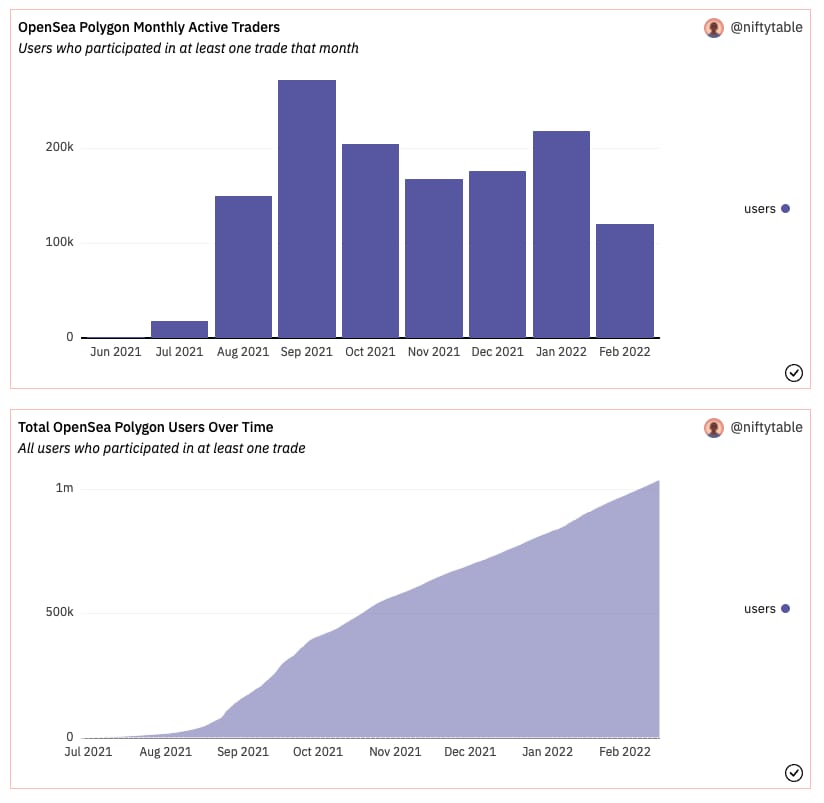

5. OpenSea Polygon Reaches 1M Unique Wallets

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Crypto Intelligence Report: Casper & DeFi Kingdoms

Stratmont Brothers is a crypto investment fund that invests in meaningful disruptive innovations, emphasizing Web 3.0, De-Fi, cryptocurrencies, tokens, and blockchain companies reshaping trillion-dollar markets. Their crypto intelligence reports highlight the fundamentals for top blockchain projects.

"Many people tend to compare the Casper network with Ethereum 2.0. However, Casper's real counterpart is Ethereum 3.0, which plans to include pure CBC-Casper and WebAssembly, two core features of the Casper network. Ethereum 2.0 does not implement full CBC-Casper; it only includes Casper-FFG, which blends the liveness properties of Proof of Work2 (PoW) with the safety properties of CBC-Casper, and it might take 3-5 years to accomplish a full Ethereum 2.0 (after phase 0,1, and 2). With the most advanced concept and technology, and without the historical burden as Ethereum has, the Casper network can jump out of the circle and build a new future-proof architecture, which is of high performance, security, and scalability.”

"DeFi Kingdoms is about adapting hard-to-learn concepts into a UI that is familiar and easy to hop into.

This is the power of DeFi Kingdoms and GameFi3 in general to layer on a new component (financialization) into something ostensibly more simple, social, and fun. It’s the simplicity (and the potential to make money) that has made the game skyrocketed in popularity.

This is how in July the GameFi boom really started, with Axie Infinity giving people the keys to earn money while having fun, and still learning and understanding the concepts of DeFi and cryptocurrency in general.

The strength of community and mutual aid is also present, with members of the community helping others to get in, explaining how to create a wallet, what is DeFi, how to farm, what is a liquidity pool, etc."

"DFK changes the way we see DEX, usually having the same design and the same ergonomics for every project. It also changes the way we see the banking system, with learning the principles of the DeFi and earning interests through farming and other systems while having fun.

DFK can be considered the biggest DEX in the shape of a videogame right now.

If we take Axie Infinity as an example, they have democratized the GameFi to the masses, even those who had never heard of crypto. However, when they first introduced their DEX, Katana, it was a regular DEX, not integrated into their game, with no UI to embellish or gamify it. Katana is required to create liquidity pair to farm, with no further explanation or easy-to-use and fun UI. The crypto beginners Axie acquired could have been lost when Katana was released and probably do not use their assets to their full potential providing liquidity and earning rewards.

This is where DFK is disruptive: finance becomes fun. Earning is a game; providing for and participating in a system is gaming."

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

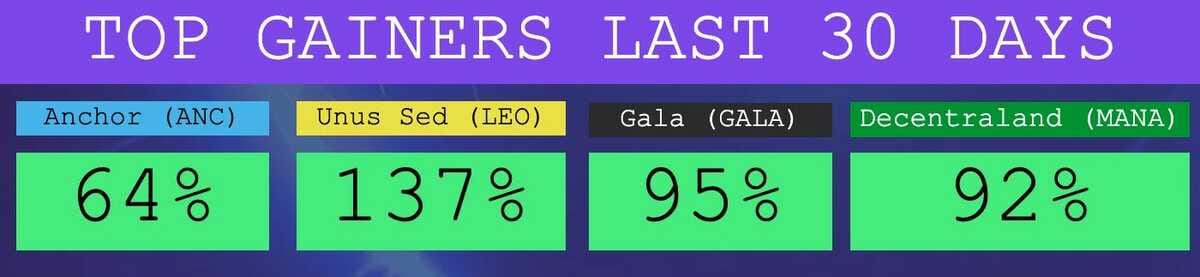

The Top Performers This Month from the Top 100: Anchor is a Yield protocol, Unus Sed is an Exchange Token, Gala is a Gaming Token, Decentraland is a Metaverse.

🎨 NFTs of the Week: Our Featured Collection

🎨LuvMonster NFTs - Collect Them Now - Starting at $8

Here are the new LuvMonster NFTs from our official Coinstack featured artist Mrs. Bubble that you can buy at our special pre-sale prices.

These NFTs are individually hand painted and then digitized for some added magic — with special sound added. We now have 272 unique LuvMonster owners — and the community is growing weekly. We’ve added 41 new owners in the last week.

For early notification on drops, so you can get them daily at the earliest possible pre-sale prices, join the Discord and the Telegram Channel.

We will continue to feature these joyous NFTs here in Coinstack, building the community and collector-base each week.

Many of our early collectors are buying up the initial supply each day and then earning a profit by reselling the NFTs in the secondary markets. We love shared prosperity!

These are on the Polygon network, so there are no gas fees.

New NFTs This Week - Limited Pre-Sale Available Starting At $8 on OpenSea

Here are the new NFTs launching this week. All of these have been handpainted by the artist and then digitized, with sound and motion added.

LuvMonster #79 - Stegasaurus Duck - 0.0068 ETH

LuvMonster #80 - Galactic Cow - 0.0075 ETH

LuvMonster #81 - Sharkey - 0.008 ETH

LuvMonster #82 - Good Luck Dragon - 0.008 ETH

LuvMonster #83 - Mamma Cloudicorn - 0.0079 ETH

LuvMonster #84 - SnuffleDotty - 0.0065 ETH

LuvMonster #85 - LuvDragons - 0.008 ETH

LuvMonster #86 - Kamy the Chameleon 0.004 ETH

LuvMonster #87 - Firefly Kitty - 0.005 ETH

LuvMonster #88 - Owl Wizardicorn - 0.0048 ETH

LuvMonster #89 - Foxipanda Eagle 0.0051 ETH

LuvMonster #90 - Happy Bear - .00032 ETH

LuvMonster #91 - Penguiskunk - 0.008 ETH

LuvMonster #92 - Magi the Catipup - 0.006 ETH

LuvMonster #93 - Monkey Surfer Boy - 0.0057 ETH

🦘Featured 1/1 Mint on Ethereum, Kangaroo Mama

We also have a featured 1/1 Mint on Ethereum this week, LuvMonster #3 Fish Legs. She is available for 0.5 ETH.

You can also join our Telegram group here and Discord group here for early NFT drop announcements.

Additional Coinstack Sponsors

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 18,667 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis and Twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.