Social Links: Twitter / Telegram / Newsletter

Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, Solana overtakes Binance, Ripple buys New York Crypto Trust Company, Starknet Airdrop, and big new venture round for Analog ($16M) and Superform Labs ($6.5M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund of the world's leading crypto funds, returning approximately 14.43% net for '23, 195%+ net (pro-forma) since '19 and aim to deeply mitigate downside. Amphibian offers BTC, ETH and USD share classes. Deck here: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders and daily audience of 60,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack. We’re filling up our 2024 sponsor slots now.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀Starknet Blockchain Plans Much-Awaited Airdrop of New STRK Tokens Next Week: Starknet Foundation announced on Wednesday that STRK, the native token for the Ethereum layer-2 blockchain Starknet, will be airdropped on Feb. 20, with roughly 1.3 million wallets eligible to receive it.

💰Ripple to Buy New York Crypto Trust Company to Expand U.S. Options: Standard Custody & Trust Co., which has a New York charter, will be the latest acquisition to grow Ripple's regulatory qualifications.

⚖️Starknet token holders could earn over 12% annually in proposed staking system: Starknet, an Ethereum layer 2 network created by Starkware, is preparing to launch its long-awaited STRK token airdrop.

🎉Ethereum devs can now deploy apps on Sei’s parallelized EVM: The high-throughput blockchain Sei has upgraded its devnet, a developer-focused kind of testnet, to v2. With the new version, apps developed on Ethereum can be deployed on Sei with no changes.

⬆️ Wormhole crosses 1B in cross-chain messages ahead of token launch: The protocol has facilitated nearly $40 billion in cross-chain transfers since its inception in September 2021.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @ZssBecker

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. On February 5th, EigenLayer announced that it would temporarily lift all of its ETH staking caps through February 9th. In just 48 hours the protocol received over $2.3B worth of deposits, increasing its TVL by 107%.

Source: @DavidShuttleworth

2. Bitcoin ETFs continue to realize substantial demand, as over $1.1B of net inflows occurred last week. BlackRock and Fidelity Investments led the way and captured 41% and 31% of this volume, respectively.

Source: @DavidShuttleworth

3. Bitcoin is following a similar pattern of adoption to technologies like steel, cement, radios, phones, cars, airplanes, and internet.

Source: @DocumentingBTC

4. Ethereum supply on exchanges drops to new all-time lows.

Source: @AltcoinDailyio

5. BTC trade volume surged to its highest level since the launch of the spot ETFs as prices rallied to $50K.

Source: @KaikoData

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Lumio - VeradiVerdict - Issue #283

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

The blockchain landscape is undergoing a swift and transformative evolution, driven by the need for more scalable and efficient solutions in the face of increasing demands. In the midst of this dynamic and ever-changing environment, Lumio emerges as a particularly noteworthy innovation to solve scalability and virtual machine (VM) diversity on Ethereum. Lumio represents a groundbreaking integration of two of the most significant blockchain components in the industry: Ethereum settlement and alternative VM execution starting with the Aptos Move VM. Ethereum, known for its reliability, decentralization, deep liquidity and extensive adoption in the blockchain world, brings to the table its robust and time-tested infrastructure. Rust based alternative VMs like the Move VM are purpose built to safely and efficiently execute transactions in parallel. Lumio will integrate Ethereum settlement with alternative VMs like the Move VM in order to give developers the option to use alternatives to the EVM while maintaining composability with popular L2 ecosystems like Optimism, Arbitrum and ZkSync.

Another alternative VM that the Lumio team is researching for integration is the Solana VM (SVM) which similarly brings the static type safety and concurrency of a Rust based VM, however it is not as user friendly as Move. This is best illustrated by the colloquial “chewing glass” initiation that Solana developers have to undergo to get started building on Solana. The Move VM, similar to Solidity, feels more like a typescript language which enables developers to more intuitively put together the business logic for Smart contracts. The Move VM also has the added benefit of a native prover for formal verification so developers don’t need patchwork solutions to avoid shooting themselves in the foot with issues like overflow errors, which can be costly as evidenced by the $50M KyberSwap hack. The main benefits of the Solana VM, as anecdotally described by developers, is more freedom for developers to architect their apps without limiting guide rails and a flourishing ecosystem of up and coming applications on Solana.

Aptos, the main maintainer of the Move VM, is recognized for its cutting-edge technology and potential to redefine blockchain performance and scalability. By bridging the capabilities of both, Lumio, a protocol that executes the Move VM on a modular Layer 2 framework such as the OP Stack, offers a unique solution that combines the best of both worlds - the liveness and widespread adoption of Ethereum with the innovative technology and potential of the Aptos Move VM.

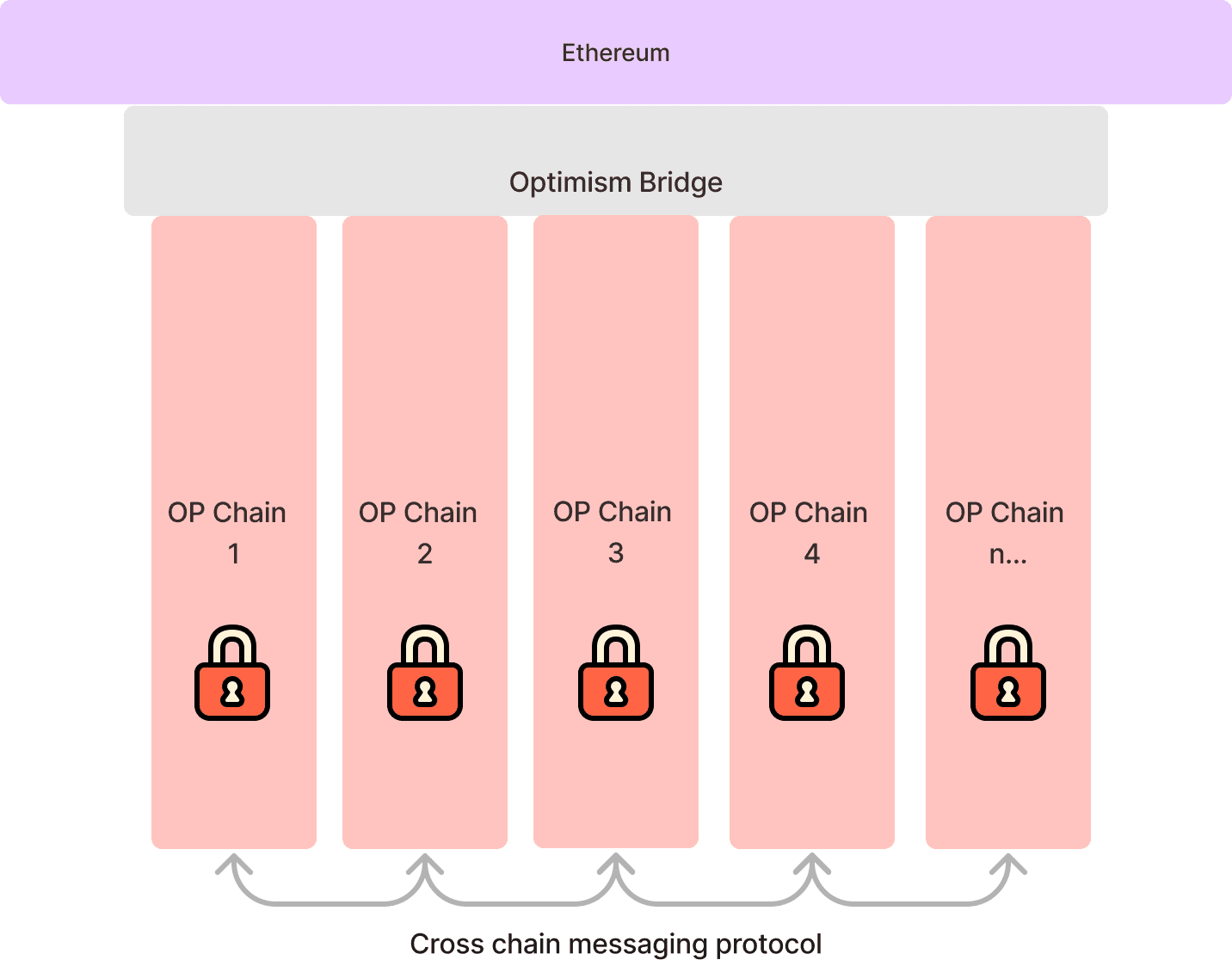

Understanding Lumio

Lumio stands out as the pioneering optimistic rollup protocol (L2) that uniquely integrates the capabilities of parallelized alternative VMs into the most popular L2 ecosystems on Ethereum starting with Optimism. At its core, an optimistic rollup is designed to address one of the most pressing issues in crypto: scalability. By aggregating numerous transactions off-chain into a single, cohesive package that gets posted on-chain, optimistic rollups substantially alleviate the strain on the main chain (L1). This method not only expedites the processing of transactions but also significantly reduces the associated costs, thereby enhancing the practicality and accessibility of blockchain technology for a wider array of applications and use cases. Popular L2 ecosystems like Optimism are further decentralizing to match the robustness of the Ethereum L1 by creating a mesh network of L2s that share a sequencer and bridge for liquidity. This enables the applications connected to the network to share security, liquidity and smart contract calls through a common framework. The best illustration of this is the upcoming Optimism Superchain which will unite Base, Mantle, Zora and other popular L2s using the OP stack framework. Arbitrum Orbits and ZkSync hyperchain are similar frameworks that are also in development. The idea of merging heterogeneous blockspace pioneered at Cosmos is now coming to fruition on Ethereum L2s, and Lumio will be at the forefront of this trend.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com