Issue summary: In this week, we talk about the Terra blockchain, the fourth largest DeFi blockchain and highlight the most important crypto news and stats of the week.

In This Week’s Issue:

Terra Deep Dive - By Mike Gavela & Ryan Allis

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

Coinstack Podcast Episodes

😳 Updated: Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

🏦 Terra Deep Dive - The Fourth Largest Smart Contract Platform In The World

By Mike Gavela & Ryan Allis

About the Authors: Mike Gavela is an analyst at Coinstack who produces our weekly newsletter and podcast. Ryan Allis is the founder of Coinstack and a Managing Partner at HeartRithm.

Terra now is the fourth largest smart contract platform by total value locked (TVL) in DeFi, with over $7.8 billion stored on its platform so far. It follows Ethereum, Binance Smart Chain, and Solana.

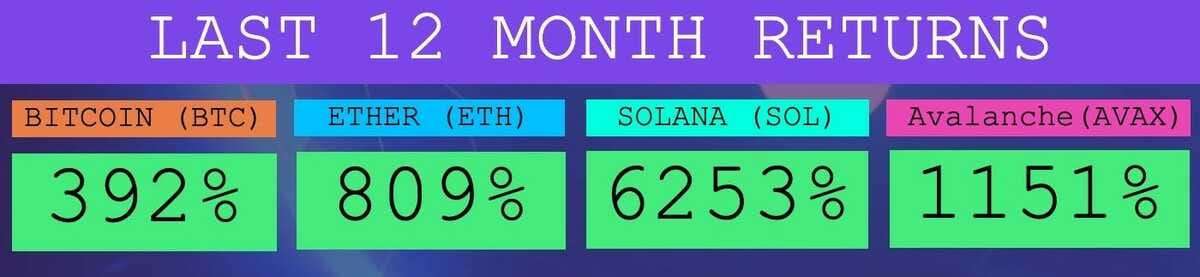

While Terra isn’t growing quite as fast as its L1 blockchain competitors Fantom and Avalanche, the fastest-growing major blockchains in DeFi in the last five weeks, it still remains larger than both and has more institutional holders.

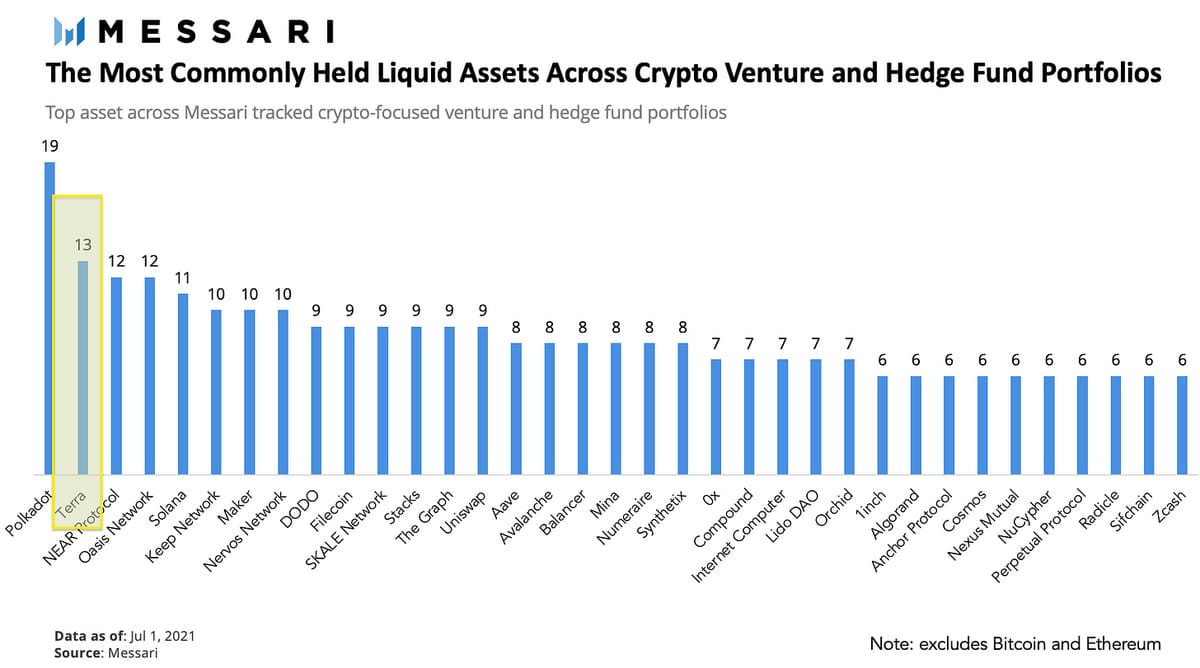

In fact, the second most commonly held liquid asset among institutional investors excluding Bitcoin and Ethereum is the Terra token, called LUNA.

At only a $34B fully diluted market cap, Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. It is an L1 vying for the top spot as the go-to smart contract platform like Ethereum, Solana, and Polkadot. In this deep dive, we will be reviewing the founders of the Terra blockchain, its tokenomics, and the Dapps on the platform to uncover why investors at large remain bullish on the chain.

Founder Background

Daniel Shin & Do Kwon are the founders of Terraform Labs. Daniel completed his undergrad at UPenn’s Wharton and is the founder of three other Korean-based companies, an eCommerce platform called TMON, a startup incubator Fast Track Asia, and the Chai payments app.

Do holds a degree in Computer Science from Stanford University and made the Forbes 30 under 30 list in 2019. Before Terraform labs, Do worked as part of Microsoft's natural language processing team and later founded a startup called Anyfi specializing in peer-to-peer telecommunications solutions, such as meshed Wi-Fi networks.

Do describes Terra as one of the few cryptocurrency projects that look outwards rather than inwards in its approach to growth and adoption. He saw that in the last bull market, there were a lot of ICOs that were primarily self-serving. In other words, he saw a circular economy where the only projects gaining traction were the ones that involved trading cryptocurrencies with one another.

He thought that it was never going to cross over to the mainstream and that you really need to ask “what can crypto do for real people in the real world for people who are not into blockchains?” From that perspective, he started Terraform Labs with his cofounder, and the Terra mainnet launched in April 2019.

As a serial entrepreneur, Do’s mission with Terra was to bring blockchain technology to real-world users. Their initial go-to-market plan focused on targeting merchants and consumers in South Korea because they would have the highest use case. They came up with their first product called Chai, a payment network that uses the Terra blockchain on the back end. The platform’s first stablecoin was the KRT which is pegged to the Korean won. KRT is used by more than a dozen applications to settle payments, including Chai, which boasts over 2.5 million users today since launching in 2019.

Terra’s Tokenomics

The Terra blockchain was built using the Cosmos SDK, and the Tendermint delegated proof of stake consensus mechanism. Cosmos brands itself as “an internet of blockchains.” By using their SDK, anyone can build their blockchain, set the parameters, and secure it in any way they like, similar to using Avalanche as a Layer 0 then leveraging the X-chain to create the blockchain using EVM.

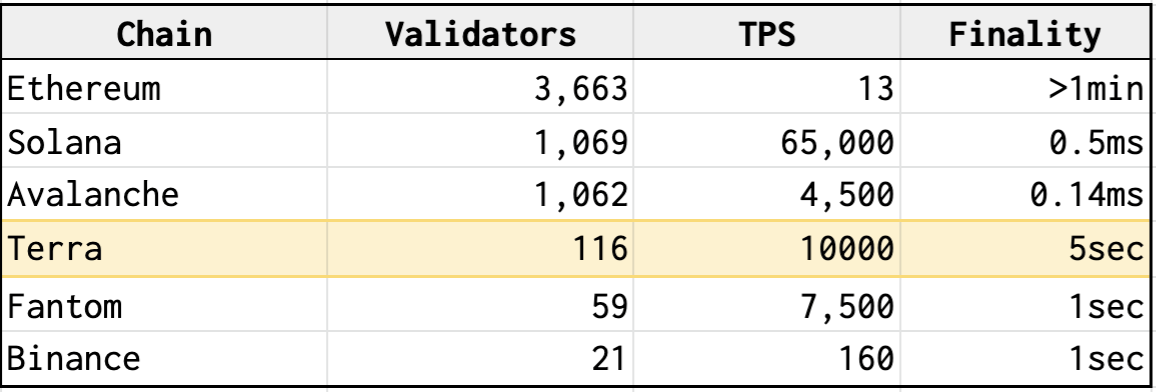

Like other Cosmos-based chains, Terra has roughly 100 validators, making it less decentralized than other proof of stake networks. A medium post from August notes that the Terra blockchain can reach thousands of transactions per second. Terra transactions are usually settled within six seconds and only cost a few cents to execute. Comparing these metrics to other L1s, Ethereum remains the most decentralized protocol.

Two tokens make up the Terra blockchain. There is the Terra stablecoin called UST, and there is the governance token for the Terra ecosystem called Luna. Unlike other decentralized stablecoins like MakerDAO's DAI. Terra's stablecoins are not collateralized. To mint a Terra stablecoin like UST, you must burn the equivalent dollar amount of Terra's native coin, Luna. For example, if you wanted to mint 5 UST and the price of Luna was $5, you would need to burn one Luna.

The same concept applies in reverse; you can also burn Terra stablecoins to redeem the equivalent value of Luna. If you had 5 UST and the price of Luna was $2.5, you would get two Luna for burning that UST. The burn mechanism creates a financial incentive that ensures Terra's stablecoins always maintain their fiat peg.

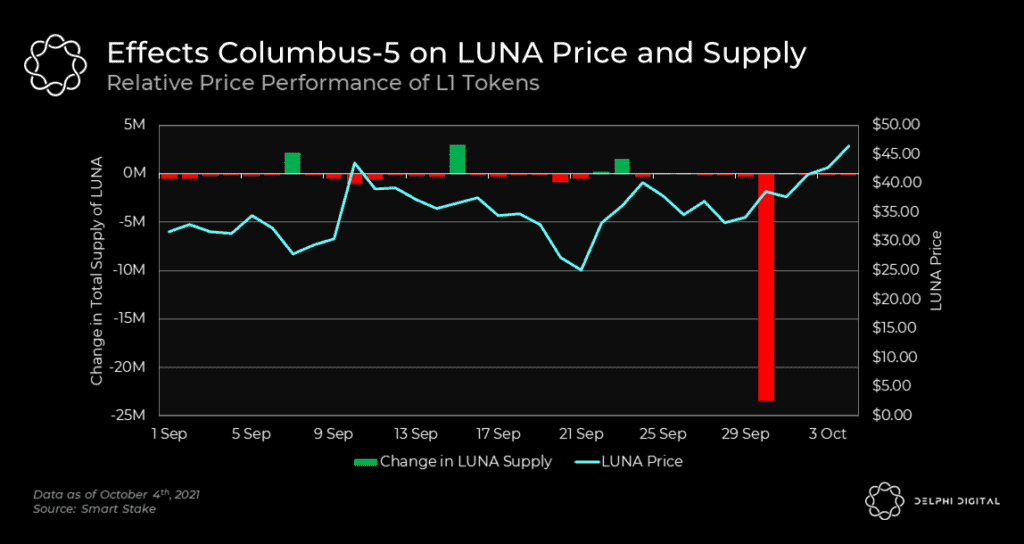

The Columbus-5 Upgrade

The Columbus-5 upgrade took place on Sept. 30 and has introduced an overhaul in Terra’s tokenomics. Columbus-5 is slated to be the most significant upgrade Terra has seen since it’s mainnet launched, and it will introduce two major features to the Terra blockchain. The first is the burning of all Seigniorage fees. Seigniorage is the small fee for burning Luna to mint UST; this fee goes to the community Treasury. The thing is, Terra community Treasury already holds over 93 million Luna, which is worth $3.4 billion.

Columbus-5 will burn all Seigniorage fees instead of redirecting them to the community Treasury. This will add deflationary pressure to Luna, potentially increasing the value of the coin and, by extension, the value of the community Treasury.

The second feature Columbus-5 will bring to Terra is interoperability with Cosmos’ inter blockchain communication protocol or IBC. The IBC essentially makes it possible to connect every cryptocurrency blockchain. The IBC works by bridging all blockchains to a single hub, in this case, that's the Cosmos blockchain itself.

With the IBC, you'd be able to move your wrapped Bitcoin (WBTC) on Ethereum and then buy Ethereum (WETH) directly on Binance's Smart Chain for example without having to go back to Bitcoin as a pitstop. The importance of Terra in this equation is, of course, UST, which will become the decentralized stable coin used for trading cross-chain assets on the IBC.

Terra’s Top Dapps

Terra hosts an impressive lineup of Dapps in its ecosystem, which also leverages the blockchain’s native token. Here are the top 4 projects on Terra that we believe are worth watching.

#1) Anchor

A money market offering a stable 20% yield through staking POS tokens that are lent to the protocol.

Symbol: ANC

Price: $2.83

FDMC: $2.8B

TVL: $4.5B

#2) Lido

Lido is a liquid staking solution that lets users stake their digital assets

Symbol: LDO

Price: $3.55

FDMC: $3.5B

TVL: $7.5B

#3) Mirror

A synthetic assets protocol built by Terraform Labs

Symbol: MIR

Price: $2.85

FDMC: $1B

TVL: $1.5B

#4) Spectrum Token

A yield optimizer to auto stake and compound mirror assets

Symbol: SPEC

Price: $7.78

FDMC: $311M

TVL: $156M

Terra’s three largest Dapps: Anchor, Lido, and Mirror make up around 90% of its TVL.

One Smart Contract to Rule Them All

Ethereum has had a multi-year head start from the rest of its L1 competitors and as it stands, Ethereum remains the king of the jungle with a little over $140B in TVL, beating its previous ATH back in May.

Other L1s such as Avalanche and Fantom saw major growth this past quarter after announcing their incentive programs to bring developers and users over to their platforms in hopes of replicating the success of Ethereum’s DeFi ecosystem. Luna and its founders have made it clear that they are vying for the top spot when it comes to bringing blockchain technology into fintech, but it still has a long way to reach the level of decentralization and Dapp ecosystem Ethereum.

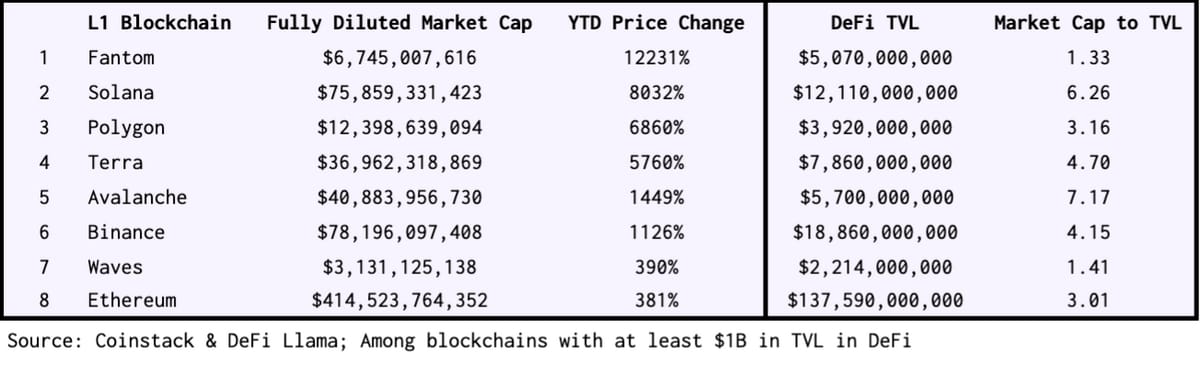

In conclusion, we are putting a Buy signal on Terra, but not quite as strong as Fantom, which is growing faster than Terra AND has a much lower Market Cap to TVL ratio per the below chart.

Could Fantom Eclipse Terra This Fall?

We’ll end this issue with a quick preview of next week’s issue, where we will be doing a deep dive on Fantom (FTM).

Among the top 8 blockchains by total value locked in DeFi, Fantom (FTM) is BOTH the fastest-growing token YTD and it has the lowest market cap to total value locked ratio, indicating it may still be substantially undervalued.

Fantom has $5B in DeFi TVL, the same as Avalanche (AVAX), yet is trading at an 80% lower market cap. We anticipate good things to come for the Fantom ecosystem this Fall.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡ Department of Justice Announces Crypto-Focused ‘Enforcement Team’ - A senior U.S. Department of Justice official said Wednesday that the department is forming a "National Cryptocurrency Enforcement Team" focused on cybercrime and money laundering. (Source)

😮 Binance Dedicates Another $1B to Smart Chain Project - Binance’s latest move came as several other new Ethereum-alternative projects are also dedicating hundreds of millions of dollars in incentives. (Source)

💳 Texas Democratic Party Aims To Use NFT Sales for Fundraising Efforts - Front Row said it would partner with the Texas Democratic Party to pilot a program to raise money for candidates and causes using nonfungible tokens (NFT). (Source)

💰 Ripple and Nelnet Launch $44M Fund for Carbon-Negative Crypto Industry - Ripple has contributed the majority of a $44-million fund to support solar energy projects across the United States. (Source)

🤑 JPMorgan: BTC Breaking $55,000 Is Fueled by Institutional Investors Appetite for Bitcoin - JPMorgan has revealed that institutional investors are investing in BTC again. (Source)

🏦 DeFi Total Value Locked Reaches Milestone High of $200B - The total value locked (TVL) across all decentralized finance (DeFi) platforms has tapped a record high OF $200M this week as crypto markets continue to build on previous gains. (Source)

💣 Ethereum (Eth) Devs Looking To Delay Difficulty Time Bomb, What Could This Mean? - Last week, Ethereum devs Tim Beiko and James Hancock posted proposal 4345 to delay the difficulty time bomb until May 2022. (Source)

📈 IMF Reiterates More Oversight for Crypto in Latest Report on Financial Stability - The group identified the crypto space at risk from hacking, “lack of transparency around issuance and distribution” of tokens, and operational risks. (Source)

🎆 Vitalik Buterin Calls Out ‘Bitcoin Maximalists’ for Supporting El Salvador’s President Nayib Bukele - Ethereum creator Vitalik Buterin criticized El Salvador president Nayib Bukele on Friday for forcing businesses in the country to adopt bitcoin. (Source)

🏧 SEC Approves Volt Equity ETF Providing Exposure to Bitcoin-Centric Companies - Regulators have green-lighted a new exchange-traded fund that provides exposure to “Bitcoin Industry Revolution Companies.” (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Fantom Leads the Fastest Growth in 14D TVL, With Another $4.3B Locked Into the Protocol

2. Long-Term Holders Rotate Out of Positions in Bull Markets, Typically As Price Breaks the Previous High, Signaling New ATHs Coming by EOY

3. AXS, the Governance Token Behind the Axie Infinity Game, Increased by Over 60% in the Past Seven Days

4. Luna Rises +25% Shortly After Columbus-5 Launches Onto Its Mainnet

5. TVL on Celo Surpassed $865M, Up 139% in Q3’21, Coming From the Announcement of a $100M DeFi Incentive Program and the Launch of Optics

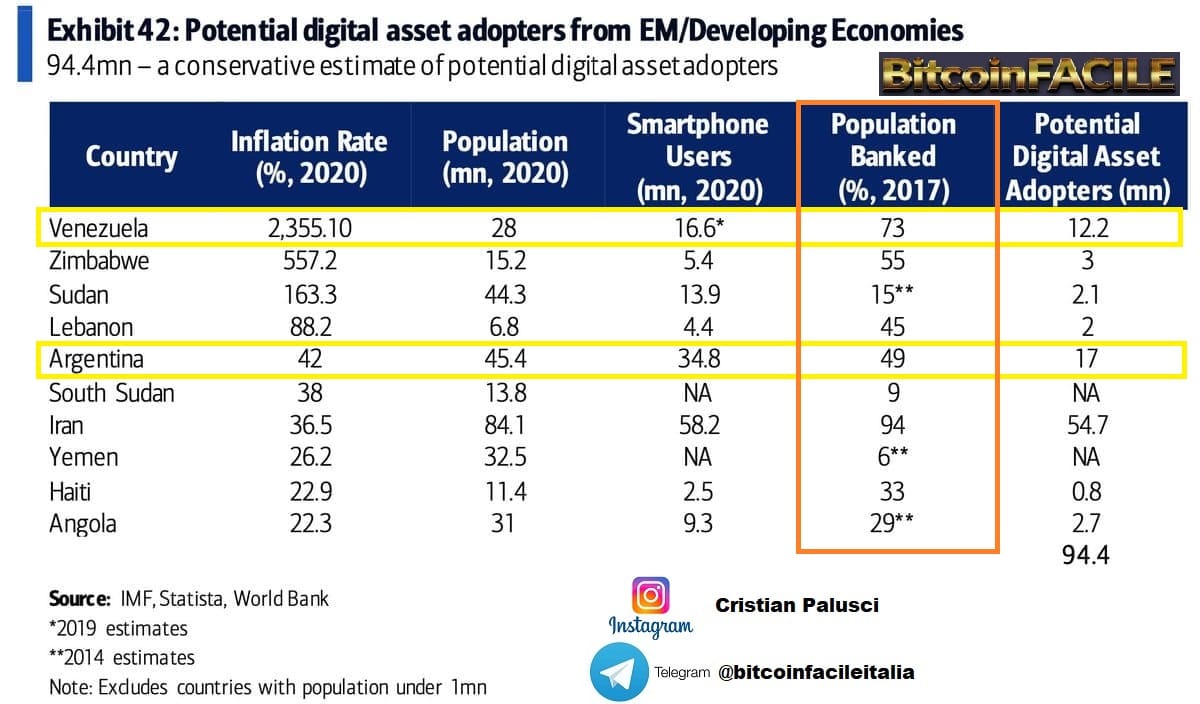

6. According to Bank of America, 94 Million People From Developing Countries Would Be Ready To Buy Digital Assets More Stable Than National Currencies Devalued by Hyperinflation

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. Institutional Traders Have Woken Up

The team at Arcane Research published their latest weekly report highlighting CME’s share of the global open interest in the BTC futures market, reaching Q1 highs.

“Institutional traders have returned to Bitcoin. CME’s share of the global open interest in the bitcoin futures reaches 17%, the highest level recorded since February 2021. CME’s open interest is growing at a rapid rate. From September 28th until today, the open interest on CME’s bitcoin futures has more than doubled from $1.5 billion to $3.3 billion. The growing basis premium suggests that CME traders are primarily focused on adding long exposure at the time being. We view this as a healthy signal from the futures market, as rapid growth in Bybit’s OI has previously tended to be a signal of an overextended market, whereas the opposite has been confirmed with growing OI from the CME futures.”

2. Crypto Networks & Economies

Chris Dixon is a general partner at a16z, where he co-leads the firm's crypto funds. In a recent report, Dixon outlines the importance of Web 3 as a necessary evolution for the web.

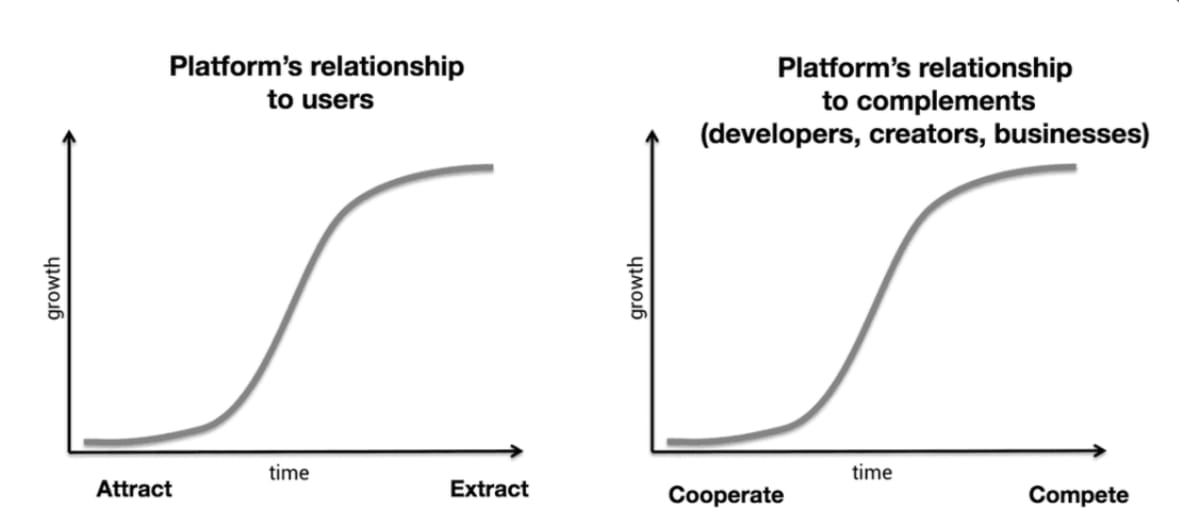

“Why does web3 matter? First, let us look at the problems with centralized platforms. Centralized platforms follow a predictable life cycle. At first, they do everything they can to recruit users and third-party complements like creators, developers, and businesses. When they hit the top of the S-curve, their relationships with network participants change from positive-sum to zero-sum. To continue growing requires extracting data from users and competing with (former) partners.

They do this to strengthen their network effect. As platforms move up the adoption S-curve, their power over users and third parties steadily grows…

Tokens align network participants to work together toward a common goal — the network's growth and the token's appreciation. This fixes the core problem of centralized networks, where the value is accumulated by one company, and the company ends up fighting its users and partners. Before web3, users and builders had to choose between the limited functionality of web1 or the corporate, centralized model of web2. Web3 offers a new way that combines the best aspects of the previous eras. It is very early in this movement and a great time to get involved.”

3. The Next Price Era

Bitcoin Price Cycles, Oct 6, 2021Pantera Capital’s Dan Morehead writes a monthly letter on the state of the Crypto economy and the trends he and his firm see emerging. Morehead goes into detail this month in regards to Bitcoin’s Price Cycle.

“Where’s that leave us? I believe we are done with the four-year halving cycle – and on to the next price era. We’ve updated charts we’ve used since 2014 – showing the major bull and bear markets. I sense that we finished the halving cycle in April. We had a period of temporary insanity – where Chinese mining bans were thought to be negative and a few people had blockchain ESG upside down – and now we’re in a new bull market. As the market becomes broader, more valuable, and more institutional, I long advocated that the amplitude of prices swings will moderate. While we’ve already had two down 83% bear markets, I believe those are a thing of our primordial past. Future bear markets will be shallower. The previous two have been -61% and -54%. Unfortunately, there’s no free lunch. The flipside is we probably won’t see any more of the 100x-in-a-year rallies either.”

For what it’s worth we disagree with Dan’s analysis and believe we remain in the same bull market that began at the halving in May 2020 -- and we expect the current bull market to last until Q1 2022.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

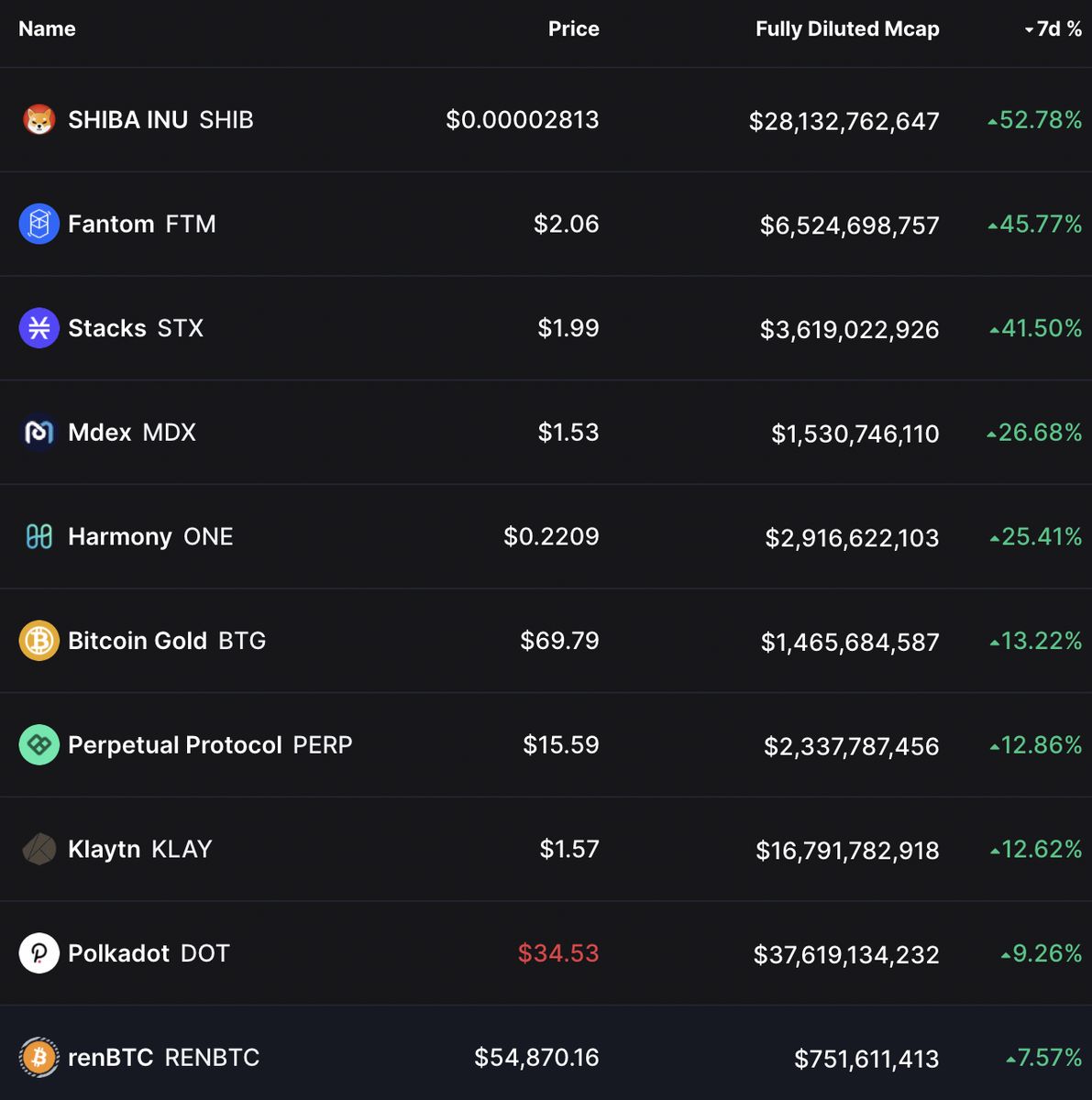

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like FTM, PERP, and DOT had an especially great week.

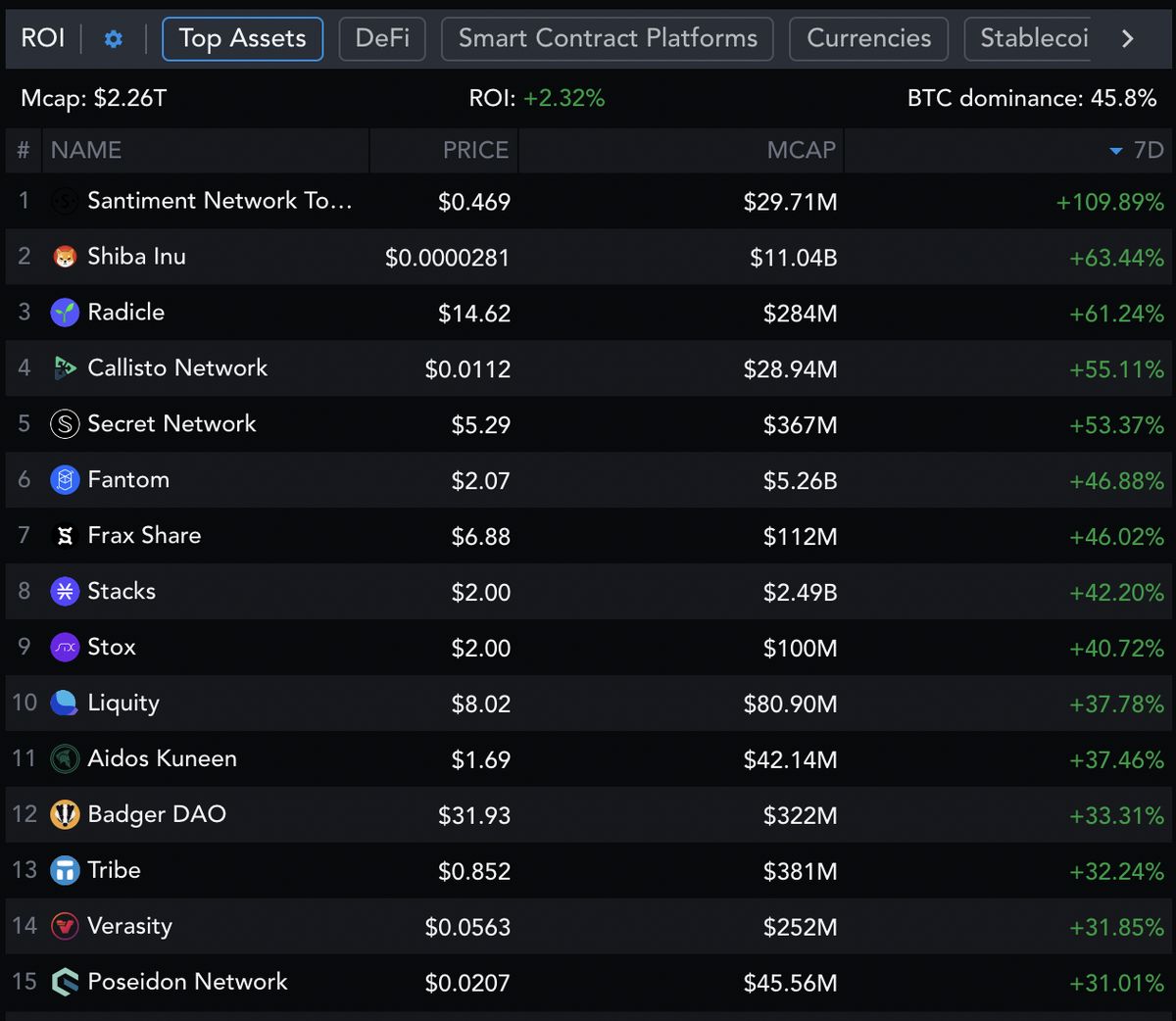

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Shiba Inu is a meme coin, dydx is a decentralized Axie Infinity is a game, OMG is an L2

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 6,758 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Updated Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.