Social Links:Twitter | Telegram | Newsletter

Issue Summary Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we cover Tether’s big Bitcoin reserve announcement, the EU greenlighting MiCA regulations, Binance halting Canadian operations, Do Kwon being granted bail in Montenegro, and big new rounds from Auradine ($81M), River Financial ($35M), and Cormint ($30M).:

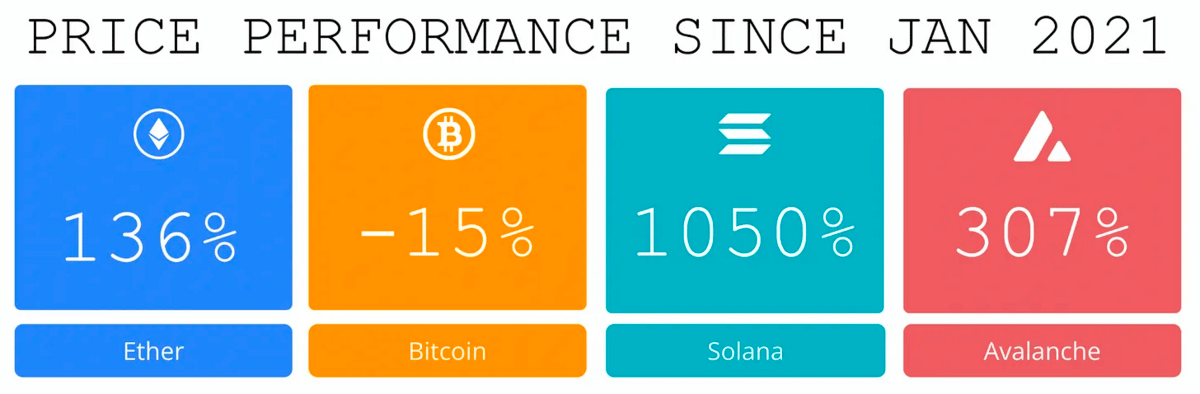

Price performance of the leading L1s since we began writing Coinstack in January 2021

Brought to You by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Become a Coinstack Sponsor

To reach our weekly audience of 100,000 crypto insiders with 40%+ weekly open rates, view our sponsor deck and schedule a call. We are now seeking a Headline Sponsor for the rest of 2023.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

Tether Says It Will Buy Bitcoin Monthly for Stablecoin Reserves - Tether reported $1.48 billion of net profits in 2023 Q1 and revealed $1.5 billion in BTC holdings already. Based on current profit levels, they expect to buy around $75M per month of Bitcoin going forward (about 15% of their total monthly profits). “Bitcoin has continually proven its resilience and has emerged as a long-term store of value with substantial growth potential,” said Paolo Ardoino, chief technology officer of Tether. 85% of their reserves will remain in “cash and cash equivalents.”

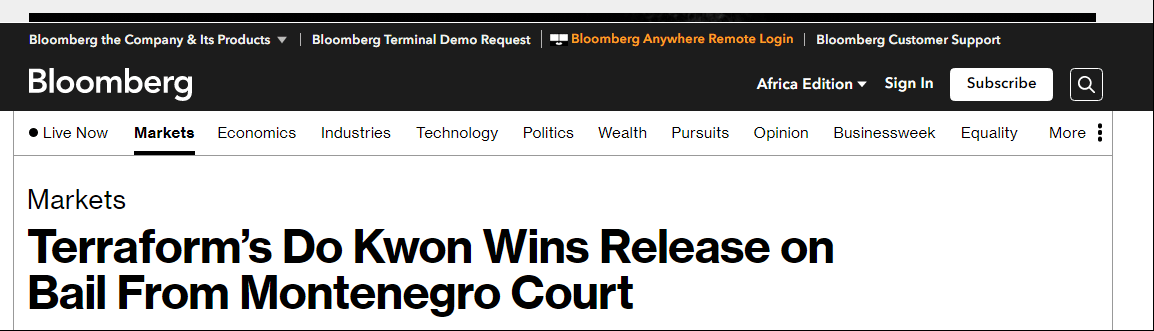

⚖️ Do Kwon Granted Bail at €400,000 – Against Prosecutors Wishes- A Montenegrin court agreed to release detained Terraform Labs co-founder Do Kwon and his former chief financial officer Han Chong-joon on 400,000 euros ($436,000) in bail for each, a move prosecutors had sought to deny.

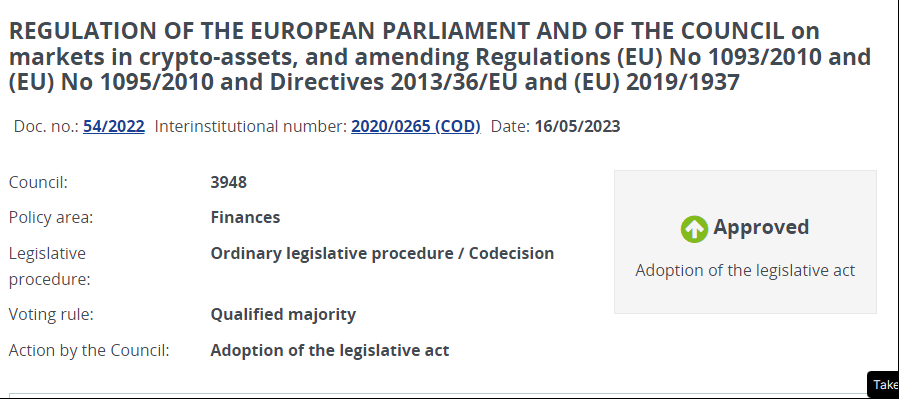

⚖️ EU Finance Ministers Unanimously Greenlight MiCA Regulations- The landmark Markets in Crypto Assets (MiCA) received the final greenlight from the Economic and Financial Affairs Council of the European Union in a unanimous vote on May 16.

🚩 Binance Halting Operations in Canada- Binance said in a May 12 tweet that it would be halting operations in Canada.The cryptocurrency exchange said that it is joining other crypto companies who are “proactively withdrawing from the Canadian marketplace.”

⚖️ BlockFi Receives Permission To Return $297M to Certain Customers- Bankrupt crypto lender BlockFi received court permission on Thursday to return $297 million to customers with non-interest-bearing accounts, without repaying customers who had tried to move funds into those accounts at the last minute. U.S. Bankruptcy Judge Michael Kaplan in Trenton, New Jersey ruled that customers owned their deposits in BlockFi's Wallet program, which did not pay interest and kept customer deposits separate from BlockFi's other funds.

🚀 Cardano’s hydra scaling solution goes live on mainnet as Ethereum gas fees surge - The first Hydra node compatible with the Cardano mainnet was launched on May 11, according to developer Sebastian Nagel.

💬 Tweet of the Week

Source: @RyanSAdams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

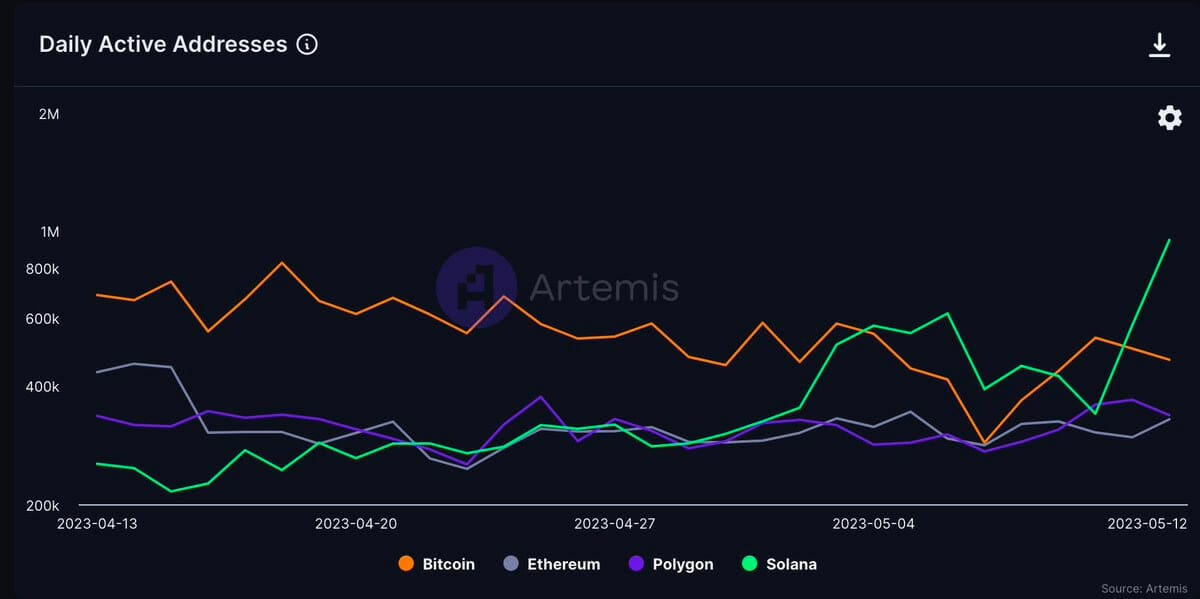

1. Solana is at nearly 1M daily active addresses as it adds over 600,000 in just 2 days.

Source: @StepDataInsight

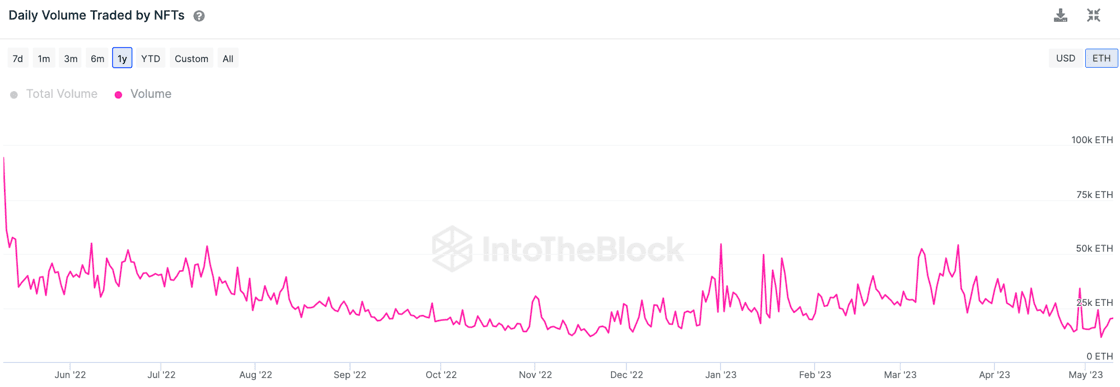

2. NFT trading volume hits a new low since 2021, down 80% from last year's numbers.

Source: @intotheblock

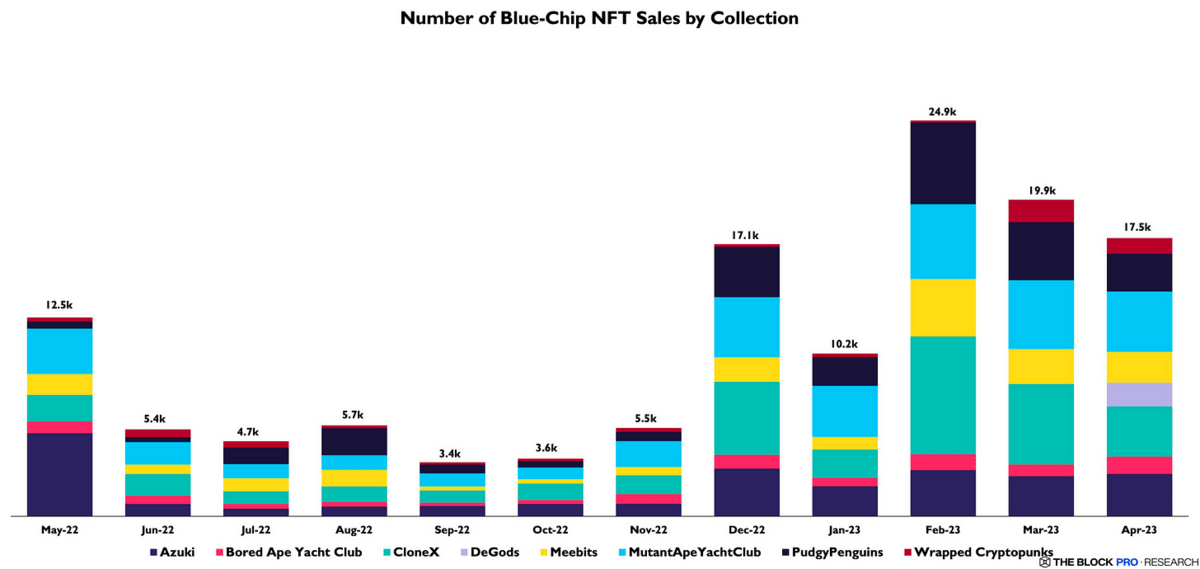

3. The total number of blue-chip NFT sales fell from 19.9K to 17.5K, a 12.2% MoM decrease. Bored Ape Yacht Club (BAYC) was the only collection to have an increase in the number of sales throughout April.

Source: @TheBlockPro__

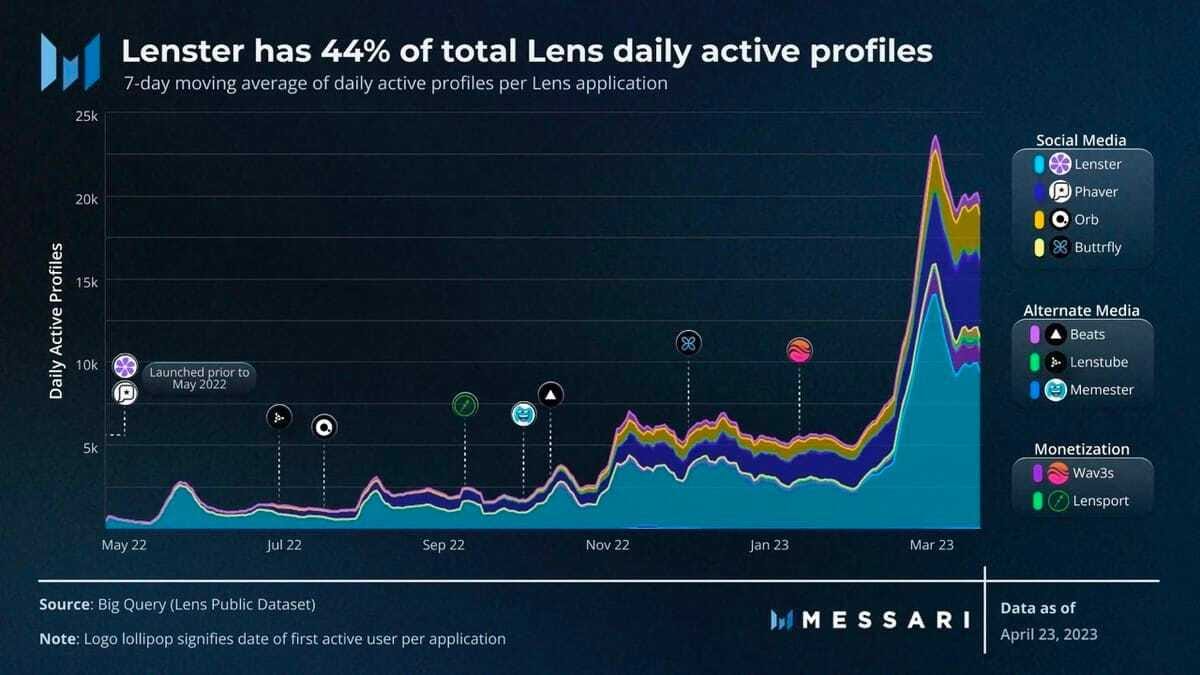

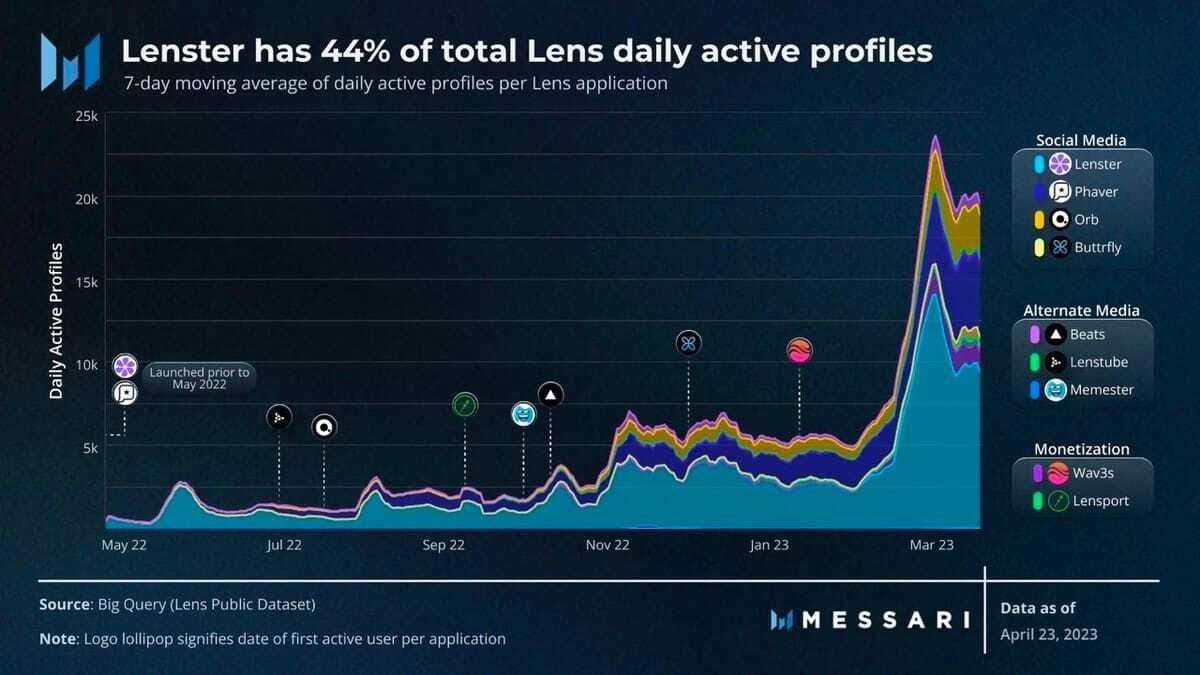

4. In the past year, Lens protocol has grown from less than 5,000 in DAU (Daily active users), to over 20,000 today

Source: @KaronPangestu

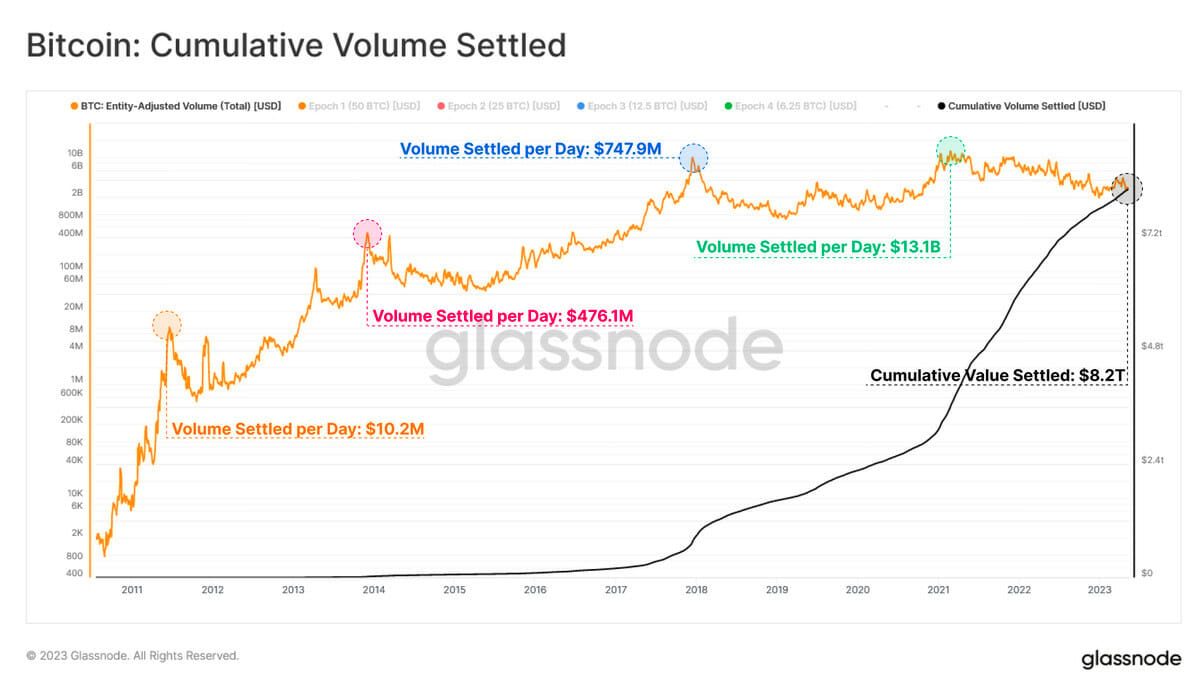

5. Since inception, without requiring any third party authority, the Bitcoin network has settled a staggering $8.2T in uncensorable transfer volume when adjusting for non-economic transactions.

Source: @glassnode

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Introduction

To get a sense of the challenge facing web3 applications looking to usurp their web2 counterparts, we may look no further than Twitter, which saw 24.4 thousand tweets per second during France’s equalizing goal during last year's World Cup Final.

For Web3 to have a puncher's chance in eating Web2 market share, it needs new scaling techniques that can reach Web3 parity via minimized asset issuance costs for developers at high levels of throughput.

Unlocking those techniques would in turn unlock a much wider design space for new applications in the crypto space via:

Reduced minting costs lead to better unit economics for a wider set of applications.

The ability to mint more assets on-chain creates greater composability between crypto-native assets: “composability is to software as compounding is to finance”.

The success of crypto-native assets begets more ecosystem success as new applications spin up to compose with leading applications.

Projects have taken several approaches to implementing technical solutions to lower the unit cost of NFT transactions. The three that stand out the most are:

Solana NFT Compression: State compression via concurrent Merkle trees

Lens: Parallel execution via Momoka

AltLayer: Rollup compression via Flash Layers

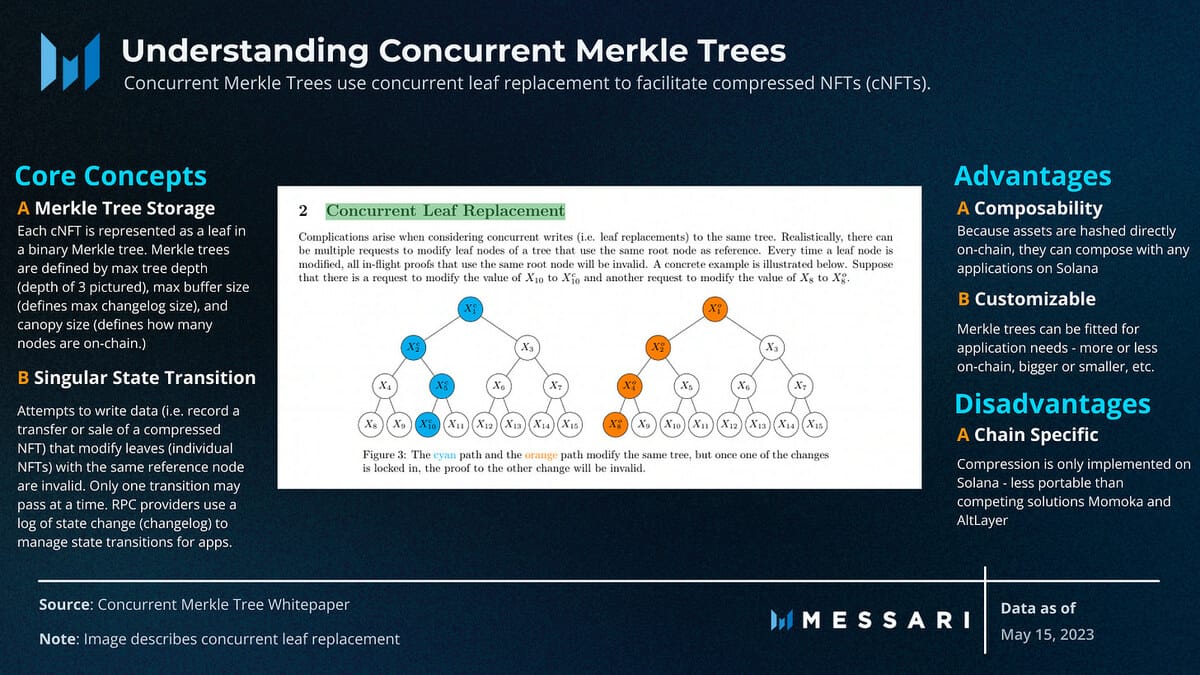

Solana State Compression

State compression is a low-cost storage and execution solution built on Solana. NFT compression (a subset of general state compression) utilizes concurrent Merkle trees to store off-chain data on-chain. By storing NFT metadata in a hashed form within a Merkle tree, Solana can compress state to a size small enough to be fully on-chain if developers desire.

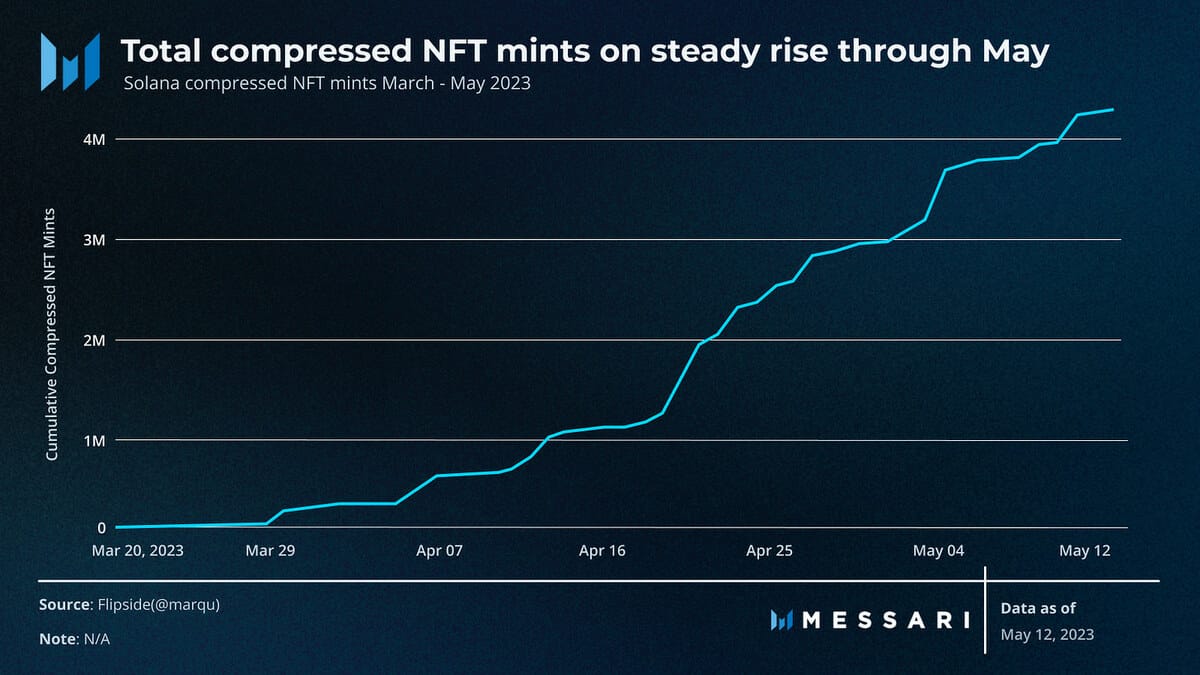

Compression has seen an explosion of adoption since its launch in mid-March. Notable teams have migrated to Solana in part to make use of the standard (Helium and Render), and many other Solana-native teams have directly used (Dialect, Crossmint, Drip, and others) or facilitated the usage (easy-use compression APIs from Metaplex and Underdog) of state compression.

Additionally, Compressed NFTs (cNFTs) have taken an impressive amount of market share in the minting market globally since launch in March. Market share oscillates on a day-to-day basis, but some 30-40% of NFT mints are cNFTs on their most highly utilized days.

cNFTs have extremely low marginal costs, ranging between 0.0001-0.00015 USD per NFT minted. Unlike Momoka, however, developers must also pay a variable tree initialization cost to create the Merkle tree in which cNFTs are stored. This one-time fixed cost roughly comes out to 5 SOL per million cNFTs, which adds another ~0.0001-0.0002 USD to the cost of minting with amortized costs across each cNFT. This brings the total unit cost (~$0.0003 USD) for cNFTS just below Momoka’s cost of 0.0004-0.0005 USD. At first glance, the difference might seem irrelevant, but at scale, the 20-40% cost savings may be material for businesses minting trillions of interactions over the course of their lifetime.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.