The Merge Has Begun

Ethereum's final hard fork before the Merge was activated Tuesday, marking the beginning of ETH's historical transition from proof-of-work (PoW) to proof-of-stake (PoS), on track to go live Sep 14

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week’s issue provides an update on the Ethereum Merge which is on track to go live next Wednesday evening, September 14.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - The Ethereum Merge Has Officially Begun, Arbitrum Upgrades to Nitro, Binance Will Stop Supporting USDC

💵 Weekly Fundraises - Limit Break ($40M), Animoca Brands Japan ($12.9M), Thirdweb ($5M)

📊 Key Stats - 73.7% of Ethereum Nodes Are Merge Ready, 69% of ENS Holders Own Just One .Eth Domain, Arbitrum Transactions Up +79.2%

📝 Report Highlights - How Solana Wins the End Game vs. Modular Chains

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

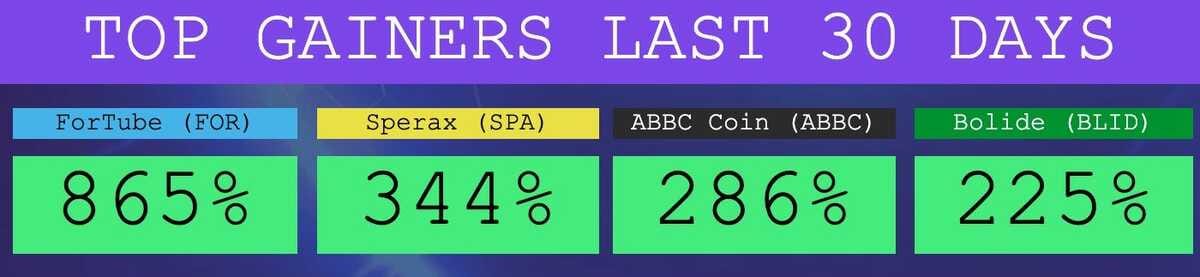

📈 Top 10 Tokens of the Week - FOR, SPA, ABBC

🌟 Coinstack Podcast Episodes

😍 Join Our Telegram Group

🎓 Getting Starting in Crypto Learning

Top L1s Avalanche and Solana are flat year over year in price performance while ETH and BTC are down around 60%

After years of community effort, Ethereum’s Merge to Proof-of-Stake is on track to go live next Wednesday night, Sep 14. This will reduce issuance by 90%, reduce electricity usage by 99.95%, and increase ETH staking yields to 6-10%.

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. See our recent article about Peer here.

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto quant funds. They have researched 250+ crypto funds, vetted 50+, and selected the 19 best based on a proprietary scoring system, providing accredited investors and institutional allocators with the ability to gain diversified crypto quant fund exposure with one investment. Download the deck at www.amphibiancapital.com.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) 😎 The Final Countdown to the Ethereum Merge Has Begun. The Ethereum blockchain’s merge to proof-of-stake is officially underway and on track to go live the evening of September 14. The Bellatrix upgrade – the network's final "hard fork" before the Merge – was activated on Tuesday, marking the beginning of Ethereum’s long-awaited transition from proof-of-work (PoW) to proof-of-stake

Source: Ultrasound.money

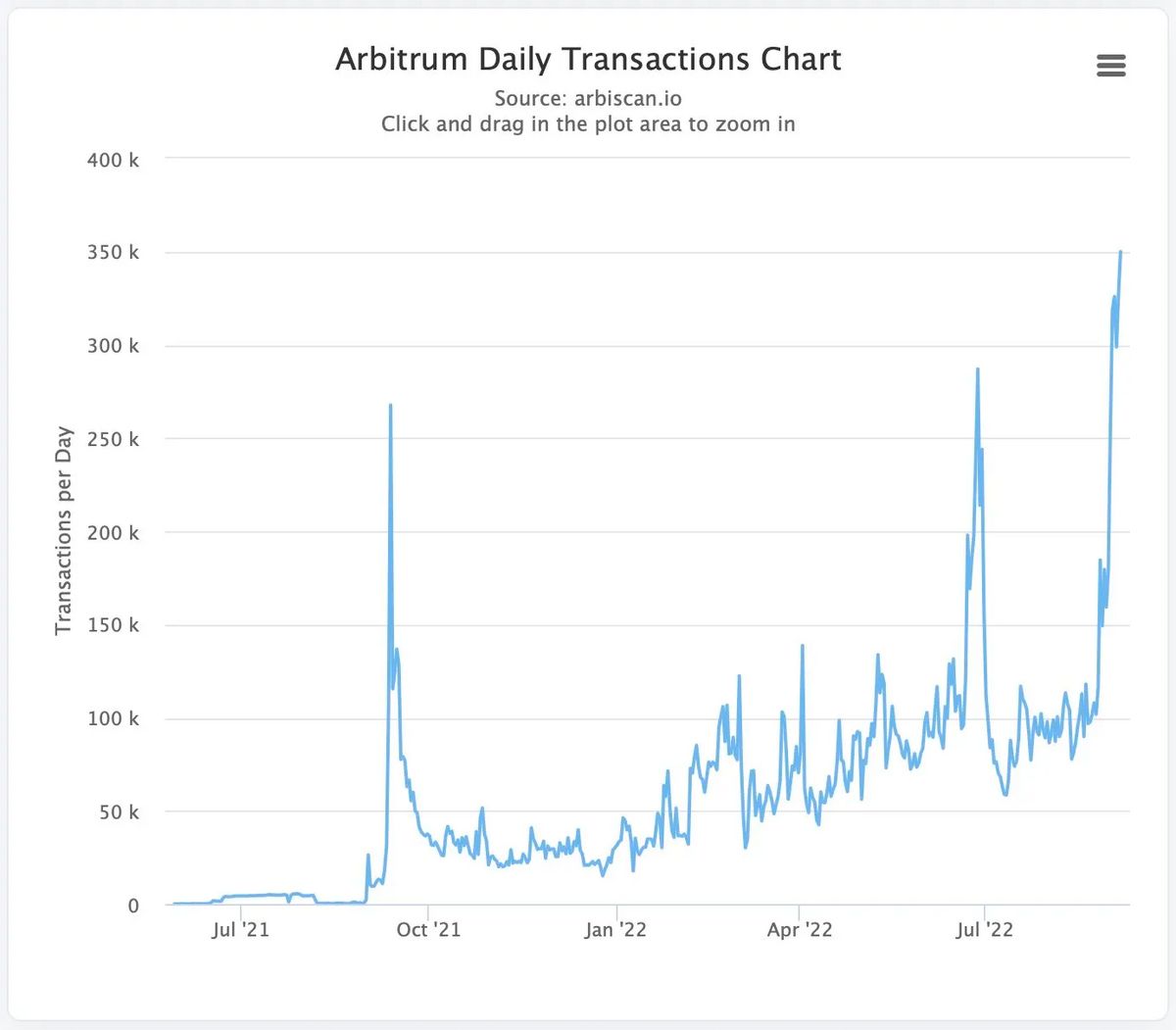

2) 🏎️ Arbitrum Upgrades to Nitro Ahead of Ethereum Merge. The largest Ethereum scaling solution just got a speed boost. Arbitrum, a layer-2 rollup built to settle transactions cheaply on top of Ethereum, successfully deployed its Nitro upgrade after several hours of network downtime on Wednesday. Arbitrum Transactions are up 79% since.

3) 👋 Binance will stop supporting USDC, certain other stablecoins by Sept. 29. Binance has revealed that it will remove USD Coin (USDC), TrueUSD (TUSD), and Paxos Standard (USDP) as tradeable assets on its platform and convert its users’ balance in these stablecoins to Binance USD (BUSD) by Sept. 29.

4) ⚖️ Suit: Michael Saylor, MicroStrategy Owe $100M+ of Damages From Back DC Taxes. Just weeks after stepping down as MicroStrategy’s long-time chief executive, noted Bitcoin bull Michael Saylor — and his company, the largest publicly traded bitcoin holder — is facing legal accusations that allege systemic tax fraud with penalties that could amount to more than $100 million.

5) 🕰️ MakerDAO Co-Founder Lays Timeline for Free Floating DAI. Weeks after threatening to “YOLO” DAI collateral from Circle’s USD coin to ether, MakerDAO’s co-founder Rune has proposed a path to “free floating” DAI — letting the stablecoin de-peg from the US dollar altogether.

6) ⚖️ U.S. sought records on Binance CEO for crypto money laundering probe– US authorities have an ongoing investigation into whether Binance violated the Bank Secrecy Act, after federal prosecutors began probing the company and its CEO in December 2020.

7) 💸 Coinbase Users Across the Country of Georgia Milk Price Bug for 100x Profit. Coinbase is seeking to clawback funds from bank accounts after discovering swathes of traders in Georgia had cashed out crypto for 100 times the intended market rate.

8) 🟥 Crypto Investment Uptick in Blockchain Infrastructure, KPMG Predicts. In the second half of the year, KPMG expects investors to move away from companies offering coins and non-fungible tokens (NFTs) and toward blockchain infrastructure projects, particularly those that involve the use of blockchain in updating financial technology.

9) 🇮🇳 Indian Police Arrest Two Suspected of Duping 1,400 in Crypto Scam. Police in the western Indian state of Maharashtra have arrested two people on suspicion of running a crypto scam thought to have conned more than 1,400 investors of between $6 million and $12 million.

10) 🏳️ 74% of Ethereum nodes ‘Merge ready’ ahead of Bellatrix upgrade- As many as 73.5% of Ethereum nodes are now marked as “Merge ready” ahead of the upcoming Bellatrix upgrade for Ethereum on Tuesday, according to data from Ethernodes.

💬 Tweet of the Week

Source: @brucefenton

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Ethereum Leads The Pack With Blockchain Revenue Last 30 Days, more than 4x nearest competitor and 10x BTC

Source: Token Terminal

2. OpenSea and Uniswap Lead the Pack with Revenues for Dapps the Last 30 Days, Both With Around $50M

Source: Token Terminal

3. 73.7% of Ethereum Nodes Are Merge Ready

Source: @Blockworks_

4. 69% of $ENS Holders Own Just One .ETH Domain

Source: @nansen_intern

5. The Total Number of Transactions on Arbitrum Has Increased +79.2% Since Arbitrum Nitro Launched

Source: Bankless

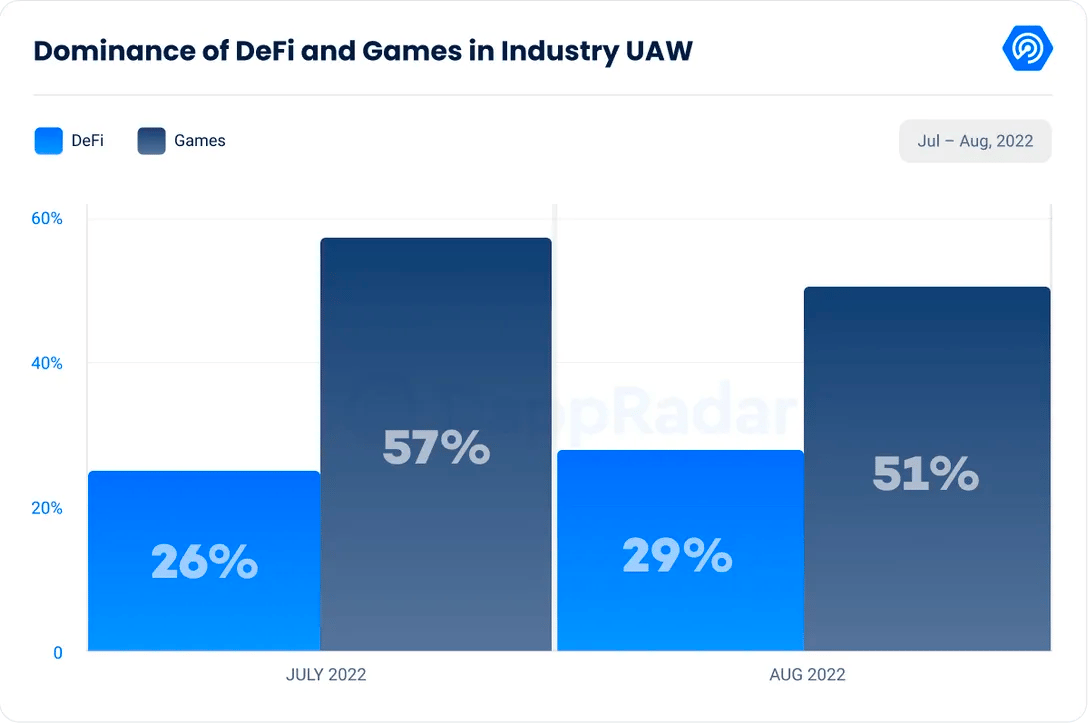

6. The Gaming Sector Accounts for Approximately 50.51% of Industry Usage Month-Over-Month (MoM) With Around 847,230 Gaming-Related Unique Active Wallets Are Active Daily With Nearly $698 Million in Transactions

Source: Myth of Money

7. BUSD’s Market Share of Stablecoin Volume Hits All Time High

Source: Kaiko

8. Arbitrum, Uniswap, Polygon See Growth in Daily Active Users Month-Over-Month

Source: @TokenTerminal

9. Avalanche NFT Marketplaces Weekly Volume Has Reached a 7-Week High, With Over 17K AVAX in Volume

Source: @NFTgators

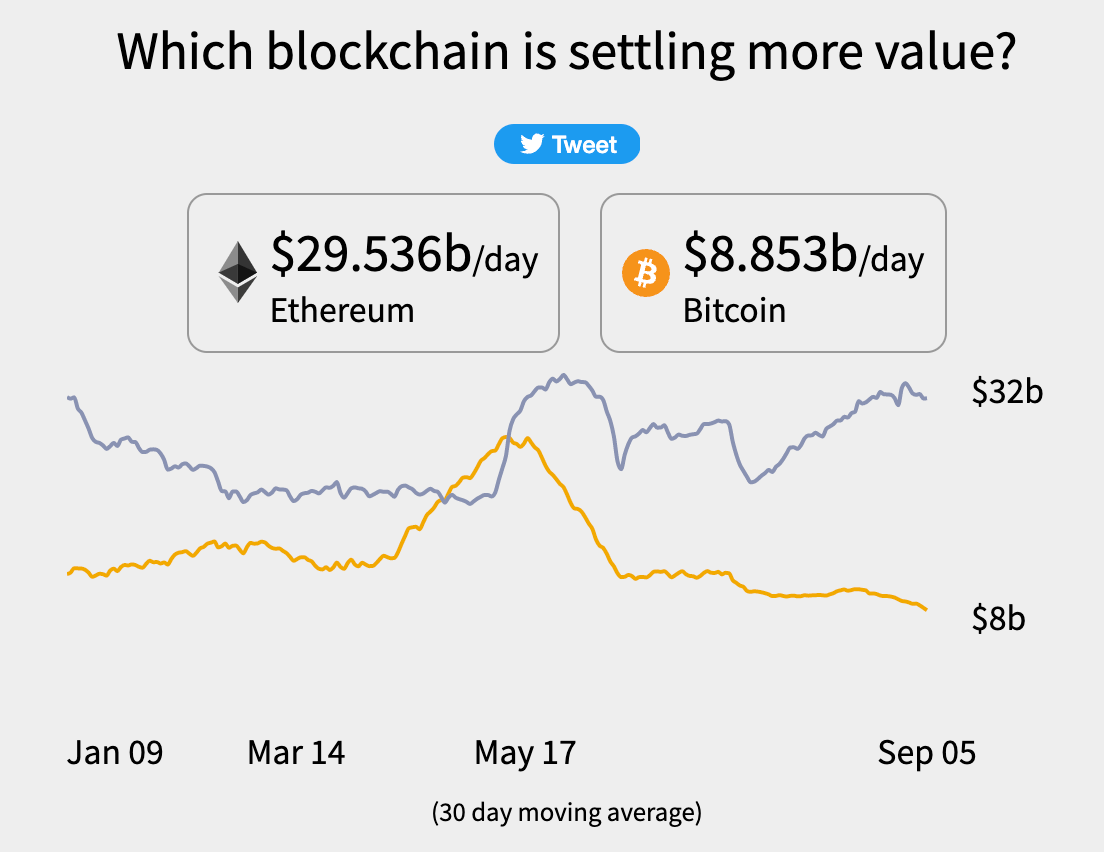

10. Ethereum Now Settling 3.3x More Value Daily Than Bitcoin

Source: Money-Movers.info

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and is building data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here

Introduction

Since the genesis of the crypto industry, there have been arguments about the best approach to build a digital distributed ledger. Big blocks versus small blocks. Account-based versus UTXO. Smart contract enabled versus non-smart contract enabled. There has been no shortage of disagreements and debates in the 14 short years since the Bitcoin whitepaper.

The latest in a long line of debates is whether Layer-1 (L1) blockchains should be monolithic (wrapping transaction execution, network consensus, proof settlement, and data availability on one mainchain) or modular (outsourcing some of these functions to Layer-2s or other chains). To date, the monolithic approach has limited either speed, decentralization, or security, in short not addressing the scalability trilemma. Modular blockchains have shown promise in better addressing these issues.

With many popular chains pursuing the modular route, many are ready to call this fight early. But perhaps we shouldn't be so quick to believe modular chains have already won.

Monolithic vs. Modular Chains

The key components of a blockchain can be broken down into security (consensus and settlement), execution, and data availability. Monolithic chains have one set of validators securing all of these functions while modular chains will have different sets of validators securing each sub-function.

Security:

Consensus: agreeing on the block number, order, and contents.

Settlement: where proofs are verified or disputed; a final step in blockchain finality.

Data availability: ensuring the history of the chain is accessible to allow validators to verify the most recent transactions are valid and no data has been excluded.

Execution: process to retrieve transactions from the mempool, compute them, and adjust the network state.

Most legacy chains are “monolithic” in that they house all of these functions under one blockchain. When your transactions are simple (i.e., no smart contracts) and use cases are straightforward (i.e., transferring tokens from one party to another), being a monolithic blockchain makes sense. Maintaining a running list of transactions doesn’t take up much space or require many computational resources. Maintaining the data availability or running a full node (i.e., downloading all block headers and all historical transactions) is easy even with a basic computer. Bitcoin is a classic example of a monolithic chain.

The issue arises when you try to add more complex transactions or those that rely on speed. These types of transactions are the lifeblood of decentralized finance. More transactions grow the state of the network. More complex transactions take up more blockspace, making blockspace more expensive or throttling the network. Faster speeds place higher hardware requirements on node operators. But if we modularized or segmented these key functions, we could individually optimize for each of them, thereby solving the blockchain trilemma or at least coming close. That's the argument for modularity.

Monolithic blockchains have addressed these issues by maintaining a smaller set of highly powerful and largely centralized set of nodes. Proponents of monolithic chain proponents like Solana argue that blockchains are all about shared finality at the fastest speeds possible, with synchronous composability across applications. They believe that segmenting these functions creates too much lag between applications. The chain with the fastest speed at the lowest cost will achieve the most attraction by users. Period. As Anatoly, the founder of Solana stated, the end goal is to synchronize information across multiple parties at close to the speed of light as possible, whether modular or monolithic.

Modular chains have many proponents among major L1s, each taking slightly different approaches. Some chains have even sprung up to support just one layer of the stack.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: ForTube is a Lending Protocol, Sperax is a Governance Token, ABBC is a Payments Platform, Bolide is a Yield Navigator

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 29,813 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com