Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.connect.financial, www.revix.com. and www.block.aero

Thanks to Our 2023 Coinstack Sponsors…

Please see our sponsor deck and schedule a call to discuss becoming a Coinstack sponsor.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week…

⚖️ SEC Sues Terraform Labs and Founder Do Kwon for Securities Fraud - The U.S. Securities and Exchange Commission has charged Singapore-based Terraform Labs and founder and CEO Do Kwon with securities fraud involving its algorithmic stablecoin Terra USD and the LUNA token.

🔫 U.S. Regulators Are On the Attack - U.S. regulators have come out guns blazing in February. Here’s everything that’s happened in just the last two weeks according to Sam Andrew from Crypto Clarity…

The Fed and other federal agencies issued a new policy advising banks not to engage with crypto companies.

Paxos confirmed the SEC is investigating its issuance of stablecoins.

The New York Department of Financial Services ordered Paxos to cease issuing the Binance stablecoin. Paxos abided.

The SEC charged Terraform Labs and its founder with securities violation. The indictment argues that the stablecoin UST is a security.

The SEC charged Kraken with selling unregistered securities as part of its staking business. Kraken immediately shut its US staking business and paid a fine.

The SEC proposed a major revamp of asset custody rules. If passed, institutions would struggle to buy crypto.

🟩 FTX Japan to Resume Crypto and Fiat Withdrawals on Feb. 21 - FTX Japan, the Japanese subsidiary of the collapsed crypto exchange FTX, will resume crypto and fiat withdrawals from Feb.21.

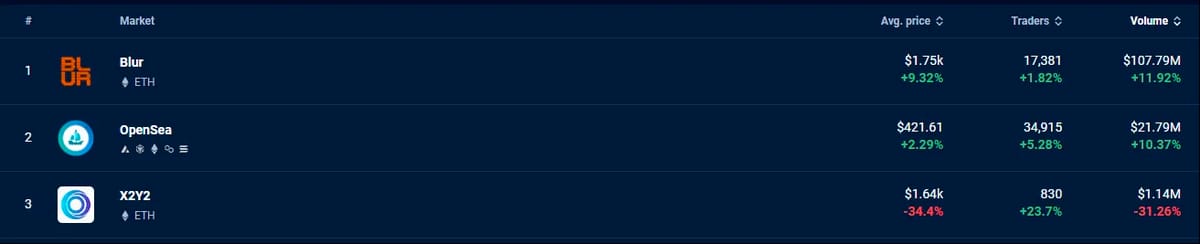

🚀 Blur Overtakes OpenSea As Ethereum NFT Trading Skyrockets - Following two straight months of sales growth, NFT trading rapidly accelerated over the past week as Ethereum NFT volume more than doubled during that span.

😲 CZ Denies Binance Is Considering Delisting Tokens From US Projects - Binance CEO Changpeng Zhao has spoken out regarding news reports that the company will cut ties with U.S. crypto projects. In a tweet Friday, Zhao—better known as CZ—wrote “False” in response to a post claiming that Binance was considering “delisting all U.S.-based cryptocurrencies.”

5.⚖️ Coinbase Says Client Assets Are ‘Segregated and Secure’ Following Proposed SEC Rule Change - Coinbase is confident that its Coinbase Custody Trust Co. (CCTC) will remain a qualified custodian even if new rules proposed by the SEC come into play, according the company's chief legal officer Paul Grewal.

💬 Tweet of the Week

Source: @_gabrielShapir0

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Nearly 22% of ETH Stakers Are Profitable in USD Since They Began Staking

Source: @pengcapital

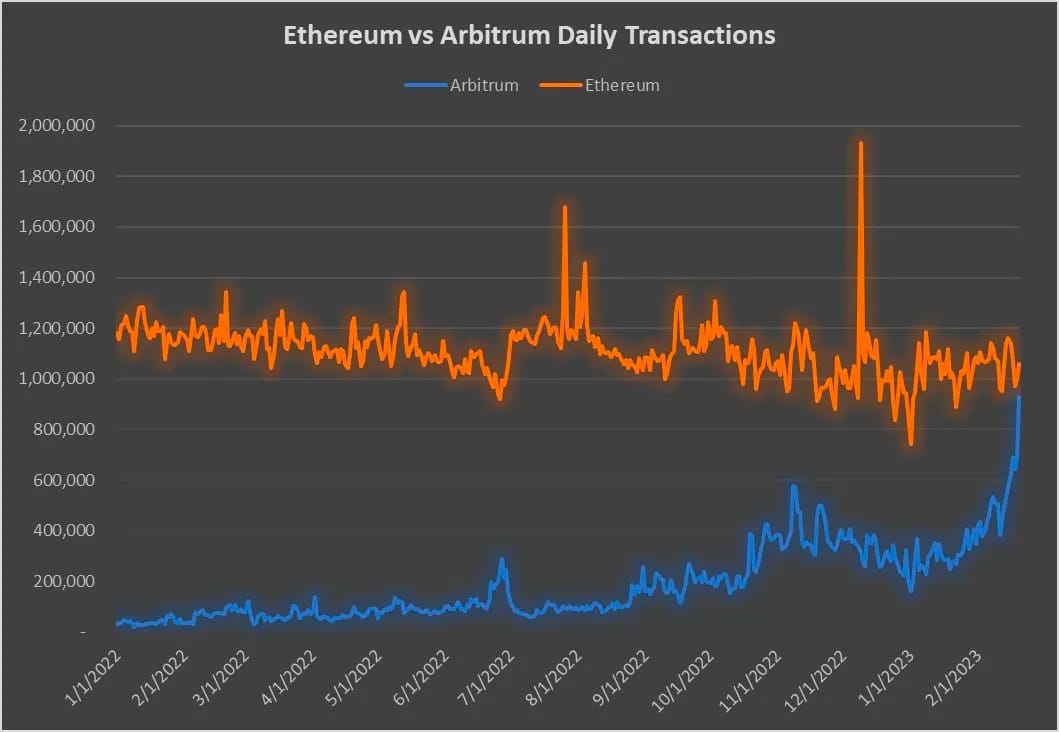

2. The Incoming Flippening. Ethereum Main Net vs Arbitrum Daily Transactions. Yesterday, Arbitrum Processed 930K Transactions, Compared to 1.059M on Ethereum.

Source: @Dynamo_Patrick

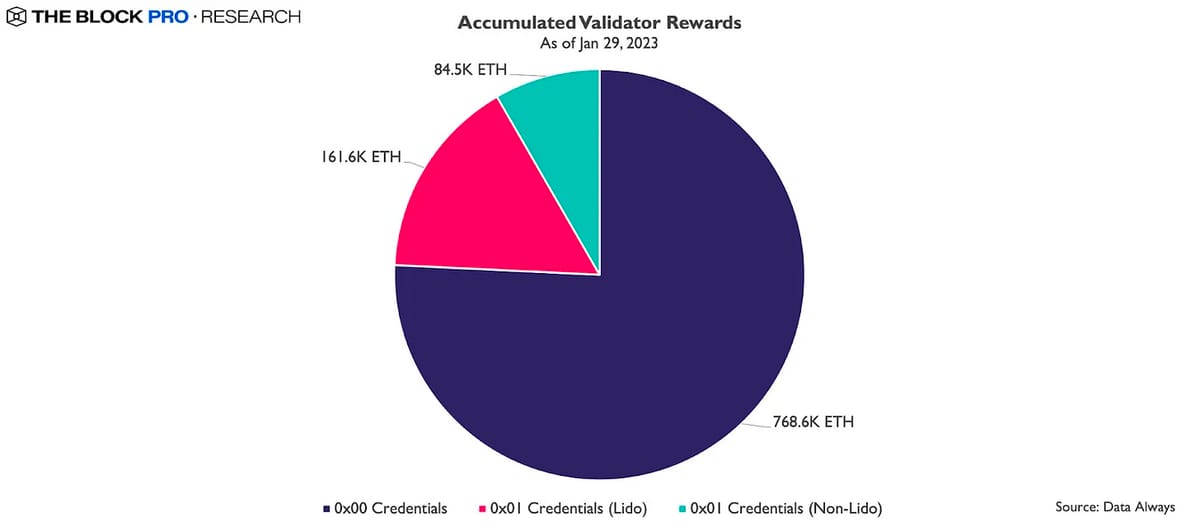

3. Contrary to Common Belief, Not All Locked ETH Will Be Automatically Eligible for Immediate Withdrawal. At the End of January, Over 75% of ETH Rewards Had Yet to Be Configured With 0x01 Credentials Required for Partial Withdrawals.

Source: @pengcapital

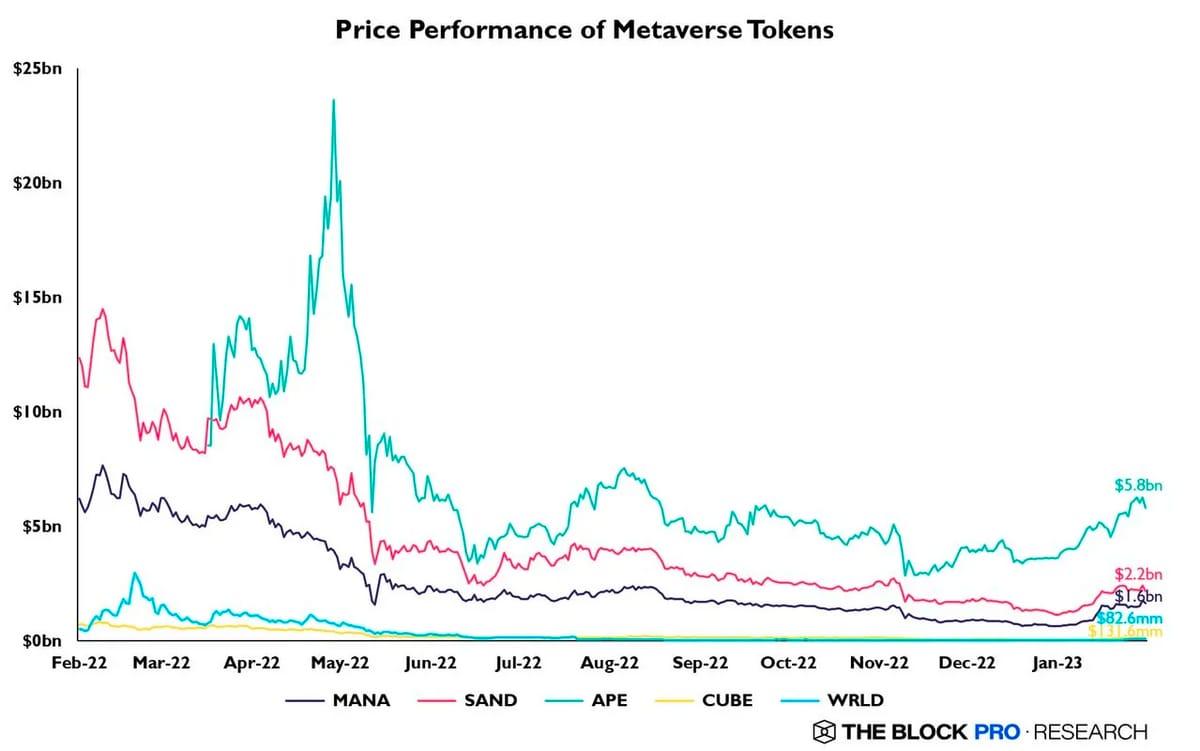

4. The Fully Diluted Valuations (FDVs) for Metaverse Tokens Experienced a Sharp Increase in January. In Particular, APE Broke Its Multi-Month Downward Trend, Climbing to a $5.8Bn FDV.

Source: @TheBlockPro__

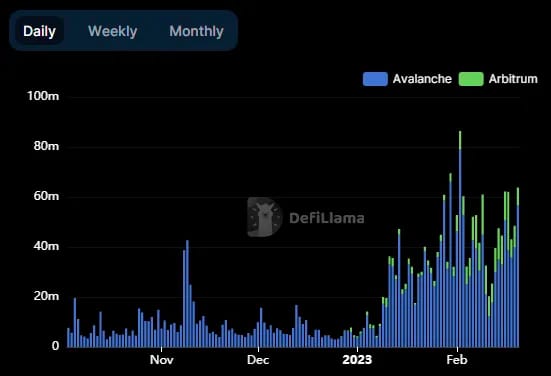

5. TraderJoe Volume Increasing Heavily on Arbitrum

Source: @Dynamo_Patrick

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Intro

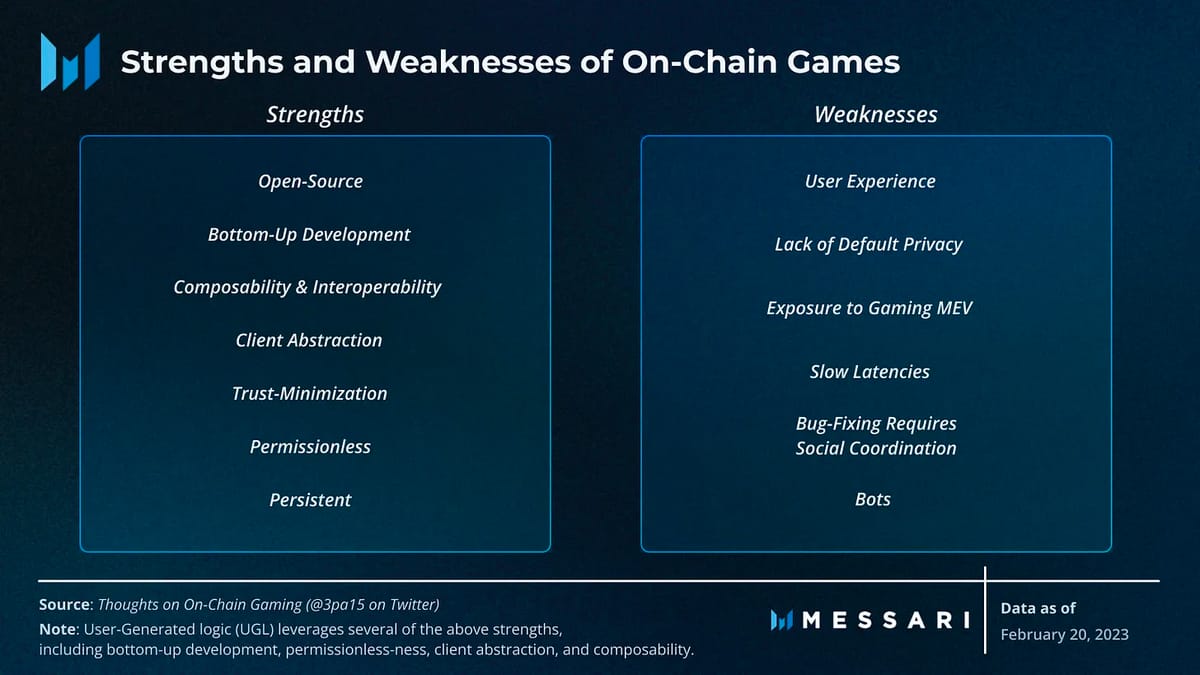

On-chain Games.

There are varying degrees to which blockchain-based games actually use on-chain features. At one end of the spectrum, only nominal game assets are stored on-chain while gameplay is entirely off-chain so that traditional, feature-rich game engines such as Unreal and Unity can be utilized. At the other end of the spectrum, the entirety of game assets and game state are stored on-chain. These games are deemed Fully On-Chain (FOC) games and are defined by the following properties:

On-Chain Game Logic – FOC games represent all game logic as smart-contracts on-chain. If users are playing an FOC rock paper scissors, the idea that “rock beats scissors” must be reflected in on-chain code. As the games get more complex, the code reflecting the game logic increases in complexity, too — all while staying on-chain.

Fully Shared State – Traditionally, a game developer would maintain the state of affairs within a game. For example, EA Sports maintains the score of my FIFA game, the positions of all the players, their stamina, etc. all on their own servers. In an FOC game, all of that data is posted on-chain and indexed by all players.

UGL enables technically capable users to encode new rules, assets, interactions, etc. into smart contracts used within the game framework. This allows players to not just imagine what new worlds look like (UGC) but also to define how the new worlds come alive and are used (UGL). Additionally, customizations are composable where one player’s extensions can be further used by another player. This is a powerful next step in game design akin to how the App Store provided a framework for developers to define a mobile computer experience.

However, while FOC games open up a new game design dimension, there are some significant trade-offs that limit the game types and features.

The most significant limitation of FOC games is the degraded user experience caused by slow latencies of syncing with the chain. Because game state is stored on-chain, when one player makes a move that updates the state, the other player must wait on the chain to confirm the change and for the game to index and show the updates. This significantly limits the style of games to turn-based games or asynchronous world-building games such as Minecraft. Massive multiplayer online (MMO) games like Fortnite are comparatively difficult to create.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

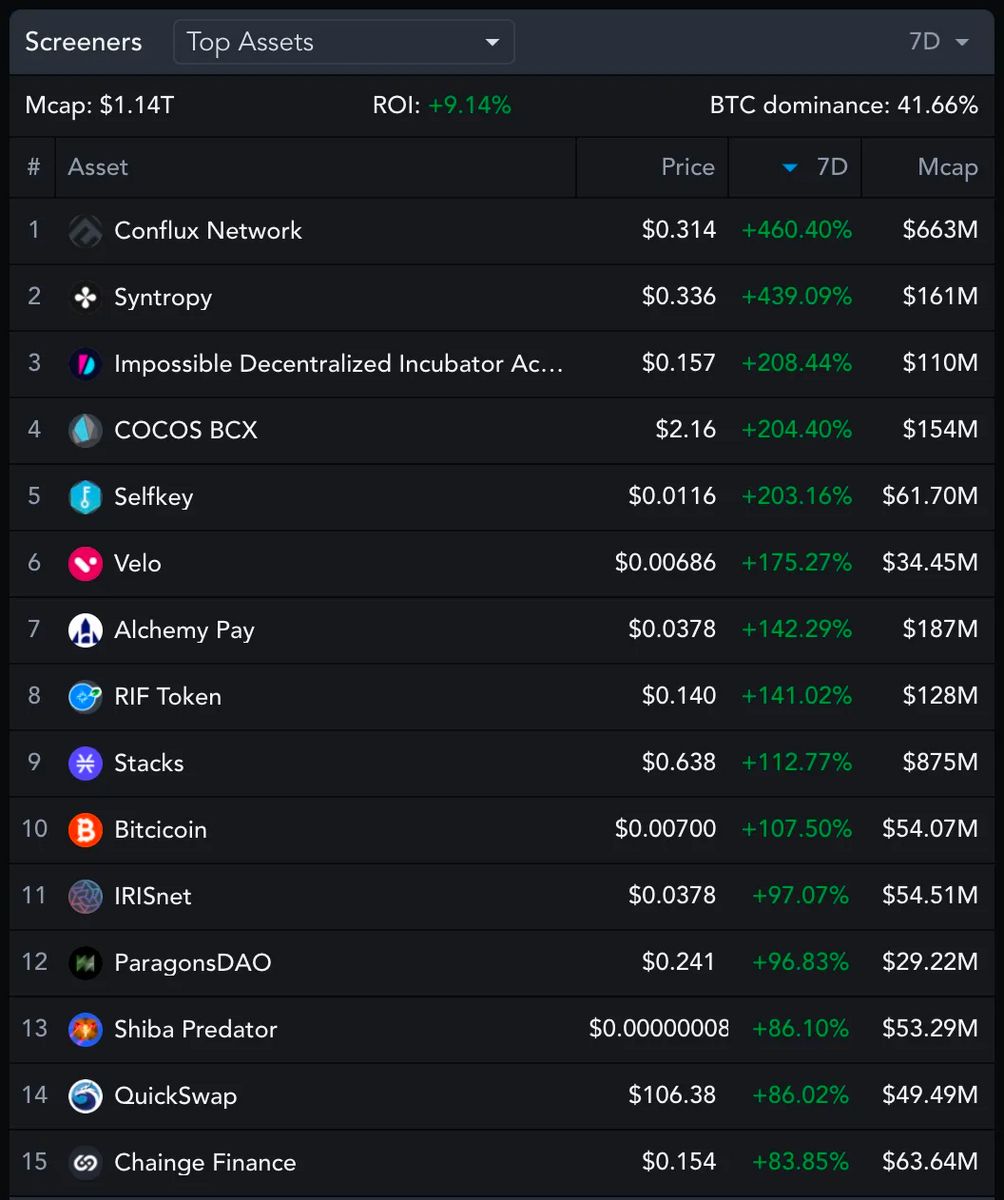

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 35,595 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.connect.financial, www.revix.com. and www.block.aero