Social Links: Twitter | Telegram | Podcast | Newsletter | Fund

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we cover the top news, stats, and reports in the digital asset ecosystem.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Uniswap Eyes $100M New Funding, Mashinsky Withdrew $10M Before Freezing Assets, Solana Restored After 13th Outage of Year

💵 Weekly Fundraises - Strike ($80M), Space and Time ($20M), Immunefi ($20M)

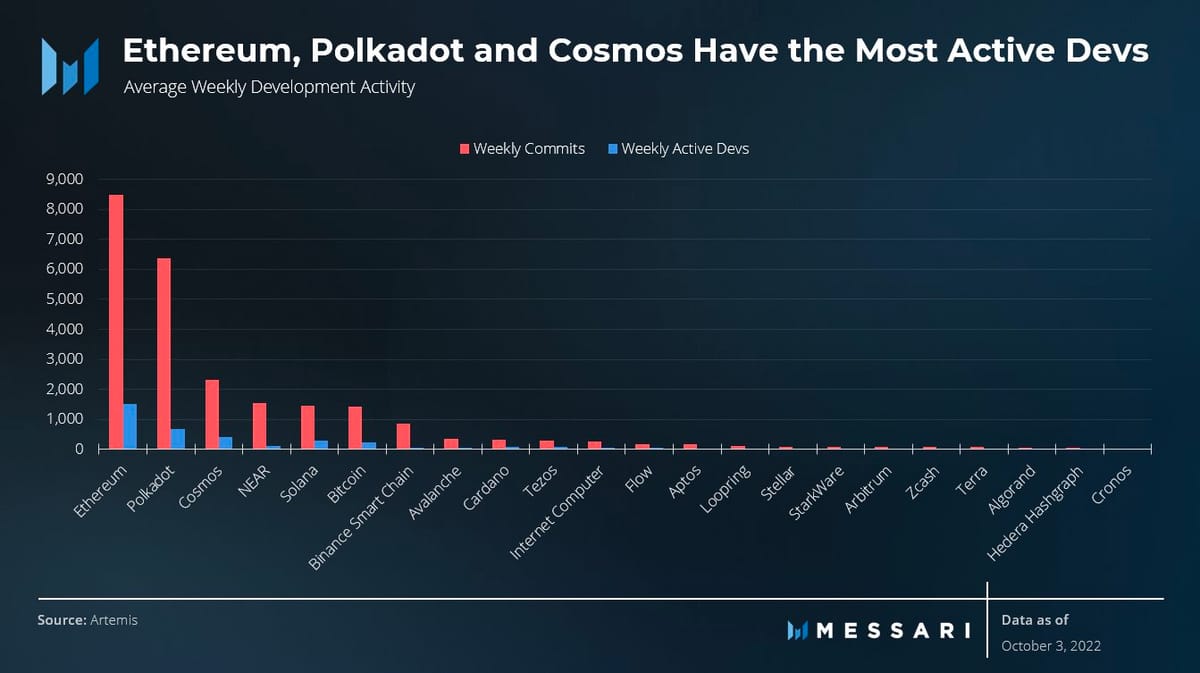

📊 Key Stats - ENS Sets New Record, Solana NFT Ecosystem Grows, ETH, DOT, ATOM Have The Most Active Development Activity

🧵 Thread of The Week - Cosmos’ Latest Whitepaper Deep Dive

📝 Report Highlights - Messari - Overlay: An Exchange for Unexplored Markets

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How To Get Started With Crypto Learning

Ethereum is leading the way in price performance among major L1s since the June 2022 market bottom

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto quant fund of funds. They have researched 250+ crypto funds, vetted 50+, and selected the 18 best based on a proprietary scoring system, providing accredited investors and institutional allocators with the ability to gain diversified crypto quant fund exposure with one investment. Amphibian Capital offers a USD-denominated fund and an ETH-denominated fund. Learn more at www.amphibiancapital.com

We have one remaining newsletter sponsorship spot available. See our sponsor deck here.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) 💰 Uniswap Labs Eyes Over $100 Million in New Funding- Uniswap Labs is in early stages of putting together a new round, according to four sources familiar with the matter, as the parent firm of the world’s largest decentralized exchange gears up to broaden its offerings. Uniswap already has A16Z and Paradigm as big backers. The Uniswap exchange currently generates over $1M in daily revenues.

Source: CryptoFees

2) 😮 Solana Suffers Another Major Outage - The Solana Outage appeared to be caused by a misconfigured node. This is the 13th outage for Solana Mainnet so far in 2022 according to their uptime tracker.

3) 🚩 Celsius Founder Took Out $10 Million Before Pausing Withdrawals and Filing for Bankruptcy- Celsius founder Alex Mashinsky withdrew $10 million from his crypto lending company just weeks before it froze withdrawals for its customers and filed for bankruptcy. Celsius co-founder and Chief Strategy Officer S. Daniel Leon resigned this week, following Mashinsky’s resignation as CEO last week.

4) 🚨 SEC Settles With Kim Kardashian for $1.26M For Touting Crypto Project EthereumMax - SEC Chair Gensler published a video warning investors not to make investment decisions based solely on the recommendations of a celebrity.

5) ⚖️ SEC Charges Hydrogen for Profiting Over $2M From Market Manipulation- The Securities and Exchange Commission (SEC) has pressed charges against market making firm Hydrogen for manipulating trading volume of its Hydro token.

6) 🏦 Crypto Loans Boom in Latin America Amid Runaway Inflation – The traditional banking system and economic instability are making it difficult for Latin Americans to get credit, but crypto lending is thriving across the region with Ledn and Buenbit offering credit.

7) 🖼️ US Facebook and Instagram Users Can Now Share NFTs - Meta announced today that all Facebook and Instagram users in the U.S. can connect their wallets and share their NFTs.

8) 🇪🇺 Europe Finalizes Crypto Rules - After 2 Years of Debate, Europe finalizes landmark crypto rules. Requires whitepaper for all projects and requires capital reserves for stablecoin issuers equal to the amount issued. Read the full proposal.

9) 😐 Coinbase Supportive of Giving CFTC Exclusive Jurisdiction Over Bitcoin, Ethereum - Coinbase Head of U.S. Policy Kara Calvert says the exchange is supportive of two bills in the U.S. Congress that would allow the CFTC to take the reins on crypto regulation.

10) 💸 Jack Dorsey Teams Up With Circle to Bring USD Stablecoin Savings and Remittances Global - TBD, the bitcoin-focused subsidiary of Jack Dorsey’s Block (SQ), is teaming up with Circle, issuer of the USDC stablecoin, to make cross-border dollar-linked stablecoin transfers more easily accessible.

💬 Tweet of the Week

Source: @brian_armstrong

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. September Was a Record-Breaking Month for ENS With Most Registrations and Renewals

Source: @Blockworks_

2. Q3 Venture Funding in Dollar Terms Down 35% from Q2 ‘22, Up 8x from Two Years Ago

Source: @dantwany

3. The Solana NFT Ecosystem Has Grown Rapidly, Peaking at 43.5% of Trading Volume

Source: @TheBlockRes

4. Ethereum, Polkadot and Cosmos Have the Most Active Devs Based on Average Weekly Development Activity

Source: @dunleavy89

5. Web3 Infrastructure Sector Revenue Down 67% QoQ

Source: @MessariCrypto

6. Number of ETH Addresses Sending to Exchanges to Sell Hits 1 Month Low, Indicating a Bullish Trend

Source: @CryptoGucci

7. Ethereum and its L2 ecosystem have a combined share of 62% of total crypto smart contract TVL

Source: @MessariCrypto

8. Top 10 Launchpads Ranked by Current ROI in Q3 2022

Source: @CryptoRank_io as of October 4, 2022

9. GBTC Discount Reaches Highest Mark Ever as Grayscale Continues Campaign to Be Allowed to Convert to ETF

Source: @CryptoRank_io

10. OpenSea Launched Optimism Support This Week - 400 Wallets Have Traded on New Marketplace

Source: @CryptoRank_io

🧵 Thread of the Week - Cosmos’ Latest Whitepaper

By: @Route2FI

1) The Cosmos Hub has successfully initiated the Internet of Blockchains, achieving its early goals by implementing the software stack used to build and connect app chains, meaning:

Cosmos SDK + IBC + Tendermint.

2) What is Cosmos?

Cosmos is a decentralized network of independent yet interoperable blockchains that are able to exchange information and tokens between each other permissionless.

The first blockchain on the Cosmos network is the Cosmos Hub and $ATOM is the native token.

3) built on the blockchain such as Uniswap and Aave being built on top of Ethereum, Layer 0 projects allow for entire blockchains to be built on top of them.

One way to think about it is that $ATOM is the main hub and then there are a lot of blockchains connected...

4) to the hub called zones.

Zones are regular blockchains while Hubs are blockchains specifically designed to connect Zones together.

Once a Zone creates an IBC connection with a Hub, it automatically has access to every other Zone that is connected to it.

5) In other words, Cosmos is a decentralized ecosystem comprising many independent blockchains.

The original Cosmos vision has now been realized which was to create a secure software stack for building and connecting application-specific blockchains.

6) This was achieved through Tendermint + IBC + Cosmos SDK.

I won’t go through the details of the Cosmos stack here, but if you want to learn more about it, check out this great thread by

7) The new whitepaper has the goal of making $ATOM the most desirable, widely deployed reserve asset in the interchain of Cosmos.

However, there was one problem with $ATOM.

Because, why would you own the token in the first place?

The inflation in the token...

8) is very high, and not something you wanted to hold long-term.

As you can see in the figure below the old model operated with a constant inflation pressure, while the new one will reduce inflation over time.

The subsidy will decrease by 10% every month for 36 months.

9) After this, inflation should be somewhere around 1% per year.

This is in stark contrast to today’s inflation in the $ATOM token of up to 20% per year.

10) Okay, so what’s new in Cosmos 2.0 and how can they achieve making it the preferred asset of Cosmos?

Let's go through the new model with these 4 parts:

-Liquid Staking

-Interchain Security

-Interchain Scheduler

-Interchain Allocator

11) 1/ Liquid staking: For those of you who used the Terra ecosystem, you may remember Stader Labs?

When you stake normally, your assets get locked up so you can't use them for anything else.

With liquid staking, on the other hand, you get a representative asset that you...

12) can use for eg. going into a yield farm.

During DeFi autumn 21’ this was a concept I was a huge fan of.

Liquid staking is important because it solves the dilemma of staking vs liquidity by allowing stakers to remain liquid while securing the network.

Also, a higher staking ratio means lower $ATOM inflation.

2/ Interchain security:

Cosmos is proof-of-stake. To secure the blockchain you need validators.

However, validators are not easy to get, so instead, one of the changes in the whitepaper is that...

13) new Cosmos projects can rent security from the Cosmos Hub validators. To pay for the rent, the projects pay with token inflation and fees.

This results in security for the new project + extra coins from new Cosmos ecosystems that are launching to stakers of $ATOM.

14) As an extra benefit, this should boost the token price of $ATOM long-term.

Interchain security will launch January 2023.

15) 3 & 4/ Interchain Scheduler & Interchain Allocator:

The Scheduler generates revenue by charging a matching fee for its secure, on-chain blockspace market ($ATOM = settlement asset)

The revenue earned from the Scheduler is used by the Allocator to add new projects…

16) which expands the Scheduler's addressable market ( $ATOM = reserve asset).

With these primitives, the Cosmos Hub will become an economic engine that drives the expansion and integration of the Cosmos Network.

17) This new monetary policy for $ATOM has two phases: transition and steady state.

The transition phase starts the moment that Cosmos shifts to the new monetary policy and ends 36 months later, at which point the steady state phase begins and lasts indefinitely.

18) At the beginning of the transition phase, 10,000,000 ATOM are issued per month.

This issuance decreases at a declining rate until it reaches steady state issuance 36 months later.

Steady-state issuance will be 300,000 ATOM per month.

19) Treasury: Another important feature is the treasury

⅔ of the issuance is directed to the new Cosmos Treasury and will be used to support initiatives that increase adoption, growth and capitalization of the interchain, including public works and opportunities for expansion

20) Combined all these new implementations for the Cosmos ecosystem will lead to growth for $ATOM.

And if $ATOM grows, the treasury will grow.

And if the treasury grows the value of the ecosystem will grow.

In other words, a positive fly-wheel.

21) If you want to stay up-to-date on Cosmos, follow:

@zmanian@buchmanster@JTremback@jackzampolin@youssef_amrani@cryptocito@cryptolikemo@cosmos@johnniecosmos

22) That was it!

I also have a free newsletter where I break down DeFi protocols & crypto concepts once per week: https://www.getrevue.co/profile/route2fi

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Conventional exchanges match one trader with another trader to form a multi-sided market. When a party goes long an asset, another counterparty somewhere is willing to take the opposite view. This is a classic model where the exchange performs order matchmaking services to earn trading fees.

Though this is a classic model, it comes with limitations. Such a system requires at least two participants. Traders are hence limited to markets where counterparties exist. Otherwise, the lack of a counterparty renders the market illiquid and creates the illiquidity problem.

Twenty-first century technologies like DeFi allow builders to explore innovative ways of tackling this challenge. Overlay is one such experimental financial primitive launching in the next few weeks. By utilizing secure data streams and dynamic token mint/burn functionalities, the protocol can create a model where traders trade against the protocol itself. The end result eliminates the need to trade against a direct counterparty, vastly opening the door to unexplored trading markets.

Market Functionality

Overlay’s product offering plays off a variation of the perpetual contract (perps), just without a traditional buyer and seller. Instead, traders deposit the protocol’s native token, OVL, into a market as a long or short position. A small fraction of the notional value is recorded as protocol revenue. If the trader’s directional position is correct, the protocol will mint new OVL tokens to pay out the trader’s profits. The opposite, burning deposited OVL tokens, holds true when the trader is wrong and takes a loss. Both mint and burn functionalities affect the number of circulating OVL tokens, leaving a variable token supply that ebbs and flows with trading activity.

A hypothetical example might involve someone choosing to long ETH. 100 OVL tokens are deposited. If ETH doubles in price, then Overlay will mint 100 new OVL tokens for the trader, who exits with 200 OVL. Conversely, should ETH price drop in half, the trader exits the position with 50 OVL and the other 50 OVL deposited with the protocol is burned.

Note this type of contract doesn’t pit a trader against an active counterparty who is taking an opposing view. Instead, one can think of the other side of the trade as all OVL tokenholders. Simply put: OVL dilution occurs when the protocol mints new tokens to pay out the trader’s profit. Assuming the market cap is unchanged, each new OVL token minted ever so slightly lowers the price of all other OVL tokens in the long run. While Overlay removes the active counterparty, it indirectly pairs the trader against the protocol itself.

Despite potential tradeoffs to this design, this mechanism enables the creation of a new category of tradable markets closer in offering to today’s prediction markets. Any untamperable, event-driven data source can be fed into the exchange for traders to wager on. Markets without significant two-sided liquidity become compatible. The hope is to one day include markets for weather patterns in New Zealand, the stats of bottom quartile quarter backs in the National Football league, and everything in between. Ultimately, it leads to Overlay’s mission statement: to become the liquidity layer for illiquid assets.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top performers in the last week from all tokens with a market cap of $20M+.

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 31,590 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com