Learn more at www.ftx.us and www.wemeta.world, and www.amphibiancapital.com

About Coinstack: Welcome back to Coinstack, your favorite weekly newsletter for the institutional crypto market, covering the rise of programmable money, smart contracts, web3, and the creation of an open, efficient, and transparent global financial system as all financial assets become tokenized and begin trading on 24/7 markets during this decade.

In This Week’s Issue:

🗞️ This Week in Crypto - Binance Invests $500M in Musk's Twitter Takeover, Deribit Loses $28M in Hack, Do Kwon Faces $57M Class-Action Suit, FTX Launching Stablecoin, Visa Launching Crypto Wallet

💵 Weekly Fundraises - Zoop ($15M), Braavos ($10M), DEC ($9M)

📊 Key Stats - Only 2196 ETH Issued Since Merge, Solana Hackathons Show Consistent Growth, Solidity Highest Paid Programming Language

🧵 Thread of The Week - Vitalik Weighs in on Crypto Regulation

📝 Report Highlights - Messari - Covalent: A Unified API for Retrieving Blockchain Data

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week - DG, DOGE, FEG

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How to Get Started in Crypto Learning

ETH Is leading the way in the price performance since the June 2022 bottom

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

WeMeta is the Zillow for Metaverse; their robust data insights and accessible UI makes it easier than ever for brands and metaverse land investors to have the right analytics and insights into their digital property. Learn more at www.wemeta.world.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 100 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Sponsor Coinstack in 2023: We have one open remaining sponsorship spot available for 2023 - please see our sponsor deck and schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) 🚩 Binance Invests $500 Million in Musk’s Twitter Takeover - Binance, the world's largest cryptocurrency exchange by trading volume, has invested $500 million in Elon Musk's $44 billion deal to buy Twitter, a small but significant move that fueled speculation Twitter could eventually be powered by blockchain technology.

2) 😔 Terra Co-founder Do Kwon Faces $57M Class-Action Lawsuit in Singapore - Terraform Labs CEO and co-founder Do Kwon faces yet another legal battle—this time in a Singapore court, which is set to hear a class-action lawsuit filed on behalf of more than 350 international investors.

3) 🔥 Crypto Exchange Deribit Loses $28M in Hot Wallet Hack, Pauses Withdrawals - Cryptocurrency options and futures exchange Deribit has been hacked, with $28 million being drained from its hot wallet. The company tweeted that client assets have not been affected, but withdrawals have been temporarily halted as the exchange makes security checks

4) 🔭 FTX May Launch Own Stablecoin ‘In the Not-Too-Distant Future,’ CEO Says - FTX CEO Sam Bankman-Fried revealed that the crypto exchange is considering developing its own stablecoin. Most major exchanges already have an asset-backed stablecoin. Binance, for instance, has Binance USD (BUSD) — issued by Paxos — and Coinbase, in collaboration with Circle, launched the USD Coin (USDC) stablecoin.

5) 🇺🇸 US Trustee Opposes Celsius’ $2.9M Employee Bonus Plan - The United States Trustee has opposed Celsius’s request to pay up to $2.9 million as retention bonuses to employees involved in the bankruptcy process. The judge in the case

6) 🔪 Digital Currency Group Promotes Mark Murphy to President & Cuts Nearly 13% Staff - Crypto venture capital and holding firm Digital Currency Group (DCG) has promoted chief operating officer (COO) Mark Murphy to president, amid a restructure which also saw the departure of some 13% of its staff.

7) 💳 Visa Planning to Launch Its Own Cryptocurrency Wallet - Additionally, the filings also implied that the credit card corporation may be considering a foray into the metaverse, where its name would be used in “virtual spaces in which users can interact for recreational, leisure, or entertainment purposes.”

8) 🟩 Solana DeFi Projects Reopen Following $114M Mango Markets Hack - Two Solana-based DeFi protocols have reopened following the $114 million hack of lending protocol Mango Markets.

9) 🤒 Meta’s Metaverse Division Reports $3.67 Billion Quarterly Loss - Meta revealed that its Reality Labs metaverse division lost over $3.6 billion in the third quarter of 2022, compared to $2.63 billion at the same time last year.

10) 🕊️ Twitter Will Allow Users to Buy and Sell NFTs Through Tweets - Social media platform Twitter today announced that it will let users buy, sell, and display NFTs directly through tweets in partnership with four marketplaces.

11) 🎮 GameStop Officially Launches NFT Marketplace - GameStop's NFT marketplace is live on Immutable X, a Layer 2 Ethereum scaling protocol. The video game stores’s business is in decline but it now stands to be a major player in the NFT gaming industry, rivaling crypto-native gaming NFT platforms like Fractal, founded by Twitch’s Justin Kan.

💬 Tweet of the Week

Source: @DrNickA

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. There has only been 2196 ETH ($3.4 million) issued since merge. Under POW, there would have been 553,312 ETH ($869 million) issued. That’s a 99.6% reduction in $ETH issuance in only 6 weeks.

Source: @CryptoGucci

2. Solana Hackathons Show Consistent Growth Despite the Bear Market

Source: @MessariCrypto

3. Solidity Is the Highest Paid Programming Language in 2022, With an Average Salary of ~$151k per Year

Source: @logan__dev

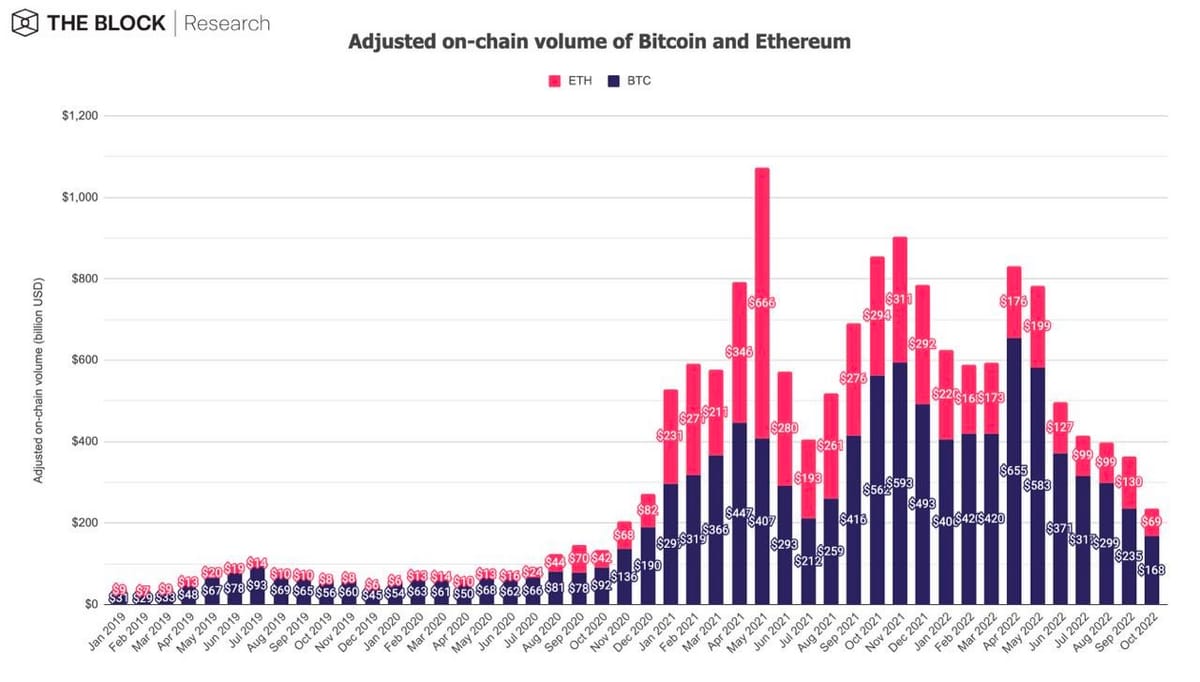

4. Total Adjusted On-Chain Volume of BTC and ETH Decreased by 35.1% in October to $237B

Source: @lars0x

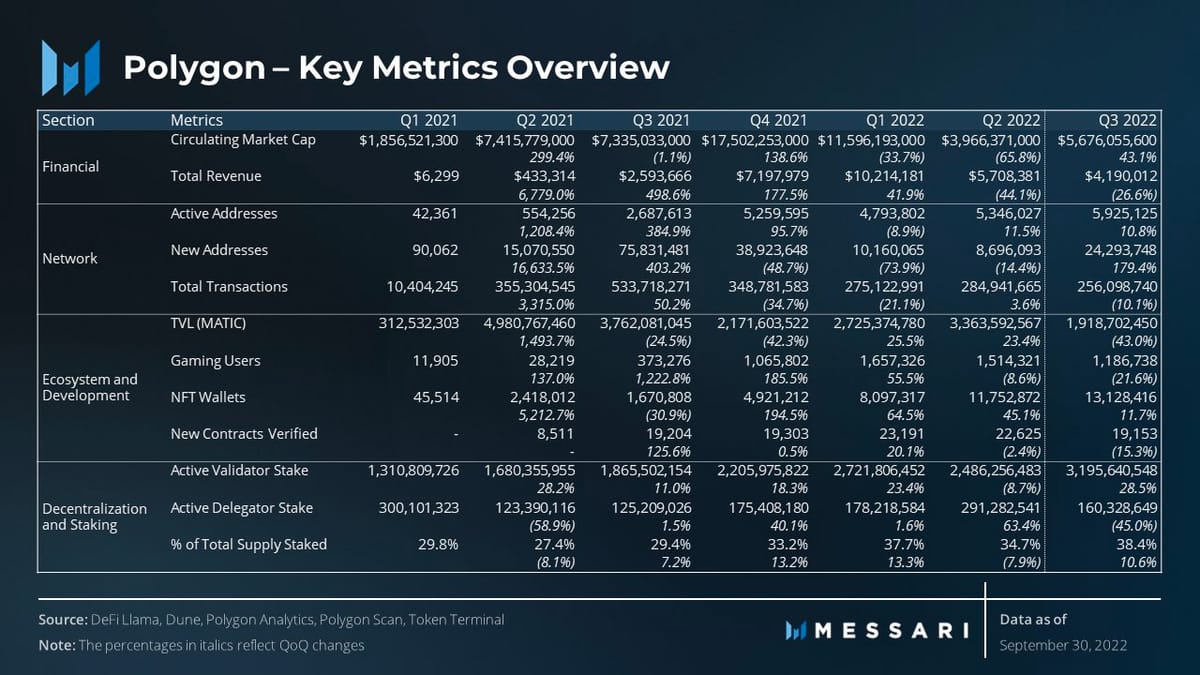

5. During Q3 Polygon’s Active Addresses Set an ATH of 6M & New Addresses Spiked 180% QoQ to 24M Due to a String of New Partnerships That Were Announced

Source: @NickDGarcia

6. A Total of 58,115 ETH, Equivalent to $78.7M, Was Burned in September

Source: @lars0x

7. Monthly NFT Marketplace Volume on Ethereum Further Decreased, by 25.1%, to $377.5M

Source: @lars0x

8. Coinbase Ventures Reaches 400+ Investments Made Globally

Source: @cbventures

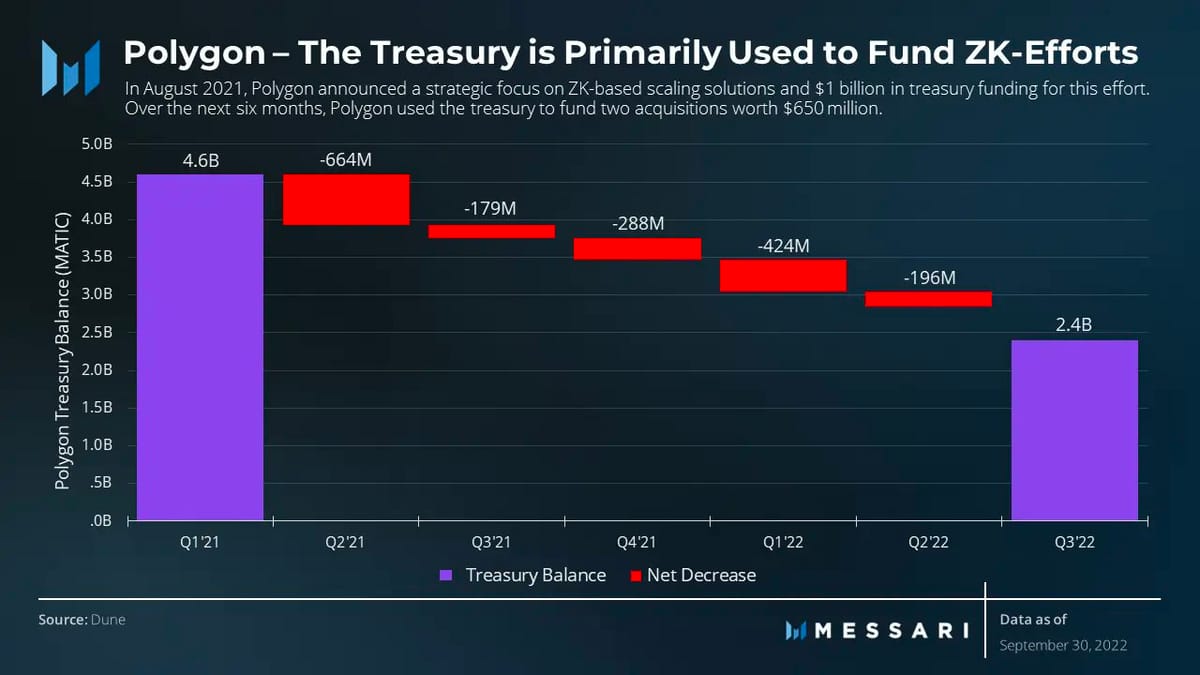

9. Polygon’s Treasury Was Down 48% in Q3 As It Focused Strategic Funds on Acquiring ZK-Tech

Source: @MessariCrypto

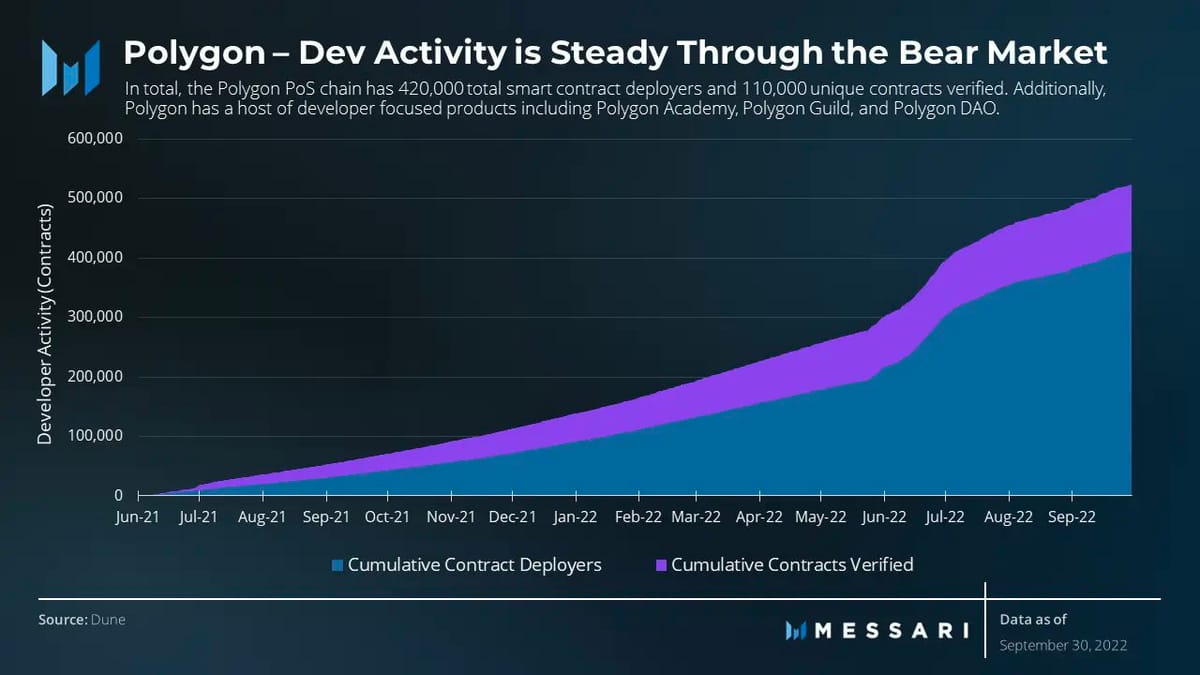

10. Polygon Now Has 420,000 Total Smart Contract Deployers and 110,000 Unique Contracts Verified

Source: @MessariCrypto

🧵 Thread of the Week - Vitalik Weighs In on Crypto Regulation

By: @VitalikButerin

Well actually here's my moderate take on mixers and privacy that I already gave in the @coinbase podcast two months ago:

Another maybe-controversial take of mine is that I don't think we should be enthusiastically pursuing large institutional capital at full speed. I'm actually kinda happy a lot of the ETFs are getting delayed. The ecosystem needs time to mature before we get even more attention.

Basically, especially at this time, regulation that leaves the crypto space free to act internally but makes it harder for crypto projects to reach the mainstream is much less bad than regulation that intrudes on how crypto works internally.

The "KYC on defi frontends" idea does not seem very pointful to me: it would annoy users but do nothing against hackers. Hackers write custom code to interact with contracts already. Exchanges are clearly a much more sensible place to do the KYC, and that's happening already.

Basically, there's two main classes of regulatory policy goals: (i) consumer protection, (ii) making it harder for baddies to move large amounts of money around. The issues around (ii) are concentrated not in defi, but in large-scale crypto payments in general.

Regs on defi frontends that *could* be more helpful may include:

(i) limits on leverage

(ii) requiring transparency about what audits, FV or other security checks were done on contract code

(iii) usage gated by knowledge-based tests instead of plutocratic net-worth minimum rules

Also, I would love to see rules written in such a way that requirements can be satisfied by zero knowledge proofs as much as possible. ZKPs offer lots of new opportunities to satisfy reg policy goals and preserve privacy at the same time, and we should take advantage of this!

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Though blockchain data is public and accessible, it’s often hard to get. It becomes even more complicated when applications like wallets and NFT marketplaces require data from multiple blockchains with varying output formats. Covalent built a protocol that standardizes data from over 25 blockchains; its Unified API allows builders to reuse queries across its supported networks.

APIs transfer data between two parties: a client and a server. Using APIs, servers maintain control over their systems and respond to client requests. Users, like application developers or analytics firms, pull data from APIs while the data providers maintain ownership. Though many companies have built server-side infrastructure to provide access to blockchain data, most have stopped at the RPC layer. These conventional approaches tend to fetch only surface-level data formatted to the requested blockchain.

Covalent’s protocol goes deeper than conventional approaches: it extracts data from various blockchains, uploads that data to a storage instance, indexes and transforms the stored data object, and loads the data into local data warehouses queried by API users. Throughout the process, it sends proofs to the Moonbeam network to authenticate the work completed at each step. In short, Covalent cryptographically secures and standardizes all of the extracted blockchain data so developers can query from any chain in a unified way, hence, the Unified API.

Covalent’s Progressive Decentralization

Covalent began as a hackathon project in 2017. Since its inception, it has maintained its goal of building an indexing engine capable of serving deep metrics from blockchains. Examples of these deep metrics would include getting tokenholders as of any block height or getting log events emitted by a certain smart contract address.

In October 2020, Covalent only supported Ethereum. But as of October 2022, Covalent supports a growing list of over 25 blockchain mainnets that API users can query. Additionally, Covalent recently became the first blockchain data provider to index app chains. Co-Founder/CEO Ganesh Swami told Messari that Covalent will announce support for additional blockchains as early as Q1 2023.

Before embarking on a path of progressive decentralization, Covalent sought product-market fit for its indexing engine. In addition to the interested parties backing Covalent, the project earned revenue from clients in the crypto industry such as ConsenSys, CoinGecko, and 0x Labs. Covalent told Messari that its years of business activity serving enterprise clients confirmed market demand, laying the foundation for the type of data that can be queried from its Unified API.

Network Participants

Covalent’s decentralized protocol will have multiple network participants, called “operators.” Currently, only one of the network operator roles is live, that of the Block Specimen Producer (BSP). As of October 2022, Covalent has 12 BSPs; notable ones include Chorus One, Woodstock, StakeWithUs, and the University of Calgary. However, this role is still permissioned as Covalent continues to decentralize.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 32,412 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.wemeta.world and www.amphibiancapital.com