Learn more at www.ftx.us and www.wemeta.world and www.amphibiancapital.com

About Coinstack: Welcome back to Coinstack, your favorite weekly newsletter for the institutional crypto market, covering the rise of programmable money, smart contracts, web3, and the creation of an open, efficient, and transparent global financial system as all financial assets become tokenized and begin trading on 24/7 markets during this decade. This is our 100th weekly issue of Coinstack. 🎉

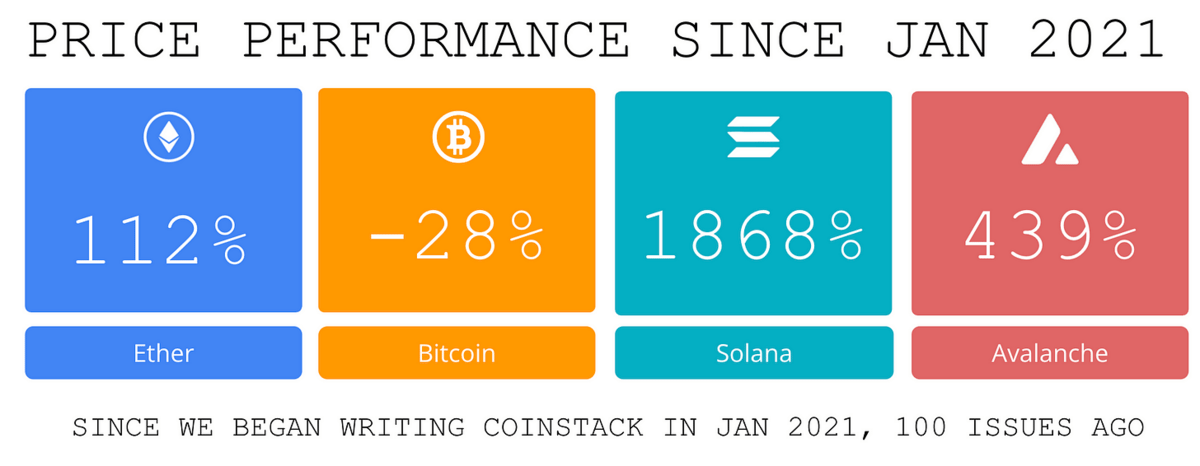

Since we began writing Coinstack, among major L1s ETH is up 112% while BTC is down -28%. It’s been a tale of the app platforms outperforming digital gold.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Price Surge Leads to Large Short Liquidations, New British PM Sunak is Pro-Crypto, CFTC Chair Says Ether is a Commodity, Polkadot Co-Founder Changes Roles

💵 Weekly Fundraises - Celestia ($55M), Manc ($50M), Lava Labs ($10M)

📊 Key Stats - 11.9% of ETH is Staked, Top 10 Projects by Earnings in the Past 7 Days, Maple Finance Dominating Institutional Lending

🧵 Thread of The Week - Apple’s New Rules for Crypto Apps

📝 Report Highlights - Messari - Web3 Social Usage and Engagement

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How to Get Started in Crypto Learning

Ethereum is up 67% from its June 2022 lows, highest among L1 blockchains

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

WeMeta is the Zillow for Metaverse; their robust data insights and accessible UI makes it easier than ever to interface with the digital worlds. What's more - WeMeta is just getting started. They are constantly releasing new features and tools to address the growing needs of their users amidst the booming Metaverse. Learn more at www.wemeta.world.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 100 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

We have one open sponsorship spot available - please see our sponsor deck and schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) 📈 Large Price Rally Leads to Most Short Liquidations in 15 Months; Ether Leads Token Surge - Crypto markets had over $700 million in short liquidations in the last day on short trades, or bets against price rises, reaching levels not seen since July 2021. Ether (ETH) jumped 14% to $1572 to lead the surge among major cryptocurrencies.

2) 🇬🇧 Incoming UK Prime Minister Is Pro-crypto - New British PM Rishi Sunak has spearheaded plans to make the UK a hub for cryptoasset technology and investments and advocated for the recognition of stablecoins as a form of payment. “It’s my ambition to make the UK a global hub for cryptoasset technology,” Sunak shared in an April 2022 statement.

3) 🛢️ CFTC Chair Says Ether Is a Commodity - The jostling between the CFTC and the SEC continued in New York on Monday, with CFTC Chair Rostin Behnam saying he sees Ether as a commodity — not a security. “Ether, I’ve suggested that it’s a commodity, ” Behnam said at the Regulating Financial Innovation event Monday morning.

4) 🚩 Polkadot Co-founder Wood Leaving Parity CEO Role - Polkadot co-founder Gavin Wood is relinquishing his chief executive role at Parity Technologies, an infrastructure provider that supports the crypto project. He will remain the company’s majority shareholder and chief architect. Bjorn Wagner will be the new CEO.

5) 😞 NEAR Protocol to Wind Down Its Terra-Like Stablecoin - NEAR Protocol’s stablecoin is being shut down after it began to exhibit risky characteristics similar to those observed with TerraUSD, a cryptocurrency that spectacularly failed this year and lost investors billions of dollars.

6) 🏆 Craig Wright Loses Lawsuit Against Hodlonaut in Norway Over Satoshi Nakamoto Claims - Magnus Granath, who goes by “Hodlonaut” on Twitter, has won a lawsuit in Norway against Craig Wright, court documents revealed Thursday. Wright has long claimed he is the pseudonymous Bitcoin creator Satoshi Nakamoto—but Hodlonaut and many others have publicly challenged Wright’s claims.

7) ⚖️ Reddit NFTs Surge As Polygon-Based Avatars Reach Millions of New Users - Online message board community Reddit has proven to be a significant force for NFT adoption, as an executive revealed last week that users created over 3 million Polygon wallets for them—with nearly three million of the NFT avatars in circulation.

8) 🤒 Terra Witness Skips Official Inquiry, Cites ‘Extreme Stress’ and ‘Panic Disorder’ - Kim Seo-joon, CEO of venture capital firm Hashed and an early investor in Terra, failed to turn up as a witness before a hearing of the Korean National Assembly’s Political Affairs Committee.

9) 💳 FTX Will Compensate Phishing Victims Up to $6 Million, Says Sam Bankman-Fried- FTX users affected by the recent 3Commas-related phishing attack will be compensated up to $6 million, Sam Bankman-Fried said. The exchange's CEO said on Twitter that this was a "one-time thing" and would not become a precedent.

10) 🇨🇳 Chinese Intelligence Attempts to Bribe U.S. Official With Bitcoin - The U.S. Department of Justice has accused two Chinese intelligence officers of obstruction of justice for attempting to bribe a U.S. government employee with $61,000 in Bitcoin to steal documents related to an investigation into Chinese tech giant Huawei.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

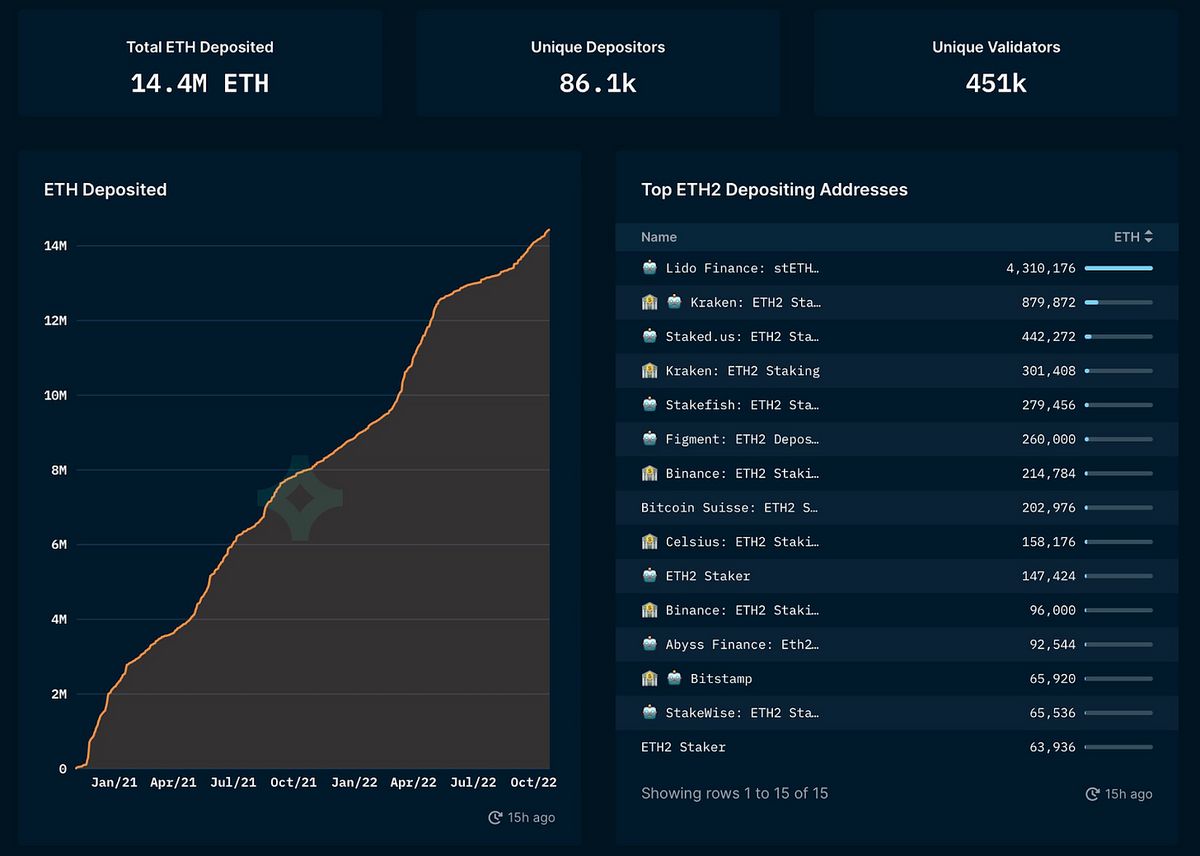

1. Over 14.4 Million ETH Are Now Being Staked, 11.9% of All Circulating ETH

Source: @CryptoGucci

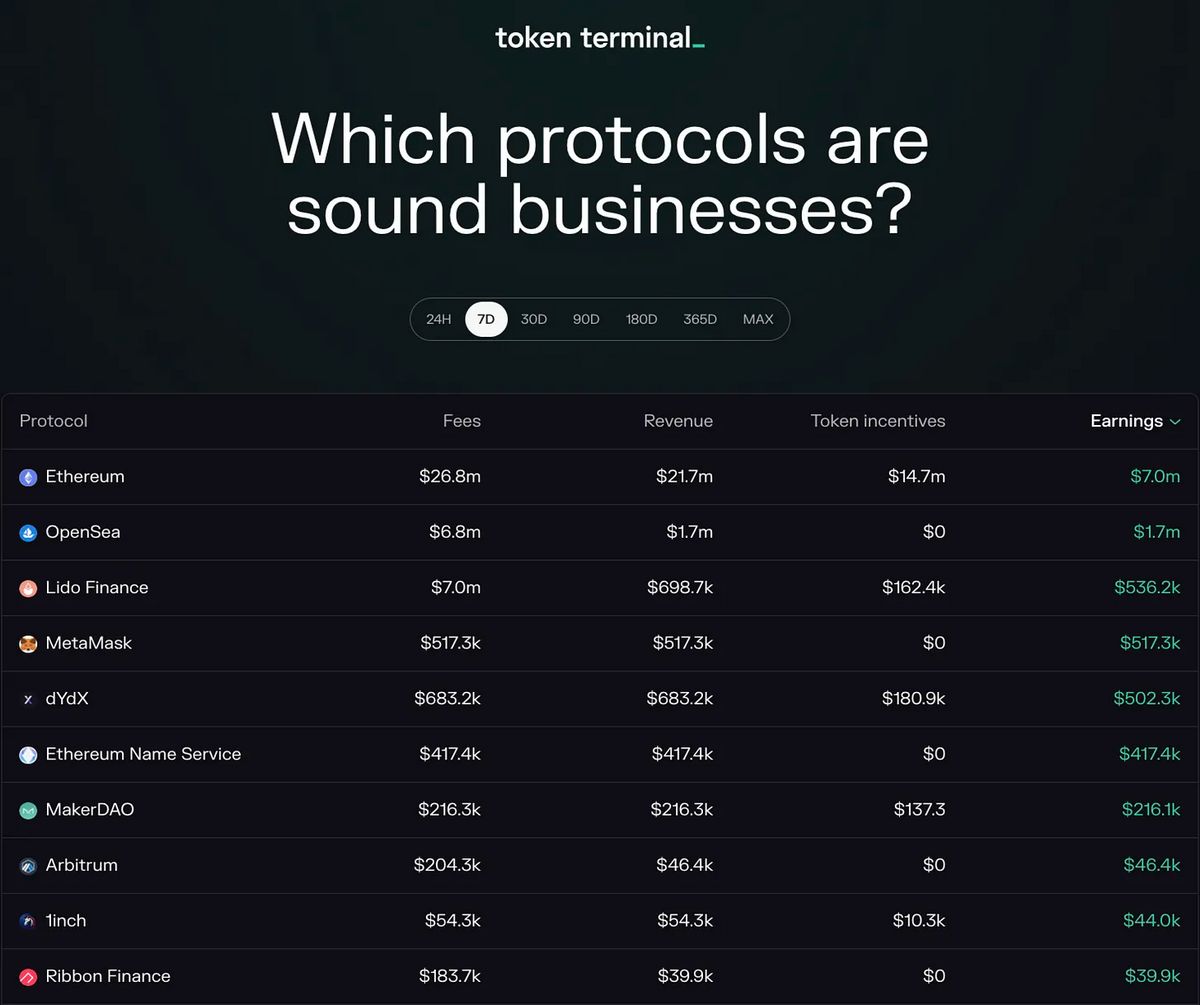

2. Top 10 Projects by Earnings in the Past 7 Days

Source: @tokenterminal

3. Developer Activity Is a Leading Indicator of Which Application Sectors and Ecosystems Are Likely to Receive Future Market Attention

Source: @MessariCrypto

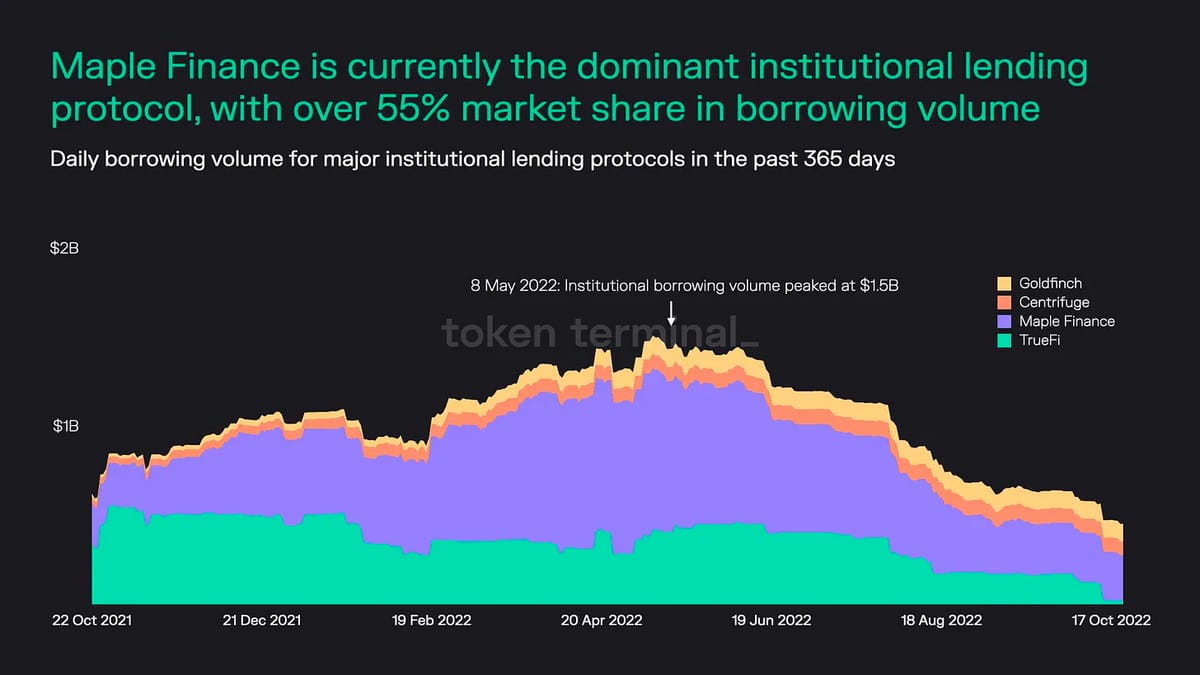

4. Maple Finance Is Dominating the Institutional Lending Market

Source: @tokenterminal

5. Revenues Are Declining Faster Than Market Caps on Non-Ethereum Based DEXs, Causing P/S Ratios to increase since August

Source: @tokenterminal

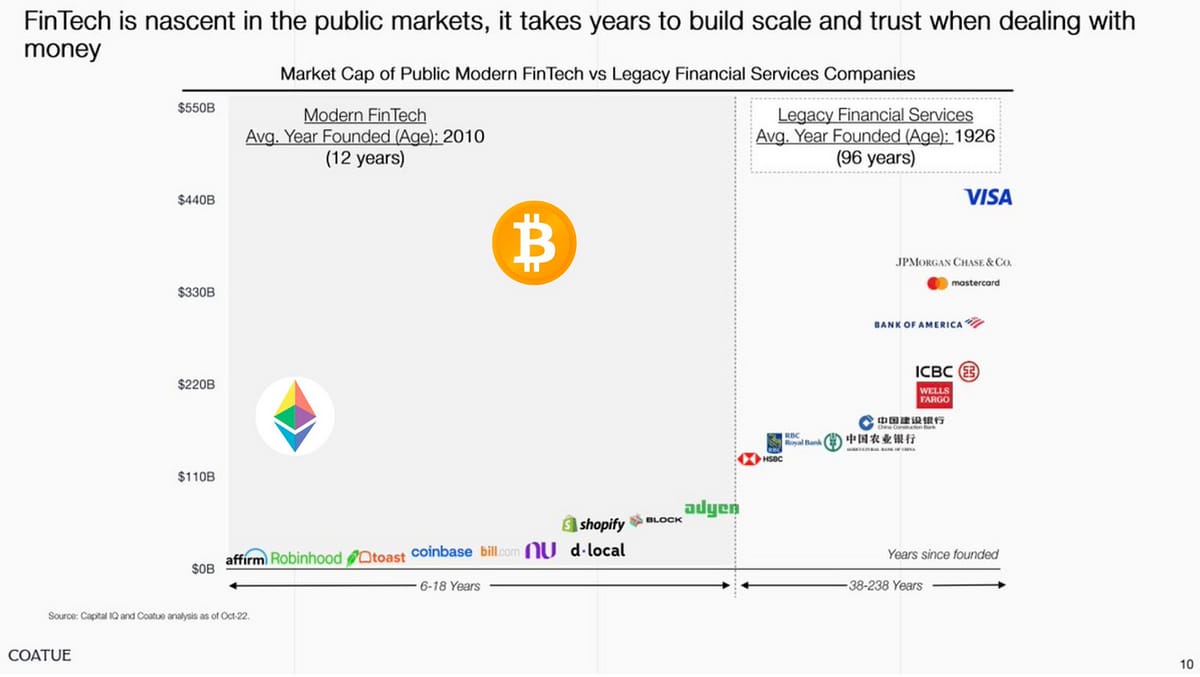

6. Market Cap of Public Modern FinTech vs Legacy Financial Services Companies

Source: @tokenterminal

7. The FIFA World Cup 2022, Is Set to Begin on Nov. 20, 2022 Bringing Renewed Interest and Attention to Fan Tokens Issued by Football Clubs

Source: @DelphiDigital

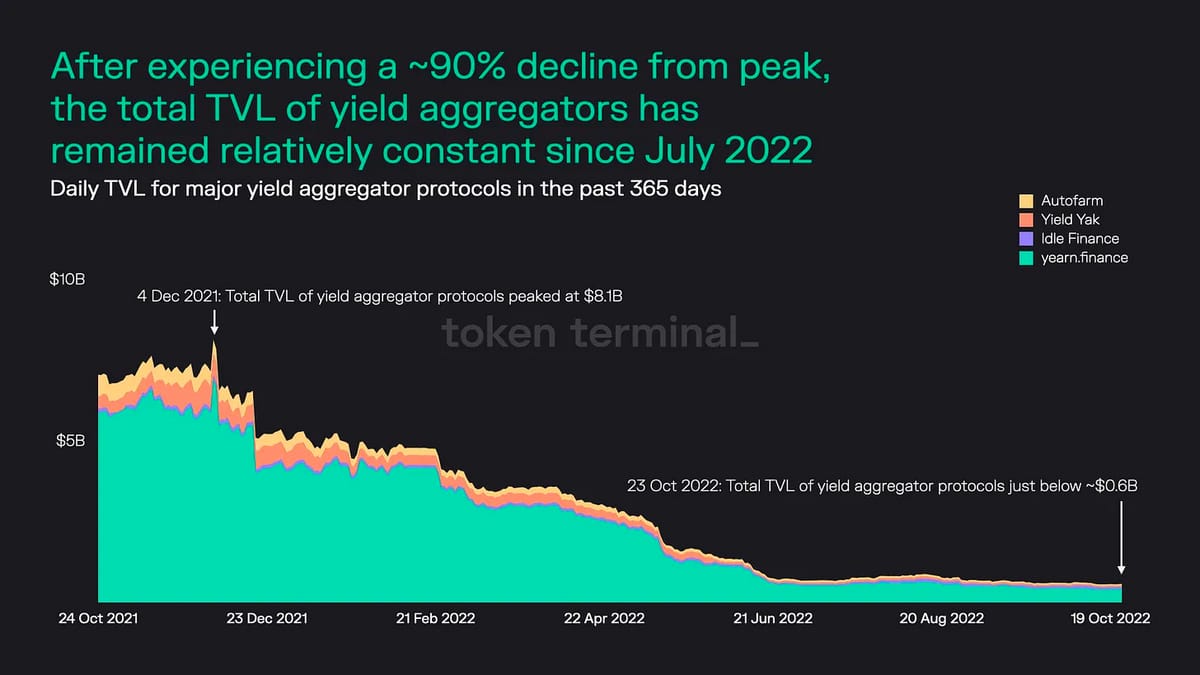

8. 💸 Yield Aggregator TVLs Have Stabilized After a Large Drop

Source: @tokenterminal

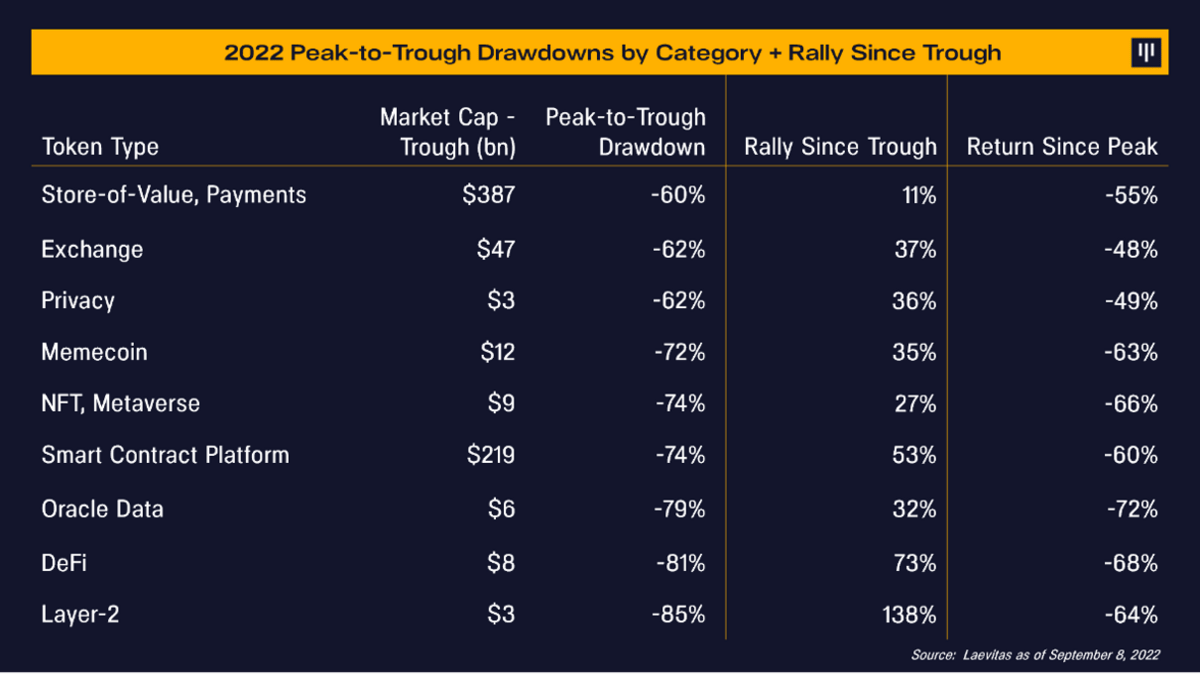

9. Cryptocurrency Declines & Rallies by Sector - L2 tokens and DeFi leading the rally since the July lows

Source: @Pantera

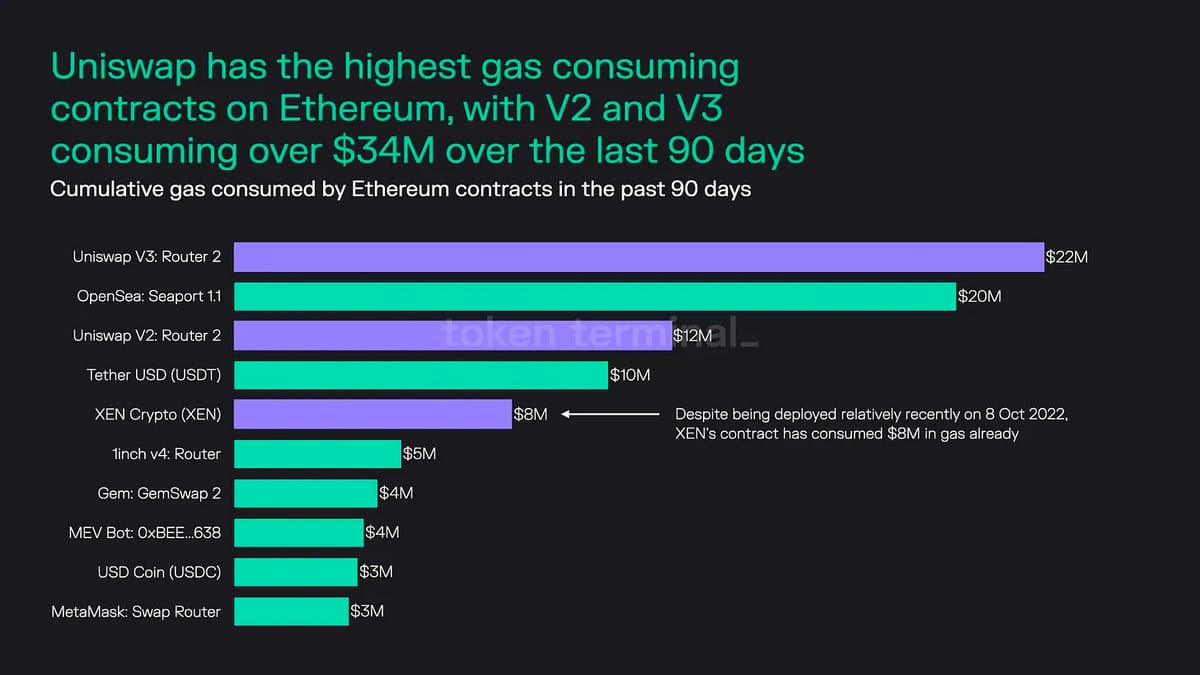

10. ⛽️ Highest Gas-Consuming Contracts on Ethereum

Source: @tokenterminal

🧵 Thread of the Week - Apple Released New Rules for Crypto Apps

By: @dgmason

2/ Games can enable NFT buying in-app purchases:

This is hugely important clarification. Developers can leverage IAP (30% Apple fee) to sell NFTs or offer NFT services (minting, listing, transferring).

This paves the way for NFTs as the gateway into crypto for mobile players.

3/ Games can't use other purchase methods or redirect users to other sides:

Apple wants to keep $$$ in the ecosystem. You can't use other payment solutions or "include buttons, external links or other CTAs...". This makes it hard for other providers to plug in and capitalize.

4/ Games can't unlock features with NFTs/crypto assets:

Premium content or functionality in-app must be unlocked with an in-app purchase. Presumably this could be an NFT purchase, but not an NFT already owned by a player or brought in from another ecosystem.

5/ Games can store virtual currencies:

Games can offer wallets to store crypto assets. It doesn't specify, but presumably but custodial and non-custodial wallets are fine.

6/ Licensed exchanges can facilitate crypto transmissions:

This is more a clarification, as Coinbase and others obviously offer iOS apps already, but approved exchanges (and ONLY approved exchanges) can facilitate crypto transfers. NFTs in this case are not considered crypto.

7/ So what are the takeaways?

* Apple is demonstrating a desire to work with crypto apps (especially games) but on its terms.

* Apple wants $$$. By enabling IAP NFT buys, banning external links, and limiting fungible crypto purchases to licensed exchanges, it limits competition.

8/ So who are the losers?

* Anyone trying to compete with apple for either primary or secondary NFT purchases. This includes exchanges (OpenSea, Magic Eden), payment ramps (Moonpay), or others trying to get in the payment flow.

* Mobile DeFi given licensed exchange ruling.

9/ Who are the winners?

* Crypto exchanges have more clarity for operating on the app store.

* Web3 games can use NFT onboarding as a frictionless way to onboard users using IAP.

* Infra providers building solutions for white label, in-game ecosystems for NFTs/tokens.

10/ Thanks for reading.

The official release is here: https://developer.apple.com/app-store/review/guidelines/#business.

Please share thoughts, insights, or the ways in which I got this whole thing wrong. 🚀.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Messari - Web3 Social Usage and Engagement

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

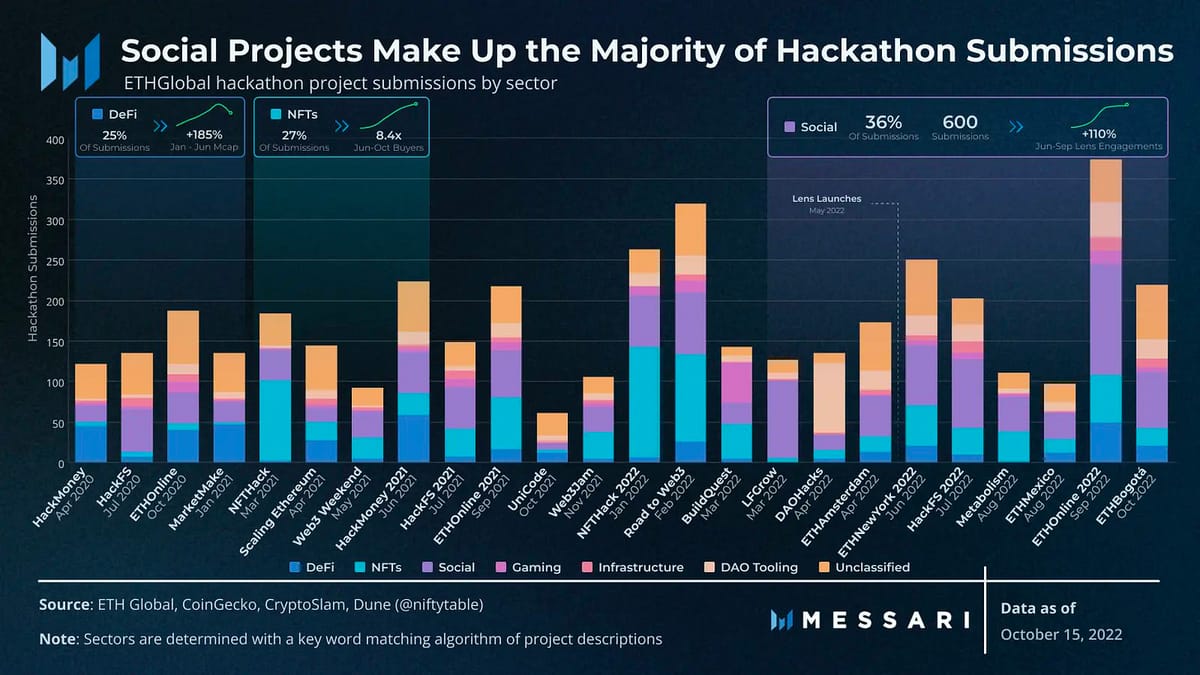

Every crypto bear market in the past has gone off to spawn a new sector or token model within crypto. This bear market is no different, with numerous sectors like decentralized social or gaming vying to lead the next consumer adoption wave. Historically, the sectors leading the wave have dominated the preceding hackathon submissions. Now, the most dominant sector amongst hackathon projects is social.

Web3 social is architecturally different from Web2 in that the underlying social graph is a separate protocol from the front ends. Most of the hackathon activity has been centered around attracting projects to build on top of one of the leading social graph protocols, Lens. While Lens may receive substantial hackathon attention, the crypto community has also praised a second social graph protocol, Farcaster. Both social graph protocols are mainly engaged through a Twitter-like front end which allows users to post, comment, and re-share. Each of the protocols has differing architectures and levels of maturity, but at the core, the most important thing for any social application is user traction.

To measure the traction of a social graph, two key metrics matter:

How many people are using the application? (monthly active users)

How engaged are the users? (monthly engagements)

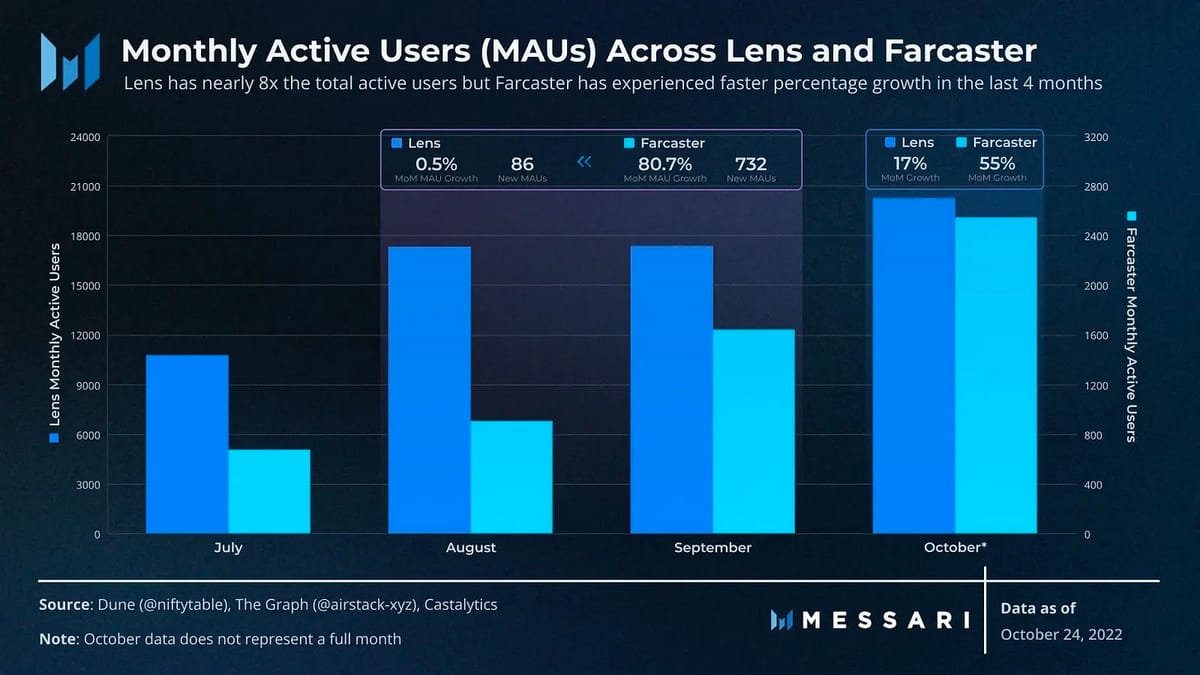

Monthly Active Users

Lens has nearly 8x the amount of monthly active users (MAUs) as Farcaster with nearly 20,000 users so far in October. Farcaster, however, has outpaced Lens in percentage growth over the last two months, growing 81% and 55% across September and October. From August to September, Lens grew active users by only 0.5% which added 86 new active users. Farcaster added over 8x the new active users in the same month with 732 new users (81% growth).

Going from September to October, Lens experienced more growth than the previous month, with a 17% active user uptick. Farcaster again outpaced Lens on a percentage basis, growing MAUs by nearly 55% over so far in October.

Since Lens is far larger than Farcaster, the growth percentages should be taken with a grain of salt as it’s far easier to grow the user counts from a few hundred than from a few thousand. That said, Farcaster’s growth outperformance is partially due to the higher levels of engagement on its front end.

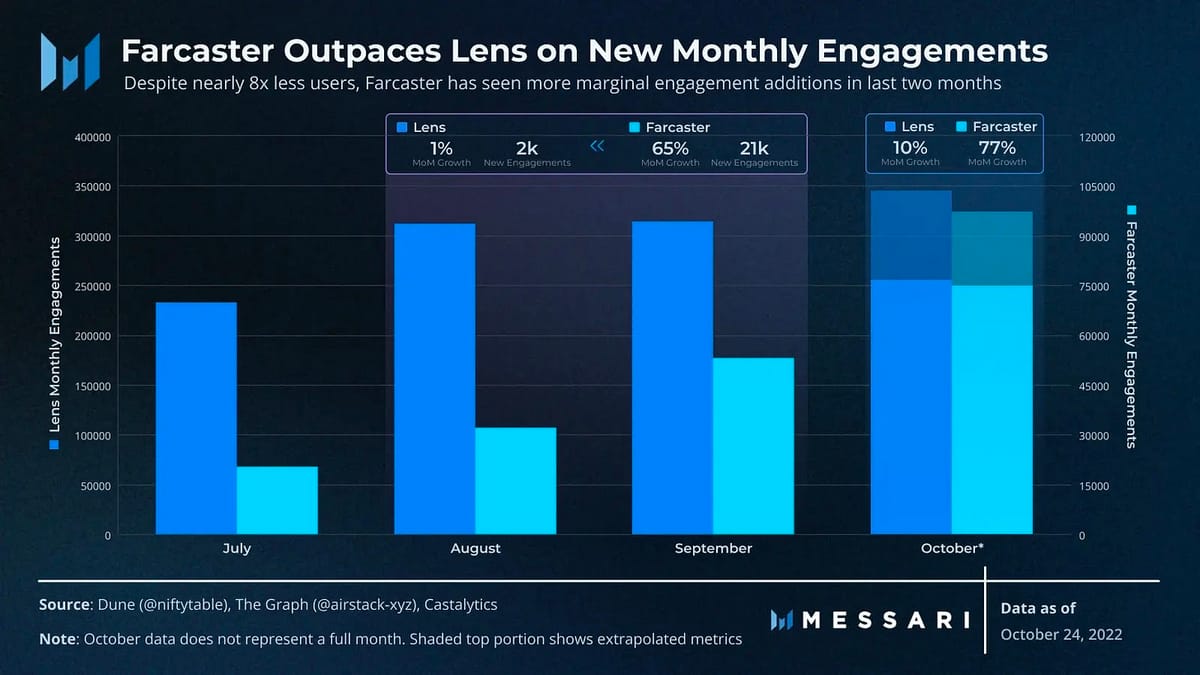

User Engagement

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

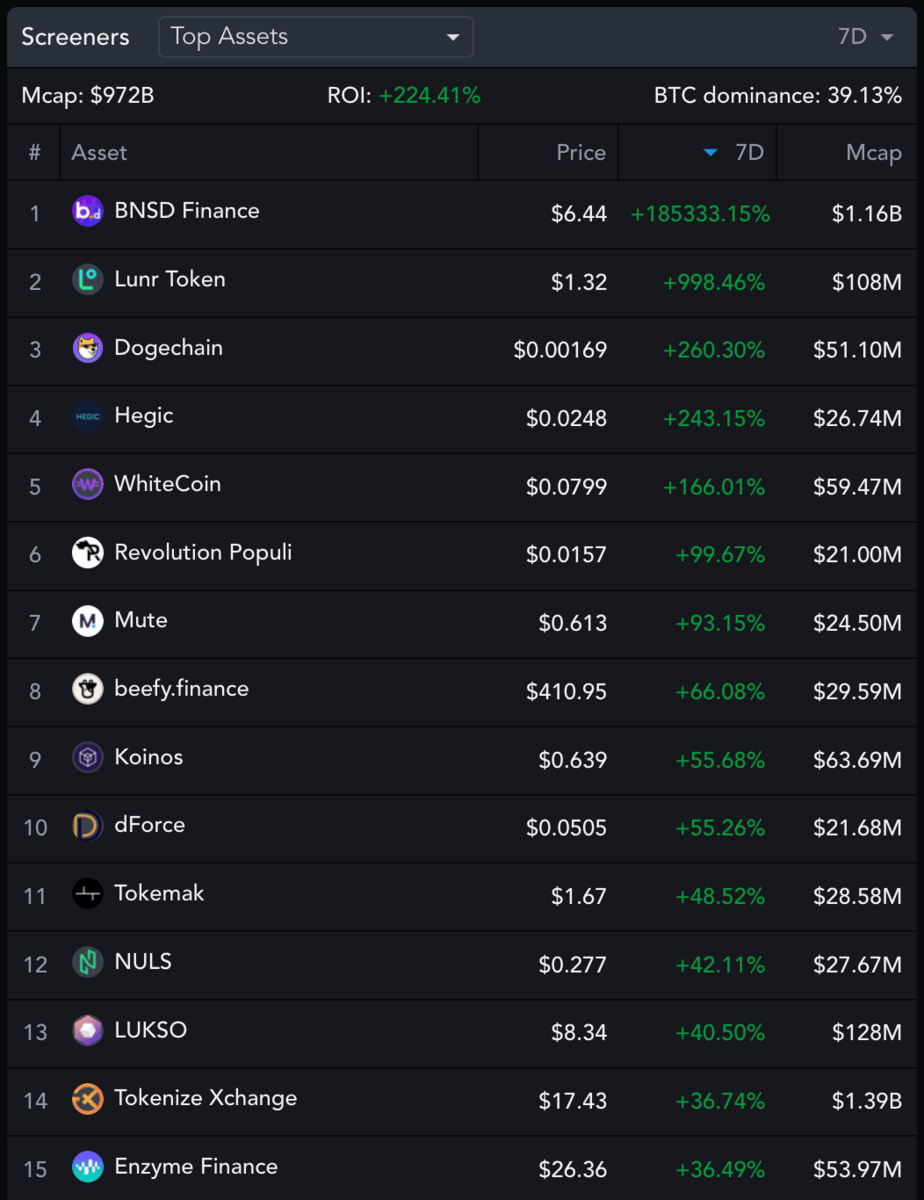

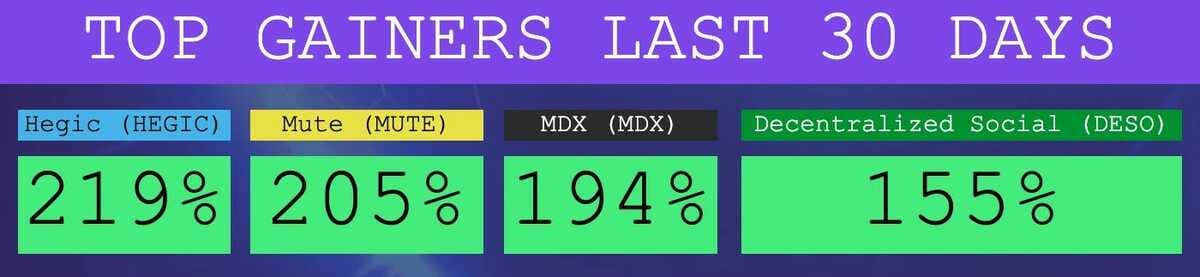

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 32,315 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.wemeta.world and www.amphibiancapital.com