Issue Summary: Welcome back to Coinstack, your weekly newsletter for institutional crypto investors, where we review the top news, stats, and reports in the digital asset ecosystem.

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Tornado Cash Gets Blacklisted by US Treasury, Coinbase Partners with BlackRock, Slope Wallet Exposed User Seed Phrases

💵 Weekly Fundraises - Pinata ($21.5M), RISC Zero ($12M), Fair.xyz ($4.5M)

📊 Key Stats - ETH Whales Accumulate, DAI Supply Grows, ETH Institutional Inflows, Top Dapps & L1s By Revenue, $23B+ in Crypto Venture Fund Dry Powder

📄 Whitepaper: Peer ICX Whitepaper: A New Method for Blockchain-Based Capital Raising - Part 2

🧵 Thread of The Week - Top Web3 Resources

💊 Vitamin3 of the Week: Web3 and Gaming

📝 Report Highlights - Blockworks Research: Q3 Protocol Outlooks

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

💬 Who We’re Following on Crypto Twitter

🎓 How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto hedge funds. They have researched and vetted over 150+ funds and selected the best based on their proprietary scoring system, providing accredited investors with the ability to gain crypto fund exposure with one investment. Learn more at www.amphibiancapital.com or register for our webinar on August 18.

🗞️ This Week in Crypto: The Top News

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

⚖️ Crypto-Mixing Service Tornado Cash Blacklisted by US Treasury - In a move that may ultimately be judged to be unconstitutional, the U.S. Treasury barred the use of privacy-focused cryptocurrency mixer Tornado Cash by U.S. persons as a matter of national security after claiming North Korean hackers used the mixer to launder stolen crypto funds. Since the announcement, the Tornado website, email accounts, and GitHub have also been suspended.

💰 Coinbase Partners With BlackRock To Create New Access Points for Institutional Crypto Investing - Cryptocurrency exchange Coinbase said it is partnering with BlackRock, the world’s largest financial asset manager, to provide its clients with direct access to crypto, starting with Bitcoin (BTC).

😡 Slope Wallet Provider Saved User Seed Phrases in Plain Text, Solana Security Researchers Find - Security researchers at Otter claim they have pinned down what may have caused the widely publicized breach, targeting nearly 8,000 crypto wallets in the Solana ecosystem.

🕊️ Ex-Coinbase Employee Accused of Insider Trading Pleads Not Guilty - An insider trading case could confirm whether some cryptocurrencies listed by Coinbase are in fact securities. Ishan Wahi, the former Coinbase product manager, accused of insider trading, has pleaded not guilty to the Securities and Exchange Commission’s (SEC) charges of wire fraud.

🔴 Crypto Lending Platform Hodlnaut Suspends Withdrawals Due to Liquidity Crisis - Blaming market conditions, and lack of liquidity, Singapore-based crypto lending platform Hodlnaut has become the latest firm to suspend withdrawals and deposits.

🥳 Voyager Plans To Resume Cash Withdrawals on Aug. 11 - Crypto lender Voyager Digital Holdings has reported users may be able to make cash withdrawals from the app more than a month after suspending trading, deposits, withdrawals and loyalty rewards.

💸Voyager CEO Sold $31M Stock As Shares Hit Record Highs - Stephen Ehrlich, CEO of bankrupt crypto lender Voyager Digital, made $31 million by selling company shares at their peak last year.

🙌 Nomad Has Recovered $22.4 Million After Hackers Drained $190 Million - According to data from Etherscan, $22.4 million or 11.7% of the $190 million hack has been returned to Nomad as its team has announced a reward. Some white hat and gray hat hackers intentionally took the funds to protect them once the smart contract vulnerability was identified and publicized, planning on returning it.

🇮🇳India Freezes $8.1M of WazirX’s Funds for Money Laundering Probe - India’s Enforcement Directorate (ED) has ordered the freeze of a WazirX bank account with Rs 64.67 crore (roughly $8.1 million) in connection with a money laundering investigation, IndiaToday reported Aug. 5.

🎉 Once Hacked for $77M, Beanstalk’s Algo Stablecoin Protocol Relaunches - Ethereum-based algorithmic stablecoin project Beanstalk Farms has relaunched its protocol just under four months after going offline after suffering a devastating $77 million governance exploit.Share Coinstack

📺 Amphibian Capital Webinar: Investing in Crypto Quant Funds: Part 2

by Ryan Allis, GP at Amphibian Capital & Publisher of Coinstack

Since July I’ve been working with a fund called Amphibian Capital. Amphibian is a crypto fund of funds. We invest in a diversified basket of vetted crypto funds. We began our fund on July 1, 2022. You can view our fact sheet here to see how the underlying funds have performed the last few years. If you’re an accredited investor or institutional investor and would like to speak with me to explore an investment in the fund, you can book a time here. You can also join our August 18 webinar.

We had over 200 registrations for last week’s webinar so we have launched a second one next week. You can learn more and register here.

Thursday, August 18, 2022

12pm PT / 3pm ET / 7pm GMT

55 minutes on Zoom / register here

Presented by Ryan Allis, Publisher of Coinstack and GP at Amphibian Capital

The webinar is for accredited and institutional investors.

What You Will Learn

How Amphibian researched and vetted 150+ crypto quant funds, selecting the 13 best for its fund of funds

The primary trading strategies of crypto quant funds

How Amphibian's pro forma portfolio of crypto funds achieved +96% net in '21 and a +10% net return YTD in 2022 while BTC dropped ~50%

How the portfolio of underlying selected funds performed in 2019-2022, never having a single down quarter

Why avoiding major market drawdowns matters so much for long-term investment results

Why the upcoming Ethereum merge scheduled for September is driving ETH prices

If you're an Ethereum bull, how to earn ETH-on-ETH returns (USD Fund vs. ETH Fund)

How the fund of funds model can mitigate risk and drawdowns

Requirements

For institutional investors and accredited investors

For portfolio managers inside hedge funds or family offices

For financial advisors advising HNWIs

💬 Tweets of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Ethereum Number of Addresses Holding 1K+ ETH Just Hit a 7 Month High as Whales Accumulate Before the Merge

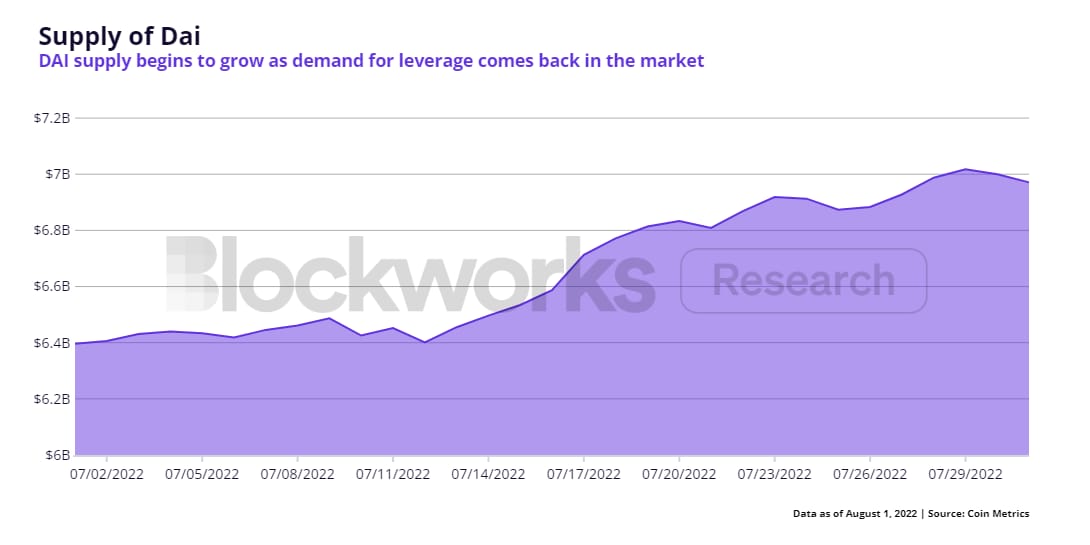

2. $150M DAI Has Been Minted From Non-Stablecoin Collateral Since July 27, As Demand for Leverage Is Slowly Coming Back in the Market

3. Ethereum Saw Inflows Totaling $16M and Is Enjoying a Near 7 Consecutive Week Run of Inflows Totaling $159M

4. Maple Finance and TrueFi’s Total Outstanding Loan Amounts Have Grown Rapidly Since Inception, Peaking at Above $800 and $400 Million, Respectively

5. The Pressure of Sanction on Stablecoin Issuers Is Mounting With Circle Blacklisting 2x the Number of $USDC Addresses Since Mid-July 2022

6. Synthetix Daily Volume Passes $200M & $1M in Fees

7. Chainlink Surpasses 95% of Oracle Enabled Volumes

8. The Top 8 Dapps by Revenue

9. The Top 8 Blockchains (L1s/L2s) by Revenue. Ethereum leads BTC by 7x.

10. There’s Over $23B in Dry Powder Among the Top Crypto VCs

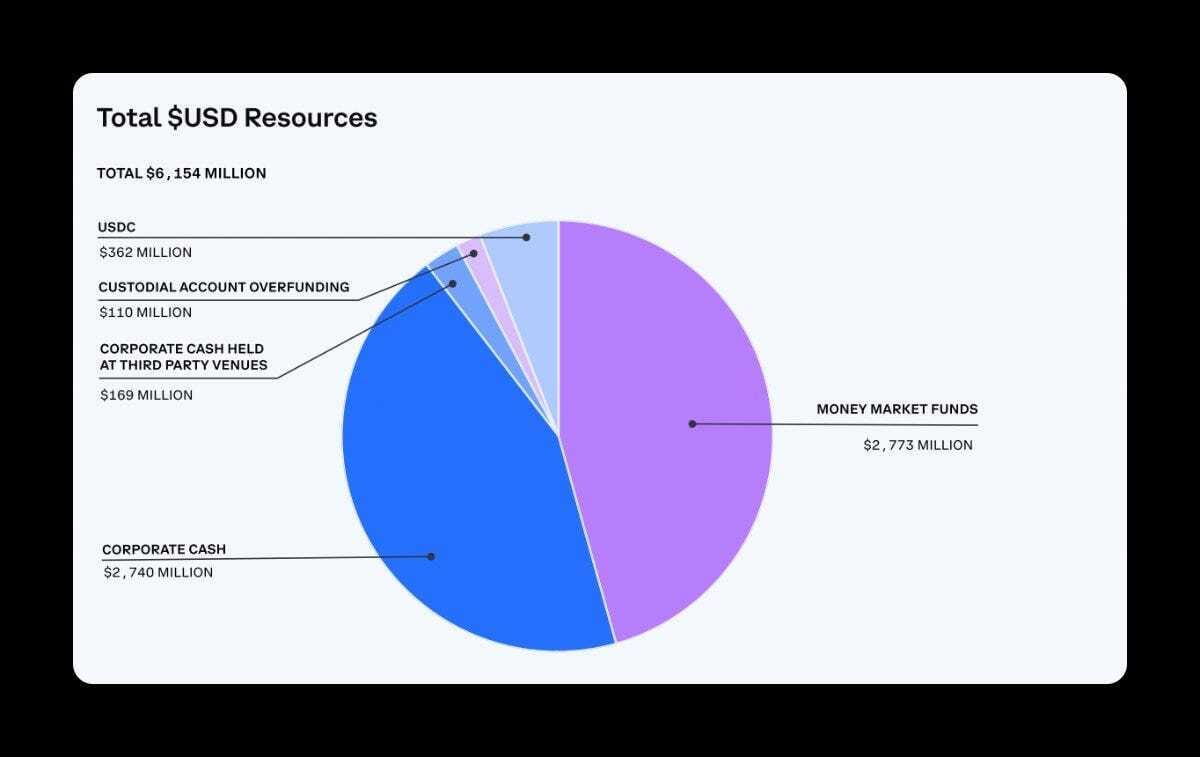

11. Coinbase Had Over $6.1B in Cash and Cash Equivalents On Its Balance Sheet as of June 30, 2022

Peer: Introducing the Initial Coin Exchange (ICX) - A New Method for Blockchain-Based Capital Raising - Part 2

About the Author: Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. You can read the full Peer ICX whitepaper here. We plan to publish parts 3 and 4 in upcoming weeks.

Part 2: The History of the ICO

The Invention of the Initial Coin Offering (ICO)

Typically, there are one of two ways a cryptocurrency or digital asset comes into existence. The first is through a Fair Launch. A fair launch is a type of crowdfunding in crypto where the project sells tokens to every participant. A fair launch allows for equitable and fair distribution of tokens. The tokens are available to everyone and anyone for purchase at the same price with no preference in price to any party. A fair launch is where a community joins to mine a cryptocurrency from zero. A few examples of fair launch tokens are Bitcoin, Litecoin, and Dogecoin.

Unfortunately, fair launch cryptos have a lower likelihood of surviving in today's competitive environment. It takes lots of money and time to build a cryptocurrency from scratch, get the minimum participation required to ensure it is decentralized and secure, and get it listed on exchanges. This is where ICOs come in.

What is an ICO?

ICO is short for initial coin offering, and it's how most cryptocurrencies have been launched. A project uses an ICO to sell its coin or token to early investors before it lists on an exchange. ICOs allow the team behind the cryptocurrency to get the money they need to develop its blockchain, raise awareness, secure partnerships, pay for exchange listing fees, and so on.

According to Merehead, some of the largest successful Initial Coin Offerings to date include:

Filecoin - $257M - September 2017

Tezos - $236M - July 2017

Bancor - $153M - June 2017

Polkadot - $121M - October 2017

Ethereum - $19M - July 2014

ICO vs. IPO

Let’s compare ICOs to traditional finance. Coinbase is a crypto- and fiat-based exchange that had its IPO in April 2021. An IPO is an Initial Public Offering in which the company, in this case, Coinsbase, is selling some shares of their company in return for capital. Hopefully, that capital can be used to help fund some of their projects or pay for salaries or, quite frankly, whatever they need it for to increase shareholder return. When you go to buy a stock that's participating in an IPO, you gain a certain amount of power within that company; you own fractions of a portion of that company.

A big difference between IPOs and ICOs is that ICOs aren't generally regulated by the U.S. government; there is nothing that is stopping you from getting your money taken. Of course, IPOs require companies to have over $50M in annual revenues and often a couple of quarters of profitability and an extensive filing with the SEC called Form S-1. None of that is needed for an ICO.

How Do You Launch an ICO?

In order to launch an ICO, every project needs a whitepaper. A whitepaper explains what issue your coin or token will be solving and how it will be different from other coins or tokens. Whitepapers usually cover what problems the coin solves, what blockchains it will be used on, how the coin is different, specific code mechanisms, future spending plans, a marketing plan, and long-term goals.

To launch a successful ICO, a project needs to get people to see the new coin, demonstrate the problem it solves, and then get them to help fund the project.

The project also needs to find an exchange to sell the coin. There are exchanges and launchpads that will allow projects to collect money for pre-sales, and then those platforms will distribute the coin to everyone who bought them. This way, the investors don't have to trust just the project’s credibility, they can trust the third-party platform who is sponsoring the launch of this new coin.

Why Invest in ICOs?

Why would you buy a coin or token early? When you invest in an ICO, the coin developer usually has a plan for the funds they are raising to help the coin succeed. Without funds, the developer may not be able to implement specific features or advertise the coin, which could hinder its success. The idea of buying an ICO is to allow investors early access to a cheaper price. Then, hopefully, once the coin launches, the price will increase, which means the investor could sell for a profit. If the project developers are launching their token as a utility token and the tokenomics of the project are right, it could increase in price if network usage goes up.

Case Study: The Success of the Ethereum ICO

Overall, the ICO craze 2014-2018 did lead to some big successes, such as Ethereum. Unlike most ICOs today, Ethereum did not have any insiders during its ICO. Ethereum did not have any venture capital before its launch either. Ethereum held a traditional ICO where all participants had an equal shot of investing in the token at the same valuation as everyone else. Ethereum’s ICO was held during the summer of 2014 and raised over $18 million in Bitcoin. With 60M ETH up for grabs, this worked out to a price of about $0.31 cents per ETH.

Using Ethereum’s current price at the time of writing ($1,400) the current ROI on Ethereum’s ICO is around 4500x. This is not all that surprising, considering Ethereum was the first smart contract cryptocurrency to get off the ground, and Ethereum has consequently become the backbone for much of the cryptocurrency space, with thousands of other cryptos being built on top of its blockchain. The decentralized applications and protocols it powers also boast millions of users and billions of dollars in total value locked. Ethereum has seen an incredible amount of institutional adoption in both the private and public sectors.

Ethereum’s ICO Created a Roadmap for Decentralized Fundraising

The Ethereum Foundation is the non-profit organization that guides the development of the standards and developer community for Ethereum, which is currently the largest smart contract platform in the world and the largest digital asset by market capitalization after Bitcoin (BTC). While there were initial discussions in 2013 and 2014 about whether Ethereum should be built as a centralized corporation, ultimately, Vitalik Buterin’s vision for a non-profit foundation that guided a decentralized community of contributors won out at launch in 2015.

The Ethereum community has intentionally structured their native token, Ether, as a utility token that can be used to pay for transaction fees for blockspace, but isn’t sold to fund the development of a company and not controlled by a central entity. Thus, it’s generally been considered as a utility token and a community.

As Camila Russo wrote in The Infinite Machine:

“The framing that Ether was a product with a specific functionality, opened the door for a whole new way of raising money. Now startups would be able to get funding from anyone who wanted to contribute, all over the world, under what seemed like a safe haven. They weren’t selling securities. These weren’t shares in any company. They didn’t give out dividends that depended on the company’s revenue and investors didn’t have any rights. They were selling digital tokens, made to be used inside these platforms. They were selling utility tokens.”

Back in June 2018, U.S. Securities and Exchange Commission (SEC) Director of Finance William Hinman stated his perspective on Ether being a community, further cementing the understanding today of how utility tokens are classified within the United States. Director Hinman stated the following in a speech:

“Based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions. And, as with Bitcoin, applying the disclosure regime of the federal securities laws to current transactions in Ether would seem to add little value. Over time, there may be other sufficiently decentralized networks and systems where regulating the tokens or coins that function on them as securities may not be required.”

While today’s SEC vs. Ripple suit as well as the RFIA will likely further define securities vs. commodities within the context of digital assets in 2022 and 2023, at the moment, many blockchain-based protocols, DAOs, and foundations have moved forward with the issuance of utility tokens that are meant to be used within the apps and networks themselves. Often, these organizations maintain a substantial share of the initial token issuance to support developer incentives and community growth, and often many have parallel for-profit development companies, such as in the case of Uniswap Labs (the company) and Uniswap DAO (the decentralized not-for-profit organization).

In the United States, the case law-based test to determine whether an asset is a security is called the Howey Test, which goes back to a 1946 trial about whether investing in orange grove fields in Florida constitutes investing in a security or not (it did). The Howey Test qualifies an asset as security as there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.

While Security Tokens (or STOs for short) do need to be registered in advance to be sold within the United States, utility tokens do not. A utility token can be thought of as a digital asset that can be utilized within the decentralized application or blockchain itself. Thus, a utility token can increase in value over time if the network grows and there is more demand for the use of the token. Utility tokens are generally considered commodities and with the pending Responsible Financial Innovation Act (RFIA) in the USA, will be regulated by the Commodities Futures Trading Commission (CFTC).

About the Author: Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. You can read the full Peer ICX whitepaper here.

🧵 Thread of the Week - Top Web3 Resources

By: @MishaDaVinci

1. Foundations of Blockchains Lecture Series by @Tim_Roughgarden Head of Research a16zcrypto. 8 free lectures on science and technology of blockchain protocols, and the applications built on top of them. If you want a deeper understanding of web3

2. Simplilearn from @simplilearn A top YouTube channel for learning digital technology including blockchain and web3. If you want to easily grasp new concepts

3. What is Web3? The 'Next Phase' of the Internet by @CNET A seven-minute breakdown on why web3 is the new internet, one that is owned by users. If you want a succinct explanation that anyone can understand

4. Web3: Never Bet Against Innovation | TEDx Talk by @John1wu A deep dive into the future of web3—the internet of value. If you want to learn how web3 changes the way money works

5. Web3, Blockchain, Cryptocurrency: a threat or an opportunity? by Shermin Voshmgir @sherminvo From the author of Token Economics, a Tedx Talk on the fundamentals of web3. If you want to learn how web3 democratizes the internet

6. Collected web3 twitter threads of @cdixon Chris Dixon's threads are a primary resource for learning the very best and latest web3 info. If you want the smartest, most incisive perspective

7. DAOs represent the next step forward in the labor movement by @ljin18 DAOs fundamentally transform power structures in organizations and can improve conditions for employees. If you want to learn how web3 can impact inequality

8. NFTs will force Hollywood, Harvard, Salesforce, Nintendo etc. to reinvent themselves by @gregisenberg NFTs turn dictatorships into democracies and reinforce the power of community. If you want to learn how NFTs can transform industries

9. The next wave of crypto adoption will come from utility tokens of real-world companies by

@TaschaLabs Tokenization is a new business model and one of the key breakthroughs of web3. If you want to learn how real businesses can use tokens to drive growth

10. How to read a smart contract by @chriscantino A step by step to understanding the codes that make NFTs work. If you want to learn how NFT transactions actually happen

11. Web3 with a16z by @smc90, @cdixon and the a16z crypto team A podcast about how builders and users can now own pieces of the internet, unlocking a new wave of creativity and entrepreneurship. If you want the latest in web3 from the very top

12. Bankless Podcast by @RyanSAdams and David Hoffman @TrustlessState Powerful conversations with two of the most passionate advocates for crypto and web3. If you want to learn from masters in the field and refine your understanding

13. Where It Happens by @gregisenberg and @SahilBloom Episode: Betting Big on Web3 with

@ljin18, the mastermind behind the creator economy and co-founder of Variant. If you want to learn about web3 and the creator economy

14. On the Other Side by @chaserchapman Exploration at the intersection of society, culture, and crypto. If you want to learn how web3 affects human lives

15. Hello Metaverse by @anni3zhang A weekly episode that demystifies the Metaverse and explores its implications on our culture and society. If you want to learn how our online lives are being designed and how to be a part of shaping it

16. The Canons Archives at a16z crypto by @smc90, @cdixon et al.The OG in-depth readings on Crypto, NFTs and DAOs, from building blocks and key concepts to tutorials and guides.If you want the best info from the team most invested in web3

17. Rabbithole Complete tasks, learn skills, and earn credentials that prove your knowledge. If you want to build your web3 resume and be ready for the many opportunities in this growing ecosystem

18. Crypto Research, Data, and Tools from @MessariCrypto The definitive data source for crypto market intelligence. If you want to know the numbers behind the stories

19. Gitcoin The place to build and fund the open web together. If you want to help develop digital public goods, create financial freedom and define the future of the open web

20. Alchemy by @AlchemyPlatform The place to build massively scalable, reliable web3 apps. If you want access to the fundamental building blocks to create the future of technology

21. The Defiant Newsletter by @CamiRusso The Defiant curates, digests, and analyzes all the major developments in DeFi. If you want to stay informed and knowledgeable about this fast-changing corner of crypto and finance

22. Not Boring by @packyM Deep dives into trends, strategies, companies, and protocols shaping the future of business. If you want incisive thinking, fresh perspectives and longform writing on web3 and crypto

23. The Milk Road by @ShaanVP and @benmlevy A daily update on all happenings in the web3 world. If you want witty, diverting takes as you keep with the twists and turns of this rapidly evolving ecosystem

24. Blockworks Newsletter A daily newsletter that helps investors understand the markets. If you want to keep up with the day-to-day changes in crypto and web3

25. Web3 Weekly from @smc90 and the a16zcrypto team A weekly go-to guide for anyone building the next generation of the internet. If you want the highest quality insights from the top team in web3

BONUS: I am hosting INTRO to WEB3 on August 26th. It's a FREE ONLINE event with some of web3's leading startups. Join us and get up to speed with the new internet and the future of the world. Limited number of seats left. Grab your spot here

Vitamin of the Week: Web3 and Gaming

About this Section: Our friends at Vitamin3 have launched a free daily SMS covering web3 topics. You can subscribe free by sending HELLO to 305-614-9440. Here’s an excerpt from their SMS earlier this week on the Metaverse.

1/3) Let's continue our exploration of web3's impacts on various sectors, focusing this week on gaming.

Gamers, similar to sports fans, are already used to many mechanics of web3: digital currencies (e.g. Fortnite V-bucks), paying for & owning digital assets (e.g. skins), pseudonym-based communities (e.g. guilds), user co-creation (e.g. modding), and creator monetization (e.g. Roblox creators).

(2/3) Web3 proponents argue that those elements of gaming are made better with crypto. For example, tokens are "safer" than corporate in-game currencies (can't be wiped off or devalued by the company), NFTs make digital assets openly tradeable (while games don't allow trading or only allow trading in owned marketplaces), and decentralization results in lower take rates, so the creators keep more $.

(3/3) While many gamers are surprisingly anti-web3 (more on that later), it's undeniable how much web3 & gaming overlap. In fact, Vitalik Buterin, the creator of Ethereum, said that he was driven to decentralization because of his experiences playing World of Warcraft (and getting his character "nerfed" i.e. weakened due to an update- yes, really); he realized how messed up central control can be.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Blockworks is a financial media brand that delivers news and insights about digital assets to millions of investors. This is an excerpt from the full article from Blockworks Research, which you can find here

Key Takeaways

We expect value accrual to flow to revenue-generating DeFi protocols for the rest of the year

Frax has the potential to gain market share as Fraxlend and fraxETH launch. The protocol has accrued $36.3 million in revenues to date

Synthetix and GMX continue to dominate perpetual trading and TVL on Optimism and Arbitrum, with each protocol bringing in daily revenue of around $100k - $300k

dYdX (DYDX) and Uniswap (UNI) will make strides toward value accrual for their tokens

The announcement of crvUSD and GHO mark the potential beginning of a new narrative around protocol-specific stablecoins. Among other features, native stablecoins allow protocols to generate additional revenue and drive utility to their governance token. Curve is optimized to provide deep stablecoin liquidity, so it is likely to become the battleground of this narrative.

Our final Q2 report focuses on the evolution of DeFi assets during a bear market and explores the upcoming developments of major protocols.

It’s been a long struggle for DeFi from the days of Maker dominance, through DeFi summer led by Synthetix and Compound, during the false hope of “DeFi 2.0” and unstable stablecoins, and now the revival of the OGs primitives. Throughout that time, TVL was used as the best measure of success.

As users were attracted through unsustainable inflationary native token rewards, TVL lost its usefulness as an indicator of product market fit (PMF). Users aped into projects to farm and dump their earnings. Once the rewards slowed or ceased, users left. Falling token prices meant that the promised APYs became unrealizable. TVL in Q2 plummeted.

One project paid out 14.7 times the original allocation within the first five months of launch, driving TVL to an all-time high by YE 2021. As the emissions rate fell to double-digit annualized inflation, TVL fled. Monthly rewards fell 99% from a high of $20 million per month to $200,000 by the end of Q2.

PMF can be better measured by how much users are willing to pay for the services. Temporary rewards can help with customer acquisition costs, but protocols need users to remain once incentives end.

While few protocols currently accrue real value to the protocol treasuries or to token holders, users pay to borrow and trade tokens, bribe liquidity pools, and to invest outside of DeFi. Users also earn real fees through ETH staking and through seigniorage. Uniswap, dYdX, Convex, Frax, Aave, GMX, Synthetix, Curve, and MakerDAO are all in the top 20 of DeFI ranked by fees.

Growth equities rarely, if ever, pay dividends. Early stage-crypto protocols likewise might consider similarly accumulating and reinvesting fee income to grow their businesses. To the extent that token holders have rights to eventually profit from the successful businesses they back, total fees will continue to be a key metric, whether their earnings are paid out or reinvested.

We believe tokens will drive the next bull market with either current or future value accrual. In this report, we present the latest news and bull cases for the protocols we believe are critical to the future of DeFi. All of the protocols covered have proven PMF and earn real fees from real users.

Lending

Aave

Aave launched its V3 product across 6 different chains at the end of the first quarter of 2022, bringing some key new features to market:

Portals are “permit listed” bridges that facilitate cross-chain transactions, allowing assets to seamlessly flow between Aave V3 markets deployed across different chains. They have helped solve liquidity fragmentation issues

High-efficiency mode (e-mode) has given users access to higher borrowing power within the same asset category, enabling borrowers to extract the most out of their collateral

Isolation mode gives Aave governance the ability to isolate certain newly-listed tokens and determine maximum loan-to-values, limiting the protocol’s exposure to riskier assets.

Gas optimization reduced fees for all transactions by 20-25%

L2-specific features enhanced the user experience on Ethereum scaling solutions Aave V3 now sees more DAUs than Aave V2:

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

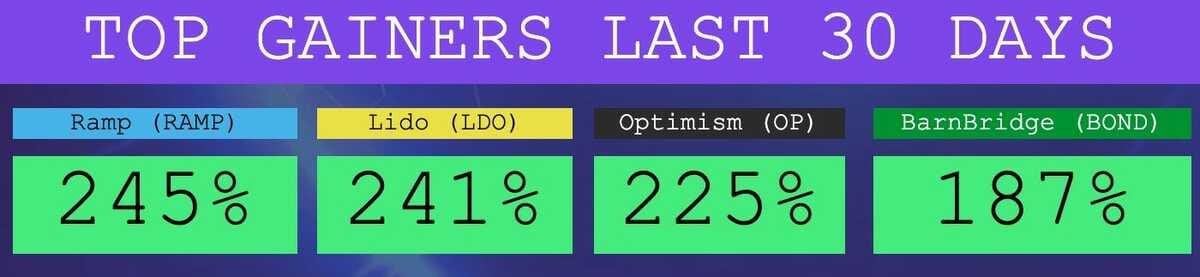

The Top Performers This Month from the Top 100: Ramp is a Lending Protocol, Lido is a Staking Service, Optimism is an L2, BarnBridge is a Derivatives Protocol

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 28,343 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.