Learn More at www.fyde.fi

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, Tornado Cash developer Alexey Pertsev was found guilty of money laundering, the SEC argued for a $2B penalty against Ripple, the Founder of dYdX stepped down as CEO, and big new venture rounds were raised by Sophon ($60M) and Polymarket ($65M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Fyde introduces AI-driven 'Liquid Vaults' to help crypto investors consistently lock in gains, earn yield, and stay liquid. Liquid Vaults are tokenized bundles of assets that can be traded and transferred, and use AI to mitigate risks. This innovation allows Fyde’s users to grow their crypto holdings faster with less volatility. To learn more, visit: Fyde Protocol or follow @FydeTreasury.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️Tornado Cash Developer Alexey Pertsev Found Guilty, Sentenced to 64 Months in Prison by Dutch Court: The 31-year old Russian was escorted after the session by police to the cells under the court. This is where he will remain until the public prosecutor finds a prison in the Netherlands that is appropriate for his crimes.

🙅♂️ SEC argues $2 billion penalty against Ripple is needed, slams $10 million counterproposal:The Securities and Exchange Commission is pushing back against Ripple's claim that it should pay fewer fines, according to a recent court filing.

🚀 Founder of dYdX steps down as CEO of firm behind decentralized exchange: Antonio Juliano, founder and CEO of dYdX Trading Inc., the developer behind the decentralized derivatives exchange dYdX, has stepped down as CEO, citing personal and professional reasons.

⚖️ Coinbase can't force the SEC to write new rules, SEC argues in new brief: The SEC has filed a new form arguing that Coinbase's petition to order the agency to develop a new regulatory system for crypto "from the ground up" should be denied. "The Commission’s determination that the rulemaking Coinbase seeks is currently unwarranted was both reasonable and reasonably explained," the SEC said, in a case before the U.S. Third Circuit Court of Appeals.

🚀 Layer3 says airdrop for utility and governance token coming in early summer: Layer3 announced it will launch its governance and utility token, $L3, with an initial drop slated for this summer, according to a post to X.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

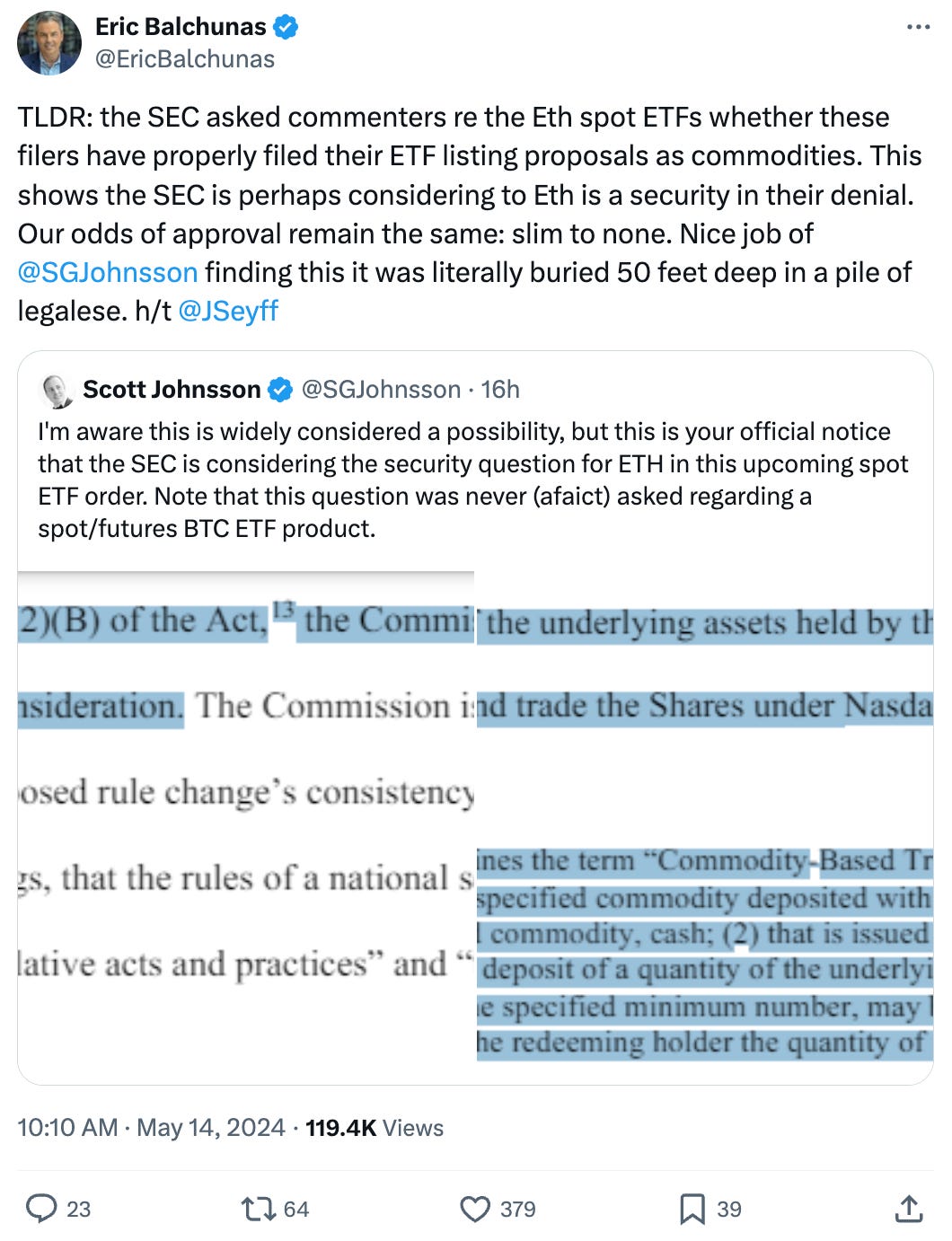

💬 Tweet of the Week

Source: @EricBalchunas

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

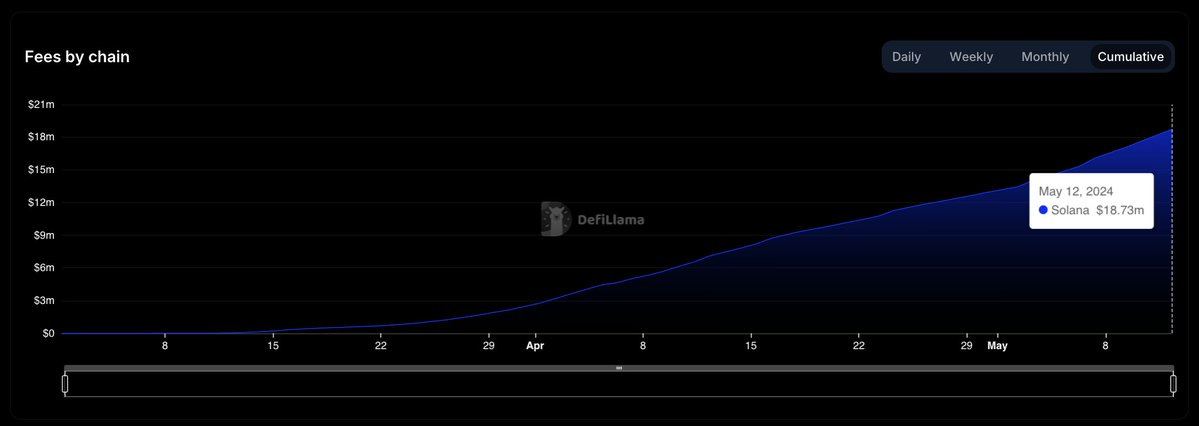

1. Pumpdotfun has been consistently generating $400-500k daily in fees. $18.73m since inception (~3 months).

Source: @sandraaleow

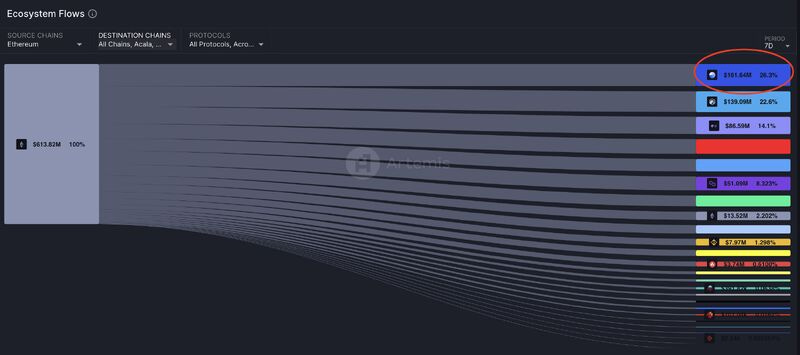

2. Over the last 7 days, 26% ($162M) of flows from Ethereum went to Base. This was the most of any destination chain, surpassing the likes of Arbitrum (generally the leading destination), Optimism, and zkSync. This brings Base's YTD inflows from Ethereum to $1.83B, third most overall of any ecosystem.

Source: @DavidShuttleworth

3. Activity on Ethereum Layer 2 network Blast continues to gain traction as over $3.3B in daily stablecoin transfer volume occurred yesterday, the most ever in the network's history, and a 714% increase week-over-week. To put this into perspective, leading L2 networks Arbitrum and Optimism had about $1.2B and $400M in daily transfer volume, respectively.Overall, the total stablecoin marketcap on Blast is now approaching $350M.

Source: @DavidShuttleworth

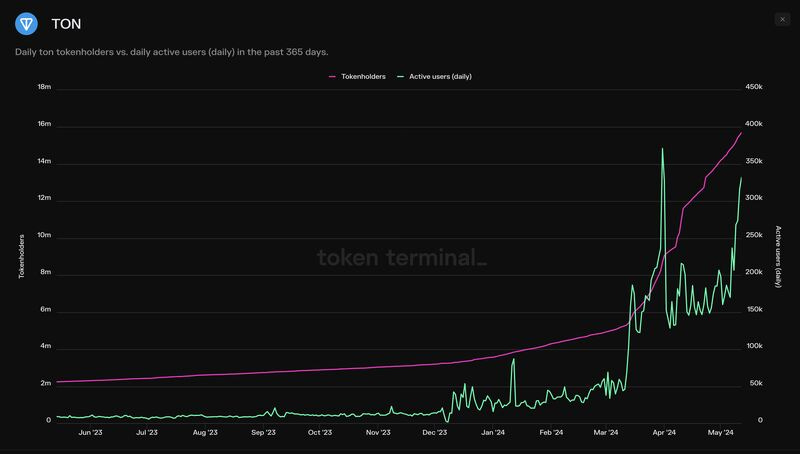

4. Over the past year, the number of TON holders has increased by 613% (to 15.7M) and is up 33% since last month. TON now has more than 332,000 daily active users, growing 65% on the month and a staggering 3600% YTD.

Source: @DavidShuttleworth

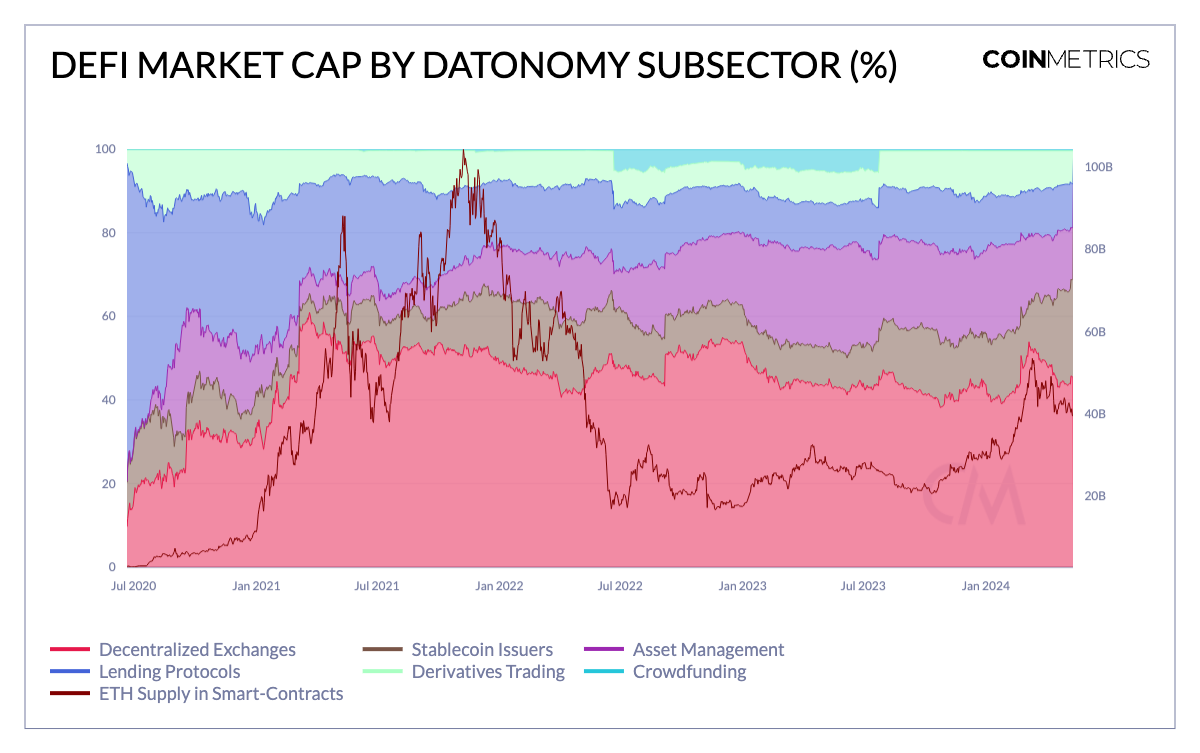

5. Ethereum DeFi token market cap rises to $36B in March, Tripling Since October 2023

Source: @OurNetwork

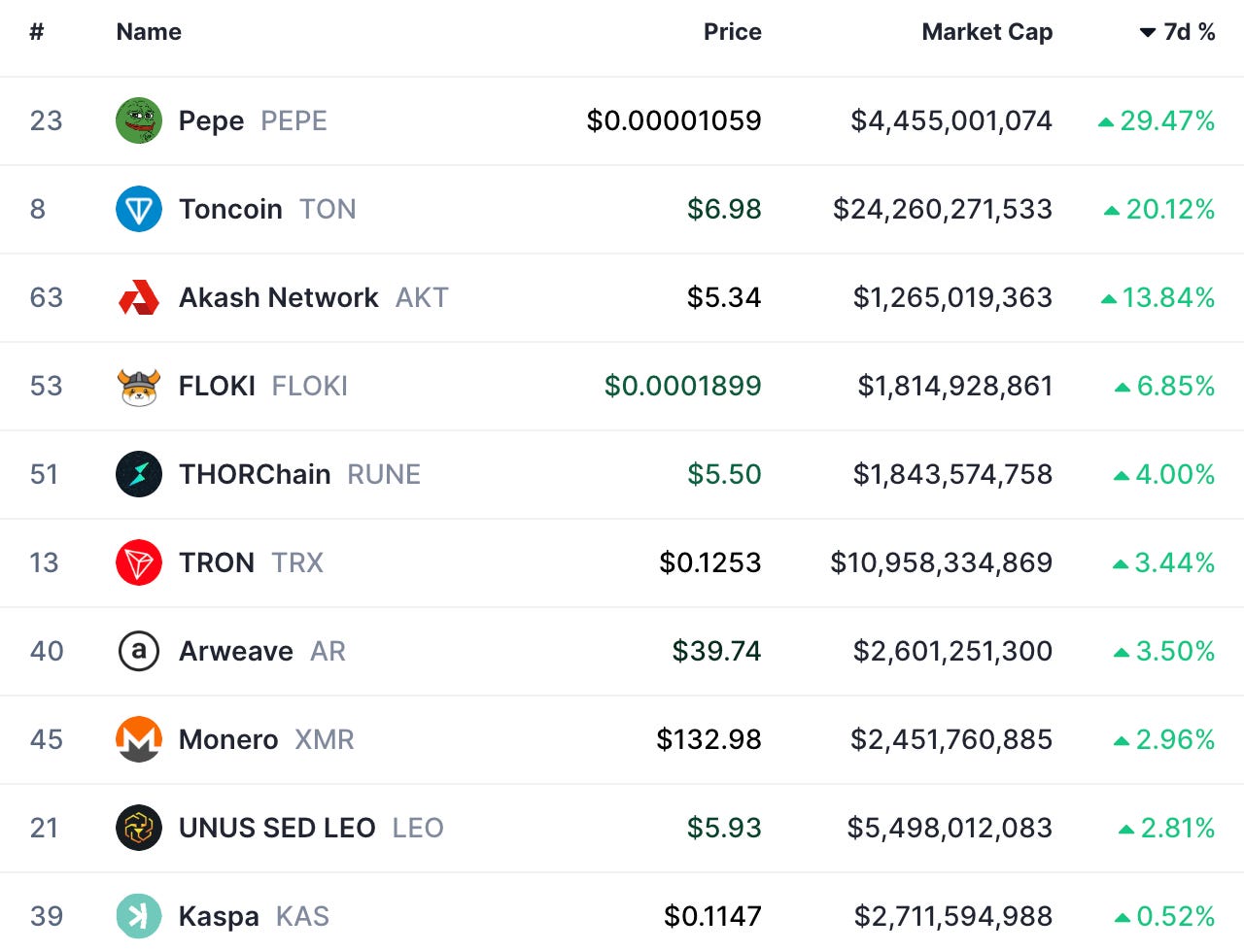

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Cole DeRousse serves as a Research Assistant at 1995 Digital Asset Research, where he blends technical research with social investing strategies. His primary focus is on fostering the growth of the Web3 community and ecosystem, aiming to awaken people to the transformative power of Web3 apps and technologies. This is an excerpt from the full article, which you can find here.

Introduction

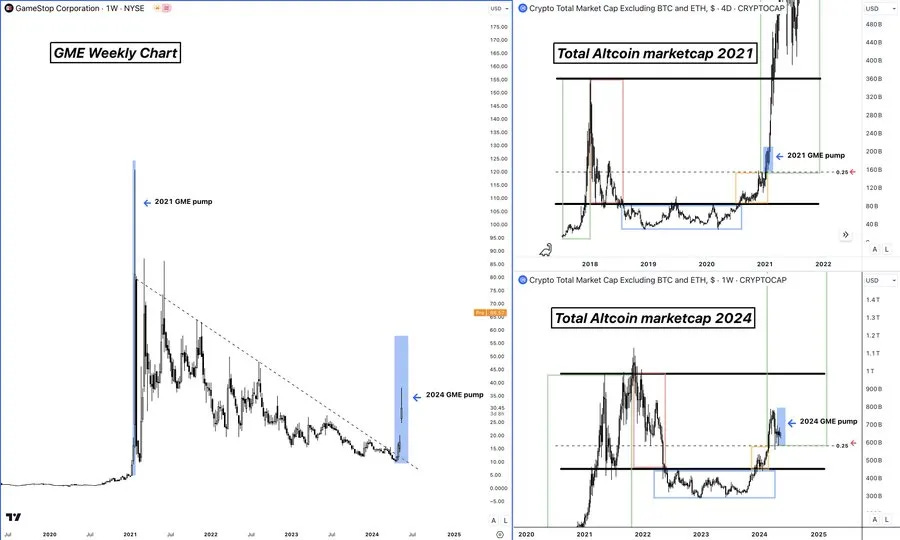

Yesterday GME was up 74% and today it’s up 107% at the stock market open! We are seeing the resurgence of meme stocks in the market! If you haven’t heard Roaring Kitty has also returned! The famous internet personality who used Reddit to build a community around GME the stock and cause a short squeeze liquidating Melvin Capital is back with a vengeance. If you haven’t seen ‘Dumb Money’, on Netflix I highly recommend it to learn more about Roaring Kitty and the GME Short Squeeze. In this report, we highlight what happened with crypto in 2021 right after we saw meme stocks go parabolic. We are currently seeing EXACTLY the same behavior that preceded a parabolic pump where the whole altcoin market expanded together for around 2-3 months.

First I want to share the GME chart overlayed on Total2, I expect Total2 to follow GME stock to the upside similar to how it did in 2021. these parabolic pumps don’t last forever, during the GME short squeeze it only lasted about 11 trading days. Watch out for violent moves in total2 coming soon and have your game plan because this market will likely get very hectic soon.

GME and AMC Stock Breakouts Indicate Potential Parabolic Pump Soon for Total 2 and 3 Charts.

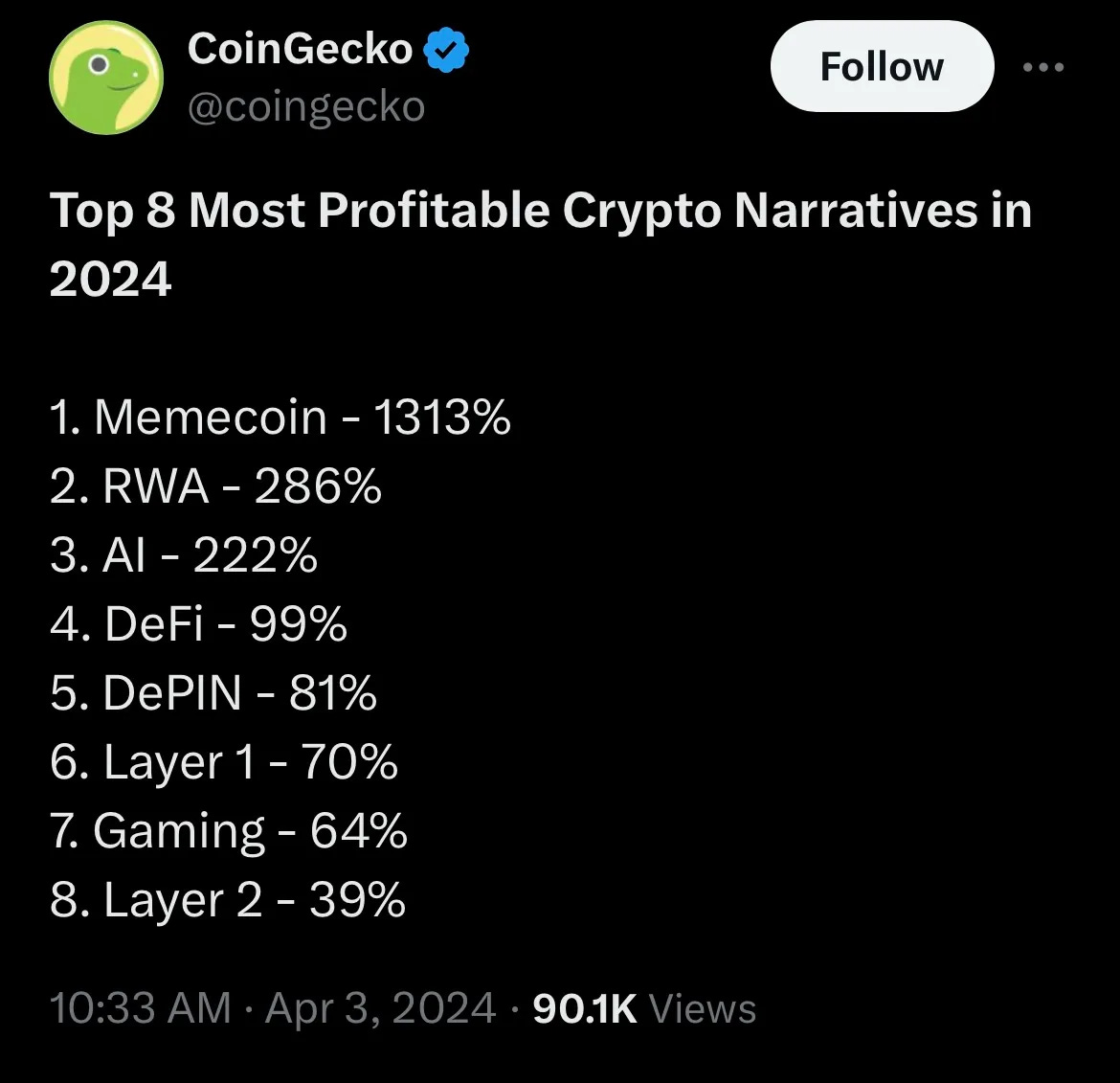

Why Are Memes Performing So Well?

Memes encapsulate the ethos of crypto like nothing else: they are decentralized, community-driven, and full of irreverence and humor. This unique blend makes them the perfect representation of the anti-establishment sentiment that also drives the cryptocurrency world. Memes, inherently viral and rapidly evolving, capture the essence of the internet’s culture and attention economy. They reflect the zeitgeist in real-time, often before traditional media can catch up, making them uniquely positioned to thrive in the fast-moving crypto markets. To give you an example Gamestop on Solana for example experienced an even greater pump than the stock itself rising over 1500% in a day and doing over 115 million in transaction volume for the whole Solana ecosystem. This is the most impressive feat of any Solana meme coin and in my opinion, solidifies the fact that Solana is King for memes at the moment.

Why Memes Will Continue to Outperform

As the digital and crypto landscapes evolve, so too does the role of memes. They are not just a reflection of Internet culture but have become a valuable asset in their own right. In an attention economy where speed and virality dictate success, cryptocurrencies associated with popular memes can see astronomical growth, much like viral internet content. This synergy between meme culture and crypto ensures that as long as the internet continues to cherish and spread these cultural icons, memecoin markets will likely prosper. Memes symbolize not only where the internet culture currently is but also where it’s headed. Their adaptability and speed are mirrored in the cryptocurrency movements, making them a fundamental component of the crypto market dynamics. If you are late to the Solana meme game you could consider looking at Eth Based memes, AI, or RWA-based projects to try and position early before the rotation from Sol memes.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.fyde.fi