Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - BTC 401ks, BAYC Hack, Stripe Crypto

💵 Weekly Fundraises - Rario, OxLabs, Certik

📊 Key Stats - Lido, Fuse, Binance

📝 Report Highlights - The Crypto Intelligence Report: Zcash

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

📈 Top Tokens of the Week - GMT, KNC, KAVA

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting an upcoming 55-minute webinar on crypto investing for family offices, wealth managers, and financial advisors, covering our thoughts on crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing, and mapping out the crypto hedge fund ecosystem. Register for free below.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week…

📈 Fidelity to Allow Retirement Savers to Put Bitcoin in 401(k) Accounts - Employees won’t be able to start adding cryptocurrencies to their nest eggs right away, but later this year, the 23,000 companies that use Fidelity to administer their retirement plans will have the option to put bitcoin on the menu. (Source)

💳 Stripe to Start Using Crypto’s Financial Rails for Payments Today - The payments giants will use USDC and Polygon, with Twitter as its first partner. (Source)

⚠️ Dozens of Pricey NFTs Stolen After BAYC Instagram Hack - The Instagram account belonging to NFT project Bored Ape Yacht Club (BAYC) was compromised Monday, paving the way for the theft of more than a dozen individuals’ digital valuables. (Source)

📈 80% of Institutions Bullish on Crypto, Survey Finds - Eight out of 10 institutional investors believe that crypto will overtake traditional investment vehicles within a decade, a survey by crypto exchange Bitstamp found. (Source)

🇦🇪 Kraken Receives Abu Dhabi’s First Virtual Asset Exchange License - The company announced that it has become the first exchange to receive a full financial license to operate as a regulated virtual asset exchange platform in the Abu Dhabi Global Market (ADGM). (Source)

🇵🇦 Panamanian Legislative Assembly’s Committee Approves Bill Regulating Crypto - The Panamanian Legislative Assembly’s economic affairs committee approved a bill on Thursday regulating the use of cryptocurrencies in the Central American country. (Source)

🇨🇫 The Central African Republic Reportedly Passes a Bill to Regulate Crypto Use - The crypto law aims to establish a favorable environment for the inclusive growth of the crypto sector in the region, reportedly allowing traders and businesses to make crypto payments and also make way for tax payments in crypto through authorized entities. (Source)

🇧🇷 Brazilian Crypto Asset Manager Hashdex Approved to List ETPs in Switzerland - Hashdex, a Brazilian crypto asset manager, has been approved to list exchange-traded products (ETPs) on the SIX stock exchange in Switzerland. (Source)

🇺🇸 US Citizens Are Moving Abroad to Sidestep Crypto Regulation, Law Firm Says - The number of US nationals looking to gain residency or citizenship abroad has spiked in recent years, according to a law firm — and crypto regulation is a prominent driver. (Source)

⚖ New York Bill Banning Proof-of-Work Crypto Mining Poised to Advance - A New York bill that would ban proof-of-work cryptocurrency mining for at least two years advanced Monday. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Lido’s Deposits Are Increasing to New ATHs (3.54M WETH)

2. 1M Wallet Addresses Are Active on FUSE and Have Completed More Than 63.5 Million Transactions

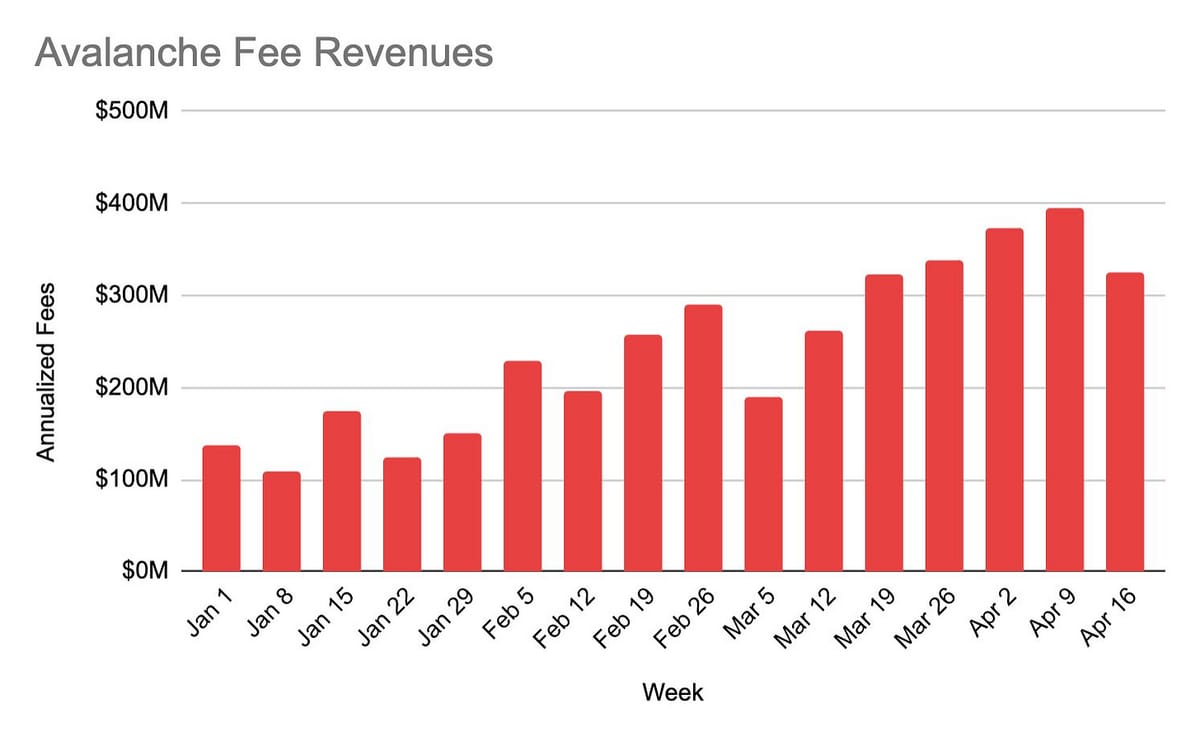

3. Avalanche Is Generating ~$400M in Annualized Transaction Fees, up Almost 3x YTD

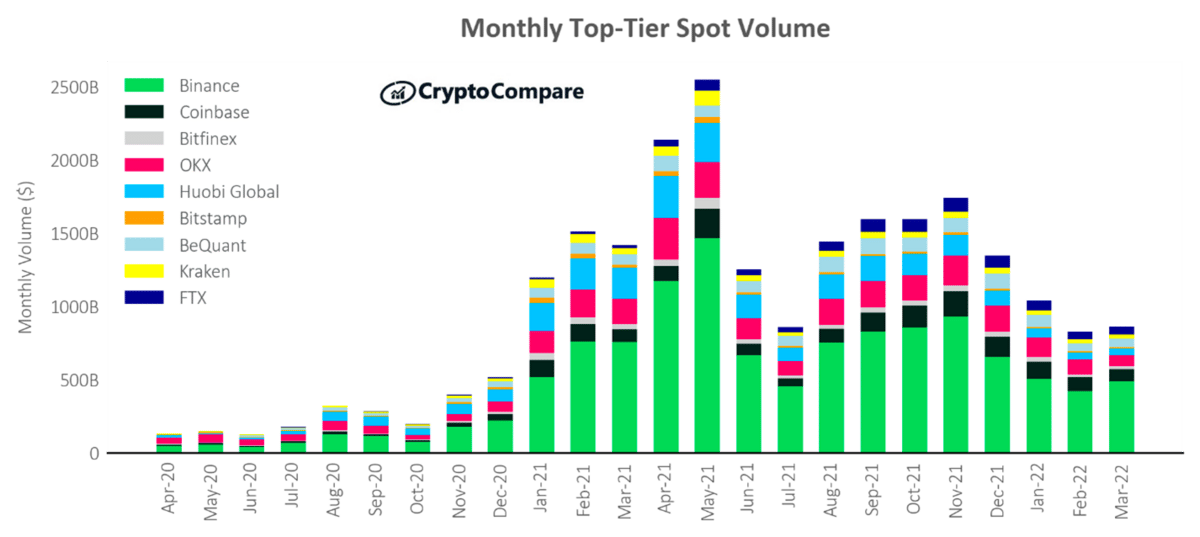

4. Binance Attains Over 30% Spot Volumes Market Share

5. Crabada, a Game on Avalanche Is Driving More Than 50% of TX Fees on the Network

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Crypto Intelligence Report: Zcash

About the Author: Stratmont Brothers is a European crypto trading fund achieving outsized returns with low drawdowns. They are known for their superior digital asset trading strategies that provide a secure vehicle for institutional investors. Equipped with a world-class intelligence department, they stay ahead of the curve and openly share their valuable insights. Stratmont Brothers mission is to create a better world for the next generations. You can subscribe to their Substack here.

About the Article: This is an excerpt from the full article which you can find here

Introducing Zcash

Zcash is a cryptocurrency network that was launched in October of 2016 by a software developer known as Zooko Wilcox-O'Hearn. Like other cryptocurrency networks (e.g. Bitcoin or Ethereum), Zcash allows anyone with a computer and an Internet connection to send and receive scarce tokens that can be used like cash on the Internet. The software that powers Zcash is directly derived from Bitcoin’s core software, but it has been modified in order to enhance user privacy.

The Zcash blockchain has its own cryptocurrency, known as ZEC. There is a maximum of 21 million ZEC coins. This blockchain can process transactions quicker than Bitcoin’s blockchain and is a lot more scalable, which means that it can process a lot of transactions at once. The members of the network who relay, validate, and bundle user transactions into blocks are, like in Bitcoin, commonly called miners. These miners are rewarded for honest participation with transaction fees and newly minted Zcash, and they must solve a difficult math problem (similar but distinct from Bitcoin’s mining algorithm) in order to earn the privilege of participation. As with Bitcoin, anyone can be a miner on the Zcash network, all they need is an Internet connection, a reasonably powerful computer, and free and open-source Zcash software. Zcash is an open blockchain network.

Growth Narrative

Bitcoin has been around for almost a decade, and by now many people have realized that it is not nearly as private or anonymous as many initially thought. That can be a good thing when it comes to catching criminals, but it can also be a bad thing for innocent users. In fact, Bitcoin’s current specifications make it almost impossible for an unsophisticated innocent user to have any privacy.

ZCash (initially known as ZeroCash), on the other hand, started out as a modified Bitcoin fork that additionally implemented zero-knowledge cryptography in how transactions are carried out across the network. Being in many ways more of a research-invested and involved experiment, with potential for a very wide variety of application implementations beyond just cryptocurrency (having academic cryptographers and institutions involved in the R&D, such as Israel's famous Institute of Technology, Technion - which, when thought about, also makes a lot of sense, given Israel) - as already witnessed by the widespread implementation of its ZkSNARKs (Succinct Non-Interactive Arguments of Knowledge) protocol in other cryptocurrency applications (e.g., Ethereum and others). This is unlike Monero, which is more of a community-run project, and also the reason why such a large portion of the mining rewards from ZCash go to the founders in order to finance further core scientific research (another example would be the BLAKE3 hashing function developed by ZCash founder Zooko Wilcox and others in January 2020, which is significantly faster than MD5 and SHA-1/2/3, additionally implementing some other very useful properties as it is itself a Merkle tree on the inside).

Development work on Zcash began in 2013 by Johns Hopkins professor Matthew Green and some of his graduate students at Johns Hopkins University and was completed by the for-profit ZCash Company, led by Zooko Wilcox (a well-known figure in the crypto space), raising over $3 million from Silicon Valley venture capitalists for the purpose. It was first mined in October of 2016 and currently implements an equihash type Proof-of-Work consensus algorithm.

Team

ZCash is a project of Electric Coin, a company focused on creating privacy-focused technical and scientific solutions for its customers. The board of directors is led by ZCash founder Zooko Wilcox, along with Andrew McLaughlin and Alan Fairless. The advisory board includes Ethereum founder Vitalik Buterin.

The team that worked on the original idea consisted of 7 scientists, including the following:

Alessandro Chiesa - UK Berkeley

Christina Garman - John Hopkins University

Eli Ben-Sasson - Technion

Eran Tromer - Tel Aviv University

Ian Miers - John Hopkins University

Madars Virza - MIT

Matthew Green - John Hopkins University

The core team currently working on the project is the ZCash Foundation, registered as a public charity. Its primary goal is to create a financial privacy framework that serves users of the ZCash blockchain, protocol and crypto-currency. The Foundation also provides policy and technical support for applications using zero-knowledge proof.

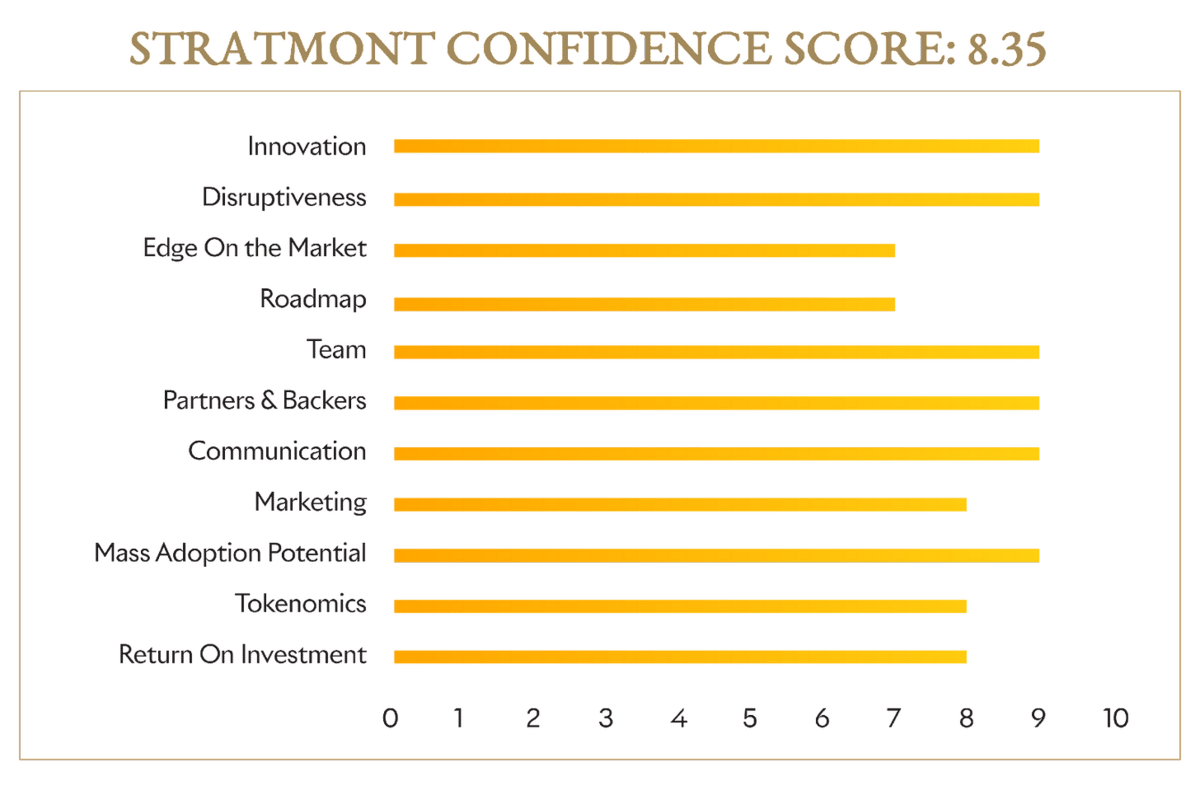

STRATMONT CONFIDENCE SCORE

Bloomberg Intelligence: Ethereum Crypto Research

Authors: Mike McGlone, Strategy- BI Commodity StrategistJamie Douglas Coutts, Market Strategy- BI Senior Market Structure Analyst

Ethereum - 21st Century Finance Building Block: BI Crypto

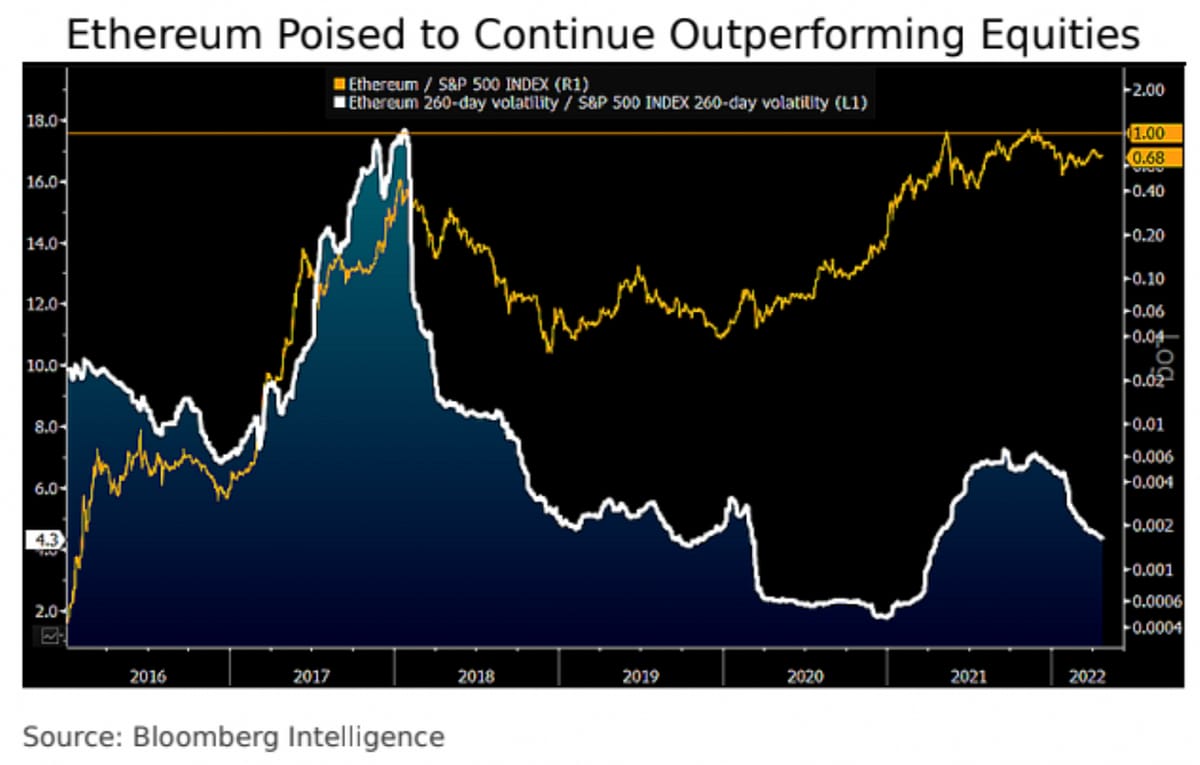

“Demand and adoption are increasing, supply is declining and Ethereum's position at the epicenter of the digitization of finance and money may be a foundation for further price appreciation. The No. 2 crypto -- the denominator for NFTs and top platform for tokenization -- appears well on its way to becoming the collateral of the internet, akin to Bitcoin's trajectory to be the global digital reserve asset. If successful, the proof-of-stake transition known as the "Merge" may transform cash flows to real-income generation, and help ease environmental concerns as the upgrade cuts energy consumption. A lot can go wrong to derail nascent technologies, and there's plenty of competition that may be a headwind, but Ethereum has passed the test of the 2021 protocol upgrade. That should help pave the way for the Merge.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Stepn is a Web3 Dapp, Kyber is a DEX, Kava is an L1, ApeCoin is a Governance Token.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 22,875 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.