Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - BlockFi, BlackRock, Russia

💵 Weekly Fundraises - Axelar, Rainbow, Solanalysis

📊 Key Stats - Eth Addresses, Sandbox, DeFi, Bitcoin

📝 Report Highlights - The Triple Halving: An Update

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

📈 Top 10 Tokens of the Week - CEL, THETA, EGLD

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Headline Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto quant fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting an upcoming webinar on crypto investing for portfolio managers, RIAs, family offices, wealth managers, and financial advisors covering our thoughts on crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing, and mapping out the crypto hedge fund ecosystem. Register for free below.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week...

⚡ BlockFi Agrees To Pay $100 Million Penalty and Pursue Registration of Its Crypto Lending Product - Company also agrees to attempt to bring its business into compliance with the Investment Company Act of 1940 within 60 days (Source)

😮 BlackRock Planning To Offer Crypto Trading - Clients would be able to trade crypto through the firm’s Aladdin investment platform, said one of the sources. (Source)

🏧 Russian Ministry Wants To Legalize Bitcoin Mining in Specific Areas - The proposal aims to recognize crypto mining as a commercial activity and introduce taxes on its realized profits. (Source)

💰 Japanese Stock Market JPX Exploring Blockchain Green Bonds - JPX announced it will explore using blockchain green bonds as part of its goal of becoming carbon neutral by 2024 by switching to 100% renewable energy. (Source)

🤑 US Rep. Josh Gottheimer Introduces Bill for Government-Backed Stablecoin Insurance - U.S. Representative Josh Gottheimer (D-N.J.) has introduced a bill establishing government-backed insurance for stablecoins. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

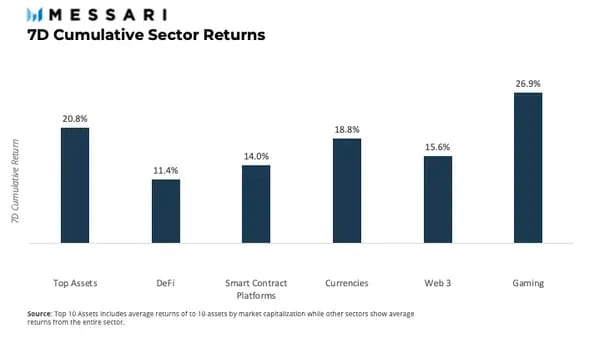

1. For the First Time in Over a Month, All Sectors Have Finished With Double-Digit Positive Returns For the Week

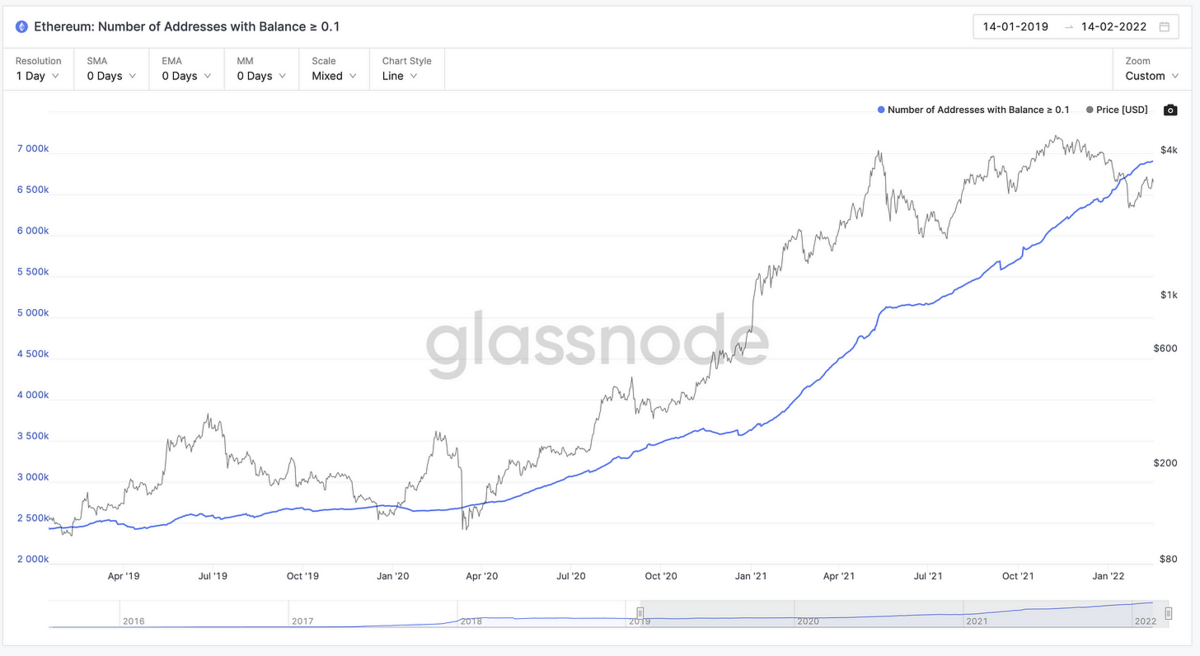

2. Number of Ethereum Addresses Holding 0.1 ETH Hits All-Time High, Nearing 7M addresses

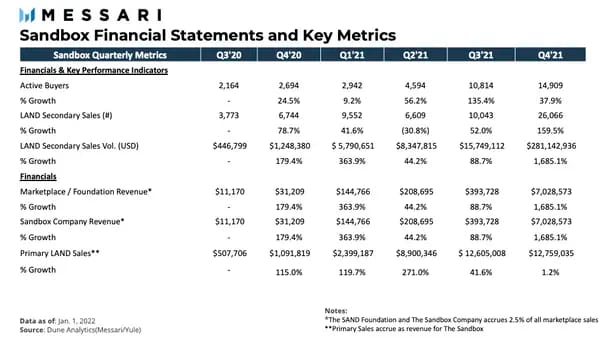

3. Sandbox’s Primary Sales Volume Remained Flat While Secondary Sales Volume Grew 1,685% Compared to the Prior Quarter

4. We’re Still Early in the On-Chain Adoption Cycle—DeFi Users Only Represent Around 2.3% of Total Unique Ethereum Addresses

5. The Number of Mentions for Bitcoin on SEC Fillings Closely Tracks Historical Price Cycles and Has Risen During Bull Runs

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Triple Halving: An Update

Squish Chaos, a pseudonym for an Ethereum researcher, updates his investment thesis for Ethereum.

"When I first wrote my report, 3.94M ETH had been staked. Today that has increased to 9.1M (+130%) ETH staked in the Beacon Chain. I expect this trend to continue for the next few months, and it will likely accelerate into the merge as reduced uncertainty around the merge date reduces the cost of locking up capital.

Another big change since my initial report is the maturation of multiple major staking derivative protocols. I wrote about Lido Finance fairly extensively in my report addendum, where I discussed the likelihood that I had dramatically underestimated the amount of Ether that would be staked. Now, however, we’ve also seen the rise of decentralized solution RocketPool to go along with centralized exchange staking solutions in Kraken and Coinbase."

"When I initially wrote my report, I was expecting EIP1559 to occur in July 2021 and burn ~30% of issuance. Today we know that EIP1559 was enacted in August 2021 and is burning 70% of issuance.

Well… did it work?

Absolutely. The intention of EIP1559 was to fix a wonky gas fee market by introducing predictable fees and reducing average transaction wait times. In doing so, we also got ultrasound money. Below we can see empirical research showing that EIP1559 has accomplished its goals in the gas fee markets.

How about the burn itself? The burn has been far, far more intense than we expected. In my report, I initially estimated a 30% fee burn, but as you can see below, we're at something more like a 70% fee burn right now."

"If 50M ETH were staked and fees were on the low end (5k), we would still expect yields of 3.3%. I downloaded the spreadsheet and tinkered a bit to find that if 50M ETH were staked and fees were on the high end (15k), yields would be 4.6%.

I’ll just pause and repeat that. 50M ETH would be staked - that’s more than 40% of today’s supply. That supply would be decreasing actively via EIP1559 induced deflation…and the yield would still be 4.6%.

Look around the market for assets yielding anywhere near that, and you’ll essentially be looking exclusively at value traps and junk bonds. With Ethereum, institutional investors will get the opportunity to invest in a large, liquid asset with a 4+% yield even once scaled which represents a bet on the future of the entire crypto market."

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

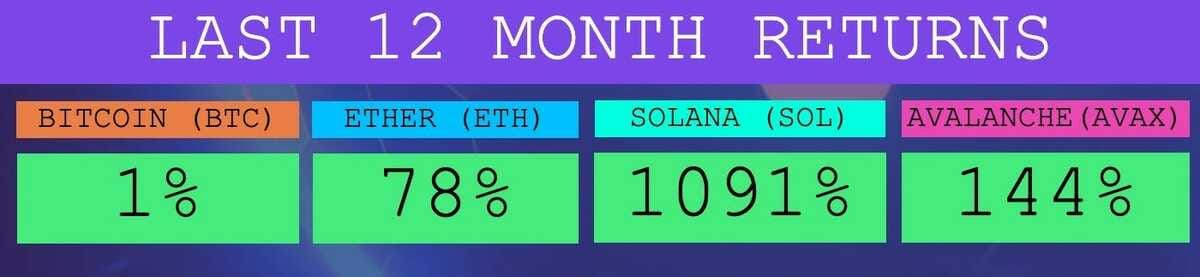

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

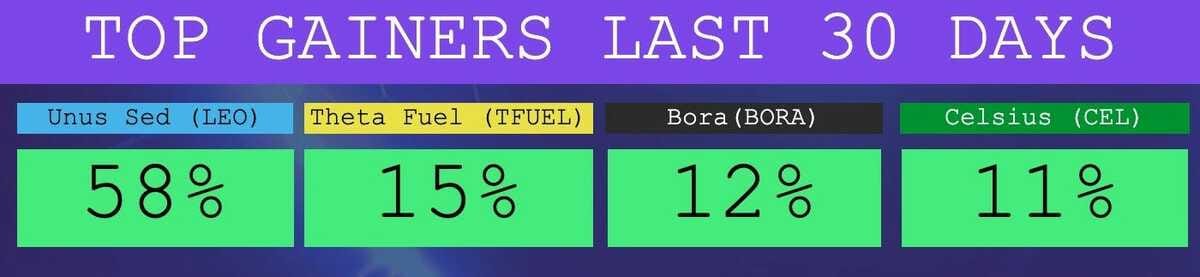

The Top Performers This Month from the Top 100: Unus Sed is an Exchange Token, Theta Fuel is a Utility Token, Bora is an Entertainment Platform, Celsius is a Money-Market Token

🎨 NFTs of the Week: Our Featured Collection

🎨LuvMonster NFTs - Collect Them Now

Here are the new LuvMonster NFTs from our official Coinstack featured artist Mrs. Bubble that you can buy at our special pre-sale prices of about $10.

These NFTs are individually hand painted and then digitized for some added magic — with special sound added. We now have 231 unique LuvMonster owners — and the community is growing weekly. We’ve added 45 new owners in the last week.

For early notification on drops, so you can get them daily at the earliest possible pre-sale prices, join the Discord and the Telegram Channel.

We will continue to feature these joyous NFTs here in Coinstack, building the community and collector-base each week.

Many of our early collectors are buying up the initial supply each day and then earning a profit by reselling the NFTs in the secondary markets. We love shared prosperity!

New NFTs This Week - Limited Pre-Sale Available Starting At 0.006 ETH on OpenSea

Here are the new NFTs launching this week. All nine of these have been handpainted by the artist then digitized.

🦘Featured 1/1 Mint on Ethereum, Kangaroo Mama

We also have a featured 1/1 Mint on Ethereum this week, LuvMonster #20, Kangaroo Mama. She is available for 0.2 ETH.

You can also join our Telegram group here and Discord group here for early NFT drop announcements.

Additional Coinstack Sponsors

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

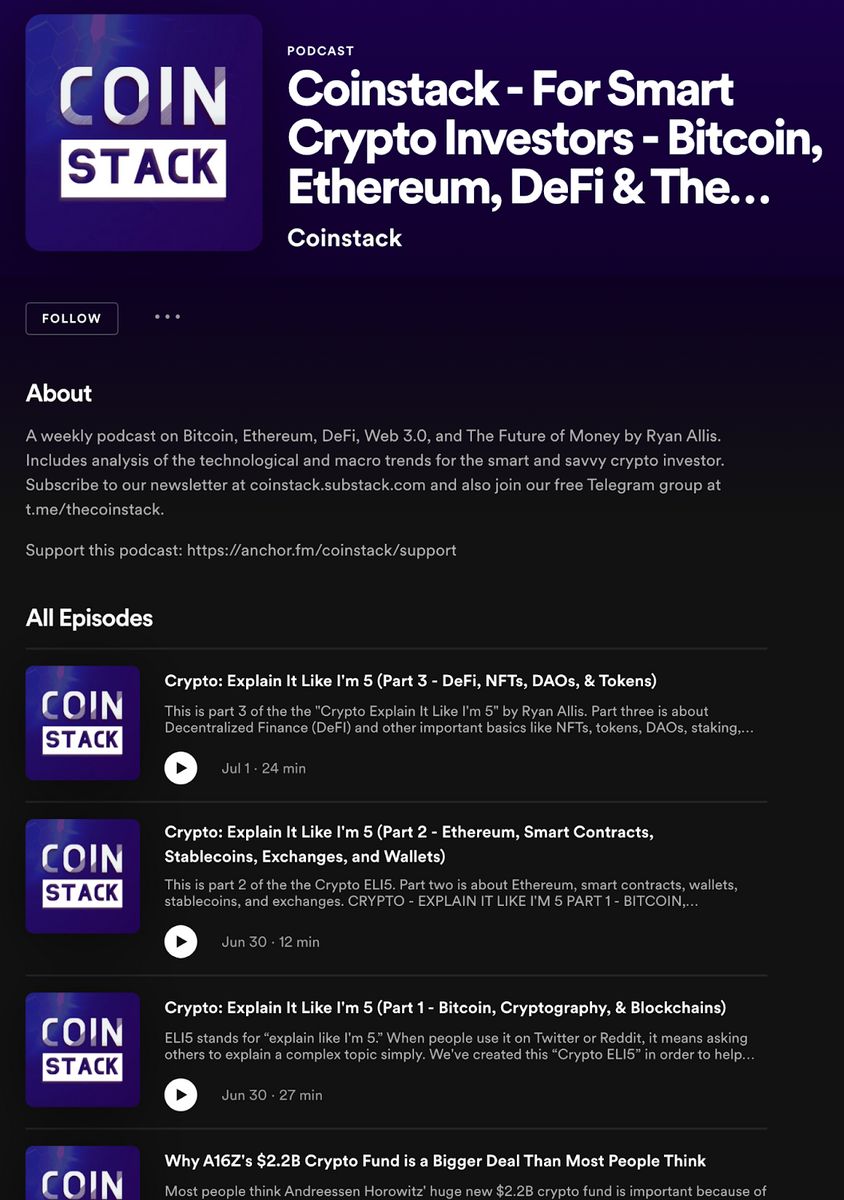

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 17,563 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

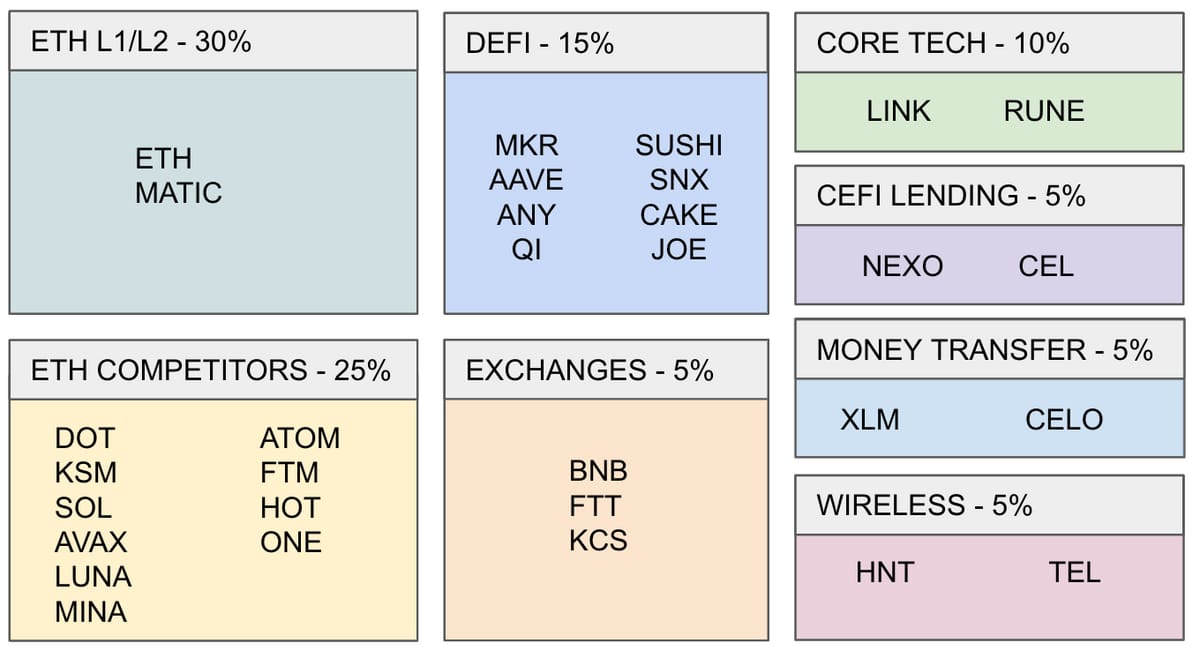

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.