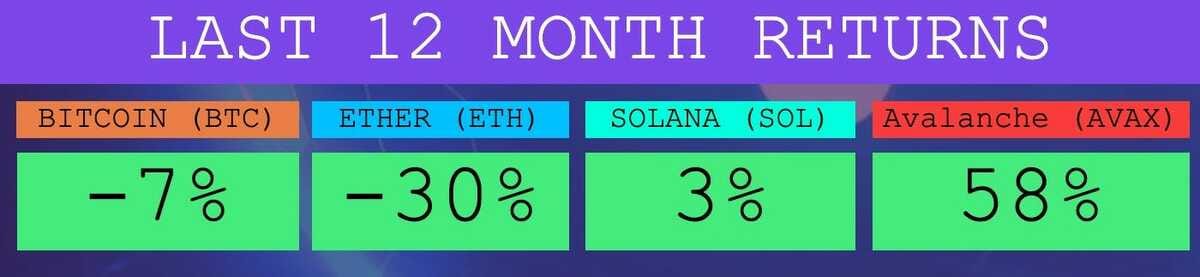

Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week the big news is the successful ETH testnet PoS merge and the new bi-partisan digital assets bill introduced in the U.S. Senate, the Responsible Financial Innovation Act (RFIA).

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - The ETH Testnet Merge, The Lummis Bill, SEC Probo of Binance’s BNB Token

💵 Weekly Fundraises - Pintu ($113M), Euler ($32M), Calaxy ($26M)

📊 Key Stats - Investment Inflows, ETH, Arweave

🧵 Thread of The Week - Senator Lummis Bipartisan Bill Breakdown

🌟 Peer’s Initial Coin Exchange (ICX) Debut: By Mike Gavela

📝 Report Highlights - Kraken Intelligence: May 2022 Market Recap & Outlook

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

📈 Top 10 Tokens of the Week - CENNZ, BEL, CRPT

Recent Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

🎆Ethereum Testnet Successfully Moves to PoS on June 8 - Ropsten, Ethereum's oldest testnet, has successfully competed its transition to proof of stake — as one of the final tests ahead of the merge on the main Ethereum blockchain, which is expected for August or September 2022 and will substantially reduce net ETH issuance and electricity usage after it is complete on ETH mainnet.

⚖ Bi-Partisan Digital Asset Bill Introduced to the U.S. Senate - Senator Cynthia Lummis (Wyo.) has introduced a major new bill called the Responsible Financial Innovation Act to expand the purview of the CFTC within the digital asset industry. See the thread of the week explaining the bill below.

⚠️ US Probes Binance Over Token That Is Now World’s Fifth Largest - US regulators are investigating whether Binance Holdings Ltd. broke securities rules by selling digital tokens just as the crypto exchange was getting off the ground five years ago.

🖊️ Lawmakers Introduce Bill to Include Crypto in Congressional Disclosures - Representatives Elissa Slotkin (D-MI) and Dusty Johnson (R-SD) have introduced a bill requiring Congress members to disclose financial interests in crypto.

🚫 New York Legislature Approves Bill to Limit Cryptocurrency Mining - New York could become the first state in the nation to curtail Bitcoin mining after state lawmakers approved a two-year moratorium early Friday. It’s unclear if NY Governor Hochul will sign or veto the bill.

🇯🇵 Japan Passes Stablecoin Bill Aimed at Protecting Crypto Investors - The upper house of Japan's parliament has just passed a landmark law clarifying the legal status of stablecoins, essentially defining them as digital money, per a Bloomberg report Friday.

🇧🇲 Bermuda Doubles Down on Crypto Despite Recent Market Turmoil - Bermuda, long known for its offshore insurance and reinsurance industry, is betting its transparency around digital-asset regulation can help it attract more cryptocurrency projects and firms, despite the recent turmoil in crypto markets.

🇸🇻 El Salvador Still not Ready to Launch Bitcoin Bond, Finance Minister Says - El Salvador's leaders still do not think it is the right time to launch its highly-anticipated bitcoin bond, finance minister Alejandro Zelaya said during a national television news show on June 1, citing market conditions following the war between Russia and Ukraine.

🇨🇳 Hong Kong Securities and Futures Commission Calls for Regulation of NFTs - The Hong Kong Securities and Futures Commission (SFC) published a statement on Monday that defined which NFTs fall under its mandate while advising investors to be mindful of regulated securities.

🌟Peer Aims to Reinvent the ICO with the New ICX Standards - Peer Inc., the Web3 social network and blockchain-based metaverse ecosystem for the future of computing, announced an alternative to the Initial Coin Offering for later stage more established projects.Share Coinstack

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

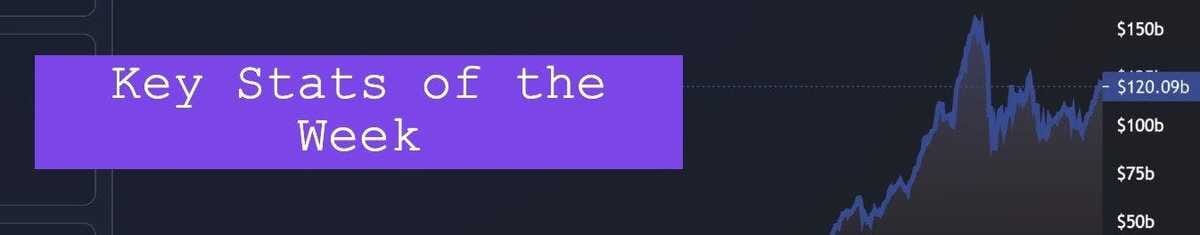

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Digital Asset Investment Products Saw Inflows Totaling $100M Last Week Showing Positive Investor Sentiment

2. Numerous Studies Indicate That, Even by the Most Conservative Estimates, PoS Will Reduce Ethereum’s Energy Use by 99%+

3. The Arweave Weave Has Grown to Over 65 TB of Data; an Impressive 8x Increase Since April 2021

4. Although TVL Has Not Grown Recently As We Are in a Bear Market, the DeFi Ecosystem Has Diversified Significantly As More Dapps Have Been Launched

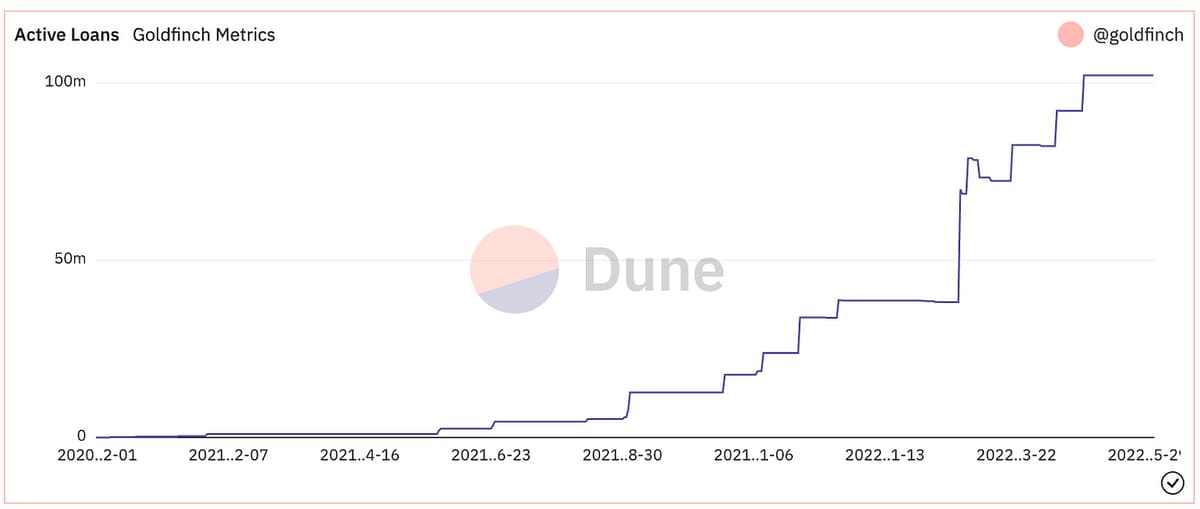

5. In Just Over a Year Old Goldfinch Has Surpassed $100M in Active Loans Across 28 Countries

🧵 Thread of the Week - The Senate Bill from Sen. Lummis - The

1/ Senator Cynthia Lummis @CynthiaMLummis has officially released her landmark bill covering #Bitcoin and digital assets.

Here are the major points in the bipartisan bill introduced with Senator Gillibrand @SenGillibrand.

A thread 🧵…

2/ Medium of Exchange

The bill encourages the usage of #bitcoin and digital currencies as a medium of exchange. It provides a tax exemption for transactions of up to $200.

3/ Commodity or security?

The bill defines a framework for differentiating which digital assets are commodities and which are securities. It uses the Howey test to determine that an ancillary asset is *not* inherently a security…

4/…An ancillary asset is an intangible, fungible asset that is offered, sold or provided to a person in connection with the purchase and sale of a security through an arrangement or scheme that constitutes an investment contract. So…

5/…To be classified as a security, the digital asset must provide the holder with a debt or equity interest in a business entity, liquidation rights or entitlement to interest or dividend payments from a entity, profit or revenue share in an entity…

6/…derived “solely from the entrepreneurial or managerial efforts of others,” or any other financial interest in the entity. But there is another aspect to it…

7/ Digital assets not fully decentralized and which benefit from entrepreneurial and managerial efforts that determine the value of the assets but are not debt or equity or don’t create rights to profits or other financial interests in a business entity are NOT securities if…

8/…*if disclosures are filed with the SEC twice a year.*

The presumption that an ancillary asset is a commodity can be appealed in court. So if the SEC wants to claim that a given digital asset is a security and not a commodity, it needs to go to court.

9/ In sum, the majority of large digital assets would be classified as commodities under the text introduced by @SenLummis and @SenGillibrand.Naturally, the SEC will oversee the securities whereas the CFTC will regulate the commodities. BTC & ETH are guaranteed as commodities.

10/ CFTC

Lummis-Gillibrand grants the CFTC exclusive spot market jurisdiction over all digital assets classified as commodities.Exchanges will register with the CFTC to conduct trading activities and abide by some rules.

- U.S. #bitcoin spot ETF more likely if bill approved.

11/ SEC & CFTC

Are tasked with studying and reporting on the creation of a self-regulatory organization (SRO) that could complement the regulatory work.

They also are tasked with developing a set of cybersecurity guidances for digital asset service providers.

12/ Energy

The bill also requires a study on the power consumption of digital assets.

It’ll seek to determine the best ways to ensure #Bitcoin helps society move closer to climate goals w/ deployment of more renewables and clean energy, and reducing energy waste.

13/ Miners

The bill provisions that miners are not to be seen as brokers and #bitcoin obtained from their activities is not to be treated as income until converted into fiat currency like dollars. It also specifies that digital asset lending agreements are not taxable events.

14/ 401(k)

The bill requires the Government Accountability Office (GAO) to analyze the opportunities and risks associated with investing in #bitcoin and digital assets with retirement accounts. Findings are to be reported to Congress, Treasury Department and Labor Department.

15/ Consumer Protections

The bipartisan bill will require providers of digital assets to disclose information about their product, including source code versioning and the legal treatment of each digital asset. Also…

16/ Self-custody

The bill grants the right to a person to keep and control the digital assets they own. 🔒

17/ Other provisions include aspects on stablecoin, an advisory committee, and clear definitions for the digital asset space. Catch a more detailed breakdown in my latest article for Bitcoin Magazine

Peer Launches ICO Alternative for Vetted Blockchain Projects Called the ICX

By: Mike Gavela

Peer, a Web3 social network and blockchain company, recently announced an alternative to the Initial Coin Offering (ICO) called the Initial Coin Exchange (ICX). The ICX provides a framework for an evidence-based fundraising standard for established blockchains and decentralized apps that promotes responsible innovation, global participation, and rapid validation.

ICO stands for "initial coin offering" and refers to a formerly popular method of fundraising capital for early-stage cryptocurrency projects. In an ICO, a blockchain-based startup mints a certain quantity of its native digital token and offers them to early investors. In contrast to initial public offerings governed by strict legal regulations, ICOs require only a white paper and some exciting features, such as a lack of barrier to entry, a scope for exponential growth, absence of geographical barriers, and easy validation. A 2018 Satis report prepared for Bloomberg stated that almost 80% of ICOs at the time were believed to be fraudulent sales."

Peer looks to evolve beyond the ICO and bring investor confidence back to the investor community regarding early-stage crypto investing. As it stands, an initial coin offering requires very little to launch and raise capital. In an ICX, a token offering must have day one utility, and the company or lab offering the token must have some IP moat. The offering must follow the securities laws and regulations of its current jurisdiction. Peer has partnered with Verifyinvestor.com for its KYC verification for the US accredited investors. Peer views an ICX as the funding stage between collecting checks from angel investors and preparing for a seed round being led by a VC.

Essentially, an ICX is for crypto companies and projects which are past the prototyping phase and are looking for their next round of funding before seeking seed-stage investors. An ICX involves a token that can be fully used on day one and is not just some pie-in-the-sky idea or whitepaper filled with marketing fluff. The company must have proven and demonstrable substance through an IP-moat and follow the rules and regulations of its jurisdiction. Peer expects to launch the world's first ICX on June 27, 2022, via its purpose-built platform.

You can follow Peer on Twitter at @peerpmc and sign up for their late June PMC token launch waitlist here.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Kraken Intelligence: May 2022 Market Recap & Outlook

About the Author: Kraken is the world’s largest global digital asset exchange based on euro volume and liquidity. Kraken’s global client base trades over 90 digital assets and 7 different fiat currencies.About the Article: This is an excerpt from the full article, which you can find here

ETH's market activity during May 2022 closely mirrored that of BTC. ETH hit a 10-month low of $1,724 on May 27th, before rebounding and ending the month at $1,944. ETH recorded a loss of -29%, larger than BTC's -16% loss for the month.

ETH's annualized volatility started off the month at 59% and closed the month at 100%, a 7-month high.

The long-awaited Ethereum 2.0 update, the "Merge," is on track to go live in August 2022. The Merge is the next major step in Ethereum's migration to Ethereum 2.0 that will transition the network from proof-of-work to proof-of-stake. On May 30th, Ethereum Foundation developer Tim Beiko announced that the Ethereum Foundation launched a new Beacon Chain for the Ropsten testnet. The launch is part of a test run slated for June 8, 2022, serving as a beta environment for the Merge. Ropsten testnet simulates the environment of the Ethereum mainnet but will not impact it. OpenEthereum, one of the most popular Ethereum clients, ended support for its software this month in anticipation of the Merge.

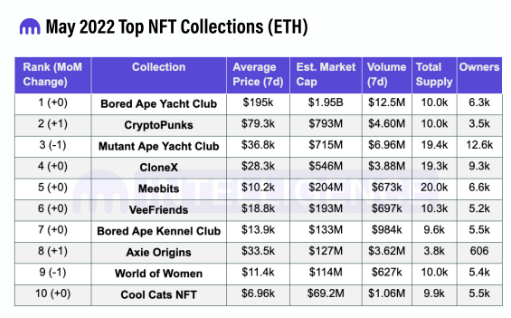

In line with overall crypto market performance, activity in NFT markets slowed down in May. Daily users and daily transactions were relatively flat at -7% and +1.1% MoM, respectively. However, NFT volume saw a significant decrease, with daily volume dropping by 87.1%.

Innovation & Developments

Kraken announced a waitlist for its upcoming Kraken NFT marketplace. Kraken NFT features zero gas fees for trading activity, built-in tools to track rarity scores for NFTs, buy and list NFTs for cash or crypto, access to NFTs across multiple blockchains, and industry-leading security, and Creator Earnings to reward artists and innovators.

The National Football League (NFL) partnered with Mythical Games to launch its own play-to-earn game that will run on the Mythical Chain protocol. The launch will kick off with the sale of 32 franchise-themed NFTs. Capital Raises.

Dapper Labs launched a $725M fund that will back projects native to the Flow ecosystem. Andreessen Horowitz launched a $600M fund that will back metaverse gaming projects. Other capital raises this month include BAYC ($285M), NCG Ventures ($100M), Zora ($50M), N3TWORK Studios ($46M), Irreverent Labs ($40M), Co:Create ($25M), Arianee ($21M), Branch ($12.5M), Highlight ($11M), Cometh ($10M), Nyan Heroes ($7.5M), UnicornDAO ($4.5M), and Ready Games ($3M).

To gauge sentiment among whales throughout May, we look to the amount of BTC and ETH held in whale wallets. Note that we define a "whale" as a wallet with more than $1,000 or =10,000.

It was a relatively quiet month for BTC whale activity. The amount of BTC held by whales decreased slightly from $8.07M to $8.04M MoM, and the number of BTC whales decreased from 2,280 to 2,212.

On Ethereum, changes in whale activity notably spiked on May 10th, when the amount of ETH held by whales hit a high of E81.8M before falling sharply to end the month at =81.6M. Similarly, the number of ETH whales started off at 1,302 and spiked mid-month, but closed at 1,308, remaining largely unchanged from the beginning of the month.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

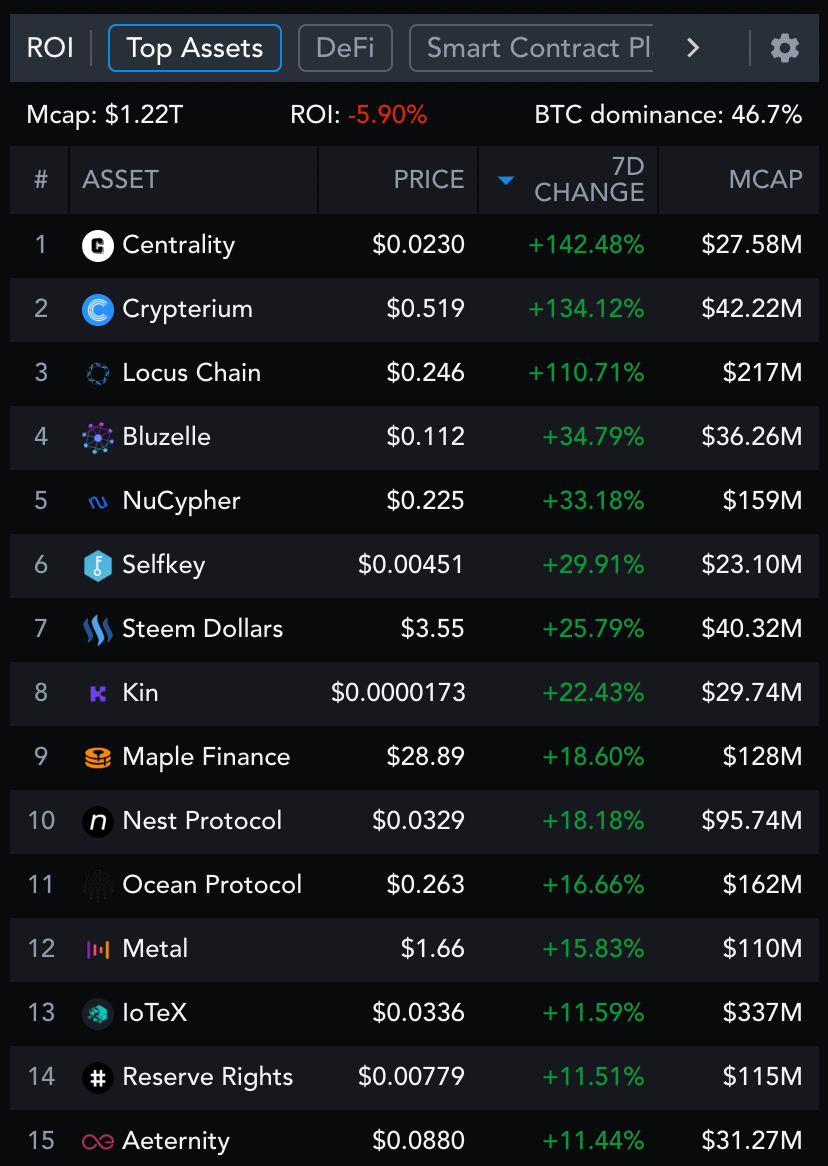

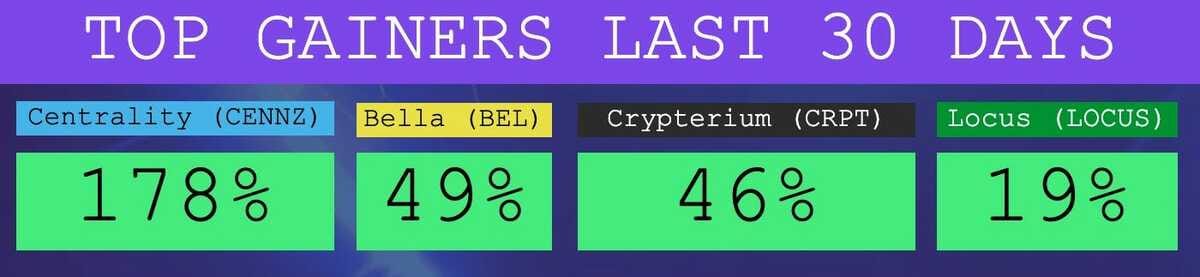

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Tron is a Venture Studio, Bella is a DeFi Dapp, Crypterium is a Wallet, Locus is an L1.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 25,019 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.