Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - LFG Spent $3B Propping Up UST, Do Kwon Requests Terra 2.0, Lido Increases Liquidity Incentives

💵 Weekly Fundraises - Fortis Digital ($100M), Elwood Capital ($70M), Certoga ($36M)

📊 Key Stats - ENS, ETH, Q1 Funding

📝 Deep Dive: Celo’s Push Into Regenerative Finance - By Mike Gavela

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

📈 Top 10 Tokens of the Week - LOCUS, ANJ, TRX

Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

💰 Luna Foundation Guard Spent $3B in Unsuccessful Bid to Defend UST Peg - On May 7, the Luna Foundation Guard (LFG), the reserve fund for the Terra ecosystem, controlled over $3.1B in assets. Today, it holds just $87M. See last week’s issue for a breakdown of what happened to UST.

⚡ Do Kwon wants to Save Terra by Creating a New Chain with 1B of Tokens for LUNA and UST Holders - Do Kwon, the maligned founder and CEO of TerraForm Labs, has posted a plan to fork the Terra blockchain and distribute 1B of a new token to stakeholders in the Terra ecosystem, forming the basis for what is being called Terra 2.0.

💧 Lido Increases Liquidity Incentives as stETH Trades at Discount to ETH - The stETH pool, which pairs ETH with a staking derivative of ETH, shows stETH trading at a 4.7% discount to ETH.

🇨🇳 New Data Confirm that Many Bitcoin Miners Kept Operating in China Even After the Ban - Following China's crackdown on bitcoin mining last year, many of miners were seemingly plugged back into the network by September 2021, according to the most recent data from the Cambridge Centre for Alternative Finance (CCAF).

🇸🇻 El Salvador’s President Promotes Bitcoin Adoption by Emerging Countries - As host of an annual meeting of the Alliance for Financial Inclusion (AFI), El Salvador President Nayib Bukele is promoting the use and adoption of bitcoin to 32 central banks and 12 financial officials representing emerging economies.

🇬🇧 UK Proposes Regulations that Would Recognize Stablecoins as a Form of Payment - Despite the recent collapse of Terra’s UST stablecoin, the U.K. government will move forward with proposed regulations that would facilitate stablecoins’ use “as a recognised form of payment,” according to a report from The Telegraph.

🇧🇷 Brazilian Stock Exchange to Begin Trading Bitcoin Futures this Year - The Brazilian stock exchange, known as B3 (Brasil, Bolsa, Balcão), will begin trading futures contracts for bitcoin within the next three to six months, according to a report from Valor.

🇦🇺 Australian Tax Office Cautions Crypto Investors to Declare Capital Gains - The agency will focus on four areas: record keeping, work-related expenses, rental property income and deductions, and capital gains from crypto assets, property, and shares.

🇵🇹 Portugal May Move to Tax Crypto Gains Soon - Portuguese Finance Minister Fernando Medina has confirmed that his government is studying how to tax crypto gains in the country.

💸 UST’s Collapse Might Push Central Banks Closer to a CBDC - The ongoing TerraUSD meltdown might be the final push central bankers need to more seriously consider establishing a central bank digital currency, some industry experts say.

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size… even in a rough week there were still many big deals…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

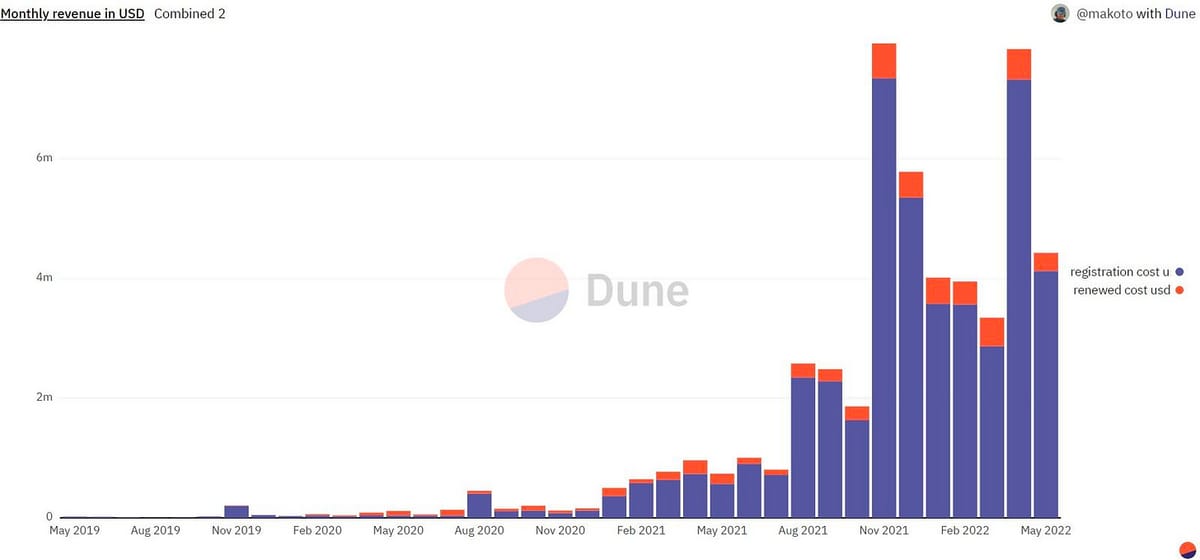

1. In April 2492, ETH ($7.3M) Was Spent Registering ENS Names. 169 ETH ($510K) Was Spent Renewing Them

2. Ethereum Addresses Holding 10+ ETH Just Hit a 16-Month High.

3. There Was a Total of $9.2B Invested in Blockchain Companies in Q1, a New All-time High

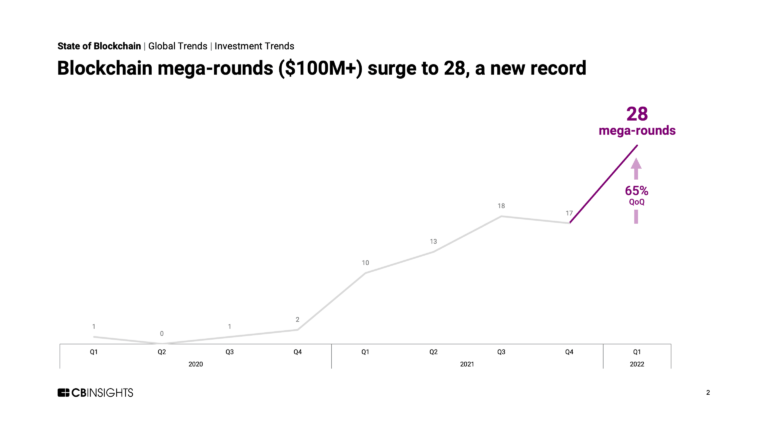

4. There Were a Total of 28 VC Rounds of $100M+ in Q1 – Up 65% From Q4

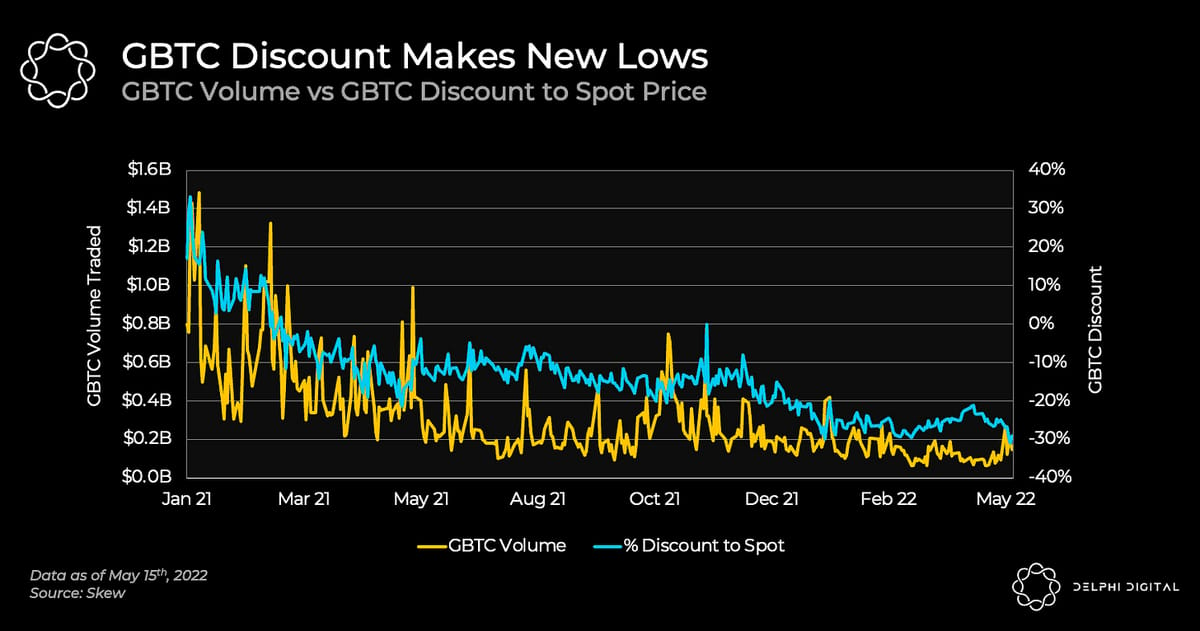

5. The GBTC Bitcoin Discount Deepened Late Last Week to a New Low of -30.8%

6. DeFi’s TVL Today Would Represent the 31st Largest Bank in the US

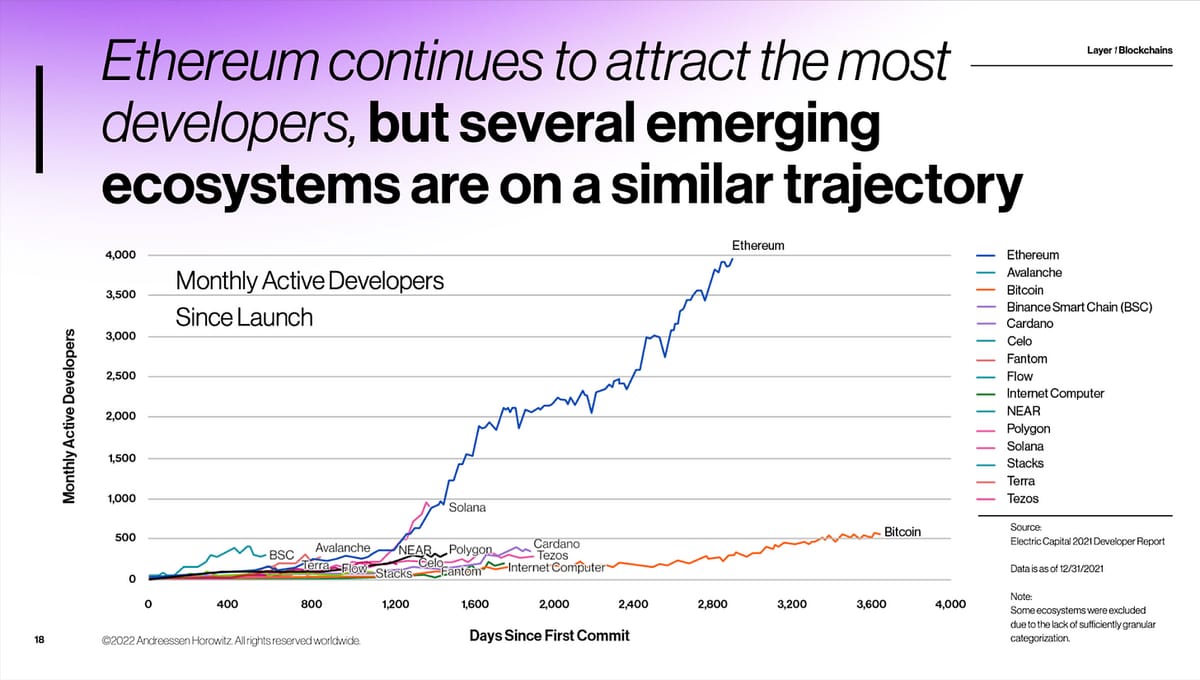

7. As Far As Developer Interest, Ethereum Has the Most Builders, With Nearly 4,000 Monthly Active Developers.

🏦 Celo - Leading the Pack in Regenerative Finance (ReFi)

By Mike Gavela

Celo's mission is to build a world of prosperity for all. They plan on achieving that mission by creating a new story of money. One that removes the invisible hand from society and builds a regenerative engine for social good.

The idea came from Charles Eisenstein’s book Sacred Economics: if you back the money with more of the things you want to see in the world, you’ll get more of those things. ReFi stands for regenerative finance and the Celo team is committed to powering the future of regenerative economics through their protocol.

Below are a few examples of projects that are building the next generation of ReFi applications on Celo.

Flow Carbon is tokenizing carbon credits to bring them on-chain and help basically get, the flow of capital back to the projects that need the capital in order to continue doing planet saving work faster.

Climate Collective, a coalition of companies, products, protocols on the ground projects, innovation networks, in fact, 1000 web three entities who are committed to combating and reversing climate change.

Toucan Protocol, building web3 building blocks for the regenerative economy. They have about 20M carbon credits that have been tokenized and are running on the Toucan meta registry right now. They have a vision is to build regenerative actions into the fabric of our financial system. So that just by having money and holding money and using money, we're flowing value to taking care of the earth.

Astro Protocol, is building tools to work with spatial and location data that will underpin web3 as well as a lot of regenerative finance protocols that use spatial and location data to back these environmental assets.

Phil Fogel from Flow Carbon explains during Celo Connect how ReFi is powered by web3 technology.

“Fundamentally, what a carbon credit and other agricultural credits our database entries. Those database entries are stored in SQL databases that are permissioned and controlled by centralized parties who decide who can and cannot have access to them. Web three and blockchain technology opens up entirely who has access and the level of transparency and liquidity that can be brought to these credits at the deepest fundamental level. You know, anytime you have an owned database entry, we should just call it a token. And obviously, we've all been in the web three space for a long time, but everything should be tokenized. But carbon credits and agricultural credits, in particular, are some of the best use cases for blockchain technology, because it just creates a true transparency layer into where those credits came from, where they're going, and who is using them, and also opens up the access to who can control them. It is almost impossible for an individual and most corporate entities to actually have custody of carbon credits. And so, therefore, their ability to use them is limited by the ability of others to provide a conduit to them. So there is a huge friction layer where people are rent-seeking in the industry. And so that money is not getting back to the project and the people creating the credits.”

Celo Overview

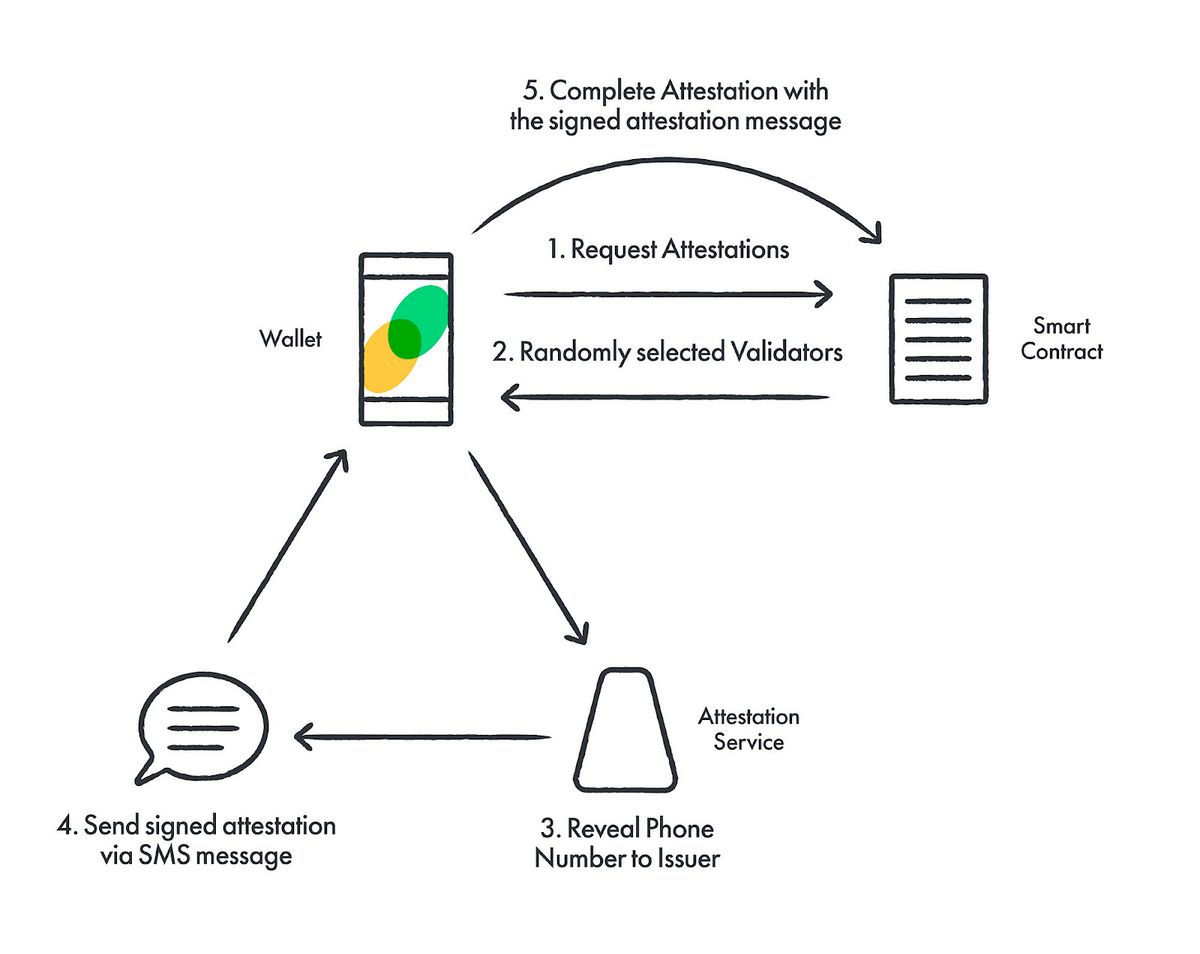

Celo is a blockchain protocol that aims to address some barriers to crypto-asset adoption by using phone numbers as public keys and issuing a native stable-value token. The network supports the development of smart contracts and decentralized applications. Its first application, Celo Wallet, intends to be a social-payments system centered around mobile phones.

Celo is an EVM-compatible smart contract layer one blockchain. Celo is a mobile-first platform that makes financial Dapps or decentralized applications and crypto payments accessible to anyone with a mobile phone, focusing on third-world countries or banking the unbanked. Anyone who has a mobile phone can now access crypto, cross-border payments, and all the decentralized apps that live on Celo in a permissionless, censorship-resistant, and trustless way.

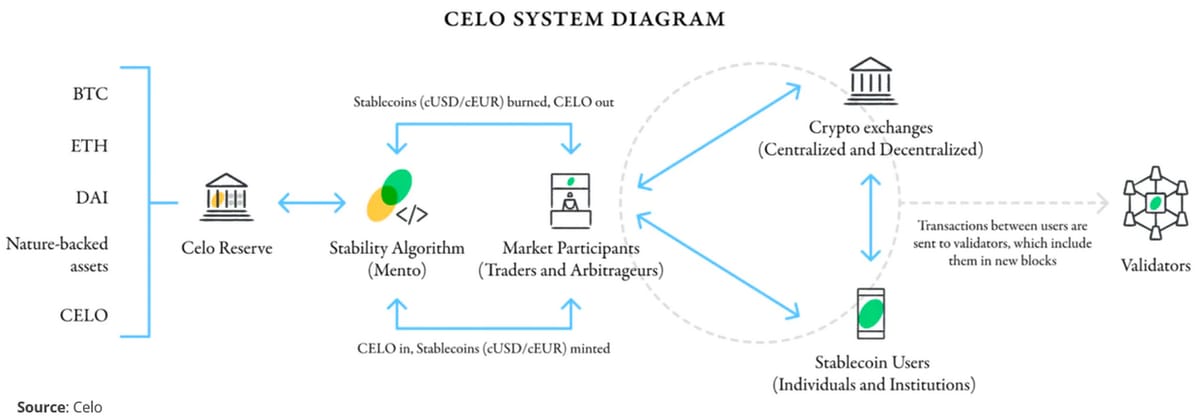

Celo features two primary crypto assets: Celo (CELO) and Celo Dollars (cUSD). Celo (CELO) is the protocol's native asset and governance token. It serves as a utility that enables users to participate in network consensus (through its Proof-of-Stake system), pays for on-chain transactions, and votes on governance decisions. cUSD and cEUR, are Celo's stablecoins maintained using a two-pronged approach. The first is Mento, a one-to-one stability mechanism that utilizes Celo's native token. The second is keeping an over-collateralized reserve of assets within the CeloReserve.

Mento is a stability algorithm and AMM. Mento allows user demand to determine the supply of Celo stable assets by enabling users to create, for example, a new Celo Dollar by sending 1 US Dollar worth of CELO to the reserve or to burn a Celo Dollar by redeeming it for 1 US Dollar worth of CELO. This mechanism creates incentives for market participants to maintain the peg for Celo Dollars (cUSD) or Celo Euros (cEUR) by taking profits whenever deviations from the peg occur.

When demand for the cUSD rises and the market price is above the peg, users can profit by buying 1 US Dollar worth of CELO on the market, exchanging it with the protocol for 1 cUSD, and selling that cUSD for the market price. Similarly, when demand for cEUR falls and the market price is below the peg, users can profit by purchasing cEUR at the market price, exchanging it with the protocol for 1 cEUR worth of CELO, and selling the CELO to the market.

Celo’s stablecoins are also backed by the Celo Reserve to ensure the healthy velocity of stablecoins that circulate and transact on Celo. The Celo reserve is a diversified portfolio of crypto assets supporting the ability of the Celo protocol to expand and contract the supply of Celo stable assets in-line with user demand.

Celo leverages a basket of diversified cryptocurrencies held as reserves to support the peg of its stablecoin family. The current composition of the reserve is determined by governance voting, and this stability mechanism can thus be defined as a hybrid crypto-collateralization / seigniorage-style model.

Celo - 6 Month Update

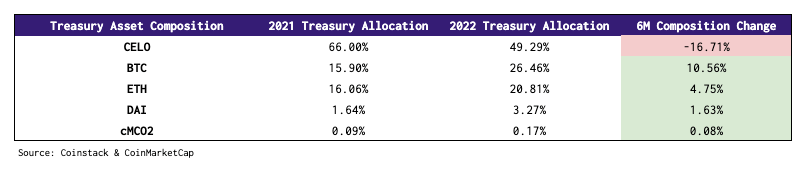

The governance community altered the treasury composition since we last wrote about Celo ~6 months ago. At the time of writing, Celo's treasury currently has $472,118,326 in reserve holdings or 4.26x the outstanding supply of its stablecoins.

Celo has increased its BTC, ETH, and DAI holdings since then, strengthening its treasury diversification.

Given the current bearish sentiment of the crypto markets, it is of no surprise that the Celo governance community voted on lowering their reserves in their native token in favor of BTC and ETH as well as increasing their position in DAI.

On December 15th, 2021, the Celo community voted to add cREAL to Celo's growing family of platform-native stablecoins. Brazil is one of the fastest-growing and largest crypto markets globally, and approximately 30% of its population now own cryptocurrency. The rise in cryptocurrency adoption over the past three years — combined with the local demand for a decentralized stablecoin — inspired community-led solid interest in the launch of cREAL. That interest grew and culminated in a formal Celo governance proposal to activate cREAL, which passed in December 2021. cREAL is now being accepted in over 50% of POS systems overall in Brazil, signaling the mass adoption potential for Celo's stablecoin family.

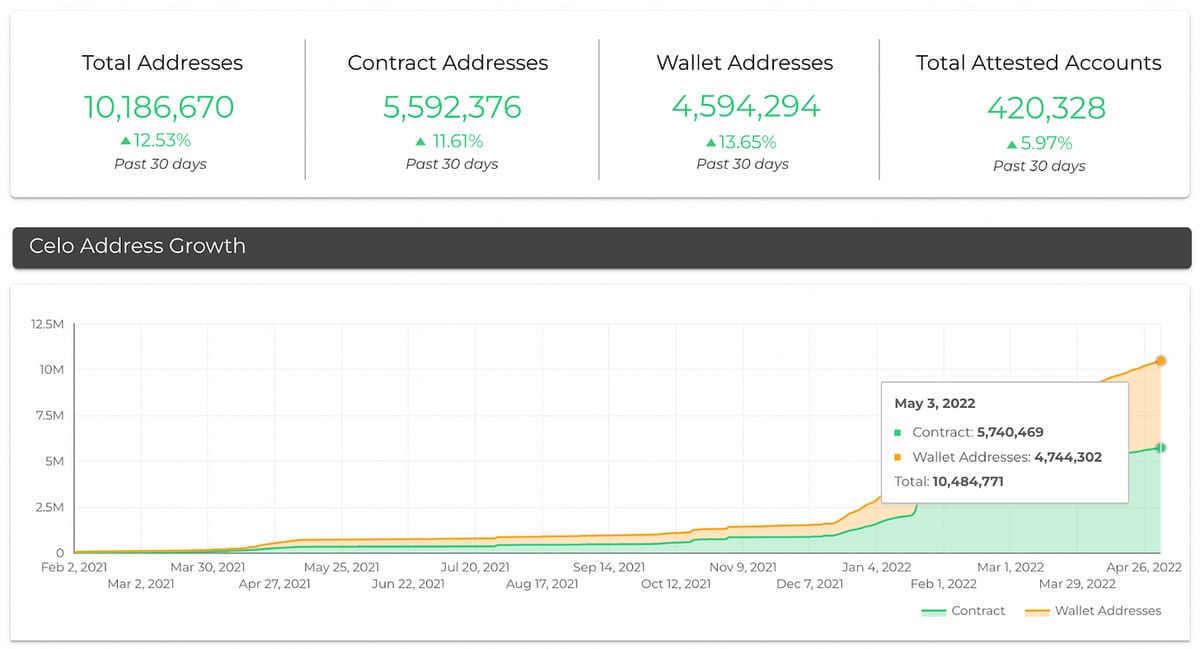

Regarding network growth, Celo has seen explosive activity year to date, with Smart Contracts on the platform increasing by 3.8x and wallet addresses increasing by 4x.

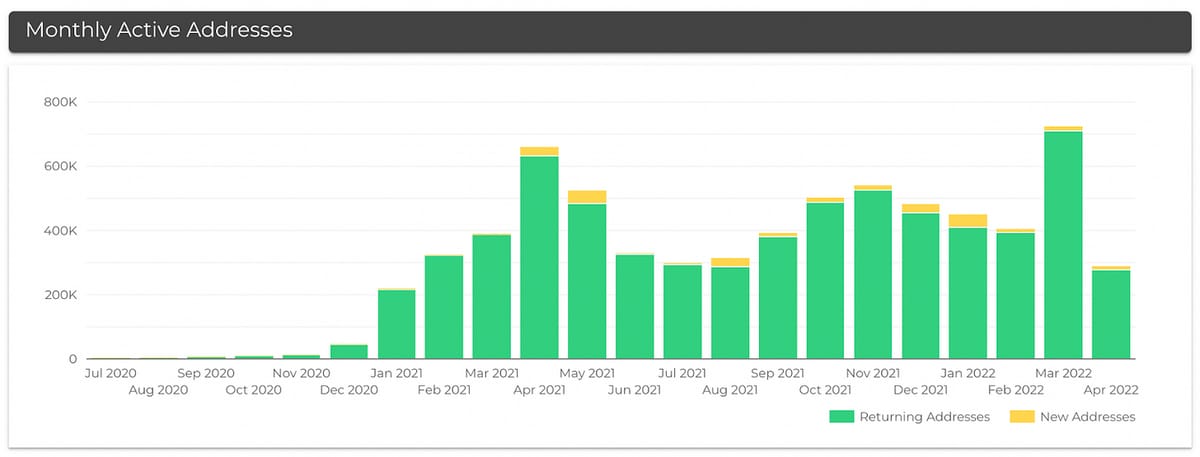

Celo's network activity also shows traction amongst protocol users, with ~300k Monthly Active Addresses returning addresses. What caused this absolute spike in network traffic and smart contract activity was Kickstarter's announcement to move its platform over to the Celo blockchain.

Since 2009, more than $6B has been pledged on Kickstarter, funding over 200,000 creative projects that otherwise may never have been made. These projects have been remarkably generative, creating an estimated 750,000+ part-time jobs, 80,000 full-time jobs, over 20,000 companies and nonprofits, and $13.5 billion in additional economic impact.

Kickstarter makes a “commitment to a more open, collaborative, and decentralized future” by choosing the Celo network to host its new decentralized protocol. In their article published on the Kickstarter site, Perry Chen, Founder of Kickstarter, and Aziz Hasan, Kickstarter CEO, explained why they opted for Celo:

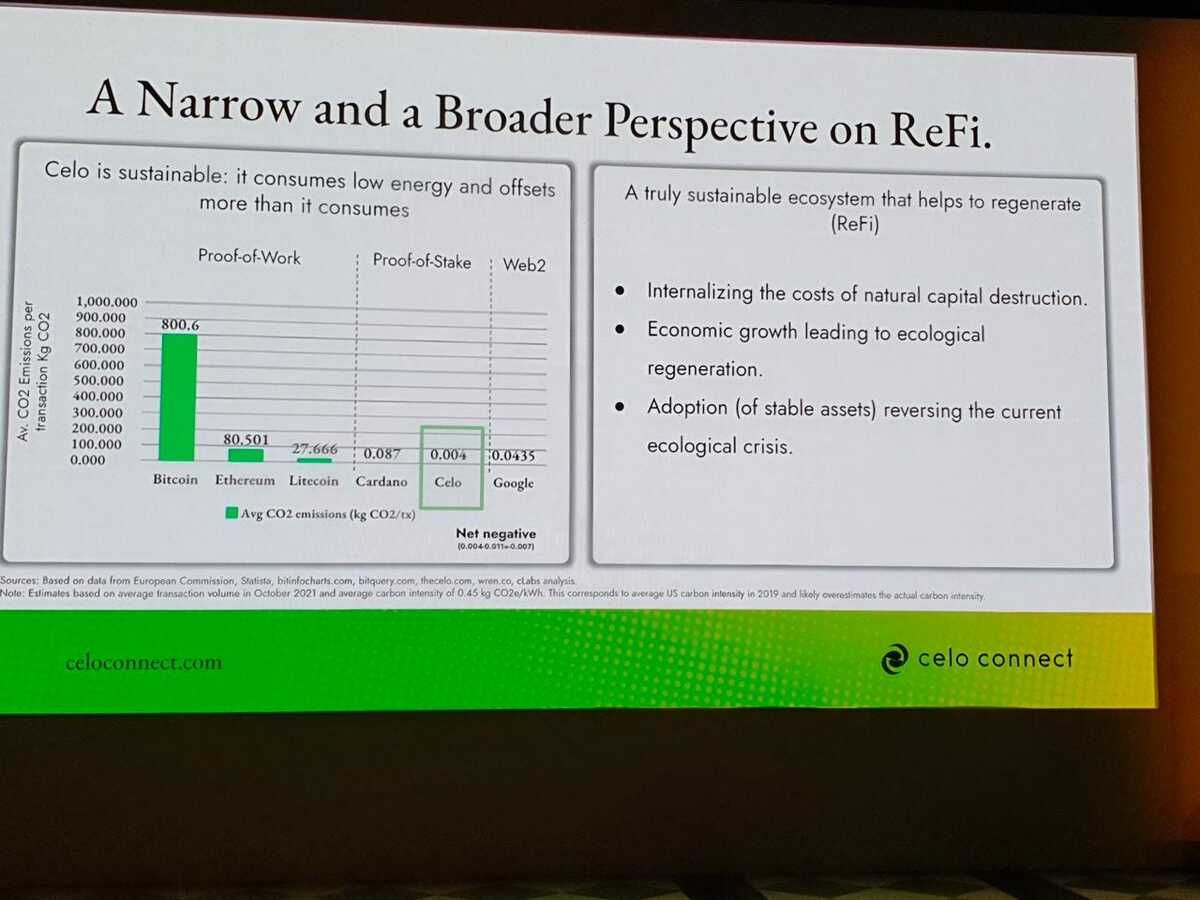

“We’ve chosen Celo, an open-source and carbon-negative blockchain platform, as the best technology and community on which to build the protocol. We’re inspired by the Celo ecosystem’s thoughtful approach to building the technology they want to see in the world. Like the internet in the early 1990s, the blockchain is a nascent technology whose story is not yet written. Celo’s efforts around minimizing environmental impact (and focus on global accessibility through mobile access to the blockchain), remind us that the best way to get better systems is to build better systems.”

Building on their momentum, Celo shared the following stats during their annual conference, Celo Connect in Barcelona back in April.

300k Phone Numbers Verified

4 Tokens Usable to Pay Gas Fees

CELO, cUSD, cEURO, cREAL

500 Transactions Per Second (TPS)

3.8M Wallet Addresses

3,008 Tons of CO2 Offset via Block Rewards

83k Tons of CO2 Offset in the Celo Reserve

53 Governance Proposals Passed

Technical Advances

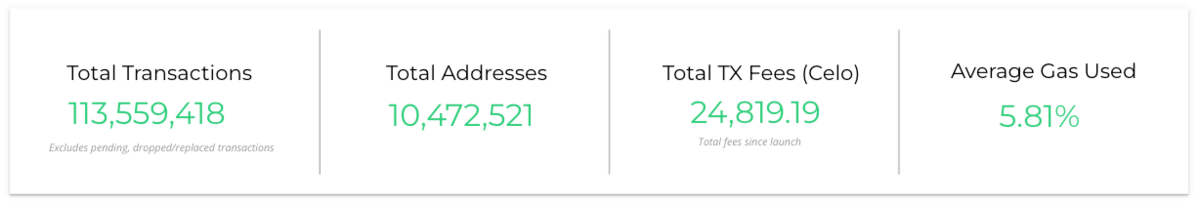

Celo has now processed over 113M transactions in the last two years and with zero downtime on a technical level. The team at cLabs (Celo core developer group) has built a reliable chain for developers considering other L1s have been down multiple times this year alone despite multiple upgrades and periods of extreme transaction loads. It is a big testament to the dedication, hard work, and technical ability of the core team building and maintaining this platform.

Besides focusing on zero downtime, the team over at cLabs has been hard at work in the last 6 months to increase the decentralization of the protocol. Celo now has over $1.2B of Celo voting for validators on the network with close to 1000 nodes. To put that into perspective, Ethereum has around 6000 nodes, meaning Celo is now one of the most decentralized networks within an order of magnitude. More importantly, none of these validators are run by the Celo Foundation or cLabs, which is unique among other proof of stake L1s. Even at the network launch, none of those nodes were run again by the Celo Foundation or cLabs.

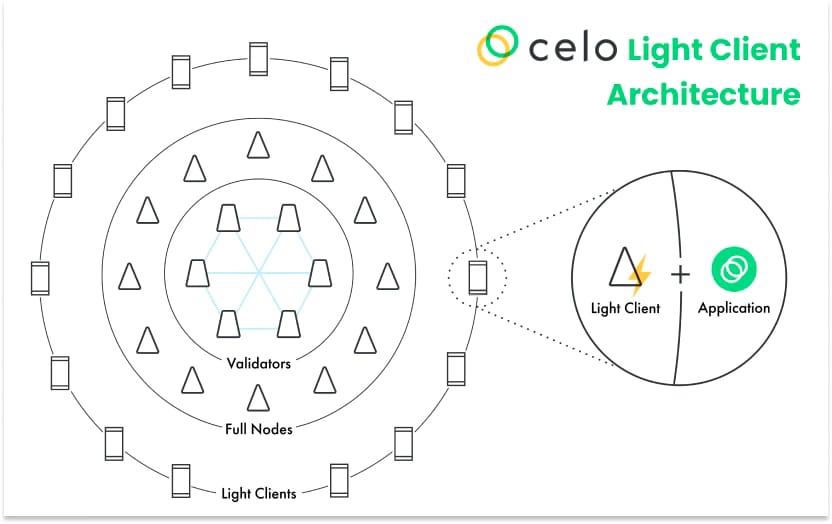

Now, one of the Celo platform's excellent designs is that Celo has a very efficient, light client protocol. That protocol enables the following network topology, where validators are in the middle and full nodes are surrounding those validators. Moreover, they can be incentivized at the protocol layer to service like clients around these full nodes. This topology allows clients and Dapps running with them to connect to the network in a fully censorship and surveillance resistant manner without a trusted RPC node like Infura; it also helps spread the load. An example would be if suddenly your network sees a lot of traffic, your applications can continue to function. They do not stop working because these centralized services start getting overloaded. These light clients have been limited to just a handful of mobile apps experimenting with them mostly because they require some pretty advanced cryptography that's been difficult to do in a web application to date. In April, they announced Plumo, Celo's ZK-Snark light client protocol during their Celo Connect conference.

Conclusion

Celo is a mobile-first platform that makes financial Dapps or decentralized applications and crypto payments accessible to anyone with a mobile phone. In the last 6 months Celo finalized a partnership with Kickstarter that 4x'd activity on the network and issued a new stablecoin called cREAL that is accepted in over 50% of retailers in Brazil. Celo's mission is to bring prosperity to all. They are doing so by building a protocol that has had 0 downtime and is now responsible for powering the future of regenerative finance.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

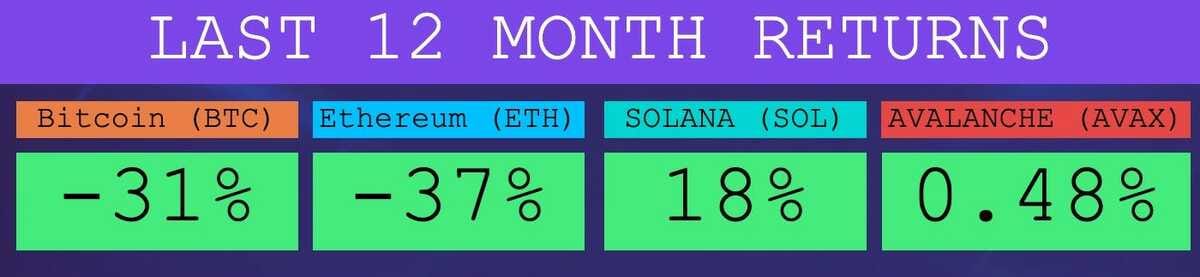

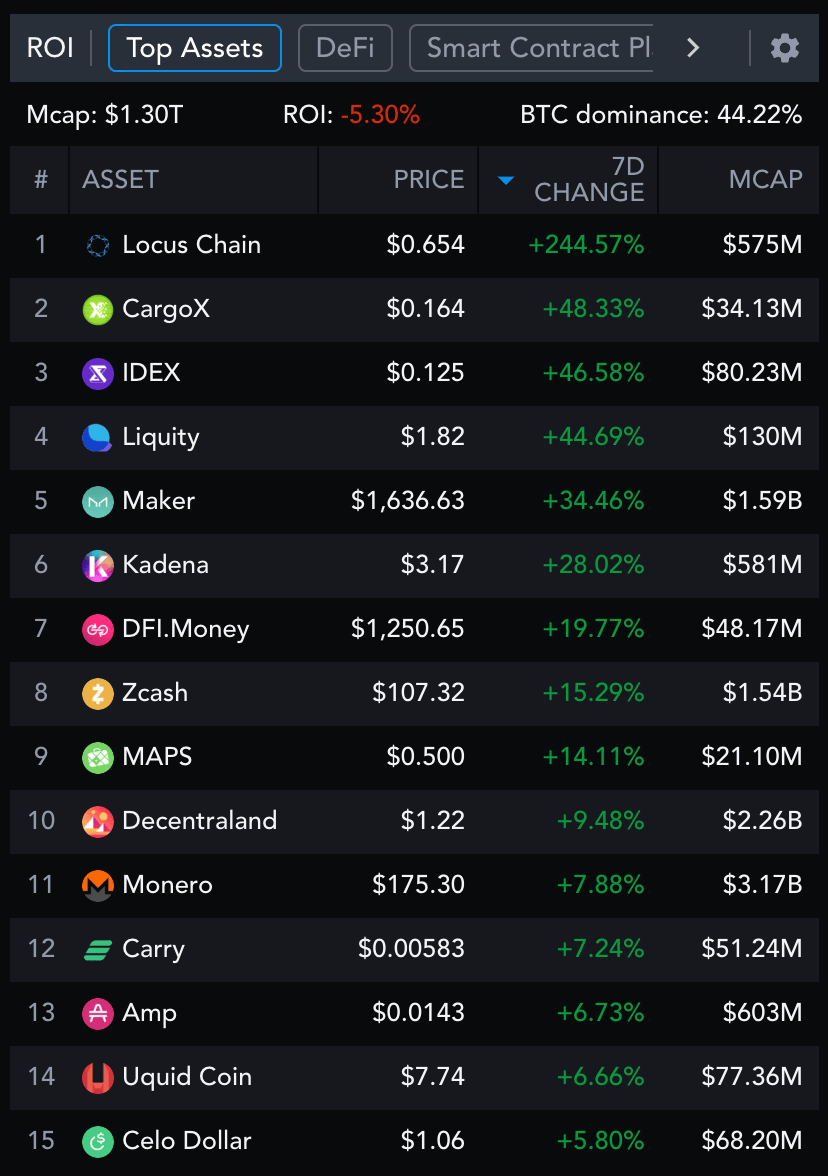

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Locus is an L1, Aragon Court is a Dapp, Tron is an L1, Uquid is a Dapp.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 24,213 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.