Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - Celsius Suspends Withdrawals, 3AC Facing Mass Liquidations, El Salvador’s BTC Reserves Tumble

💵 Weekly Fundraises - Flip ($55M), Wildcard ($46M), Molecule ($13M)

📊 Key Stats - ETH, Optimism, Celsius

🧵 Thread of The Week - Celsius Insolvency

📝 Report Highlights - Messari: Akash: Solving Web3’s Centralization Problems

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

📈 Top 10 Tokens of the Week - DAR, UNFI, BEL

Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. Join their PMC Token launch waitlist here.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

⚠️ Celsius Lending Platform Suspends Withdrawals and Transfers - Crypto lending platform Celsius announced on Sunday, Jun. 12 at 10:10 pm ET, that it would be pausing withdrawals, swaps and transfers between accounts on its platform due to “extreme market conditions.”

🏹 Crypto Fund Three Arrows Capital Facing Potential Insolvency - After liquidations worth $400 million, Three Arrows Capital is reportedly working on an arrangement with lenders and other parties.

🇸🇻 El Salvador’s Reserves Tumble as Bitcoin Extends Losses - El Salvador has amassed an estimated 2,301 bitcoins since announcing it would recognize the world’s largest cryptocurrency as legal tender a year ago.

📉 Crypto Total Market Capitalization Under $1T after 10% Fall - Panic is sweeping crypto markets in early Monday trading following unsettling news of paused withdrawals at Celsius and Binance. The total market capitalization of all crypto assets has dropped to around $960 billion, its lowest point in 18 months.

🚫 Coinbase Has Laid Off Around 1,100 Employees - Coinbase Global (COIN) has laid off around 1,100 employees as part of a cost cutting plan, the company said in a filing on Tuesday.

🏦 Silvergate Capital Could Benefit from Institutional Crypto Adoption, Wells Fargo Says - "Much of the bear case is priced in at current levels, which makes for an attractive entry point,” the Wall Street bank said in the report, initiating coverage of the stock with an "overweight" rating and a price target of $120 a share.

⚡ Goldman Sachs Executes its First Trade of Ether-Linked Derivative: Report - The Wall Street giant executed its first Ethereum non-deliverable forward, a derivative that pays out based on the price of ether and offers institutional investors indirect exposure to the cryptocurrency, the report said.

🖊️ Celsius Withdrawal Halt Reveals Run Risks on Other Crypto Banks - As cryptocurrencies and related equities continue to tumble, industry participants are questioning how the crumbling of crypto lending platform Celsius might impact digital asset markets elsewhere.

🔍 Ethereum’s Ropsten Testnet Has Completed Its Merge - The Ethereum blockchain’s first dress rehearsal for its upcoming Merge was successfully completed last Wednesday.

💰 Tron’s USDD Stablecoin Slips From Dollar Peg Amid Crypto Market Crash - Amid Monday's crypto market crash, Tron's recently launched algorithmic stablecoin USDD lost its dollar peg, slipping to a low of $0.9764 according to data from CoinMarketCap.Share Coinstack

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Celsius Is a Large Holder of Lido’s Staked ETH Token (stETH), a Synthetic Token That Represents ETH Staked for the Upcoming Transition to Proof of Stake

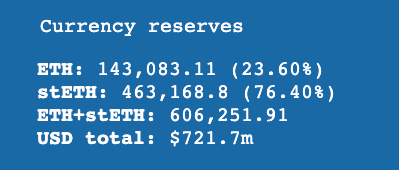

2. The Largest Source of Liquidity for stETH Is the stETH-ETH Pool on Curve. This Pool Intends to Maintain a 50/50 Balance Between the Two Assets. It Currently Sits at a Ratio of 21.7% ETH to 78.2% stETH.

At Its Current Size, the Pool Holds Just 127,155 ETH to 510,388 stETH. This Means That Not Every stETH Holder Is Able to Exit Their Position.

3. Ethereum Approaches 2.5M ETH Burned Since Activating EIP-1559 312 Days Ago

4. With ~250k Eligible Addresses, an Impressive 135k (55%) Have Claimed Their Share of Optimism’s Token Airdrop

5. Argent X (@argentHQ) Is Currently the Most Popular Wallet to Interact With StarkNet.Key Metrics, 3.5M Transactions, 462K Wallets Created

🧵 Thread of the Week - Celsius Insolvency

1/ For starters, Celsius is a do-it-all fintech app meant to give consumers easy, trusted access to crypto services:

- Trading- High-yield deposits on stablecoins and cryptocurrency- Crypto-backed lending

2/ In essence, it's a custodial asset manager.

Take the traditional world of ETFs.

Vanguard and Fidelity wrap a basket of stocks into a retail-facing ETF and take a fee for rendering the service to investors.

3/ Celsius is kind of like Vanguard but for decentralized finance opportunities. It provides regulated access to loans and yield, and takes a fee for doing so. All without exposing users to the purported inconveniences and risks of self-custodied crypto.

4/ Like an ETF provider, Celsius doesn't offer direct exposure to the underlying positions.

They promise withdrawals and redemptions in case users want to exit their positions, but Celsius ultimately manages the positions on investors' behalf.

5/ But for all of its traditional finance bona fides, Celsius positions itself as a crypto-native product.

For starters it has:

- a "whitepaper" (essentially its website in PDF form); and- the $CEL token (which offers loyalty rewards and discounts on using Celsius services)

6/ $CEL for its part hasn't performed, uhm, exceptionally well under these conditions.

7/ But even worse than the pseudo-crypto vibe is Celsius' dangerous use of meaningless platitudes and strident anti-bank rhetoric:

- Banking is Broken- Unbank Yourself- Replacing Wall Street with Blockchain- 99% vs. 1%

All taken from their website and whitepaper.

8/ Worst of all is the in-your-face focus on safety, security, transparency, and most of all, trust:

- "military grade security"- "withdraw your crypto at any time"- "keep your crypto safe"- "next-level transparency"- "why trust Celsius"

All from their own marketing copy.

9/ And therein lies the problem:

1) the promise of sky-high yields

combined with

2) a veneer of legitimacy (regulated onramp, premium access for accredited investors, regulator logos)

Cleared the way for Celsius to pursue truly degenerate trading strategies with investor funds.

10/ There are two Extremely Bad behaviors Celsius undertook that have combined to put it--and its millions of retail investors--in a bind.

1) Use of on-chain leverage2) stETH

Let's take each in turn.

11/ On-chain leverage.

In order to provide low-rate borrowing for users, Celsius itself accesses leverage through permissionless on-chain money markets like

@MakerDAO

That means taking user deposits in assets like $WBTC and depositing them to borrow $DAI.

12/ Maker is a collateralized lending protocol: Put in $1.50 of volatile collateral (e.g. $ETH), and borrow the $DAI stablecoin. If the value of collateral falls below a liquidation threshold, it is liquidated to repay the loan and prevent bad debt.

Cool. Now back to Celsius:

13/ Having a 9-figure loan on Maker is a bit troubling, but normally it shouldn't be a problem. If Celsius's lending collateral is falling in value, then so is Celsius customers' lending collateral. Liquidate your customers' loans and repay your own.

Cool again.

14/ Onto the $stETH problem. Celsius offered, uh, ~robust~ yields on $ETH. $ETH staking on Ethereum's proof-of-stake beacon chain offers ~4.2%, and $ETH yields on @iearnfinance are a paltry 0.20%.

So what gives? How did they offer ~8%?

15/ It turns out the absolute mad lads at Celsius were using an $ETH derivative called $stETH to pump up their headline $ETH yield and attract more investors.

So what's $stETH?

16/ $stETH is a product by @LidoFinance. It stands for (liquid) staked $ETH and it's one of the most innovative DeFi products to be released in the last few years. It allows anyone to earn $ETH staking yields without running staking infrastructure.

17/ $stETH can also be used to earn MORE yield than otherwise possible with vanilla $ETH. Why? Because while $stETH already earns staking yield, it can also be lent out or liquidity provisioned. A common strategy is to provide liquidity to @CurveFinance to enhance $stETH yields.

18/ The unfortunate trade-off with $stETH? While it can be traded for $ETH on the open market...

~* it cannot be redeemed for $ETH *~

At least not until the beacon chain merges, and then Ethereum goes through a hard fork.

19/ Translation? Celsius bought a bunch of $stETH, which can't be redeemed for $ETH for 6-12 months AFTER the merge. And the merge hasn't even happened yet!

20/ Now to kick this all off, $stETH is no longer trading 1:1 with $ETH. So they bought something for $1 that's now worth $0.96.

"But Jon, if you gave me two of the same asset--one yield-producing and one not--shouldn't they trade 1:1?"

Not necessarily:

21/ Due to all of the uncertainty around $stETH, it's trading at ~$0.96 to the dollar against $ETH. Worse yet, there isn't enough liquidity--anywhere--for Celsius to swap out of $stETH for $ETH, even at a loss.

22/ Celsius has 445k ($565m!!) of $stETH, and there's only 143k of $ETH liquidity in the $stETH-$ETH Curve pool.Furthermore, they've got billions in combined liabilities across multiple assets and protocols.

23/ So let's plate this delightful dish of degenerate delicacies:

1) Celsius opened a bunch of loans2) They took user deposits and traded them for $stETH3) They now owe a lot of money and don't have the reserves to pay them back

Celsius is insolvent.

24/ But the story's not over. This is where Celsius went from plausible oopsie to gross negligence.

25/ As of yesterday, Celsius paused withdrawals & transfers, freezing users in place & giving them an awful choice:

- Top up their own collateral to save their loans- Get liquidated

26/ But rather than repaying their OWN loans, today Celsius began topping up their collateral.Why is this negligent?

Why is this ~* insane *~ ?

27/ Celsius's lender Maker has a minimum 150% collateral ratio on loans. That means to access $1.00 of borrow, you must place $1.50 of collateral. Now say you have a big outstanding loan and you want to repay it. You can either:

a) Repay $1Orb) Put in $1.50 of collateral.

28/ Option (b) seems 50% worse than (a). So why would you choose it? You'd do it if you can't actually repay. If you're a degenerate gambler taking the little solvency you have left and putting it all on black, hoping to make it all back in one trade.

29/ All this uncertainty has sent $BTC and $ETH tumbling, meaning Celsius has even less collateral. Rumors are hedge fund Alameda Research is buying distressed assets, and even Celsius's competitors--in a public show of disrespect--are making the offer:

30/ CEO Alex Mashinsky for his part has been on a road show propping up confidence in Celsius and its liquidity reserves, claiming safety til the very end.

31/ Even the day before announcing withdrawals were frozen, Mashinsky was adamant:

- Celsius withdrawal freezes are FUD- We have enough liquidity- Our job is to "fight Tradfi together"

All hours before freezing user funds.

32/ tl;dr

Celsius had all the opaqueness of Tradfi and all the degeneracy of Defi:

- take retail money- lever up- bet it on black- convinced everyone it's safe until the moment it's not

They were ignorant, negligent, or both. It's getting real for them, and now for all of us.

33/ If you enjoyed this thread, sign up for @fortyiq, a newsletter for idiots by me and @0xbarry.

There's too much noise in crypto.

We're committed to breaking down clown town, and in the process making you dumber every day:

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and is building data tools that will drive informed decision-making and investment.About the Article: This is an excerpt from the full article, which you can find here

Key Insights:

Akash enables projects to reduce their dependence on major cloud providers and increase the decentralization and resiliency of their core blockchain infrastructure.

Akash offers developers the ability to build full-stack decentralized applications through key partnerships with other Web3 infrastructure projects, making it the premier Web3-native cloud platform.

Various projects use Akash’s cloud for hosting full/validator nodes, miners, middleware, and front ends.

The addition of GPUs to Akash’s platform will allow the network to handle data-intensive workloads such as machine learning, rendering, and cloud gaming. This will unlock new use cases that will bring additional demand to the network.

The Akash Network continues to grow despite the crypto bear market, with the number of active leases up 41% since the beginning of 2022.

The original premise of Web3 was to build open distributed systems that were decentralized, trustless, and secure. By reintroducing the original philosophy behind Web1, which emphasized open protocols that were decentralized and community governed, Web3 aimed to recreate the internet as we know it today without the centralization issues that have plagued Web2. But the overarching problem is that most Web3 projects are built on the same centralized cloud platforms that Web2 companies have relied on.The current state of the ecosystem consists of a majority of Web3 infrastructure, including full nodes, validator nodes, and middleware, all hosted on the servers of big tech companies, including Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. These three companies collectively represent 64% of the cloud market share. In reality, distributed systems built on the cloud platforms of these major companies aren’t actually decentralized. If DeFi is supposed to be the decentralized alternative to our current financial system, does it make sense to be building it all on top of AWS?

People’s lives have been simplified dramatically thanks to the cloud, and it’s clear that it will not be replaced by people operating their own nodes/servers. With this in mind, a decentralized alternative to the cloud is needed to build permissionless and censorship-resistant protocols and applications truly.

Akash is a decentralized cloud (deCloud) marketplace connecting users looking for computing resources with providers with extra compute capacity. The protocol aims to build a permissionless and sovereign alternative to today’s overly centralized cloud services. With an estimated 7.2 million data centers worldwide, Akash aims to leverage the abundant amount of underutilized server capacity to provide alternatives to the big three cloud providers at a lower cost.

The Lack of Decentralization in Web3

There are two main issues impacting the resilience and decentralization of Web3 projects:

A majority of blockchain core infrastructure, including nodes and validators, are hosted on the cloud servers of a handful of big tech companies.

Protocol front ends and middleware are also typically hosted on the same cloud service providers.

The dependency on the major cloud providers for hosting Web3 infrastructure has resulted in Web3 being built around the same choke points as Web2. This severely decreases the antifragility and censorship-resistant properties of the protocols and introduces numerous vulnerabilities and risks.

A closer look at the node breakdown for two major protocols makes the lack of decentralization evident. On Ethereum, 65% of all nodes are hosted in data centers. Of those nodes, 63% are hosted by just three major cloud providers (AWS, Hetzner, and OVH), with 43% hosted on AWS alone. This means Amazon could shut off nearly a third of Ethereum's nodes within minutes. For Solana, the exact node breakdown by network type is unknown, but it is estimated that over 95% of all validator nodes are hosted in data centers. With that said, 67% of the nodes are hosted on the same top three cloud providers as Ethereum. Together, these three cloud providers also represent 64% of the actively staked SOL on the network.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

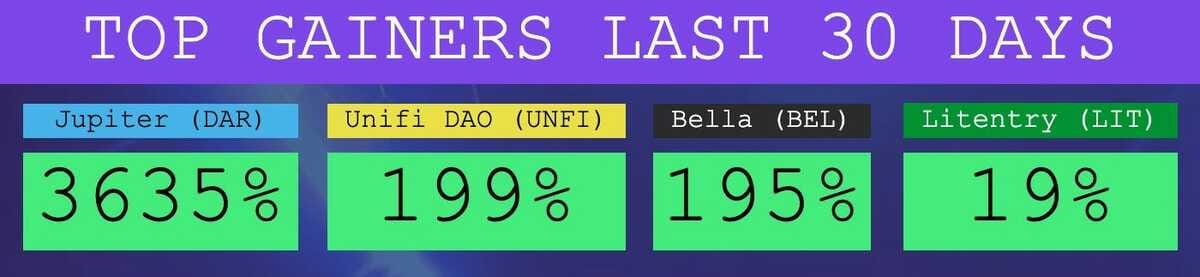

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Tron is a Venture Studio, Bella is a DeFi Dapp, Crypterium is a Wallet, and Locus is an L1.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 25,442 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.