Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - BAYC Otherside, Goldman Sachs Bitcoin-Backed Loan, SEC Doubles Crypto Enforcement Team

💵 Weekly Fundraises - OneFootball ($300M), Argent ($40M), Venly ($23M), Decrypt ($10M)

📊 Key Stats - Polygon, Goldfinch, Near

🧵 Thread of the Week - What Crypto Whales Don’t Want You To Know About Evaluating Tokenomics

📝 Stratmont Report Highlights - Deep Dive into NEAR L1

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

📈 Top 10 Tokens of the Week - GMT, KNC, APE

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting an upcoming 55-minute webinar on crypto investing for family offices, wealth managers, and financial advisors, covering our thoughts on DeFi and crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing, and mapping out the crypto hedge fund ecosystem. Register for free below.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

💸 BAYC Team Raises $285M With Otherside NFTs, Clogs Ethereum - Yuga Labs held the public debut for its “Otherside” metaverse project, generating roughly $285 million for the company while also creating some of the highest gas fees in the history of the Ethereum network. (Source)

₿ Goldman Sachs Makes its First Bitcoin-Backed Loan - Goldman Sachs (GS) has offered its first bitcoin-backed loan in the latest sign that Wall Street is moving further into crypto. (Source)

📈 SEC Nearly Doubles Size of Enforcement’s Crypto Assets and Cyber Unit - The infusion of 20 additional positions into the Crypto Assets and Cyber Unit will bolster the ranks of its supervisors, investigative staff attorneys, trial counsels, and fraud analysts in the agency’s headquarters in Washington, DC, as well as several regional offices. (Source)

🇮🇳 India Includes Crypto Businesses in New Rules for Cyber Security - The move requires crypto businesses, such as virtual asset service providers, to keep know-your-customer (KYC) information and records of financial transactions for five years "to ensure cyber security in the area of payments and financial markets for citizens while protecting their data, fundamental rights, and economic freedom in view of the growth of virtual assets.” (Source)

🇵🇭 Philippines to Pilot Wholesale CBDC later this year, May Moin Project Dunbar - The Philippines will launch a wholesale central bank digital currency (CBDC) pilot in the fourth quarter of this year. (Source)

♻️ Bitcoin Mining Council Rebuts House Democrats in Letter to EPA - Over 50 of bitcoin mining's biggest advocates have put their names to a letter addressed to the Environmental Protection Agency (EPA) pushing back on recent claims made by a group of US House Democrats. (Source)

🇦🇷 Argentina’s Largest Private Bank to Offer Bitcoin & Ethereum Trading - Argentina's largest private bank, Buenos Aires-based Banco Galicia, is making available to customers four different cryptocurrencies—Bitcoin, Ethereum, USD Coin, and XRP. (Source)

⚡ Seven-Hour Solana Crash Blamed on Bots Swarming Candy Machine - Solana went dark for nearly seven hours on Saturday—roughly 4:30 pm to 11 pm EST—after bots appeared to have swarmed Candy Machine, an NFT minting tool. (Source)

⚠️ Hacker Steals $80M from Rari Capital’s Fuse Lending Pools - DeFi platform Rari Capital was hacked for more than $80 million in crypto assets held within its Fuse lending pools. (Source)

📈 Samsung’s Investment Arm to Pursue Asia’s First Blockchain ETF - South Korea’s Samsung Asset Management will attempt to launch the fund sometime within the first half of 2022 on the Hong Kong Stock Exchange, The Korea Economic Daily reported Thursday. (Source) Share Coinstack

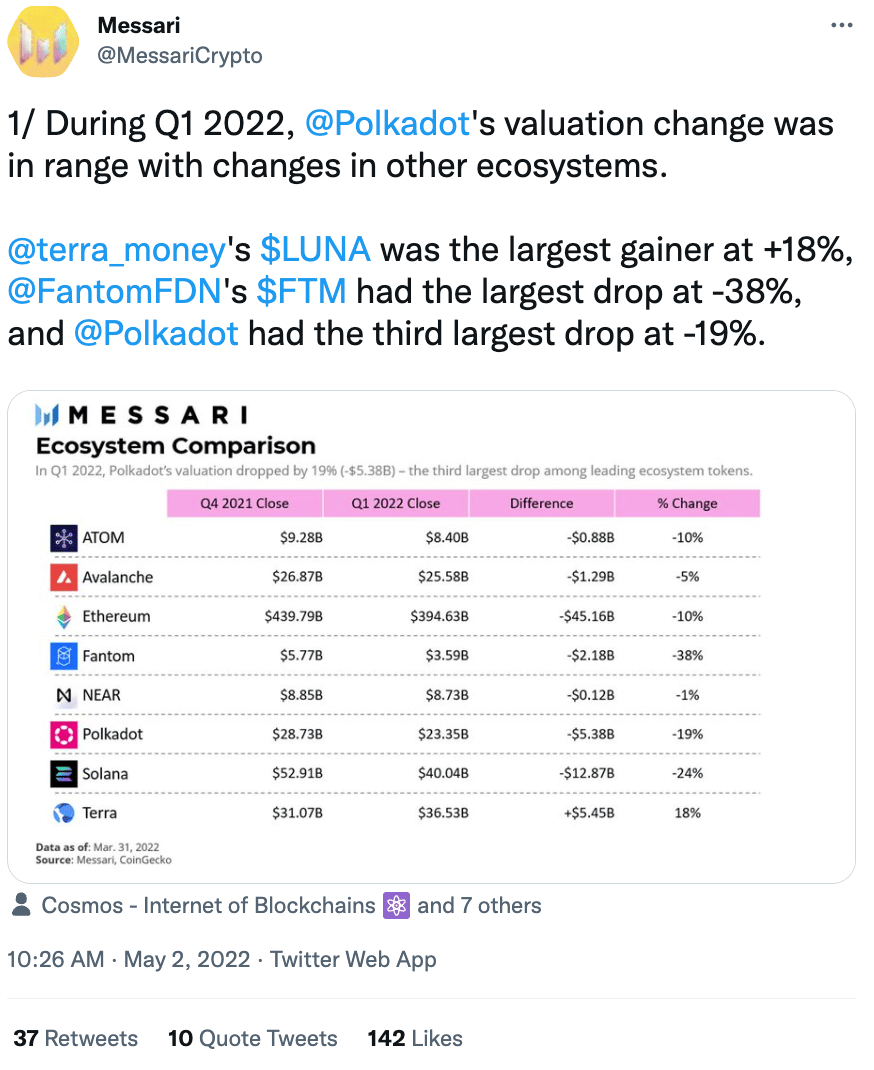

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Polygon Continues to Have Strong Adoption, With 1.05M Active Addresses Last Week

2. DeFi Gaming Daily Unique Active Wallets Soar 35k% Since 2018

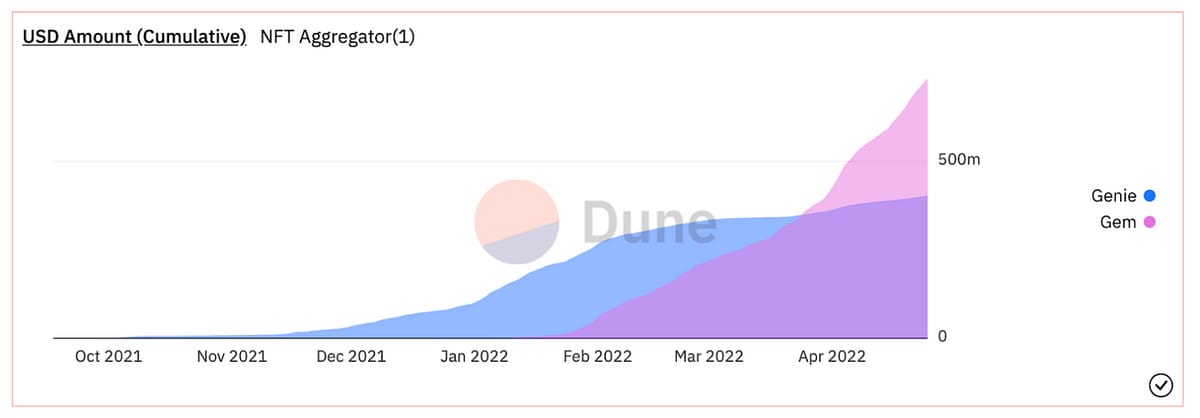

3. Gem (an NFT Aggregator) Processed an Average of Around $10M Volume Daily, With the Highest Being Over $20M on a Single Day

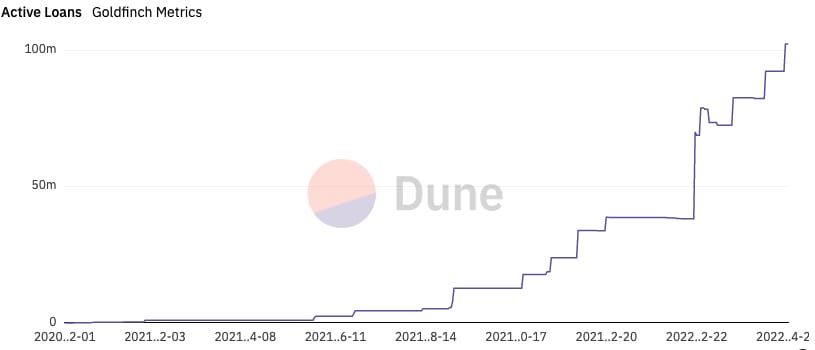

4. DeFi Lender Goldfinch Hits $100M in Loans As Crypto-to-Real World Model Picks Up Steam

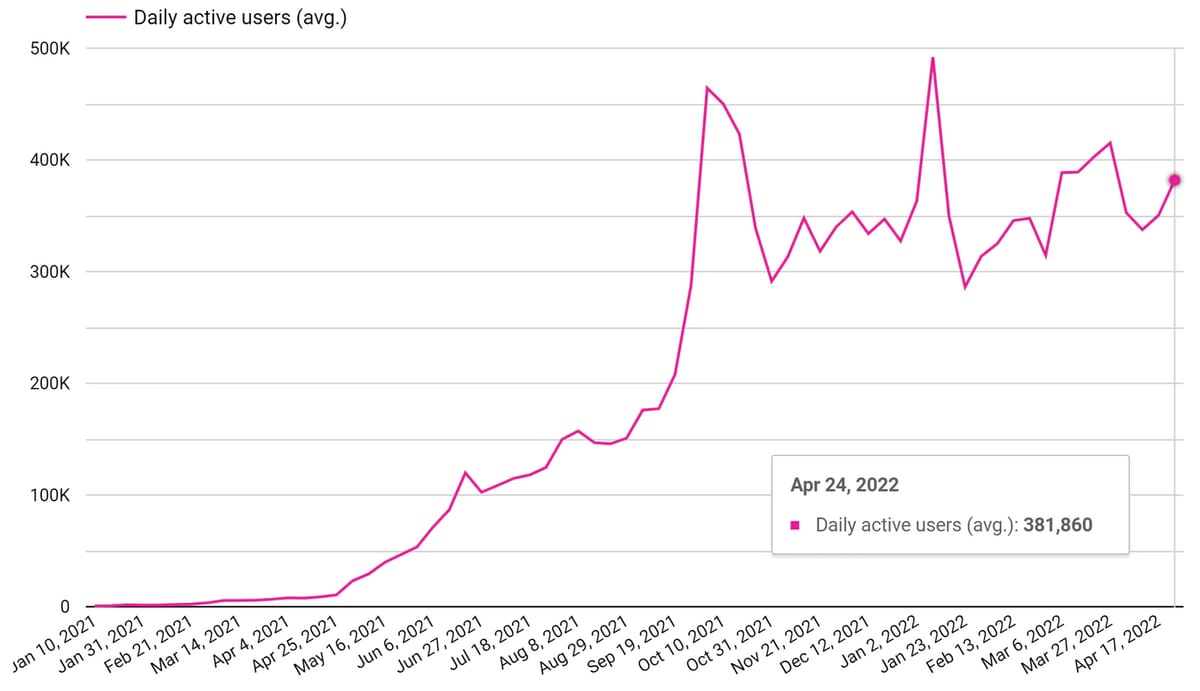

5. Sharded Layer-1 Near Protocol Saw TVL Rise 278% in the Last 30 Days

🧵 Thread of the Week - 5 Things That Crypto Whales and Insiders Don’t Want You To Know

By @milesdeutscher1/24) Crypto isn't a fair playing field. The truth is that 99% of "retail" investors are at the behest of the top whales and VCs. So, how can you break the mould?

🧵: Here are 5 things that crypto whales and insiders don't want you to know (but you should). 👇

2/24) 1. Harsh reality: Most DeFi protocols don't need a token. I'm a proponent that the world is moving to a tokenised future. Many companies could benefit greatly from the token model as it: • Enables division of governance • Increases liquidity and facilitates a secondary market

3/24) But in crypto, tokens are often created with the intent of lining the team's pockets, as opposed to offering a strategic benefit. There are many great projects out there, but unfortunately this space is also full of cash grabs (who may have a great product, but a useless token).

4/24) So to avoid this, if you're investing in a project - make sure the token: • Has a strong value accrual mechanism (price growth reflects user growth) • Fills a market need • Has a competitive advantage over comparable protocols • Has a purpose beyond making holders money.

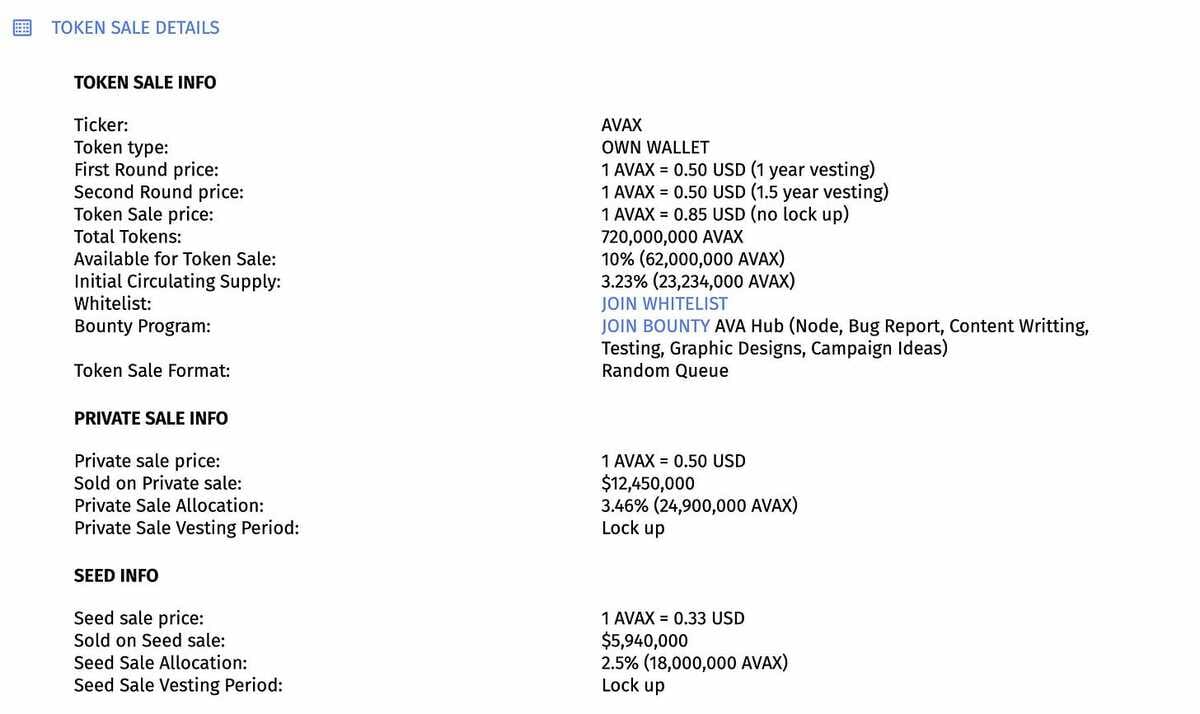

5/24) 2. The majority of VCs make their money through investing early in token seed & private sale rounds. You might think a project is "cheap", but the reality is that the VCs got in at much lower levels.

6/24) For example, initial private round investors got into $SOL at $0.04 (that's a 2250x vs current levels). They also bought: $FTM for $0.043 $AVAX for $0.50 $BNB $0.15 You can check the price of investment rounds on

7/24) Private and seed rounds are a crucial part of the development process. Without them, new projects wouldn't be able to generate the funding and support necessary to build. The rounds aren't the problem. The problem is that retail forgets where the majority of VCs bought in.

8/24) This can create large sell events. Even though a token's market price may drop 50%, the reality is that most initial investors are still up 500x+. This leads to profit taking, or as some people would label it: "dumping on retail."

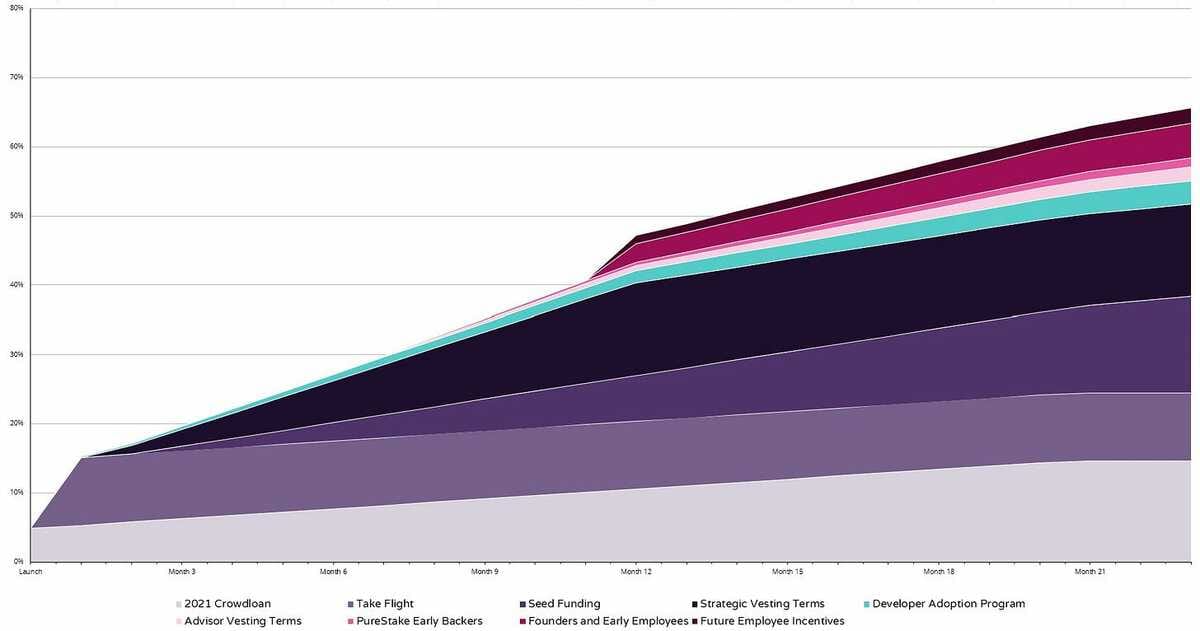

9/24) For example, $GLMR is fundamentally a great project. But its token price hasn't fared too well. Why? Due to its vesting schedule. We can see the major unlocks outlined in the token release schedule:

10/24) Watch out for unlock dates before investing. Each project should outline the vesting schedule under "tokenomics" in their white paper. Consider: • When tokens are unlocking • How steep the "cliff" is • Where tokens are being allocated

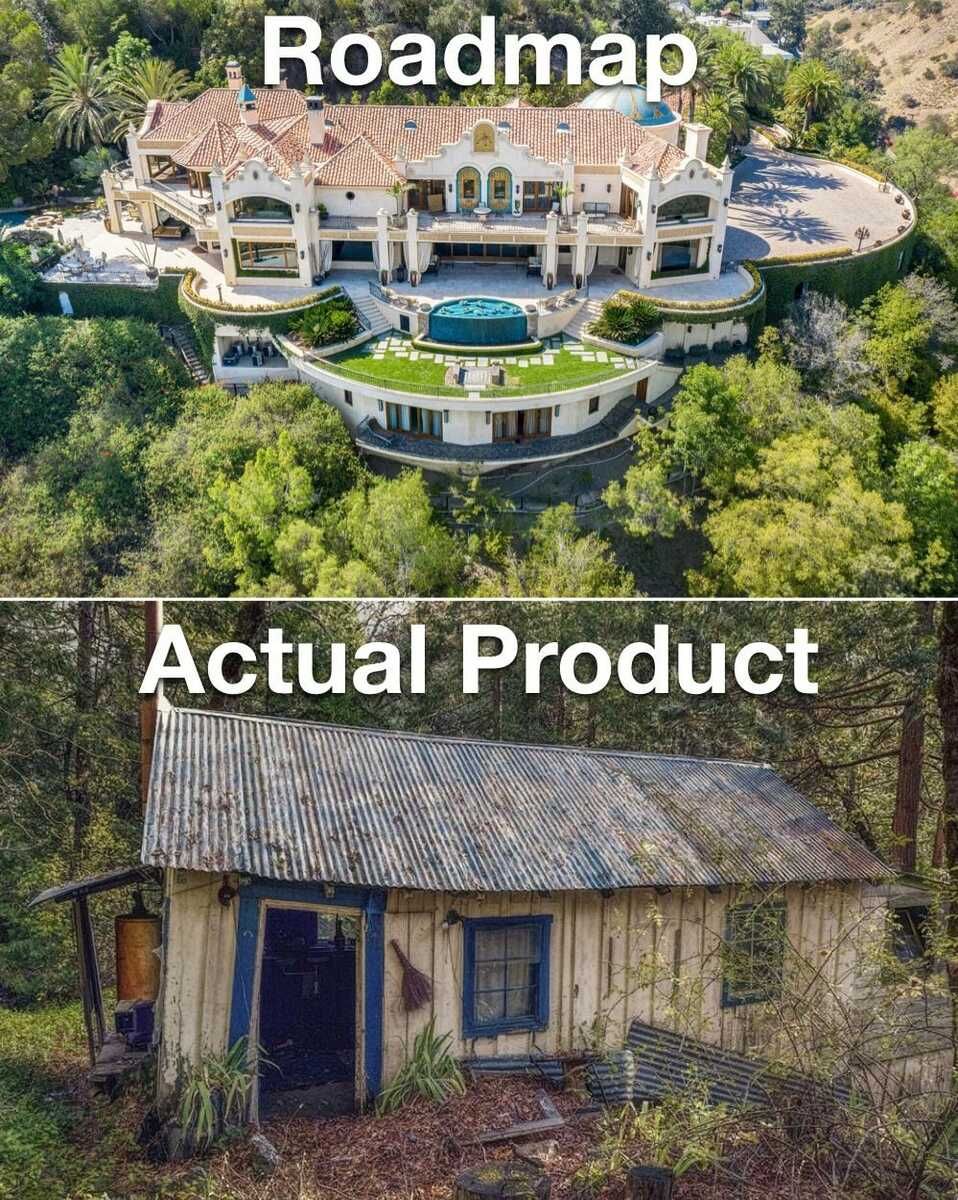

11/24) 3. Many projects don't have a product. Projects often use their seed and private rounds to bootstrap funding for development. They'll put out a fancy white paper and ambitious roadmap, before they've built a single thing.

11/24) This is the way crypto works (which is fine). But it becomes a problem when the market slaps an exorbitant valuation on a project before it even has a product. This significantly increases the risk profile of said investment.

12/24 For example, there are many gaming projects commanding valuations of $100m+, despite having little or no product to show for it. Ultimately, it's a new industry and the market is pricing in future growth. But on the other hand, it manufactures more room for downside.

13/24) Overpromising and underdelivering is basically the synopsis of every NFT project barring a few exceptions. So before investing, ask yourself: • Does the team have a proven track record? • Who are the big backers? • Is their valuation reasonable vs other projects?

14/24) 4. APRs are meant to incentivise liquidity. In the real world, when companies first launch they'll offer promotions to incentivise people to spend money/grow accustomed to their product. "Buy one get one free" "50% off for the 1st 100 users" "First time sign up bonus of $__"

15/24) In crypto it's no different. Except instead of incentivising via discounts, DeFi projects use token emissions to incentivise early liquidity. This model has worked very successfully for the likes of $LUNA (via @anchor_protocol), @CurveFinance etc.

16/24) But for the majority of DeFi projects, emissions end up being their downfall. Often times, the tokenomics are poorly designed and lead to over dilution. A few examples:

17/24) Thus, the burning question in DeFi is "what happens when emissions run out?" Well, protocols will need to pivot from incentivising liquidity towards incentivising fees. Holders should primarily generate a return via fees, not emissions.

18/24) Look for projects with: • High fees generated vs emissions • Tangible users and trade volume (leading to fees) • Strong token value accrual mechanisms • Real utility That way, you won't end up holding the bag on a farming token which endlessly prints.

19/24) Investing in farming tokens is fine, but only if you're actively benefitting from the emissions (which offset the decline in token price). Many naive investors will purchase DEX tokens etc. but not use them for their intended purpose (to generate a return via yield).

20/24) Since APRs are used to incentivise liquidity, the #1 lesson is: Never chase yield. Don't buy a token solely because it's paying a high APR. Invest in a token primarily because you have conviction, then look to farm it. This mindset switch could save you a lot of pain.

21/24) 5. Whales do the opposite of the market. As Warren Buffet famously stated: Be "fearful when others are greedy, and greedy when others are fearful." Historically (in traditional markets and crypto), those who buy during extreme times of fear come out ahead over time.

22/24) Whales accumulate when the market is low, and take profits when the market is high. Whales were: • Taking profits in May 2021 • Accumulating in September • Taking profits in November • Accumulating now. We can see this clearly evidenced via the whale holdings chart:

23/24) What's the pattern here? Whale holdings are inversely correlated with price. They do the exact opposite of retail participants. To simplify: • Take profits into massive pumps (greed) • Buy into massive dumps (fear) Rinse/repeat.

24/24) Hopefully these 5 tips help you navigate this market. Crypto is a tricky game, but if conducted successfully it can create life-changing wealth. If you want to be as rich as a whale, it's time to act like one. 🐋

📝 Highlights From Crypto Reports

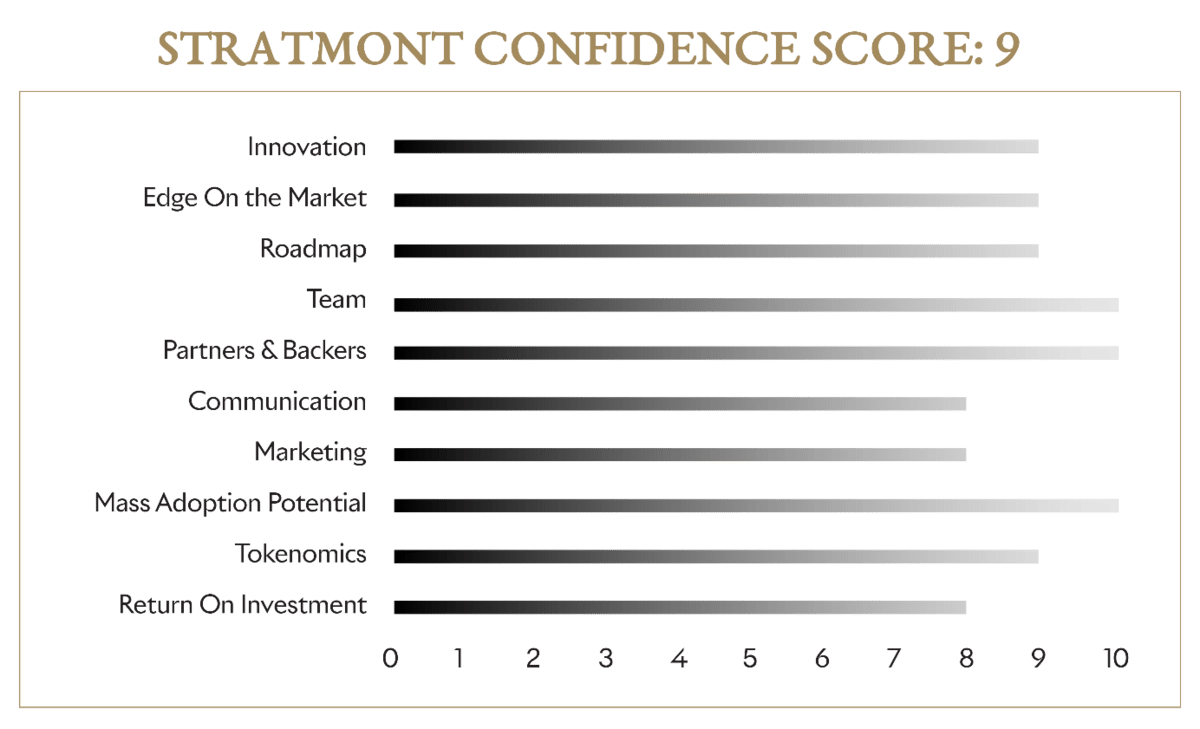

Below is a deep dive into the NEAR L1 smart contract platform.

Crypto Intelligence Report: NEAR

About the Author: Stratmont Brothers is a European crypto trading fund achieving outsized returns with low drawdowns. They are known for their superior digital asset trading strategies that provide a secure vehicle for institutional investors. Equipped with a world-class intelligence department, they stay ahead of the curve and openly share their valuable insights. Stratmont Brothers mission is to create a better world for the next generations. You can subscribe to their Substack here.

About the Article: This is an excerpt from the full article which you can find here

Introducing Near Protocol

NEAR is a decentralized application platform that secures high value assets like money and identity while providing the performance necessary to make them useful for everyday people. It is built atop a brand-new public, proof-of-stake blockchain which uses a novel consensus mechanism called Doomslug and a new sharding approach called Nightshade which splits the network into multiple pieces so that the computation is done in parallel and there is no theoretical limit on capacity.

NEAR’s contract-based account model provides the flexibility that other chains only get from second layer components, allowing NEAR to consistently provide better native usability for developers, validators, and end-users.

Growth narrative

NEAR was created by Alexander Skidanov and Illia Polosukhin, two brilliant minds highly passionate about machine learning. It first started as an artificial intelligence and machine learning project in 2017, with the aim to explore the field of automating programs from a human specification. They then headed towards programmable smart contract platforms and crypto payments. However, blockchain and their technologies at this time did not meet their needs, which led them to begin development of NEAR Protocol, in August 2018.

It is well-known that Ethereum, the most used general purpose blockchain, can only process less than 20 transactions per second on the main chain. This limitation, coupled with the popularity of the network, leads to high gas prices (the cost of executing a transaction on the network) and long confirmation times; even though a new block is produced approximately every 10–20 seconds the average time it actually takes for a transaction to be added to the blockchain is 1.2 minutes, according to ETH Gas Station. Low throughput, high prices, and high latency all make Ethereum not suitable to run services that need to scale with adoption.

We most recently saw it with the latest Bored Ape Yacht Club’s NFT mint, the Otherside metaverse lands, Otherdeeds. There was a gas war at mint and fees suddenly spiked to thousands of dollars per transaction. While some were able to get their transactions processed within a few hours for a couple hundred dollars in gas fees, others reported paying upwards of $4,000 for a single transaction. The average gwei, or price of Ethereum gas, was roughly 100 to 200 times normal. In addition to abnormal prices for a transaction, it was not guaranteed for everyone to have the opportunity to mint (because of the limited supply, large number of transactions, and blockchain congestion), and many paid such gas fees to have their transaction rejected and therefore get no NFT in exchange.

This is where NEAR is the solution. NEAR scales through sharding, a technology that Ethereum plans to implement in 2023, although announced several years ago, and postponed many times. NEAR has launched phase 0 of its roadmap towards a fully sharded blockchain in 2021. This phase, nicknamed Simple Nightshade, was the first step to make NEAR super-fast, incredibly secure, and capable of onboarding millions of users into the world of Web3 without skipping a beat. The last phase of the sharding development will be Dynamic Resharding and is expected to be released in Q4 2022. Sharding partitions data into several pieces, data can then be processed in parallel with each other. The goal with Dynamic Resharding is to create the ability for the network to dynamically split and merge shards based on resource utilization. This will make NEAR almost infinitely more scalable and resilient to short-term usage spikes. We could see NEAR with a 100,000+ TPS - Enough to surpass Visa for real-world usage.

Team

Over 140 people work at NEAR. There are many medalists and finalists of international sports programming competitions among them. Here are some of the many brilliant minds in the NEAR team.

Alexander SkidanovCofounder

Alexander has a master’s degree in computer science and is recognized for his technical skills. He has notably won a bronze and a gold medal at the International Collegiate Programming Contest in 2005 and 2008. Alexander starter his career as a Software Developer at Microsoft in the field of machine learning, before working for over 5 years at MemSQL (now Singlestore) first as a Senior Software Developer, then as a Director of Engineering. He designed and built several key components of the database and drove several critical projects. Alexander cofounded Near in 2017.

Illia PolosukhinCofounder

Illia has a master’s degree in applied math and computer science and his main domains are artificial intelligence and machine intelligence. He worked for 6 years as a Software Engineer at Salford Systems (now Minitab), developing new tools for big data predictive analytics, text mining and geo mining. Illia then worked at Google for over 3 years as an Engineering Manager, managing a team of Deep Learning and Natural Language Understanding Researchers. Illia cofounded Near in 2017.

Maksym ZavershynskyiHead of Engineering

Maksym has a master’s degree and a Ph.D. in computer science. He has more than 15 years of professional experience in IT. He developed an analytical system for the Budget Committee and the Accounting Chamber of Ukraine. Maksym also has been a researcher for 4 years in design of probabilistic algorithms and proximity data structures. He worked for 3 years as a Software Engineer at Google, first in Zurich, then in New York. Maksym has been working at Near for over 5 years, first as an Engineer, then as the Engineering Manager, until now, as the Head of Engineering.

Vladyslav FrolovEngineering Manager

Vladyslav has a master’s degree in Security of Information and Communication Systems. He has over 13 years of work experience. He is a very experienced developer with very diverse computer science skills. As a Software Engineer, he developed a variety of websites and web-services for EwaDev and Salford Systems (now Minitab). Vladyslav also is an expert in BigData and Machine learning where he offered his expertise to Salford Systems and Mirabit. He is also very invested in the open-source development community and has shared over 50 open-source projects and contributed to over 100 projects. Among many skills, Vladyslav is an expert in Linux systems, Backend and Frontend development, web development frameworks, Databases, System administration, BigData, Docker and cloud systems, etc. He has been working at Near since 2019 being a Software Engineer and Engineering Manager.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Stepn is a Web3 Dapp, Kyber is a DEX, Kava is an L1, ApeCoin is a Governance Token.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 22,875 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

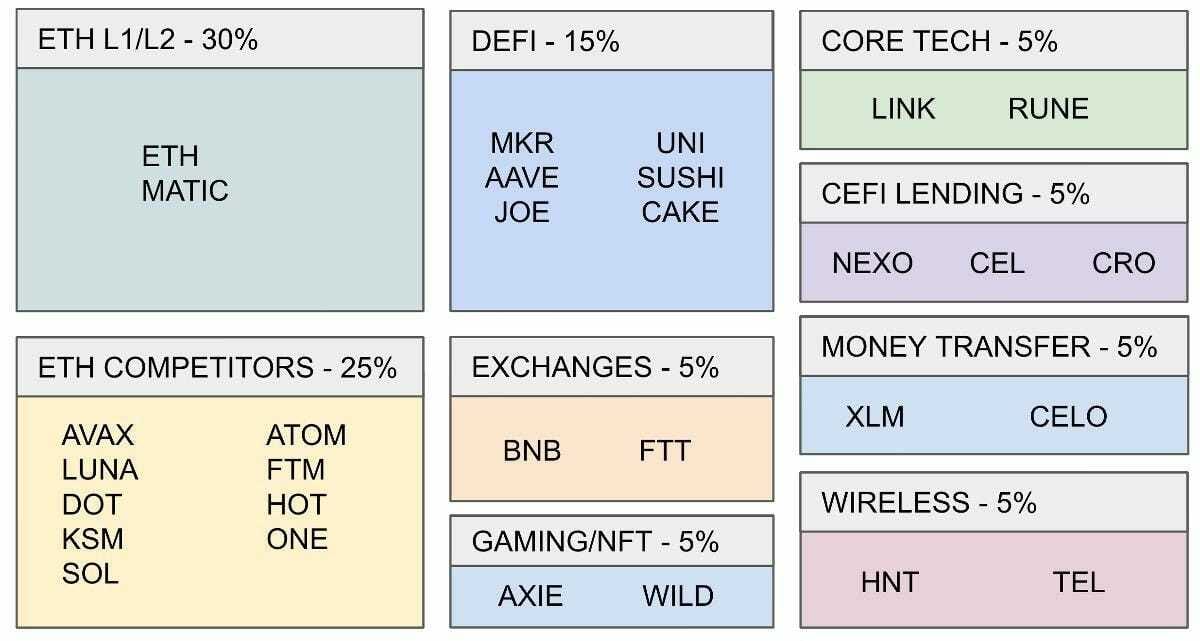

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.