Issue summary: We recap the top weekly crypto news, fundraises, stats, and podcasts. For our feature article, Coinstack analyst Mike Gavela writes an on-chain analytics piece showing why he believes Bitcoin has established a new price floor at $40k. This week we are also celebrating passing 10,000 subscribers.

In This Week’s Issue:

Our Crypto Market Forecast

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

🚀 Coin Of The Week - PLA Up 452% in 30 Days

On-Chain Analysis by Mike Gavela - Bitcoin Establishing a New Floor at $40k

The Coinstack Alpha Fund

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

📈 Latest Crypto Market Forecast

Based on on-chain analytics and the amount of capital coming into the space from institutional investors, crypto markets appear headed toward a double market peak as we first predicted July 5. We expect to see new all-time high during Fall 2021 for both Bitcoin and Ethereum. While things could always change, we expect to see $80k+ BTC and $6k+ ETH by the end of 2021.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

🕵️ Poly Network Offers Job to Hacker Who Stole & Then Returned $600M - After last week’s $600M hack was sent back by the hacker, Poly Network on Tuesday sent the hacker known as, “Mr. White Hat” a cordial invitation to become the firm’s Chief Security Advisor. The firm said in a statement, “To extend our thanks and encourage Mr. White Hat to continue contributing to security advancement in the blockchain world together with Poly Network, we cordially invite Mr. White Hat to be the Chief Security Advisor of Poly Network.” (Source)

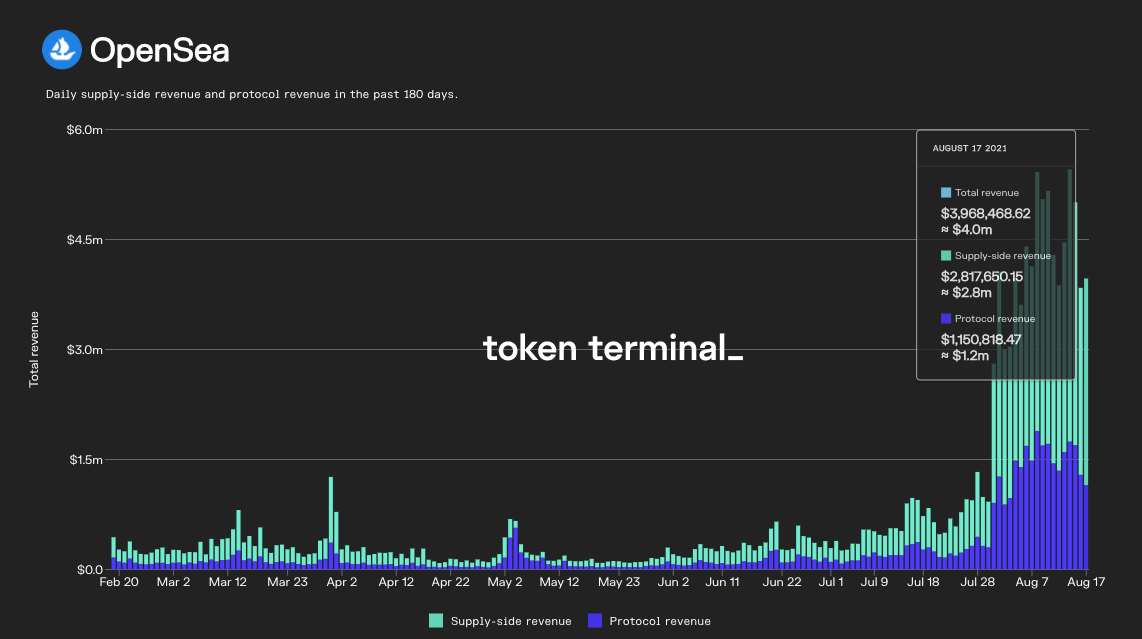

💳 OpenSea Marketplace Reaches $1B in Monthly Trading Volume - As Ether price rallies, Openea has seen 1.36 million transactions over the last 30 days, a 180% increase in the previous 30-day period. (Source)

💰 Bridgewater, Citadel, and Tennessee’s Treasury Among Coinbase COIN Whales - New SEC filings show Goldman Sachs, JPMorgan, CitiGroup, Bank of America, Millennium Management, BlackRock, and Miller Value Partners as holders of Coinbase’s stock COIN further demonstrating the institutional demand for crypto exposure. (Source)

🤑 NFT Trading Surges 8X Averaging 60k Transactions per Day - According to another data tracker, DappRadar, OpenSea’s trading volume over the past 30 days was $1.22 billion, up 933% from the previous 30 days. (Source)

🏦 90% of Fidelity’s Biggest Clients Want Crypto Exposure - The firm is now planning to open up the digital asset space to retail investors. (Source)

⚖️ Walmart Is Hiring a Cryptocurrency Expert - Walmart is hiring a cryptocurrency expert per their new LinkedIn job post to potentially expand its virtual payment options as a growing number of Fortune 500 companies warm up to digital currencies. (Source)

📈 Crypto Firms Go on a Hiring Spree - The number of postings for crypto and blockchain jobs surged by 118% on employment website Indeed in the last 11 months. (Source)

🎆 Twitter Chooses Former Zcash Dev To Head Bluesky Project - Former Zcash developer Jay Graber has announced that she will be heading up Bluesky, Twitter’s social media decentralization project. (Source)

🕵️ Alibaba Launches NFT Marketplace for Copyright Trading - Alibaba has launched a new marketplace allowing trademark holders to sell NFTs representing licenses to their copyright. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Current Burn Rate Sits at 3.26 ETH/Min (~$10k USD per Minute)

2. Net Exchange Flows for ETH and BTC Are Currently Negative. Periods of Higher ETH Outflows Coincide With ETH/BTC Rallies Due to Lower Available Supply

3. BTC Continues To Show Momentum Above Key Indicators Like 50, 100, and 200 Day Moving Average

4. Ethereum Is Now Averaging Over $20M per Day in Revenues, Up 50% From the Previous Week and 30x Bitcoin

5. Ethereum Is Now Settling Over $22.8B per Day in Value, Over 3x Bitcoin

6. Token Terminal Launches OpenSea On-Chain Data to the Platform Showing Its Daily Revenue Rivaling Uniswap

7. BTC’s Hash Rate Recovers 30–40% From the China Exodus Just 6 Weeks Ago Further Demonstrating BTC’s Bullish Trend

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. ETH2 Staking Commitments Strengthen

Lewis Harland from Decentral Park Capital points out that Ethereum doubled its daily staking deposits to the ETH2 deposit contract last month.

For Ethereum, ETH holders have been showing stronger commitments to ETH2 with the number of daily ETH deposited into the ETH2 deposit contract increasing 100% since last month. A successful London Hard Fork (where 51k ETH has now been burned) and growing popularity for liquid staking platforms are likely reasons for this interest. Lido Finance has now had 800k ETH deposited via its DAO, with the platform becoming a more popular venue for ETH holders to receive staking rewards. Lido deposits now represent 13% of all deposits made to the deposit contract.

2. Macro: Retail Buying Puts Points to Mid Stages of a Bull Market

In his latest report, famed on-chain analyst Willy Woo shows how Bitcoin bull markets coincide with an increasing flow of coins to retail investors.

One of my favorite macro metrics to watch is the buying habits of retail. I covered this in my last letter, and I’ll make a note of this again with a chart update. While larger entities 100 BTC upwards like to swing trade with buying and selling, smaller retail (less than 1 BTC of ownership) as a cohort are continual buyers as the borg of Bitcoin continues its adoption S-curve bringing in the masses. True Bitcoin bear markets happen when retail stops buying. Presently buying is on a very strong exponential curve synonymous with mid parts of a bull market.

3. Open Interest Tracks Price, Leverage Proxy

Ashwath Balakrishnan from Delphi Digital takes a look at how open interest tracks price. For the most part, this is because the vast majority of open interest accounts are for traders trying to increase their long exposure and delta-neutral players taking advantage of basis/funding. Regarding Ethereum, Ashwath notes the difference between BTC’s price and open interest growth is a little wider for ETH.

ETH closed yesterday at $3310 per coin with $8.25bn in open interest. The first time ETH hit $3300, in May 2021, open interest was just over $10bn, and trading volume was much, much higher. In general, lower leverage implies a healthier market with less fuel for liquidations and stop hunts.

4. Bitcoin realized cap just broke ATH

The team at Arcane Research published their latest weekly report highlighting Bitcoin’s realized market cap surpassing the previous all-time high back in April.

Translation: the network holds more capital today at $47k than it did at $64k in April. Through realized cap, people can then determine whether bitcoin is overvalued or not. A high realized cap is a healthy indicator indicating that the market accepts current prices, suggesting a strong fundamental build-up for bitcoin. Moreover, the strong spot demand indicates that new money is flowing into bitcoin and that the market can absorb the sell-side pressure.

5. Nexus Most Undervalued Project in DeFi Insurance

Spencer Noon, an investor at Variant, an early-stage crypto VC fund, looks at some on-chain metrics for DeFi and concludes that there is a major opportunity with Nexus Mutual. He writes:

With protocol cover, Nexus is covering more projects on other chains outside of Ethereum L1. Anchor Protocol has been a popular source of cover purchases (with $25M in active covers), as APYs are still around 20% when stablecoin yields have come down across the board on Ethereum.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top 10 Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like SOL, LUNA, FTM, and AVAX had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Axie is a game, Terra and Solana are L1 blockchains, and Audius is an audio streaming platform.

🚀 Coin Of The Week

We write about a new utility token each week to help spread the word about new and upcoming projects. As always, investing in early stage crypto projects is particularly risky with the opportunity for major gains and major losses.

Coin: PlayDappSymbol: PLAAvailable On: Coinbase, Uniswap, Crypto.comFully Diluted Market Cap: $660MPrice Change Last 30 Days: +452%Coin Ranking: #267 by Market Cap

With gaming protocols like Axie Infinity and NFT marketplaces such as OpenSea breaking records, it's not surprising that other platforms such as PlayDapp are also gaining steam, having doubled their token price in the last week alone. PlayDapp is a game portal marketplace. All PlayDapp games are interoperable thus providing a portfolio of game content that gamers can enjoy with their non-fungible tokens (NFT).

📰 On-Chain Analysis: BTC Establishing New Floor at $40k by Mike Gavela

It has been a wild ride for BTC and ETH as we begin to see prices rallying up since the end of July. With rallies continuing to move both assets’ spot price, the same can be said for the markets realized price, which is evident in Glassnode's UTXO Realized Price Distribution (URPD) metric.

UTXOs are the amount of digital currency remaining after a cryptocurrency transaction is executed. UTXOs are processed continuously and are responsible for beginning and ending each transaction.

The URPD shows at which price the current set of Bitcoin UTXOs were created, i.e., each bar indicates the number of existing bitcoins that last moved within that specified price bucket. The price specified on the x-axis refers to the lower bound of that bucket.

Over the last couple of weeks during the rally, we’ve seen UTXOs beginning to concentrate between the $30k-$40k range. BTC held solid support and created a launchpad to hit higher highs later in the year, with volume accumulating within those price ranges. Currently, investors are building a significant support zone which is evident by looking at the gaps in volumes in the $20k price range while the $40k plus range accumulates.

We expect these price ranges to hold in the event of a future pullback. The amount of time that we've now spent with coins stacking between these price ranges shows that a new cost basis has been formed. Overall, this is very positive. The market continues to build up that support level as whales accumulate, which we can see using Relative Transfer Volume Breakdown by Size.

Whales continue to move lots of value, especially at the beginning of the month. The light blue shade shows $10M plus transactions in the area graph above. $10M+ volume transactions made up ~ 41% of the total transaction volume over the BTC network at the beginning of the month. This means that larger transaction sizes are on the move, despite having relatively lower transaction counts and volumes, showing that most of the people who are moving money at the moment are "smarter money" whales. We are seeing accumulation happening, and it's happening on both ends of the spectrum.

When looking at the activity flow for exchanges, we can see a sustained level of outflows for Bitcoin as the Exchange Net Position Change on All Exchanges. The Balance on All Exchanges continues to trend down.

The same can be said for Ethereum as investors continue to move their assets off into cold storage. Historically, when exchange outflows increase, price tends to go up. Since there is less circulating supply in the market, there is inherently a higher market demand for the asset. We expect the $2500 price point to hold in future pullbacks, based on current on-chain data.

The Spent Output Profit Ratio (SOPR) is computed by dividing the realized value (in USD) divided by the value at creation (USD) of a spent output. Or simply: price sold / price paid. On the one-day chart, the lines tracking SOPR jump erratically. We’ve gone ahead and smoothed the curve out to see the emerging trends by taking the seven-day average. So we now have what looks to be a very healthy market with the market taking profits and price continuing to trend up. It wouldn’t be surprising to get a pullback from these price levels, but nothing currently indicates another crash as we had in May.

The Takeaway: Looking at all of these metrics for both BTC and ETH, it is fair to say that the macro bull trend continues and the price floors are rising. The supply dynamics for both BTC and ETH are looking very good. That is not to say we won't be having a pullback in the coming weeks. However, we can rest assured that a new cost basis has been formed, and the current on-chain metrics do not indicate any major pullbacks like we saw in May 2021 due to the unexpected China mining ban enforcement. We see a slow and steady base being formed before hitting all-time highs later this year.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 2,556 plays and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, KSM, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

📈 The Coinstack Alpha Fund

In April 2021 we launched The Coinstack Alpha Fund, which is an on-chain fund on top of the Enzyme platform.

The fund is up 19% in the last week, driven by a resurgence in Ethereum, Polkadot, and Defi investments.

You can invest here in the Coinstack Alpha Fund. There is no minimum investment, although there is a gas fee you pay to Ethereum network to invest -- which has been around $50-$100 recently.

We are now up to $271k from 31 depositors in the Coinstack Alpha Fund. Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

Our current portfolio allocation in our fund is:

📞 Join Our Wednesday Crypto Community Zoom Calls

After two weeks off for summer vacation we will be restarting our weekly calls next week. Restarting next Wednesday August 25, Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 12PM PT / 3PM ET / 8pm GMT. All investors in our Coinstack Alpha Fund on Enzyme and all owners of Mrs. Bubble NFTs are invited to join and ask questions and share learnings with each other. After you invest or buy an NFT, just reach out to us on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.