In this issue we recap the past week in crypto, look at Q2 2021 results in DeFi, and reflect on the rapid growth and geopolitical importance of Stablecoins like USDT, USDC, and Dai. We are also celebrating passing 8,000 subscribers and our six month anniversary.

Inside This Issue:

This Week in Crypto

Crypto News Recap

Crypto Fundraises & Deals

Best Crypto Podcasts This Week

Messari Q2 2021 DeFi Research Report Highlights

An Analysis of Stablecoins & CBDCs: The Hottest Topic in D.C. This Week

Coinstack Podcast Episodes & Subscribe Link

A Good Long-Term Crypto Portfolio

The Coinstack Alpha Fund

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

📰 Crypto News Recap: The Top 10 Stories

Here’s your weekly crypto news recap…

🚀 Elon Musk Personally Owns Both Bitcoin and Ethereum. At the B Word conference on Wednesday, Elon Musk confirmed he personally owns both Bitcoin and Ethereum. He also confirmed both Tesla and SpaceX own Bitcoin. Both cryptocurrencies finished the day around 10% higher. (Source)

⚖️ The Securities Clarity Act (SCA) Is Brought to Congress. The Securities Clarity Act, a bill that would provide clarity about the state of digital assets, has been brought to Congress with bi-partisan sponsors. It would treat blockchain based tokens as commodities, not securities — which would allow companies to sell and trade tokens without registering them as securities with the Securities and Exchange Commission. The bill was sponsored by Rep. Tom Emer, a Republican from Minnesota, Rep. Darren Soto, a Democrat from Florida, and Rep. Ro Hanna, a Democrat from California. Emer said, “There’s been an unreasonable approach by regulators as to how federal securities laws should be applied to transactions involving the sale of blockchain based tokens. And this lack of clarity is hurting American innovation.” (Source)

🇪🇺 Europe is moving forward with their Digital Euro project. The European Central Bank (ECB) announced on July 14 they would begin a 24 month investigation process. ECB President Christine Lagarde said, “It has been 9 months since we published our report on a Digital Euro. In that time we’ve carried out further analysis, sought input from citizens, and professionals, and we conducted some experiments with encouraging results. All of this has led us to decide to move up a gear and start the Digital Euro project.” (Source)

🇺🇸 Janet Yellen Convenes President’s Working Group To Discuss Stablecoins . The Vice Chair for Supervision at the U.S. Federal Reserve Bank, Randal Quarles gave a speech on stablecoins in late June in which he said, “In my judgment, we do not need to fear stablecoins… The combination of imminent improvements in the existing payments systems such as various instant payment initiatives combined with the cross-border efficiency of properly structured stablecoins could well make superfluous any effort to develop a CBDC.” This speech set the stage for U.S. Treasury Secretary Janet Yellen to convene the President’s Working Group on Financial Markets to discuss stablecoins this past Monday (more on this below). (Source)

📈 Capital Group Buys 12% Stake in Microstrategy. Capital Group, a large asset manager with $2 trillion AUM has purchased a 12.2% stake in Microstrategy (MSTR) for around $600 million, making the firm the 3rd largest shareholder (Source).

🇨🇳 Chinese CBDC to Allow Smart Contracts. China has confirmed for the first time that its digital yuan (ECNY) will include native support for smart contracts. The People’s Bank of China stated the following in their Whitepaper for their CBDC, “ECNY obtains programmability from deploying smart contracts that don’t impair its monetary functions. Under the premise of security and compliance, this feature enables self-executing payments according to predefined conditions or terms agreed upon by two sides, in order to facilitate business model innovation.” (Source)

🏈 Another NFL Athlete Goes For Bitcoin. NFL Athlete Saqoun Barkley has announced that he will be taking all of his endorsement money in Bitcoin only. He said, “You see inflation and how high it is right now and you learn that you can’t save your wealth. So that’s why I’ll be taking my marketing money in Bitcoin. I think it’s a smart thing to do and the right thing to do to take my investment via Bitcoin and Strike.” He is expected to earn over $10M in endorsements this year. He joins NFL players Sean Culkin, Russell Okung, and Tom Brady as Bitcoin fans. (Source)

♦️ EIP-1559 Launch is Less Than 2 Weeks Away. Ethereum’s much anticipated upgrade EIP-1559 is set to go live on August 4, 2021 at Block 12,965,000 with the London Upgrade. This upgrade will begin to burn transaction fees, reducing the supply of Ether (ETH). Next step: Launching EIP-3625 in early 2022 to move Ethereum to a Proof-of-Stake chain with deflationary issuance. (Source)

🦄 Uniswap Launches on Optimism. Uniswap Has Launched on Ethereum Layer 2 Scaling Solution Optimism. The version of Uniswap on Optimism offers transaction fees of less than $1 instead of $20 and instant trades. (Source)

U.S. Inflation Continues to Rise. The U.S. June Consumer Price Index (CPI) was announced last week, showing that inflation in the United States increased by 5.4% year over year, the highest rate in 13 years since June 2008. Many see Bitcoin as a hedge to expected inflation in the U.S. dollar. (Source)

💵 Weekly Crypto Fundraises & Deals

🎧 Weekly Podcast Review: Recommended Listening

📝 Messari: Q2 2021 DeFi in ReviewRecap by Ryan Allis

Here are some of the highlights from Messari’s excellent free Q2 2021 DeFi in Review report which came out this week from Ryan Watkins and Roberto Talamas...

Messari also released a second free report last week “1H 2021: Examining Liquid Portfolios of Crypto Funds.” Here’s the key takeaway chart from the research.

📝 An Analysis of Stablecoins & CBDCs: The Hottest Topic in D.C. This Week by Ryan Allis

On Monday July 19, U.S. Secretary Treasury Janet Yellen convened the President’s Working Group on Financial Markets to review the current state of Stablecoins and Central Bank Digital Currencies (CBDCs).

They offered the following summary of the meeting afterwards:

WASHINGTON — Today, Secretary of the Treasury Janet L. Yellen convened the President’s Working Group on Financial Markets (PWG), joined by the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation, to discuss stablecoins.

In the meeting, participants discussed the rapid growth of stablecoins, potential uses of stablecoins as a means of payment, and potential risks to end-users, the financial system, and national security. The Secretary underscored the need to act quickly to ensure there is an appropriate U.S. regulatory framework in place.

The group also heard a presentation from Treasury staff on the preparation of a report on stablecoins, which would discuss their potential benefits and risks, the current U.S. regulatory framework, and the development of recommendations for addressing any regulatory gaps. The PWG expects to issue recommendations in the coming months.

In attendance were:

It is important to note that Randal Quarles, Vice Chair for Supervision, attended the meeting. As we reported above, Vice Chairman Quarles said the following in a late June speech on stablecoins:

“In my judgment, we do not need to fear stablecoins… The combination of imminent improvements in the existing payments systems such as various instant payment initiatives combined with the cross-border efficiency of properly structured stablecoins could well make superfluous any effort to develop a CBDC.”

With both Quarles and SEC Chair Gary Gensler in the room, who previously taught at MIT on the topic of blockchain technology -- we are hopeful that a path forward to create a regulatory framework that allows the USA to maintain leadership in this new evolution in global financial structure as money becomes programmable and the global financial system becomes more transparent via smart contracts.

Reserve Attestations Really Matter for Stablecoins

With Circle, the creator of USDC, offering a very transparent attestation of their reserves this week and their preparation to become a publicly traded firm, it seems more and more likely that the U.S. government will work closely with Circle in a public-private partnership to create a quasi-public regulated and backed stablecoin that is ahead of the Chinese Digital Yuan.

Circle offered the following statement this week:

“With this latest reserve attestation, we are now including a breakdown of dollar-denominated reserve assets, which are all held in the care, custody and control of U.S. regulated financial institutions and in line with laws and guidelines from our U.S. state money transmission regulators.

Indeed, as pioneers in the digital currency industry, Circle, together with Centre Consortium, have evolved a reserve management model that is more conservative and transparent than comparatively regulated digital payments systems and financial technology (FinTech) organizations. Along these lines, we welcome the work being undertaken by the President’s Working Group on stablecoins, and note that calls for building the future of banking, payments, and money can continue to remain a private sector activity with appropriate public sector and regulatory oversight, transparency and accountability.

As we continue our journey to becoming a public company, we will have increasing opportunities for greater transparency, accountability and disclosure around our broader business and operations. Altogether, this expanding public accountability can help to strengthen trust in Circle, USDC and companies building on the standards and market infrastructure that we have been delivering over the past several years.

While USDT (Tether) is still the largest stablecoin by volume. they have had relatively weaker transparency and reserve attestations. In fact, 50% of their reserves are held in commercial paper instead of cash equivalents, creating some market concern in the case these short-term corporate bond instruments go bad.

Here’s a handy comparison table of Tether and USDC’s reserves. As you can see, USDC has a much higher percentage of their reserves in safer instruments.

I’ll take Circle’s 73% in cash equivalents instead of Tether’s 26% -- any day. This is the main reason I pretty much only use USDC whenever possible.

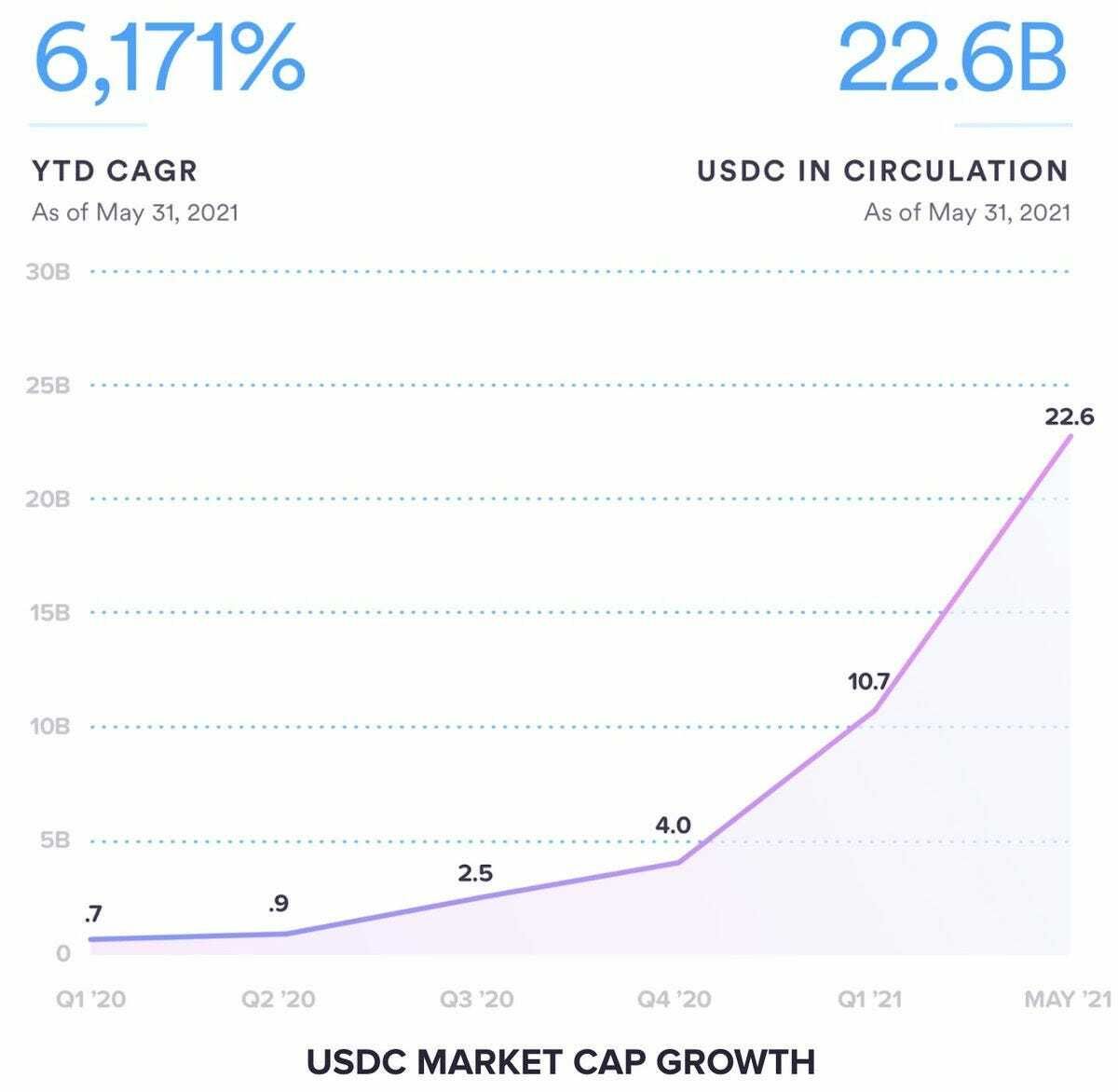

Which Stablecoin is Winning Today?

Now, let’s take a look at the total Stablecoin market capitalization:

It will be fascinating to watch over the next few years to see if decentralized stablecoins like DAI and UST can catch up with USDC -- and whether USDC is selected by the U.S. government as their “official CBDC.”

With MIT set to produce their report advising the US government on stablecoins this summer, it will be fascinating to watch whether the U.S. decided to bless USDC as the de facto digital dollar or work on building their own private stablecoin.

My guess is that there will be a LOT of productive collaboration between USDC and the U.S. government over the next 36 months. This path would immediately put the USA ahead of China in the race to maintain the advantage in the next-generation of the global financial payments system characterized by instant settlement and cross-border payments.

The Legacy SWIFT system is starting to feel more like the TURTLE system. Upgrades are needed if the U.S. is going to maintain a premier place in the global financial system.

While banks have innovated in China the last decade, they are still quite stagnant in the USA, as Bankless founder Ryan Sean Adams highlighted this week in his article, “I Still Write Checks.”

Adams writes:

“I’m halfway through Cashless a book about China’s digital banking system. (Stay tuned—we’re recording a podcast with the author next week)! Here’s what China did differently. They let big tech eat their banks. They were so hungry to digitize their financial system they gave it all to AliPay and WeChat. These are China’s equivalent of Amazon, Google, and Facebook.

So over the last 10 year while the U.S. banking system stayed stagnant, China’s Silicon Valley completely digitized China’s banking system. They turned banking into a giant app platform. As a result, digital banking functionality in China has leapfrogged the the West in ways Westerners are just beginning to fathom.

Here’s a stat…

And now China’s starting to export… I hope you like RMB.”

Instead of working to slow blockchain-based financial innovation, if leaders like Treasury Secretary Janet Yellen, SEC Chain Gary Gensler, and Fed Chair Jerome Powell can embrace it and create a predictable regulatory framework -- we can ensure that the USA continues its global leadership role in creating the global banking system for the 21st century.

It’s going to be a fascinating decade as we create the future of money.

Jeremy Allaire’s Incredible Tweet Thread On USDC and the USA

We’ll end this article with Circle CEO Jeremy Allaire’s Twitter exceptionally relevant and helpful thread Monday on the future of potential collaboration between the USA and USDC…

VERY significant meeting today with Presidential Working Group meeting to discuss appropriate policy and supervision of private stablecoins. Lots to say about this, @SecYellen, @federalreserve , and @USOCC teams.

Recall that in late December, the PWG issued their first broad statement on policy for stablecoins, which grew out of the G20 FSB recommendations on the same.

Crypto, public chains, DeFi, stablecoins and other digital currency models pose many complex questions, and requires significant engagement with policy makers if we hope to achieve global mainstream scale and adoption.

It's extraordinary and positive that US financial policy leadership are taking this on right now. It's a sign of how far we've come and how fast this is all happening.

There seems to be an emerging consensus view, outside of extreme academic positions, that private digital currencies and stablecoins are here to stay and likely to become global scale, systemic parts of the economic and financial system.

The speed of adoption of dollar and other fiat digital currencies appears headed for exponential vs. incremental adoption, and should achieve mainstream scale far ahead of any CBDC projects in most parts of the world.

It's not only appropriate, but critical, for national governments and regulators to take a view on this, just as they are in other areas of exponential tech.

But taking a view and determining policy should be a journey of learning, and it’s crucial that the PWG and related agencies not simply try and fit a square peg in a round hole.

The pace of innovation in this space is astounding, and has the potential to impact the world on a scale far greater than the impact of the "information and communications" revolution of Web1 and Web2. Patience is a virtue. Web3 breaks a lot of molds.

This moment of engagement offers an enormous opportunity for leadership by both the US government and the global digital currency industry.

For the US govt., the leadership opportunity is to embrace and enable an open and competitive field in financial infrastructure innovation on the internet, much like was done in communications with the 1996 Telecommunications Act. Don't try to "Out China, China".

For the digital currency industry, this is an opportunity to step up and engage, and foster constructive dialogue with important policy leaders.

This is a process not a meeting, and it will very likely ultimately take years to get things right. We remain committed to engaging and helping the US find a path forward for stablecoins at global scale.

Thank you @JoeBiden and @SecYellen for making this a national priority.

Yes my friends, we are watching the future of the global financial system emerge before our eyes this decade.

We have a new Coinstack podcast. You can listen to it on Anchor, Spotify, or Google Podcasts. Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends. So far we’re at 1,283 plays and growing!

Our Top 30: A Long-Term Crypto Portfolio

Everything is on sale right now and from our vantage point, it’s a great time to buy.

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term. If you’d rather make one crypto investment and then have someone else manage it for you, you can also invest in the Coinstack Alpha Fund (see info below).

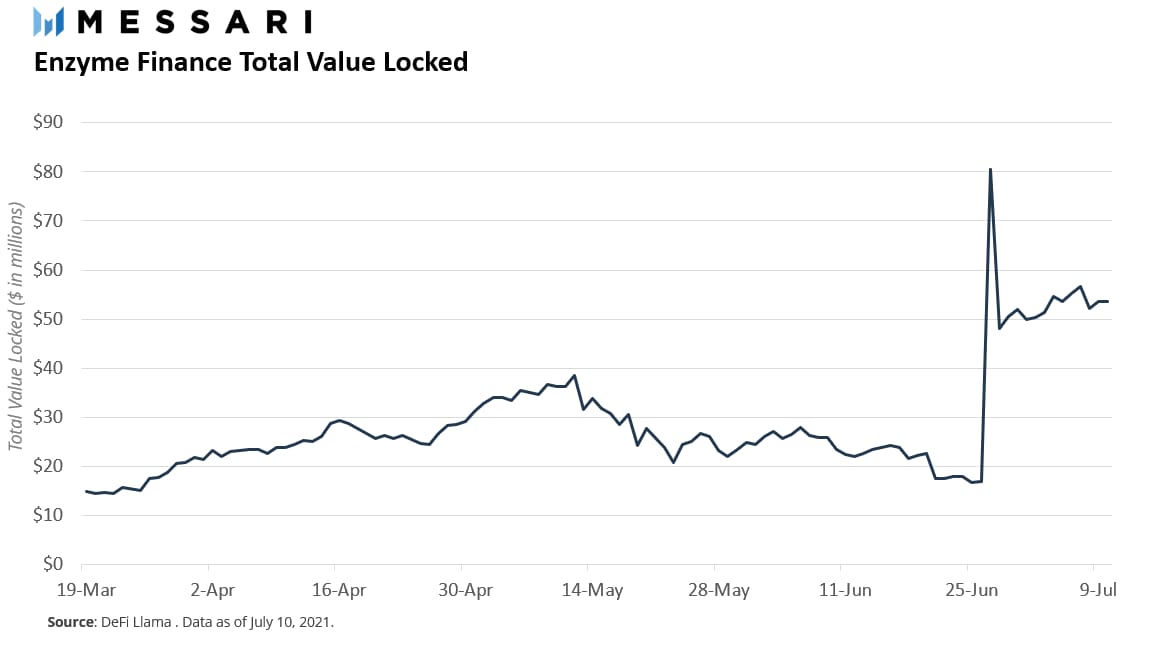

If you don’t want to manage your own crypto portfolio, we can manage it for you. Check out the Coinstack Alpha Fund on Enzyme. We are now up to $165k from 30 depositors in the Coinstack Alpha Fund.

Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

While the crypto market has gone lower the last 90 days, we are expecting strong returns from the sector over the next 10 years.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

Our current portfolio allocation in our fund is:

📞 Join Our Wednesday Crypto Community Zoom Calls With Ryan Allis

Every Wednesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 12PM PT / 3PM ET / 8pm GMT. All investors in our Coinstack Alpha Fund on Enzyme are invited to join and ask questions and share learnings with each other. After you invest, just reach out to Ryan Allis on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Joinour Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1650 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. At the time of publication, we are long on much of what we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.