In this special edition of Coinstack I share a recap of what happened yesterday that crashed crypto markets. Please share this post with your friends if you think it will help.

MAY 19 WHALE MARKET ATTACK: A POST-MORTEM...

Here's my analysis on how the BTC price dropped from $42k to $30k and how the ETH price dropped from $3400 to $1800 so quickly yesterday. I’m putting my new Glassnode subscription to good use.

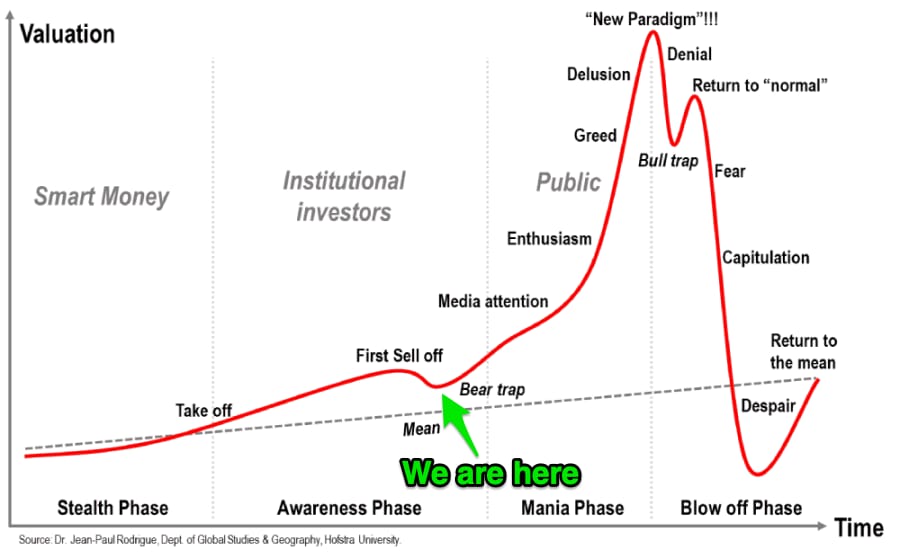

My take on it all is that we are still in the bull market with around 6 months left, and yesterday’s action was short-term and driven by price manipulation by whales (very large holders) who wanted to shake some people out before we go much higher.

A Timeline of What Happened On-Chain (Corresponds With the Above Chart)

At 12:30am UTC yesterday May 19 everything was looking okay and BTC was trading at $42k and ETH was at $3.4k. Other than having a rough weekend due to Elon's tweetstorms and some incorrect China FUD recycled from 2017, things were generally OK in crypto markets.

At exactly 12:40am UTC whales moved a net of 500,095 ETH onto exchanges to sell. At the time this was $1.65B worth of ETH. This caused the ETH price to drop from $3391 to $3009 within 6 hours.

At exactly 6:30am UTC whales moved a net of 13,555 BTC onto exchanges to sell. At the time this was $535M worth of Bitcoin. This caused the BTC price to drop to $37976, which further led the ETH price to drop from $3009 to $2651 within 5 hours.

Investors in Europe and the USA began waking up, saw the price declines, and got fearful. Once the price points of $38k BTC and $2.5k ETH broke, cascading liquidations starting piling up, forcing those with leverage to auto-sell at market prices, and bringing down the BTC price from $38k to $30k and ETH to $1.8k within 60 minutes around 11:30am UTC. This was about 7:30am ET in New York City and 4:30am in Los Angeles.

These artificially low prices recovered very quickly back to $37k and $2.8k within two hours. However, other large whales, perhaps concerned by the reductions in market price moved coins to exchanges and began selling, causing another temporary pullback to $35k and $2.2k.

Once the cascading liquidations and whale selling was complete, whales bought back in, getting lower average prices than they had previously.

The BTC price is now $39k and the ETH price is now $2.6k -- now with a LOT less leverage than before, which will allow the market to likely move more upward as the bull cycle continues.

Why I’m Writing This Analysis

I'm writing this to help lay some groundwork for others to look deeper -- so we can strengthen the industry.

I have no evidence of coordination between the ETH dumper and the BTC dumper, however I do hope someone looks into that. This may have been coordination and premeditated or it may have been simply been two separate major market actors acting 6 hours apart during a week when the news cycle was already challenging.

A lot of people lost a lot of money (some on paper, some in reality through futures liquidations) and many regular people got scared and sold their investments and now won't touch crypto for some time. I got lots of text messages from friends asking if they should sell. I told them definitely not and to hold. Remember to buy low and sell high -- and we are going much higher from here over the next few years.

Personally, I lost $100k by being liquidated on a long ETH position. I appreciate this learning as I think it will help me be safer during the coming bigger phase of the bull run.

The 2021 Bull Market is Still On… Now It’s Time For the Next Leg Up…

I believe we are still in the middle of an overall bull market structure that most analysts expect to continue into the Fall/Winter of 2021. This was just a particularly nasty 45% drop that we are now recovering from, which isn’t abnormal in crypto.

I expect to see new All Time Highs (ATHs) for ETH by late June and by July/August for BTC.

Yes, we are about 60% through the 2020-2021 bull cycle and EXTREMELY EARLY compared to what the overall crypto market cap will be by 2030. We’re at $1.7T and are going to $100T+. Just buy the dips and HODL.

We Do Need Deeper Exchange Liquidity To Prevent These Artificial Crashes

It it a sign of major market illiquidity that just $2B in net sales can move the BTC market cap by $200B and the ETH market cap by $100B. As I understand it, this happens as exchanges tend to have low liquidity during crisis moments, making prices go a LOT lower than they should, and causing a lot more cascading liquidations than are necessary. ThorChain (RUNE) is working on this issue of cross-chain liquidity as are many others.

It also didn’t helped that most exchanges went offline during the exact hour the crash happened, preventing many from placing buy orders.

I very much look forward to the day when $2B in sales barely moves the market. I’m writing this to help both explain what happened and to help shine a light on exchange illiquidity that causes prices to temporarily drop artificially lower that they needed to as we as a crypto industry work to build an anti-fragile market that is safe for everyone to participate in fairly.

We need to get better at this.

We need to solve both of these issues before crypto will be ready for prime time and true global adoption of DeFi as the rails of new global financial system.

What do you think? What this whale market manipulation? Or something else? And who’s working on improving exchange liquidity to reduce sudden drops beyond market demand.

Let me know in the comments! I’m still learning myself.

What I Learned This Week in Crypto Investing

This week (on-paper) I lost $650,000. It’s been quite a week. I am counting my blessings to still be up 276% YTD after this exceptionally crazy week.

Here’s what I’ve learned this week…

Always have 10% of portfolio available in stablecoins to buy big dips when they happen.

Have pre-set limit buy orders that execute at various price points under current, with larger buys at lower levels (great tip PK!)

Don’t use leverage even when liquidation prices are 50% below (I got $100k liquidated yesterday from a leveraged position I took on May 11).

“Just buy the dips, sell the rips, and above all else, no liqs”

For the large majority of people a buy and hold till 2030 strategy will work best, especially with an asset like ETH with so much underlying utility and coming cash flows to holders.

For active investors, a buy, hodl, sell a bit, and buy back in on dips may work better, but takes quite a bit more time and attention.

Days like yesterday are where we learn and grow and get our stripes.

Hope everyone out there is okay. It’s going to be a good weekend to spend some time with our families and relax to see the bigger picture.

Take care out there and keep focusing on the long term. Think in terms of quarters and years and not days.

One happy reminder is that ETH is still up 20% in the last 30 days, even after all this craziness. It’s that strong of an asset.

Don’t lose the forest for the trees. Just buy and HODL and we’re all gonna make it.

Join The CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1350 members on our Telegram.

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

Coinstack Twitter at twitter.com/coinstackcrypto

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

Mrs. Bubble’s NFTs at opensea.io/assets/mrsbubble

Substack at CoinStack.substack.com

Please share with your friends and colleagues.