Social Links: Twitter | Telegram | Podcast | Newsletter | Fund

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. If you’re a large holder of ETH (150+ ETH), be sure to read our feature article below, “What’s Even Better Than Staking Ether?”

A new alternative to staking for large ETH holders is covered in our featured article below

In This Week’s Issue:

🗞️ Top Weekly Crypto News - Celsius CEO Resigns, FTX Wins $1.4B Bid for Voyager’s Assets, CFTC Calls for Crypto Retail Regulation Office

💵 Weekly Fundraises - Deribit ($40M), Hadean ($30M), Immunefi ($24M)

💰 What’s Better Than Staking Ether? By Ryan Allis, Founder of Coinstack

📊 Key Stats - Wintermute Hack, Positive Earning Protocols, Nike NFT Success

🧵 Thread of The Week - Decoding Exchange Volume and Market Sentiment

📝 Messari Report - Red Oceans: Exploring the Unbundling OpenSea Thesis

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

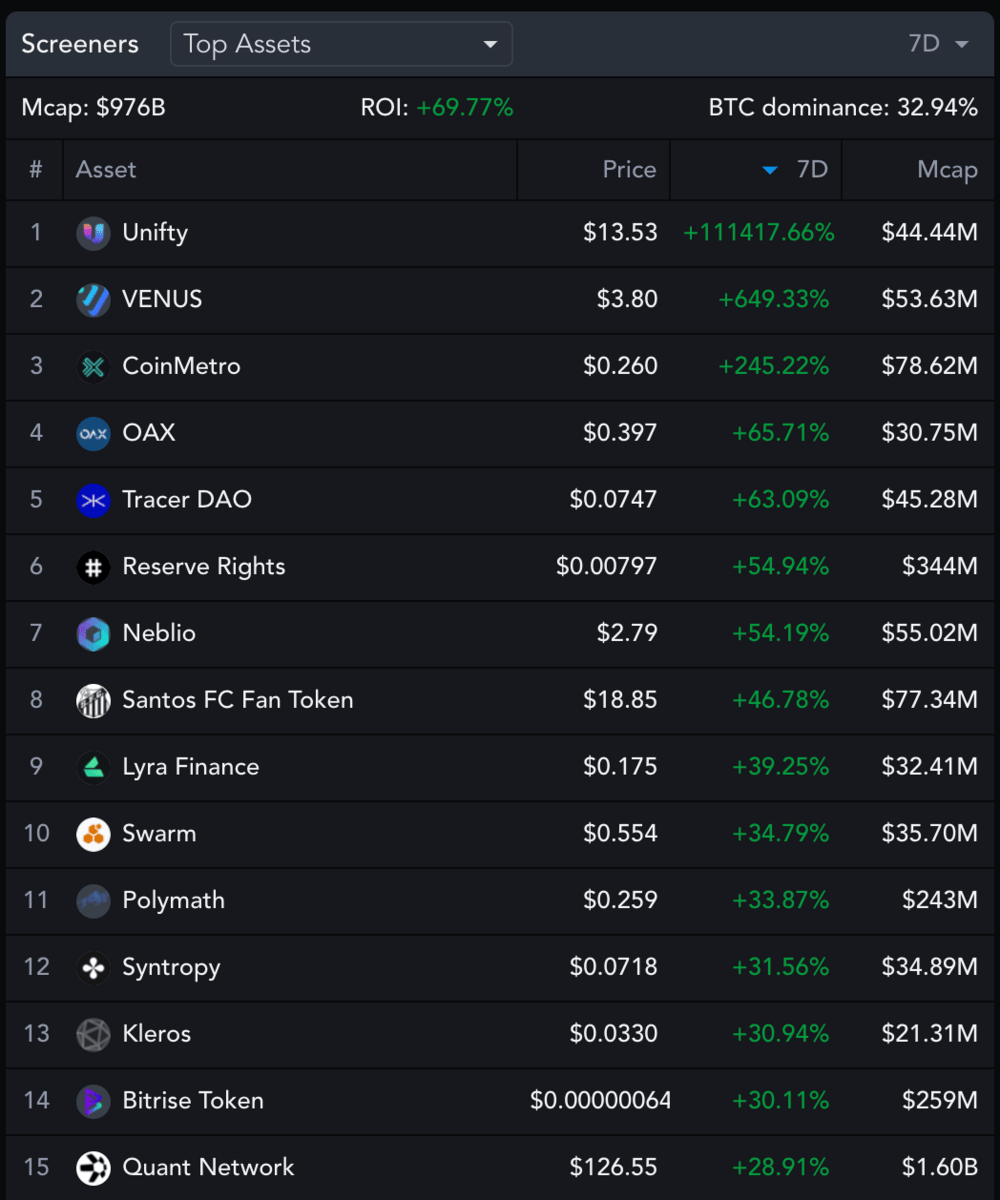

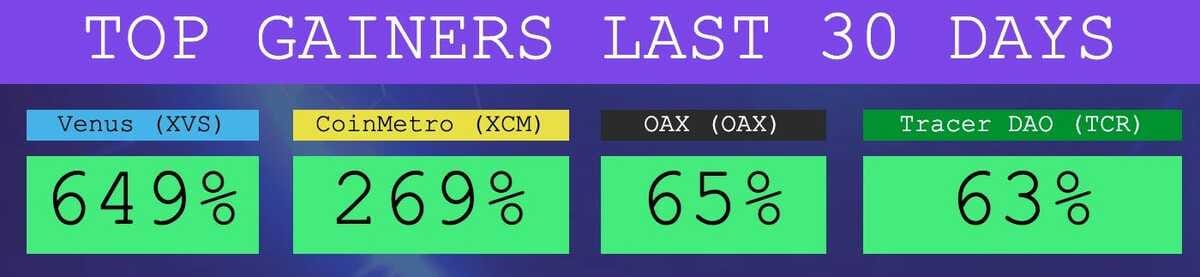

📈 Top 10 Tokens of the Week - XVS, XCM, OAX

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

Ethereum is leading in terms of price performance since the June ‘22 lows among major L1 blockchains

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is an augmented reality and web3 technology company developing a gamified digital layer on top of the world -- a metaverse for the real world. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

Amphibian Capital is a crypto quant fund of funds investing in the world’s leading crypto quant funds. We have researched 250+ crypto funds, vetted 50+, and selected the 19 best based on a proprietary scoring system, providing accredited investors and institutional allocators with the ability to gain diversified crypto quant fund exposure with one investment. Amphibian Capital offers a USD-denominated fund and an ETH-denominated fund. Learn more at www.amphibiancapital.com

We have one remaining newsletter sponsorship spot available see our Q4 2022 Sponsor Deck Here.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) 🏦 FTX US Wins Auction for Voyager Digital’s Assets - FTX.US bids $1.4 billion for Voyager’s assets. Hints that its customers will eventually transition to the FTX platform after it finishes Chapter 11 bankruptcy. This bid selection follow’s Voyager Digital’s CFO Ashwin Prithipaul resigning last week.

2) 😮 Celsius CEO Resigns As Bankrupt Crypto Firm Works to Survive - Celsius Chief Executive Officer Alex Mashinsky, who founded the embattled crypto startup and served as pitchman for the high yields it promised to its investors, is stepping down as the company works its way through bankruptcy after being asked to step aside by firm creditors.

3) ⚖️ CFTC Commissioner Calls for New Office Focused on Retail Trader Crypto Protections - CFTC Commissioner Caroline Pham has proposed a new 'Office of the Retail Advocate' at the CFTC, one that could factor into a broader push by leadership at the agency to more directly oversee crypto markets.

4) 😔 FTX US President Brett Harrison Steps Down From Crypto Exchange - Crypto exchange FTX US president Brett Harrison is stepping down and will move into an advisory role, a surprise exit that came after less than 18 months on the job and as the industry weathers a downturn that’s curbed trading.

5) 🤠 Do Kwon & The Luna Foundation Guard (LFG) Deny Link to $67M in Bitcoin Sought by Authorities - Authorities in South Korea are seeking to freeze $67 million in Bitcoin with potential ties to Do Kwon and Terra. Do’s location remains unknown after a red Interpol notice was issued for his arrest.

6) ⚖️ US Judge Orders Tether to Demonstrate What Backs USDT – A US Judge has ordered Tether to prove what backs its stablecoin as part of a lawsuit. “We had already agreed to produce documents sufficient to establish the reserves backing USDT, and this dispute merely concerned the scope of documents to be produced,” the company said in a statement.

7) 💸 California Files Desist and Refrain Order Against Nexo - California’s Department of Financial Protection and Innovation (DFPI) has filed a desist and refrain action against crypto platform Nexo for allegedly offering interest accounts to the state’s residents without qualifying them as securities. The document claims that, as of July 31, more than 18,000 California residents had Nexo accounts worth at least $175 million.

8) 💸 Hacker Saves Abritrum From $530M Hack, Upset with $400k Bounty - A white hat hacker discovered a bug in Arbitrum, an Ethereum layer 2 scaling network, that could have led to the theft of over $530 million. A controversy has arisen after Arbitrum paid out a bounty of just $400,000 compared to their advertised max bounty of $2M for discovering major vulnerabilities.

9) 💸 Pantera Eyeing New $1.25B Blockchain VC Fund - Pantera founder Dan Morehead said today at a conference in Singapore that Pantera is planning to raise $1.25 billion for a second blockchain fund.

10) 🥳 Ethereum Coin Mixer Tornado Cash Is Back on GitHub - Coin mixer Tornado Cash is now back on Microsoft owned software hosting website GitHub, in a major victory for free speech and privacy advocates.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

💰 What’s Even Better Than Staking Ether? A New Option for Large ETH Holders

By: Ryan Allis, Publisher of Coinstack & GP at Amphibian Capital

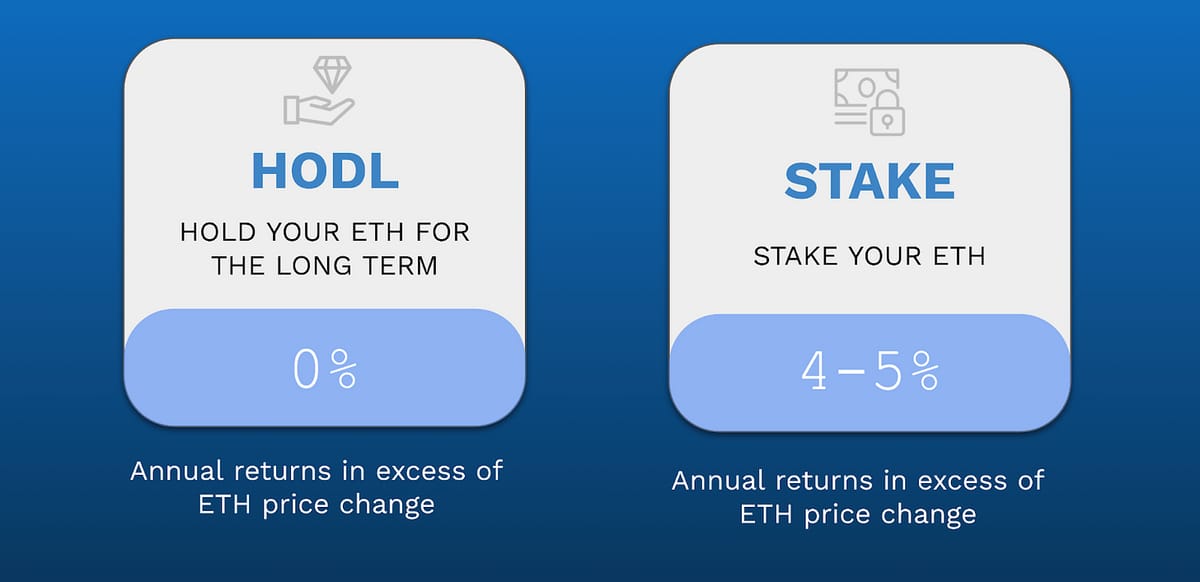

About this article: If you’re a large holder of ETH (150+ ETH), this may be a very helpful article. Large ETH holders who are bullish about the long-term future of Ethereum previously had two options — to either HODL their ETH or to stake their ETH it for 4-5% extra annual returns. Now there is a third option…

Now that Ethereum’s Proof of Stake network is live, anyone can stake their Ether (ETH) and earn around 4-5% per year in extra ETH.

Stakers earn daily fees for providing a service to the Ethereum network of helping validate the blockchain.

You can stake ETH on any major exchange (like FTX, Binance, or Coinbase for example), in a staking pool like Lido or Rocket Pool, or even run your own validator if you have 32 ETH.

Current staking yields are sitting around 4.0% and change continually based on network usage. More transaction fees = higher staking yields. And of course the more ETH that is staked, the lower the yields per ETH (sharing same revenues with more people).

Source: The Ethereum Foundation

The Downside of Staking ETH

One big downside to staking, however, is that your ETH gets locked up (can’t be sold or transferred) until withdrawals are enabled in the coming “Shanghai Update” that remains roughly 6-12 months away on the Ethereum roadmap (an actual date hasn’t yet been announced).

It’s never fun to have your money locked up without a clear date as to when you will be able to withdraw it.

So while staking is cool, I’ve found something that I think is quite a bit better than staking -- that doesn’t have the same issue with an undefined lockup.

A New Option for Large ETH Holders…

Previously, if you were an ETH Bull and plan to hold the asset for the long-term until at least 2025 or 2030 (what I’m planning on) you had two options.

You could either HODL the ETH and get whatever the ETH performance is…

You could stake the ETH and get around 4%-5% additional annually.

Now, holders of 150+ ETH have a third option -- investing their Ether in an Ethereum-denominated crypto fund of funds called the Amphibian ETH Alpha Fund.

Below we show the results of the selected funds within the Amphibian ETH Alpha Fund so you can see how they have performed from 2019-2022 and especially how they’ve done during the 2022 bear market.

First, the story of how Amphibian Capital got started, which now has an ETH-denominated fund and a USD-denominated fund.

How This Fund Got Started…

A year ago in October 2021, three friends of mine (David Langer, James Hodges, and Todd Bendell) started working on designing an Ethereum-denominated Crypto Quant Fund of Funds.

Their goal was to find crypto quant funds (funds that trade crypto using algorithms) that were successful at generating good trading results in both bull markets (like we had in 2021) and bear markets (like we have now).

They found and vetted 25 Ethereum-denominated crypto quant funds -- and selected the 7 best to include in their fund of funds (based on their returns, team, volatility, capacity, and security).

I joined the team in July 2022. I have been VERY impressed by the underlying funds and the results of the underlying funds, especially during a bear market.

Let’s take a look…

The Performance of the Underlying Funds in 2022

Here’s how these underlying funds have performed since January 1, 2022…

The funds, after all fees, averaged 21.39% net returns (denominated in ETH) through August 31, 2022. The 7th fund started on 9/1 so isn’t shown above yet.

With staking rewards at 4-5% annually, 21.39% YTD through 9/1/2022 compares nicely.

This means that had you invested 1000 ETH on January 1, 2022 (spread evenly across these funds), you would have turned that into 1213 ETH on September 1, 2022, after all fees.

What Amphibian’s ETH Alpha Fund does is allow accredited investors to make a single investment — and then we allocate for you across a diversified portfolio of vetted top funds — removing the time-consuming (and expertise-intensive) process of identifying and vetting funds and then making 6, 7, or more fund investments and managing them monthly.

The Performance of the Underlying Funds Since 2019

Now let’s look at a LONGER time period, going back to 2019, using the average net returns for the selected funds that now make up the Amphibian ETH Alpha Fund.

As you can see, the net returns of these selected funds going back to March 2019 has been quite positive.

Amphibian Capital has two funds -- a USD-denominated fund and an ETH-denominated fund. For the sake of this article, we’re focusing on the ETH-denominated fund.

The firm has a U.S. Fund and a BVI fund, and thus are able to accept capital from both U.S. and international citizens/entities.

You can learn more about the firm at www.amphibiancapital.com. There are more details below if you may be interested in allocating to the fund.

How Are These Excess ETH Returns Achieved?

It’s very very important to understand how the excess ETH returns are achieved.

In crypto, you need to understand the source of your returns -- otherwise you end up in a platform like Anchor, which spectacularly crashed and burned in May 2022 after offering 19.5% annual yields generated through inflationary rewards in a stablecoin (UST) primarily collateralized from its own native LUNA token.

So where do these excess ETH returns actually come from?

Amphibian Capital is a fund of funds. For the Amphibian ETH Alpha Fund we are talking about, there are 7 underlying funds that have been selected (soon to be 9 on Oct 1).

These 7 underlying funds all trade Ether, the native token of the Ethereum network. Some do algorithmic trading and some sell derivatives. Here is an example of the trading strategies the underlying funds use:

These trading strategies (plus a few others) are used by the underlying funds to earn additional returns on ETH, beyond the price performance of ETH itself. In the four years of tracking the underlying funds’ average monthly net returns, through all market environments, there have been 35 up months, 6 down months, and zero down quarters.

Over 12,000 ETH Committed So Far

The Amphibian ETH Alpha fund went live on August 1, 2022 and in the first month of live trading, achieved a +1.33% net return.

The fund is now live, and has more than 12,000 ETH committed (roughly $16M at current ETH prices) -- and we expect to have capacity for up to 250,000 ETH.

The opportunity is only available to accredited investors who have at least 150 ETH.

So for the large ETH holders out there… please reach out and let’s see how we can help. Whether you manage 150, 1500, or even 150,000 ETH — let’s work together.

How Accredited Investors & Institutional Allocators Can Invest

The process of onboarding involves a call with me or another partner on our team, sending you our PPM, and then completing subscription documents, KYC, and then a wire or transfer. For our primary service providers, we use NAV Consulting as our fund administrator and Richey May as the fund auditor.

Here’s the slide deck from the ETH Whales: How to Invest Your ETH Webinar I held earlier this month. That will be helpful to review as you learn more.

If you are a large ETH holder and are interested in learning more, please review the deck and fact sheet and then either email me or schedule a call with me and I’ll walk you through everything.

We’re ETH bulls too -- and would love to work together.

We’ll be happy to share more about fund selection, the team, and how we can be of assistance.

Notes and Disclaimers: The above article is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of any private investment fund to be offered or managed by Amphibian Capital GP, LLC (“ACGP”) are offered to selected investors only by means of an offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in such fund (“the Fund”, and such documents, the “Offering Documents”). Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, including this article. An investment in any strategy, including the strategy described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. Past performance of these strategies is not necessarily indicative of future results. The information in this presentation was prepared by ACGP and is believed by ACGP to be reliable and has been obtained from public sources believed to be reliable. ACGP makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of ACGP and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions. No representations or warranties are made as to the accuracy of such forward-looking statements. Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. Performance data is presented net of all standard fees calculated at the highest rate charged, expenses and estimated incentive allocation that would be charged to an investor in the Fund.

💬 Tweet of the Week

Source: @ultrasoundmoney

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

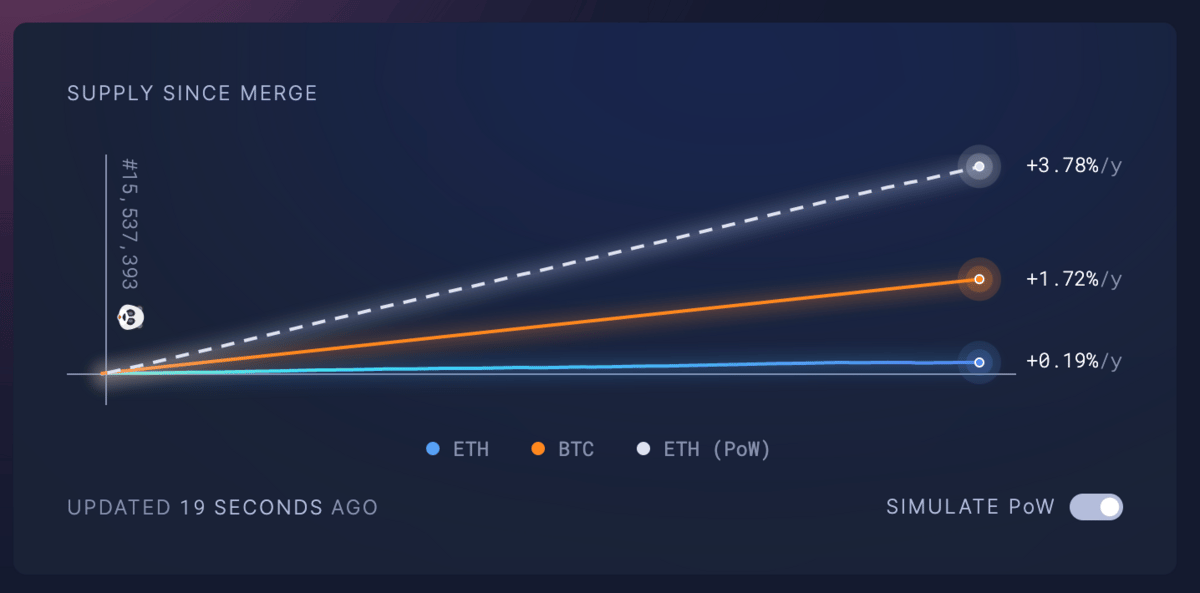

1. ETH Net New Supply Issuance Now Much Lower than BTC, Tracking for +0.19% Annually vs. 1.72% for Bitcoin

2. After Wintermute Hacked for $160M, a Series of Transactions Quickly Followed the Hack, Which Saw 112 Million Tokens Transferred to Curve’s 3pool

Source: @KaikoData

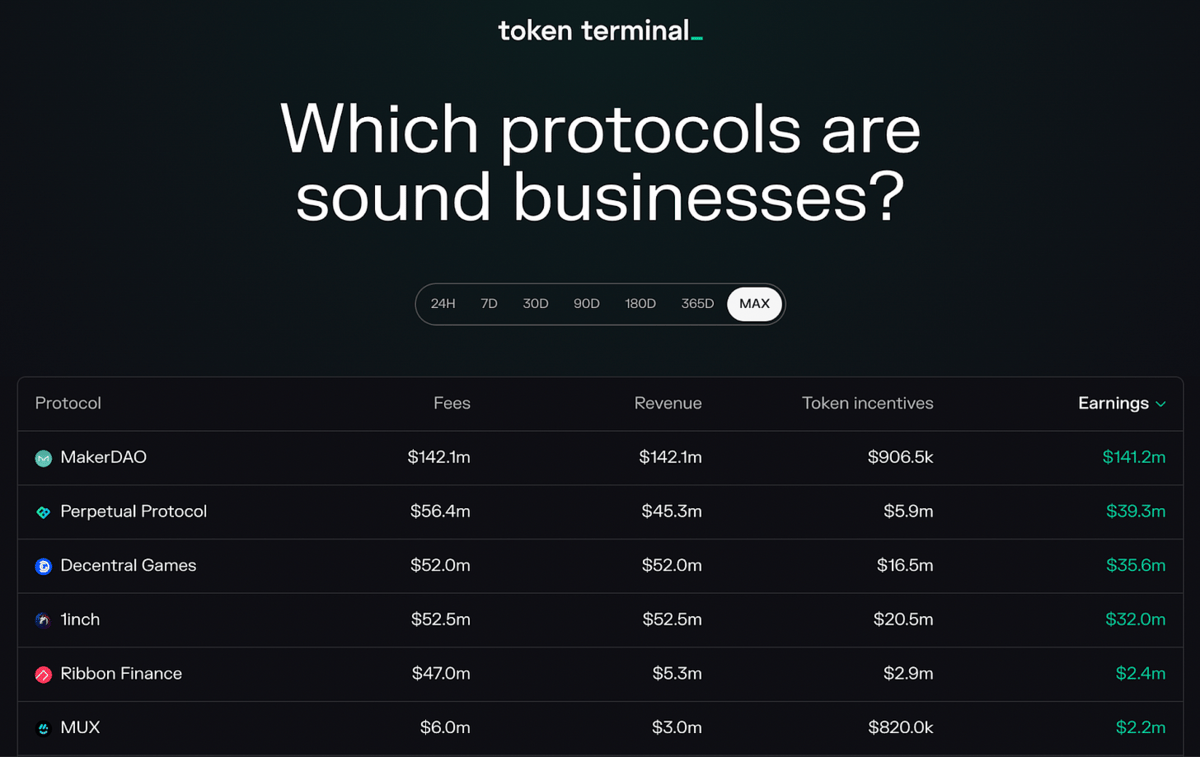

3. Six Protocols With Positive Earnings (Earnings = Revenue – Token Incentives)

Source: Token Termninal

4. Nike’s Most Recent NFT Drop Closed Over $11M in Sales in a Week, Which Is Nearly As Much Revenue As Other Fashion Houses Like Adidas and Gucci Have Earned From Their NFT Collection Lifetimes.

Source: Delphi Digital

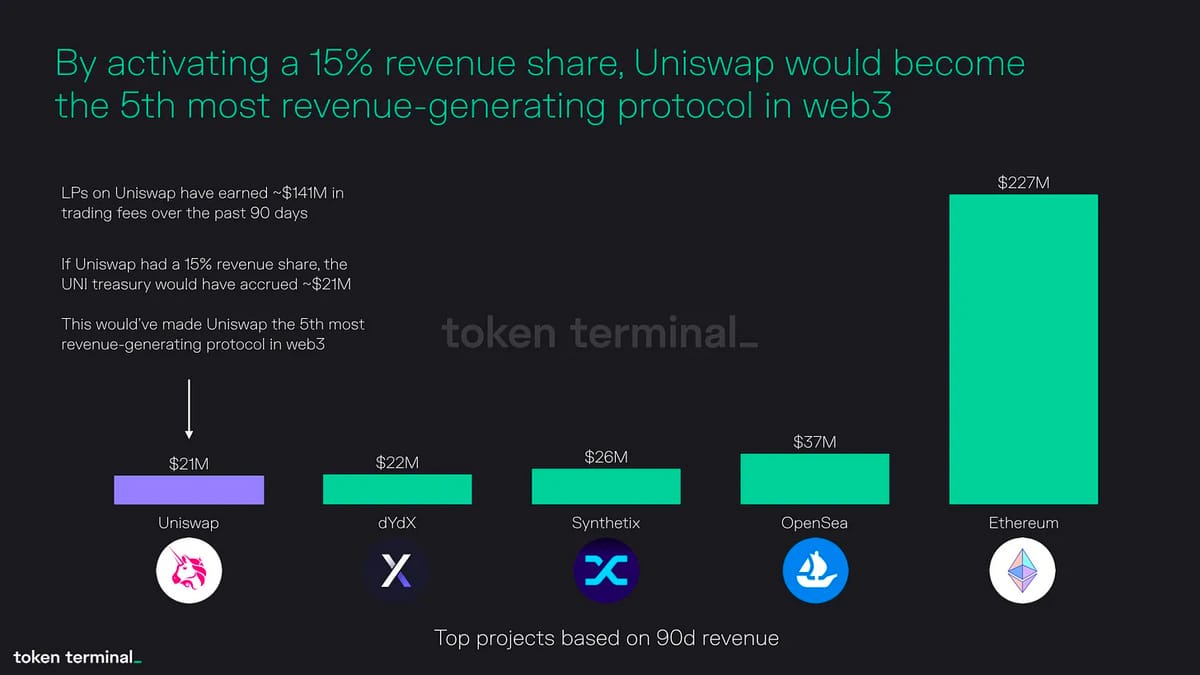

5. Assuming a 15% Revenue Share, Uniswap Would Be the Fifth Most Revenue-Generating Protocol in web3 Based on Total Fees Paid Over the Past 90 Days, Netting Over $21M for UNI Tokenholders.

Source: Token Terminal

6. Transaction Volume on X2Y2 Has Regularly Surpassed OpenSea Since Late July, Primarily Due to Wash Trading

Source: Delphi Digital

7. MakerDAO Is Currently the Only Major Lending Protocol That Has Captured More Value via Fees Than It Has Paid Out in Incentives to Users

Source: Token Terminal

8 Arbitrum-Based Derivative Protocols Maintain Stable Trading Volumes

Source: Token Terminal

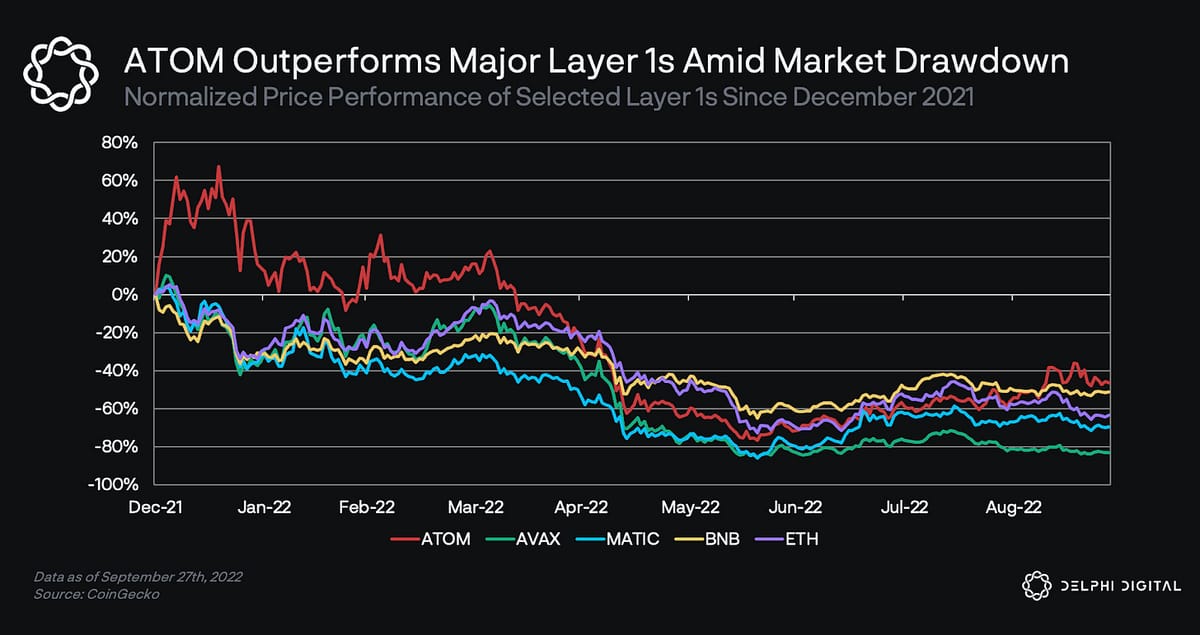

9. Cosmos Outperforms L1s, ATOM token Up 90% in the Last 3 Months

Source: Token Terminal

🧵 Thread of the Week - Decoding Exchange Volume and Market Sentiment

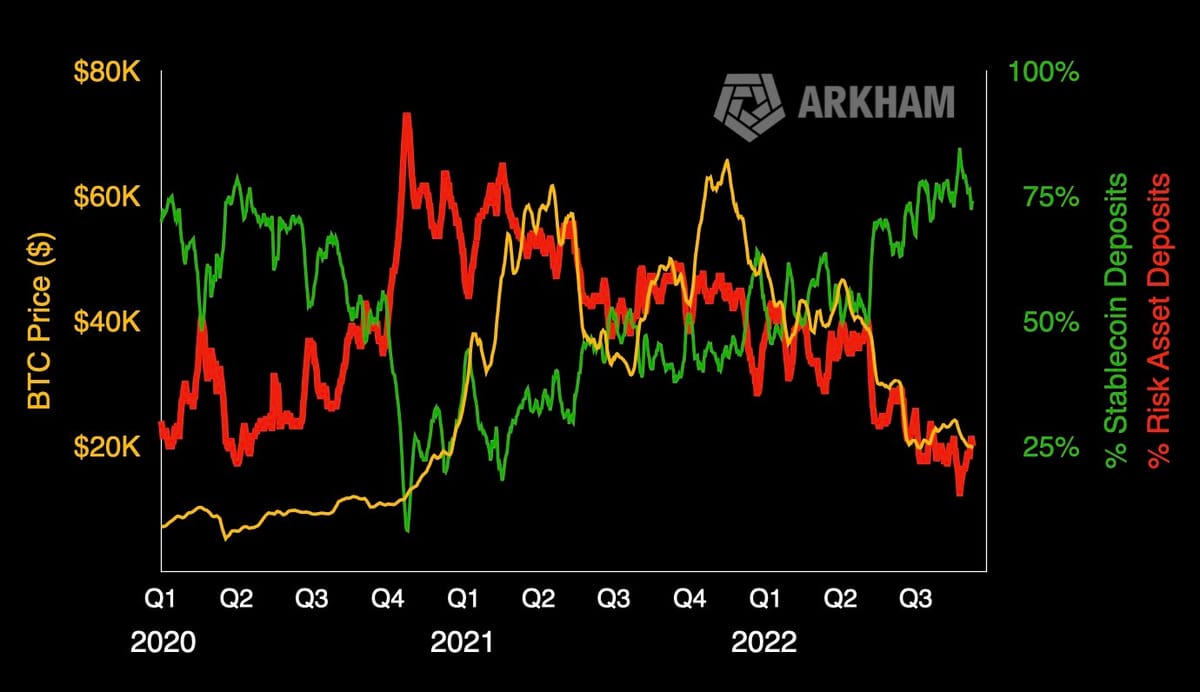

By: @ArkhamIntel

1) Firstly, for the purposes of this thread, we define stablecoins as the most used tokens pegged to off-chain currencies like $USD. Risk assets may be understood as all cryptoassets that are not this.

2) As shown by the chart, during bearish conditions, the majority of exchange deposit volume is in stablecoins. In periods of bullishness, the majority of exchange deposits are risk assets. From mid-2020 onwards, risk assets’ share of deposit volume saw a significant uptrend.

3) This preceded the bull run of $BTC to $60K. Once risk assets exceeded 50% of deposit volumes, conditions hit full bull run. What's interesting to note is that risk deposit percentages peaked right before $BTC’s price peaked.4) A few months later, in May 2021, the entire crypto market crashed, and risk asset deposit volumes never regained their exchange deposit volume Even when $BTC ran up some months later to an all time high of $69K.

5) Around July of this year, stablecoins began to dominate exchange deposit volumes, coinciding with the drift into the current bear market. What does this data tell us?

6) The conclusion appears to be that if risk deposit percentages exceed 50%, this signifies clear risk on conditions. Meaning people are interacting more with risky assets over stable ones.

7) At the conclusion of a bear market, we can expect then to see an uptrend in risk deposit percentages relative to stablecoin deposit percentages. Once risk deposit percentages crossover stablecoin deposit percentages, this signifies the market being clearly risk-on.

8) At the conclusion of a bear market, we can expect then to see an uptrend in risk deposit percentages relative to stablecoin deposit percentages. Once risk deposit percentages crossover stablecoin deposit percentages, this signifies the market being clearly risk-on.

9) Additionally, at the end of a bear market, we expect to see an uptrend in risk deposit percentage relative to stablecoin deposit percentage. Once risk deposit percentage crosses over stablecoin deposits, market conditions are risk-on. We hypothesize that this is a pattern.

10) Looking at this chart for the same from 2019, these trends are not isolated to the past few years. This trend has now played out multiple times in Crypto’s short history.In future, it is likely that such a trend may take place again.

11) Using the power of on-chain analytics platforms like Arkham, traders can make use of such data to take positions & prepare their market participation accordingly. And most importantly, Arkham will be entirely free at point of use. Anyone will soon have access to this data.

12) If you found this thread please useful, please give it a Retweet. And signup for Arkham’s beta here

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

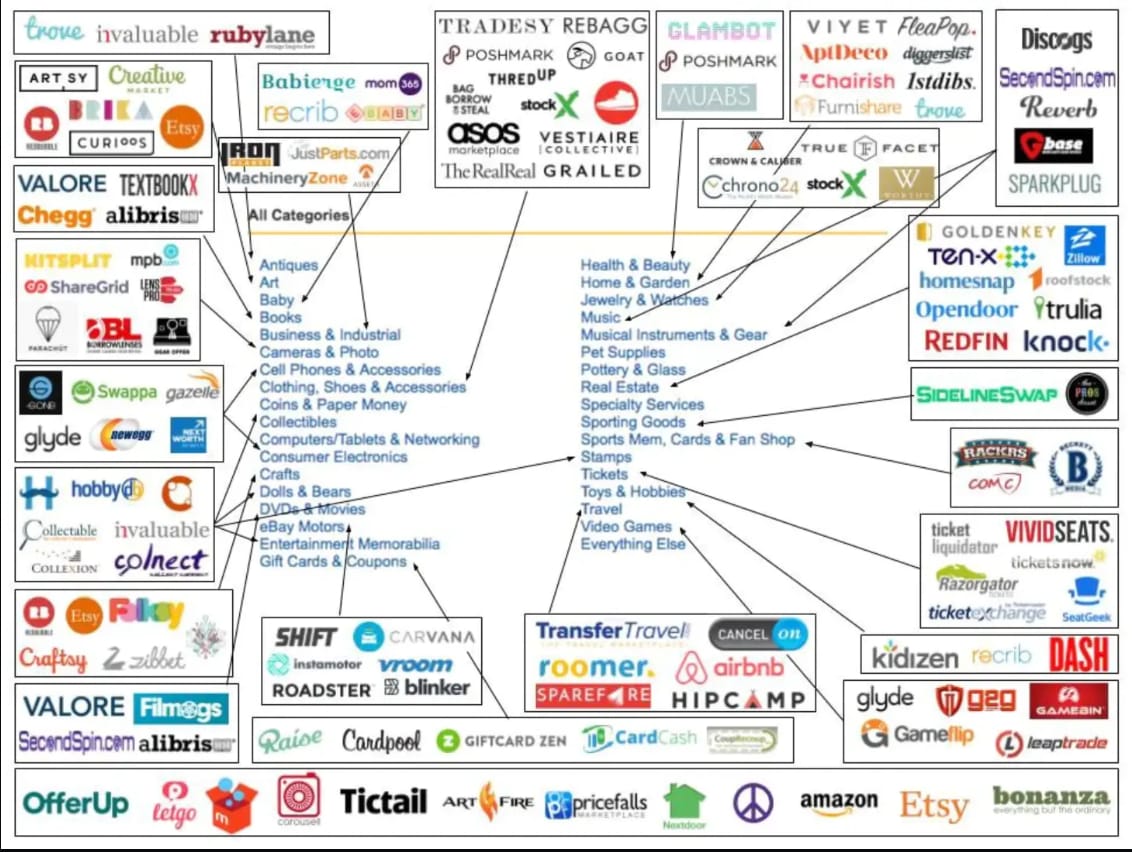

Earlier this year, Tasha Kim wrote a thesis claiming that OpenSea would follow eBay’s unbundling process. From 1995 to 2013, eBay became a dominant horizontally integrated marketplace, growing to over $80 billion in gross merchandise value exchanged on the platform.

But by 2022, eBay had lost its market share to dozens of verticalized marketplaces. Kim drew attention to five marketplaces: Etsy, Airbnb, 1stdibs, Chegg, and Zillow. At the time of writing, these five were worth ~$130 billion — over 4 times greater than eBay’s ~$30 billion valuation at the same time.

Despite OpenSea’s astronomic growth in the last two years, Kim argues that horizontally integrated marketplaces like OpenSea will follow eBay’s path. Emerging NFT verticals like profile pics (PFPs), crypto gaming, art, and others will eventually be serviced by specialized marketplaces rather than by generalized marketplaces like OpenSea.

PFPs

PFP’s were OpenSea’s bread and butter for the last two years. Although they generated billions in volume for the exchange, these collections are prime candidates to trade on verticalized marketplaces. Instead of generating huge volumes and revenues for OpenSea, large PFP collections could set up their own marketplaces to capture said revenue.

CryptoPunks’ native marketplace already set the precedent for a collection to trade on its own marketplace, doing billions in volume in the process. High-value, high-recognizability collections could, and arguably should follow the same playbook. For example, if the BAYC ecosystem had its own marketplace, it would have been able to recycle/save $126 million dollars in fees that its traders paid to OpenSea over the last year and a half.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Venus is a Lending Platform, CoinMetro is an Exchange, Oax is a Foundation, Tracer DAO is a Derivatives Exchange

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 31,417 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.ftx.us and www.peer.inc and www.amphibiancapital.com